The Impact of Impact Investing

By Elisabetta Basilico, PhD, CFA|January 27th, 2025|Elisabetta Basilico, ESG, Research Insights, Other Insights|

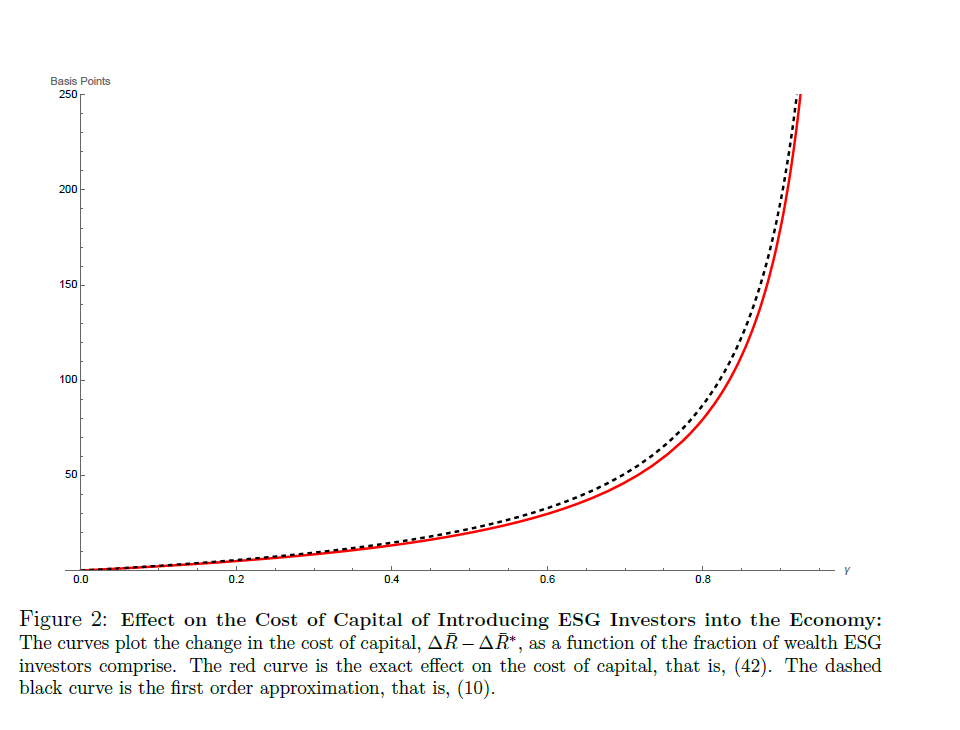

Divestment, a commonly used strategy, involves withdrawing support from companies that contribute to these issues, with the intention of creating positive societal change. Despite its appeal, the connection between divestment actions and their actual impact on society remains unclear.

Growth Predictions, Growth Surprises, and Equity Returns

By Larry Swedroe|January 24th, 2025|Asset Growth, Predicting Market Returns, Research Insights, Factor Investing, Larry Swedroe, Other Insights|

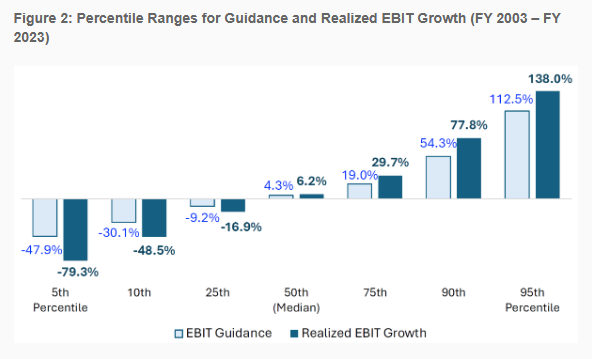

What matters is not the expectation of future growth, but the deviation between projected growth and realized growth, which, by definition is a surprise, and, thus, is not forecastable.

Artificial Intelligence and the Risks of Harking (Hypothesizing After-the-Fact)

By Larry Swedroe|January 17th, 2025|Research Insights, Larry Swedroe, AI and Machine Learning, Other Insights|

Because AI systems can produce hundreds of seemingly coherent theoretical explanations for mined empirical results, investors need to establish high hurdles before allocating to anomaly-based strategies.

