If you can recall something, you think it’s important

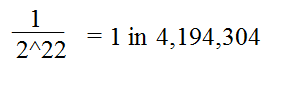

From 1990 through 2000 there were 1.4 deaths per 10 million passengers on U.S. scheduled airlines. Flying understandably feels dangerous. But we have actually been less likely to crash and die on any flight than, when coin tossing, to flip 22 heads in a row…. Vivid, memorable images dominate our fears. We can know that unprovoked great white shark attacks have claimed merely 67 lives worldwide since 1876. Yet after watching Jaws and reading vivid accounts of last summer’s Atlantic coastal shark attacks, we may feel chills when an underwater object brushes our leg…. We fear what’s most readily available in memory.

When judging the frequency or probability of an event, we are unconsciously influenced by the ease with which memorable images spring to mind. This bias is widely known as “Availability Bias.”

If we can easily think of examples about a category, we can make systematic errors and overestimate the frequency or size of that category. A tsunami. A nuclear accident. A place crash. Yet, how easily an example of an event comes to mind may have nothing to do with how likely it is to occur. When the ease of recall is unrelated to the probability of an outcome, and we fail to compensate for the peculiarities and recency of of memories that are available to us, we develop a distorted picture of statistical reality.

What increases our awareness of certain risk categories? The media. Newspapers, for example, are famous for the phrase, “if it bleeds, it leads.” Crime. Murder. Violence. Disaster. These stories activate our emotions, and the more sensational a story is, the more we are fascinated by it, and the more available it becomes.

We can overestimate the risk of flight crashes, shark attacks, and terrorist violence, because our probability assessments are affected by the vividness of recent events, and media exposure. Bosch et al. (1998) indicates that when air crashes occur, people tend to switch to rival airlines and fly less.

During a single week recently, there were 3 high-profile plane crashes that killed hundreds. How are you feeling about flying on Malaysia Airlines these days after 2 recent accidents? Not good? You’re not alone, and these perceptions are not lost on Malaysia Airlines, which is considering a name change.

Getting back to the first quote in this post, just how likely is it anyway that you will get 22 consecutive heads when tossing a coin?

In “Availability Cascades and Risk Regulation,” Kuran and Sunstein discuss availability cascades, when beliefs and perceptions are expressed and reinforced via a bandwagon or snowballing effect. If my neighbor says it’s true, well then I think it could be true too. Check out the Twitter feeds on “never fly malaysia.” The odds are still incredibly remote that you will die on a Malaysian Airlines flight, but with cascading availability, many don’t want to take that chance.

Game 1: Classical word problem

Which number do you think is greater? The number of words in English that _______.

- A) Begin with the letter R

- B) Have R as their third letter

When Tversky and Kahneman (1973) first studied “availability bias,” they designed this simple experiment in their paper “Availability: A heuristic for judging frequency and probability” . The results show that among 152 participants, 105 (69%) judged example A to be more likely, while only 47 (31%) chose example B.

Words beginning with R are highly available to us. They come tripping off our tongues. Words with R as the third letter? Not so much. Yet there are plenty of common words with R as the third letter, including earth, darn, fire, horn, series, part, siren and turn. In fact, words which have R in the third position are 2.5 times more prevalent in the dictionary than words beginning with R. We can think of more words that start with R and, based on this observation, assign a faulty (overstated) statistical likelihood to their occurrence versus words with R as the third letter.

Here is an article written by Jaymi Heimbuch, which reminds us not to fear the wrong things:

Applications in Finance

1. Media coverage and investors’ reactions

Investor attention affects stock market premia and volatility. Some research, such as Barber and Odean (2008), has indicated that investors prefer stocks that grab their attention, which can lead to systematic errors and investing mistakes. Here are two older posts exploring this idea:

Media coverage reinforces our availability bias causing us to overreact to news and underact to continuous information. Investors make decisions based on memorable or sensational news stories, but they pay less attention to the ongoing flow of mundane information arriving continuously in small amounts, consistent with frog in the pan theory. Below is another example cited from David G. Myers “Do We Fear the Right Things?”

Why do so many smokers (whose habit shortens their lives, on average, by about five years) fret before flying (which, averaged across people, shortens life by one day)? … We fear what’s immediate.

This may have something to do with our tendency towards hyperbolic discounting or present bias in the context of loss aversion, but also has some availability roots. We fear what’s immediate, since it’s available. Similarly, we can overreact to discrete sensational news items, which are also highly available.

Frog-in-the-pan theory states that it is continuous information that induces stronger and more persistent return continuation than discrete information, and it does not reverse in the long run, consistent with limited attention to continuous information. See the paper for details. Eye-catching news stories, such as CNBC’s CEO interviews, may generate abnormal returns in the near-term, but appear to exhibit strong reversion over the ensuing trading days.

2. Risk and benefit measurements

“Human emotions were road tested in the Stone Age,” which is how David Myers put it. Human beings, based on a millennium of evolution, are simply wired to be emotional and behaviorally biased. This leads to some surprising outcomes in our risk/benefit measurements.

Shelor et al. (1992) studied the 1989 California Earthquake, a natural disaster which led to catastrophic damage, and billions in losses. They pointed out that such unexpected natural disasters are also a nightmare for the insurance industry, since insurers had to cover the losses. However, the stock prices of insurance industry increased significantly after the earthquake. Huh?

It was theorized that such abnormal returns were based on investors’ expectations. Investors believed that the earthquake would lead to subsequent increased demand for insurance, as people overestimated the likelihood of another earthquake, and the increased demand for coverage would not only offset insurer’s losses but lead to long-term financial benefits for insurance industry.

In this case, as before, people tend to overestimate the frequency and possibility of an event since they are so heavily influenced by availability bias.

References:

- Tversky, A; Kahneman (1973). Availability: A heuristic for Judging Frequency and Probability. Cognitive Psychology 5 (1): 207–233.

- Frog in the Pan: Continuous Information and Momentum, AFA 2012 Chicago Meeting Paper

- The Availability Heuristic and Investors’ Reaction to Company-specific Events. The Journal of Behavioral Finance 11:50-65

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.