Passive versus Active Fund Performance: Do Index Funds Have Skill?

- Alan Crane, Kevin Crotty

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

We examine the nature of skill in active management by asking whether active funds beat not just passive benchmarks, but the traded assets that represent the opportunity cost of active investments: index funds. Using the recent growth in the cross-section of index funds, we examine the entire distribution of actively managed funds. Our results are surprising. We find little evidence that active funds exhibit more skill than passive funds, even for top-performing funds before fees. On the other hand, the worst index funds fare far better than the worst active funds. If some active funds have skill, one must also conclude that some index funds do as well. Since the extent of index fund skill is limited, the same must be true for active funds. Our results cast doubt on traditional theories regarding skill in active management, as we also find strong evidence of a flow-for-performance relationship even among index funds.

Alpha Highlight:

What’s the value of active portfolio management? This question has been debated for decades and the consensus seems to be that active funds might exhibit skill, but after fees you’re just as well off owning an index fund.

So what is different about this paper? In the words of the authors:

We compliment this literature by comparing fund performance not to a simulated no-skill distribution, but to an economically appealing set of alternative funds that are actually traded. In a sense, we set a higher hurdle for skill. We show that both index funds and active managers appear to perform better than the simulated funds in some parts of the distribution, but that active funds still do not outperform passive funds.

In short, the authors compare active fund performance to tradeable index alternatives, whereas, historically, researchers compare active performance to theoretical no-skill funds.

Why look at index funds? In a perfect CAPM world there is only one index fund–an index fund that is value-weighted across all assets around the globe, or in the nomenclature of classic portfolio theory, the “market portfolio.” Of course, in reality there are thousands of index funds from which an investor can choose.

The authors in this paper address the active vs. passive question by comparing the bootstrapped distributions of traded index funds and active funds. They assume that the differences in active and index performance represent the value of active management.

The data sample consists of 2,153 distinct funds, 240 of which are passive index mutual funds or ETFs. In general, the passive vs. active funds can be characterized as follows:

- Index funds:

- Do not engage in stock picking;

- Lower expenses— average expense ratio of 47 basis points;

- Lower turnover— turnover of 24%.

- Active managed funds:

- Engage in stock picking;

- Higher expenses— average expense ratio of 125 basis points;

- Higher turnover— turnover of 74%.

Key findings:

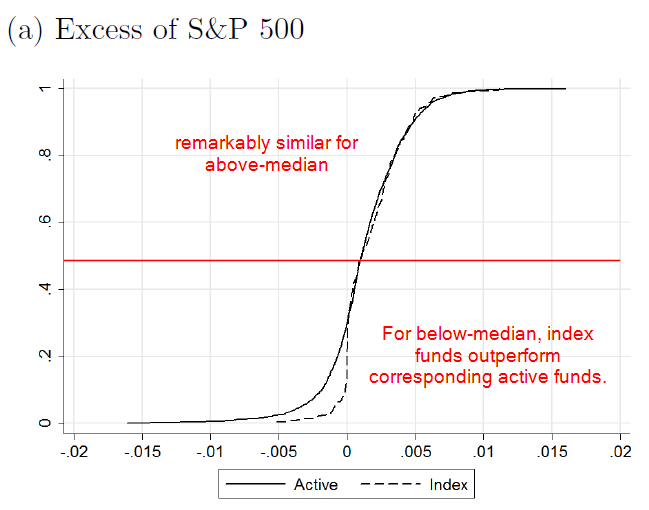

The figure below plot the cumulative distribution functions (CDFs) of gross alpha for index and active funds in excess of S&P 500. More risks adjustments such as CAPM, Fama-French-Carhart, Vanguard, 7-factor and Ferson-Schadt can be found in Figure 1–all variations tell the same story:

- Top-performing index funds have similar skill to the best active funds;

- For below-median funds, passive funds generally outperform actively managed funds;

- On net, index are similar–if not better–than their active counterparts…BEFORE fees!

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.