Training Machine Learning Models For Return Prediction

By Elisabetta Basilico, PhD, CFA|January 13th, 2025|Elisabetta Basilico, Research Insights, AI and Machine Learning, Other Insights|

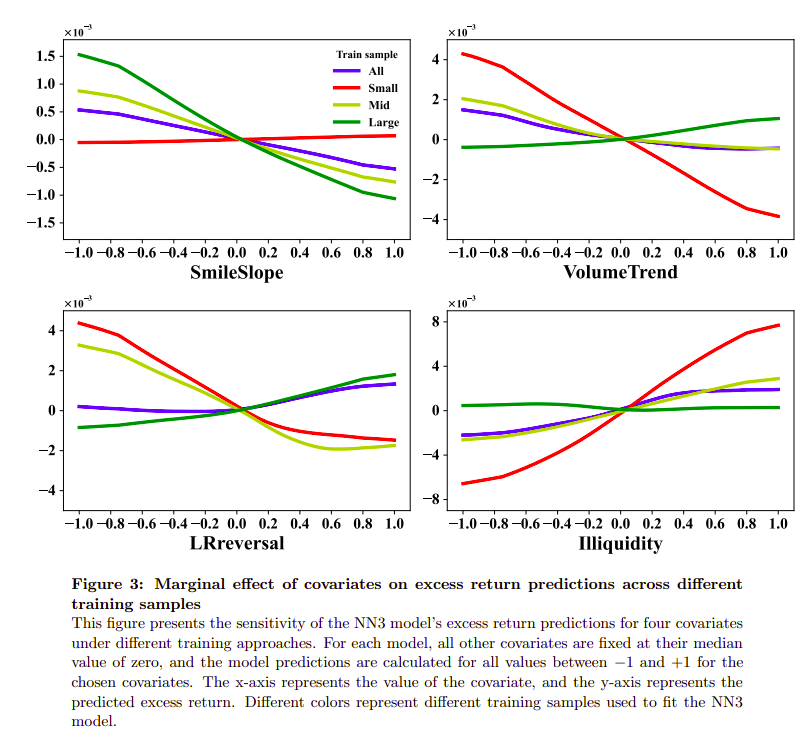

This paper investigates how modeling choices impact MLM outcomes such as cross-sectional return predictability.

Private Credit: Upper Versus Lower Middle Market Lending

By Larry Swedroe|January 10th, 2025|Private Equity, Research Insights, Larry Swedroe, Other Insights|

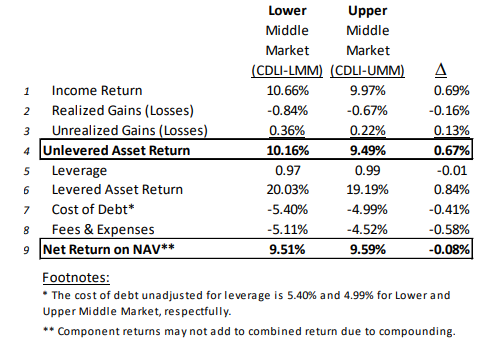

Given the similar net returns that UMM and LMM loans have delivered, allocators should consider diversifying across borrower size cohorts. Since LLM loans are somewhat riskier, careful due diligence should be performed in terms of a lender’s credit loss history, fees/expenses, and use of leverage.

Global Factor Performance: January 2025

By Wesley Gray, PhD|January 7th, 2025|Index Updates, Factor Investing, Research Insights, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index [...]

