The baseline theory for understanding asset prices is the Efficient Market Hypothesis (the “EMH”), pioneered by Eugene Fama. Of particular interest is semi-strong market efficiency, which claims that markets prices reflect all publicly available information about securities. As the story goes, when mispricings occur in markets, these arbitrage opportunities will be immediately eliminated by professional investors, who exploit these opportunities for a profit. And because of this competitive mechanism, in the EMH view, prices should always reflect fundamental value.

The EMH is a great theory and there is a lot of evidence to suggest that it holds in many cases. However, there is a complementary framework–behavioral finance–that helps solve many of the puzzles in the stock market.

Behavioral finance is often considered a “new” thing, but the concepts have been around for a long time. Consider John Maynard Keynes, who was a shrewd observer of financial markets, and a successful investor in his own right. His investing success, however, was uneven, and at one point he was reportedly wiped out while speculating on leveraged currencies. This led him to share one of the greatest market mantras of all time:

Markets can remain irrational longer than you can remain solvent.

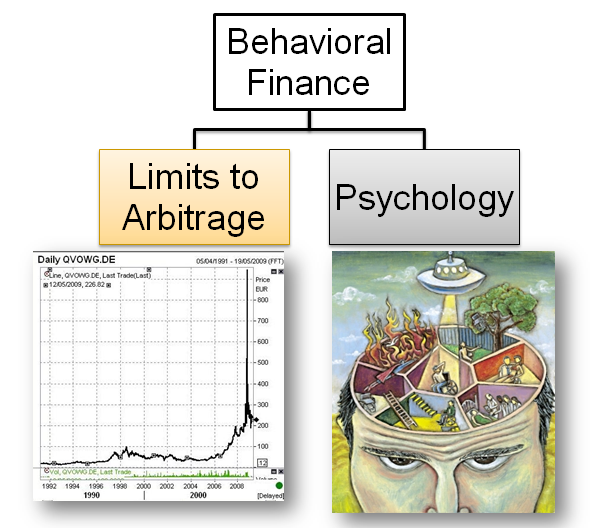

Keynes quip highlights two elements of real world markets that the efficient market hypothesis doesn’t consider: investors can be irrational and arbitrage is risky. In academic parlance, “investors can be irrational” boils down to an understanding of psychology and “arbitrage is risky” boils down to what academics call limits to arbitrage, or market frictions. These two elements–psychology and market frictions–are the building blocks for behavioral finance.

First, a discussion of limits to arbitrage. The efficient market hypothesis predicts that prices reflect fundamental value. Why? People are greedy and any mispricings are immediately corrected by arbitragers. But in the real world, true arbitrage–profits earned with zero risk after all possible costs–rarely, if ever, exist. Most arbitrage-like trades involve some form of cost or risk. This could mean fundamental or basis risk, transaction costs, or noise trader risk.

Basic example:

- Oranges in Florida cost $1 per orange.

- Oranges in California cost $2 per orange.

- The fundamental value of an orange is $1 (Assumption for the example).

- The EMH suggests arbitragers will buy oranges in Florida and sell oranges in California until California oranges drop to $1. Prices will quickly correct and there is no free lunch.

- But what if it costs $1 to ship oranges from Florida to California? Prices are decidedly not correct–the fundamental value of an orange is $1. But there is also not a free lunch.

Next, a discussion of psychology. The literature from psychology makes it fairly clear that humans are not 100% rational all the time. As we have mentioned many times on this site, Kahneman tells a story of 2 modes of thinking: System 1 and System 2. System 1 is an efficient heuristics-based decision-making component of the human brain. System 2 is the analytic and calculated portion of the brain ~ 100% rational. Unfortunately, the efficiency of System 1 comes with drawbacks–we can make instinctive decisions that are irrational. We write extensively on behavior and how it affects markets both here and here.

As stand-alone topics, limits of arbitrage and psychology are interesting, but they have limited potential to affect prices via their individual influences. However, crafting a hypothesis that involves elements of silly investors and market frictions, simultaneously, is a potent combination. For example, consider the concept of noise traders. Brad De Long, Andrei Shleifer, Larry Summers, and Robert Waldmann wrote an article called, “Noise Trader Risk in Financial Markets” in the Journal of Political Economy in 1990.

Here is the abstract from the paper:

We present a simple overlapping generations model of an asset market in which irrational noise traders with erroneous stochastic beliefs both affect prices and earn higher expected returns. The unpredictability of noise traders’ beliefs creates a risk in the price of the asset that deters rational arbitrageurs from aggressively betting against them. As a result, prices can diverge significantly from fundamental values even in the absence of fundamental risk. Moreover, bearing a disproportionate amount of risk that they themselves create enables noise traders to earn a higher expected return than rational investors do. The model sheds light on a number of financial anomalies, including the excess volatility of asset prices, the mean reversion of stock returns, the underpricing of closed-end mutual funds, and the Mehra-Prescott equity premium puzzle.

Combining biased investors with an understanding of market frictions/incentives can create powerful investment concepts. This combination also describes what behavioral finance is all about:

Understanding how behavioral bias, in conjunction with market frictions, create interesting impacts on the market prices.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.