Concentrated Stock Risk, Tax Drag, and a Smarter Path Forward.

By Wesley Gray, PhD|June 12th, 2025|Research Insights, Strategy Background, Tax Efficient Investing|

Investors with concentrated stock positions face a frustrating paradox: stay exposed to high single-stock risk or trigger steep capital gains taxes by selling. But what if there were a third option—one that preserved wealth, enhanced diversification, and maintained tax efficiency? That’s the vision behind the strategic partnership between Alpha Architect and Cache. Together, we’re working to reshape the way sophisticated investors and advisors approach concentrated equity positions—making advanced tools more accessible, transparent, and investor-friendly.

The Hidden Effort Problem: Work more and get better results?

By Elisabetta Basilico, PhD, CFA|June 9th, 2025|Elisabetta Basilico, Factor Investing, Research Insights, Other Insights, Behavioral Finance, Corporate Governance|

Increased executive effort correlates with positive earnings surprises, higher cumulative abnormal returns post-earnings announcements, and narrower credit default swap spreads. Moreover, portfolios constructed based on changes in executive effort demonstrate significant risk-adjusted returns, underscoring the tangible value of diligent leadership.

What Is an Exchange Fund? A Way to Diversify Without Triggering a Tax Bill

By Jose Ordonez|June 4th, 2025|Research Insights, Strategy Background, Tax Efficient Investing|

Investors with large, concentrated stock positions often find themselves stuck between a rock and a hard place. On one hand, holding on to a single stock position exposes them to unnecessary risk. On the other, selling that stock can mean paying a hefty capital gains tax bill. What most investors don’t realize is that there’s a third option—a relatively obscure yet entirely legitimate strategy that can help diversify away single-stock risk without triggering immediate taxes: exchange funds.

Raising Capital from Investor Syndicates with Strategic Communication

By Elisabetta Basilico, PhD, CFA|June 2nd, 2025|Elisabetta Basilico, Factor Investing, Research Insights, Academic Research Insight, Other Insights, Behavioral Finance|

The structure of investor syndicates—hierarchical or flat—significantly impacts the flow of information and investment decisions. In hierarchical structures, differentiated incentives can lead to persuasive cascades, while flat structures promote truthful information sharing.

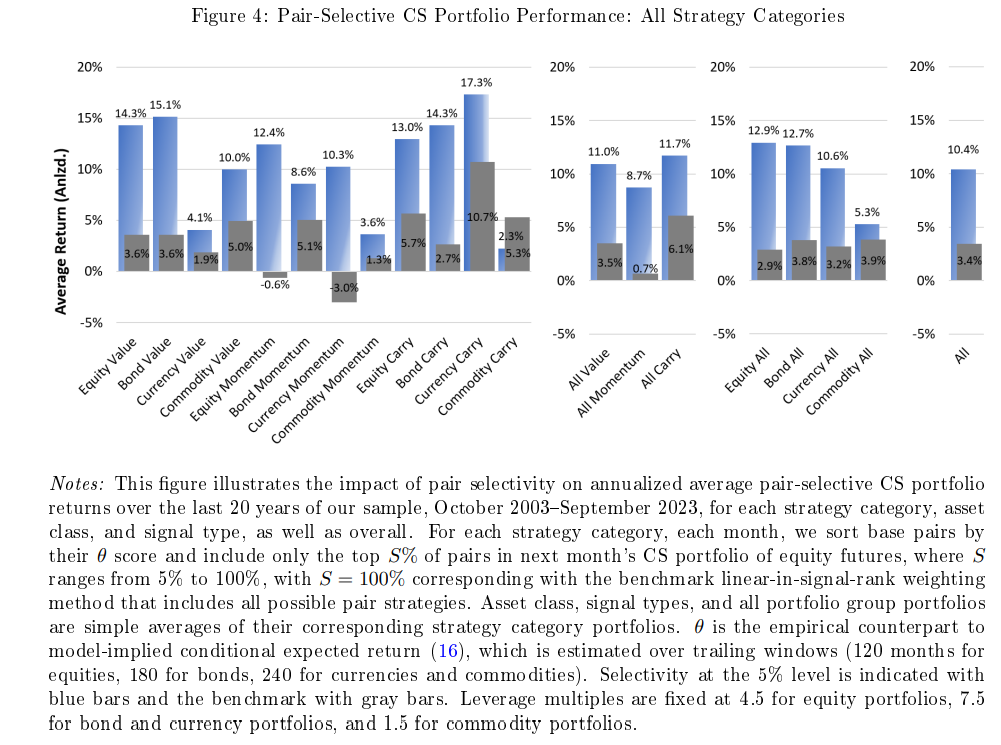

Unlocking Cross-Asset Potential: A New Approach to Portfolio Construction

By Larry Swedroe|May 30th, 2025|Factor Investing, Research Insights, Larry Swedroe, Other Insights, Tactical Asset Allocation Research|

Christian Goulding and Campbell Harvey, authors of the study "Investment Base Pairs," proposed a groundbreaking framework for portfolio construction that challenges traditional approaches in modern finance. Their research focused on leveraging cross-asset information to optimize investment strategies and improve returns across diverse asset classes. Here's an overview of their investigation, key findings, and takeaways for investors and advisors.