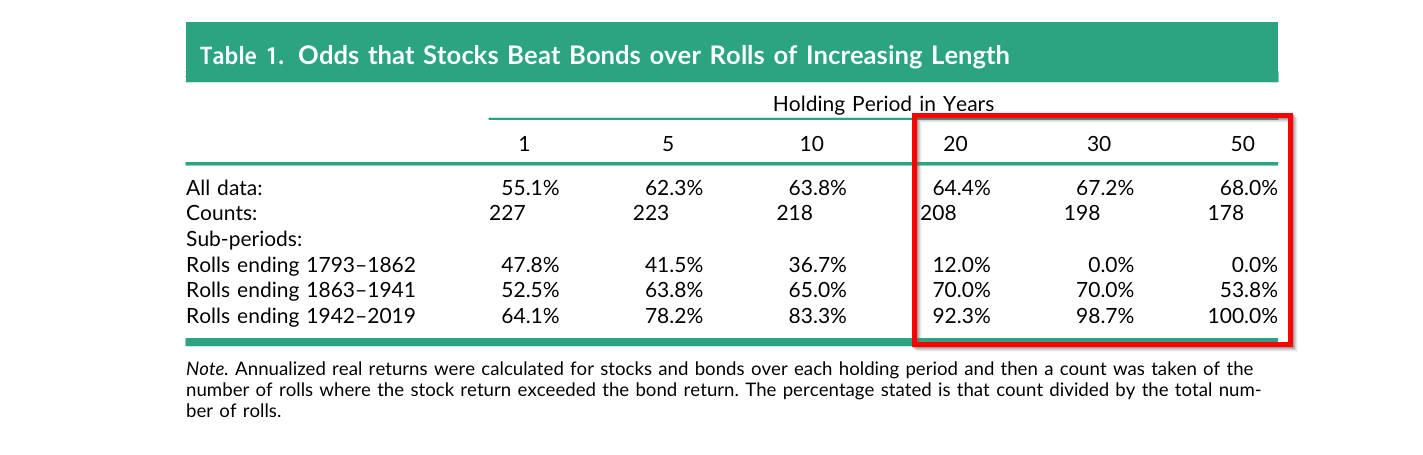

Stocks aren’t always the best in the long-run

By Tommi Johnsen, PhD|January 6th, 2025|Tommi Johnsen, Research Insights, Academic Research Insight, Other Insights, Tactical Asset Allocation Research|

Advisors and managers will have to adopt a more nuanced view of risk as recognition of the frequency of equity underperformance becomes widespread.

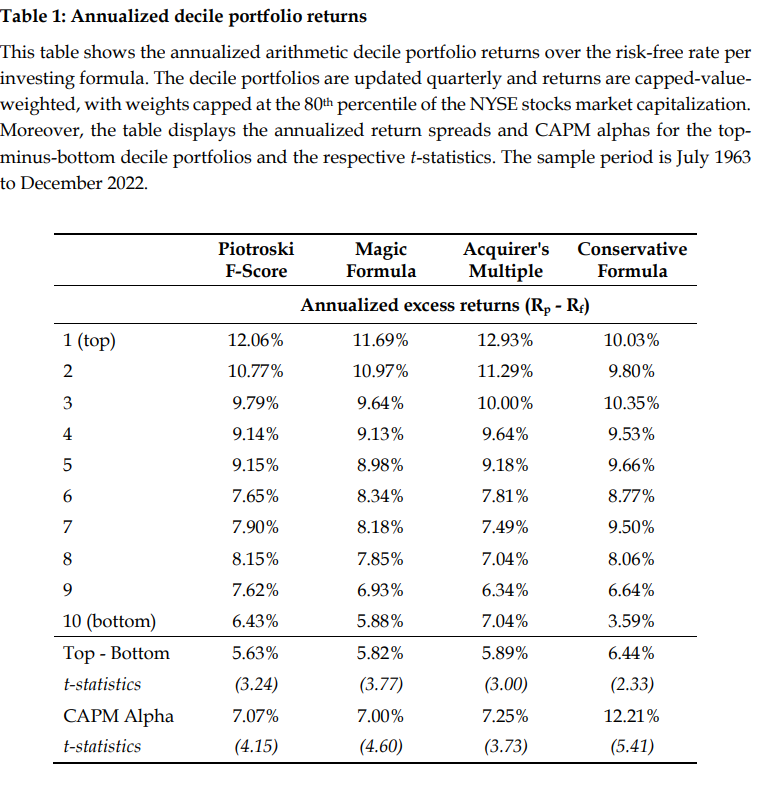

Investigating Simple Formulaic Investing

By Larry Swedroe|January 3rd, 2025|Research Insights, Larry Swedroe, Factor Investing, Other Insights|

Simple, easy-to-implement, systematic formula-based investing can still generate market outperformance, providing investors with efficient exposure to well-documented factor premiums.

DIY Trend-Following Allocations: January 2025

By Ryan Kirlin|January 2nd, 2025|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Do-It-Yourself trend-following asset allocation weights for the Robust Asset Allocation [...]

What the Index Effect’s Disappearance means for Market Efficiency

By Elisabetta Basilico, PhD, CFA|December 31st, 2024|Elisabetta Basilico, Liquidity Factor, Research Insights, Other Insights|

One critical, yet often overlooked, choice is how stocks are weighted in the objective function during training, with equally weighted (EW) approaches being the norm. This paper investigates how such choices impact cross-sectional return predictability and the performance of trading strategies derived from these predictions, focusing on the interplay between objective function design and model outcomes.