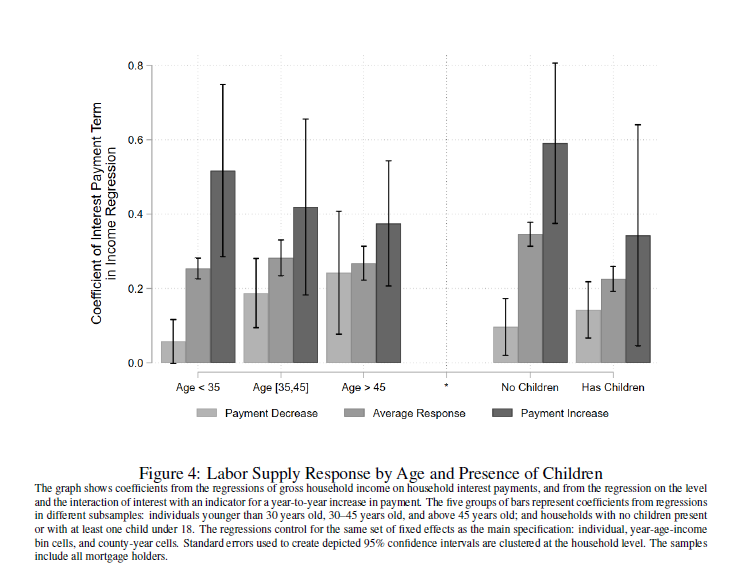

Working More to Pay the Mortgage

By Elisabetta Basilico, PhD, CFA|May 27th, 2025|Elisabetta Basilico, Research Insights, Other Insights, Behavioral Finance|

The study examines how households adjust their labor supply in response to changes in mortgage payments due to fluctuating interest rates.

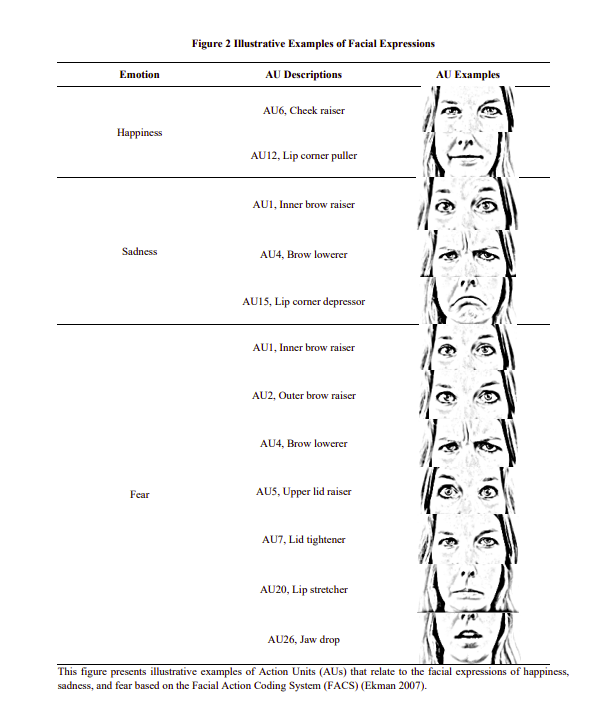

A Good Sketch is Better than a Long Speech

By Elisabetta Basilico, PhD, CFA|May 21st, 2025|Elisabetta Basilico, Factor Investing, Research Insights, Other Insights, Behavioral Finance|

In the evolving landscape of financial technology, innovative methods are emerging to assess creditworthiness. One such approach involves analyzing borrowers' facial expressions during loan applications to predict delinquency risk. This study explores this novel intersection of psychology, machine learning, and finance.

Profitability Retrospective: Key Takeaways for Investors

By Larry Swedroe|May 16th, 2025|Profitability, Intangibles, Quality Investing, Research Insights, Factor Investing, Larry Swedroe, Other Insights, Low Volatility Investing|

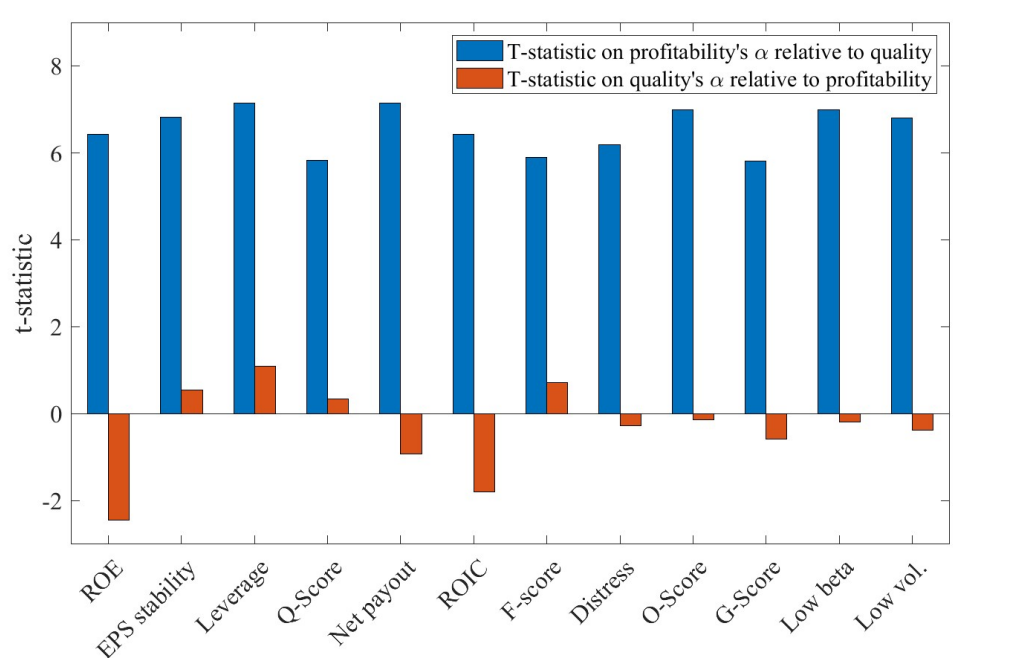

Profitability subsumes all of the quality factor, explaining both the performance of the strategies the investment industry market and the factors that academics employ—none of the quality factors generated significant positive alpha relative to profitability, the other Fama and French factors, and momentum.

The Virtue of Complexity in Return Prediction

By Elisabetta Basilico, PhD, CFA|May 12th, 2025|Elisabetta Basilico, Predicting Market Returns, Research Insights, Factor Investing, AI and Machine Learning, Other Insights|

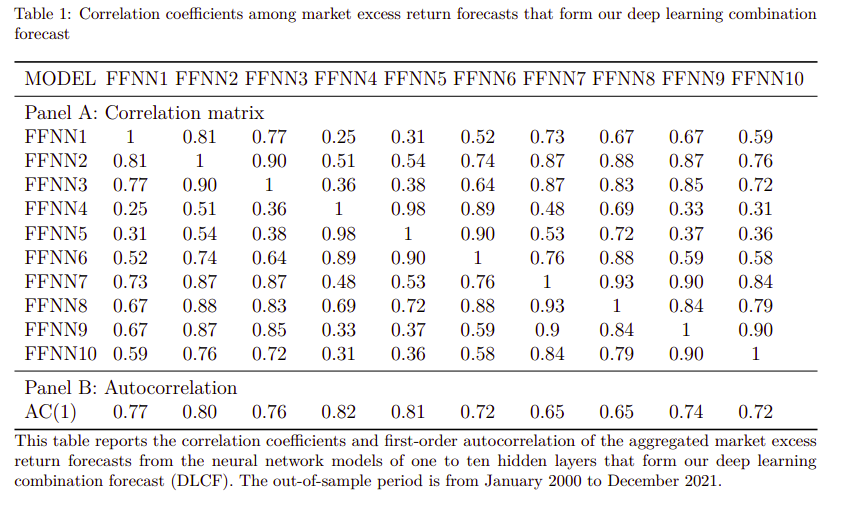

This article explores how researchers forecast market returns by aggregating expected returns from individual stocks.

Cut Through the Noise! These Two Factors Tend to Drive Portfolio Success

By Jose Ordonez|May 8th, 2025|Research Insights, Podcasts and Video, Factor Investing, Investor Education, Value Investing Research, Momentum Investing Research, Size Investing Research|

Let’s break down how to build a robust factor portfolio—without getting lost in the weeds. We investigate which equity factors have the strongest historical returns and diversification benefits from a long-only perspective.