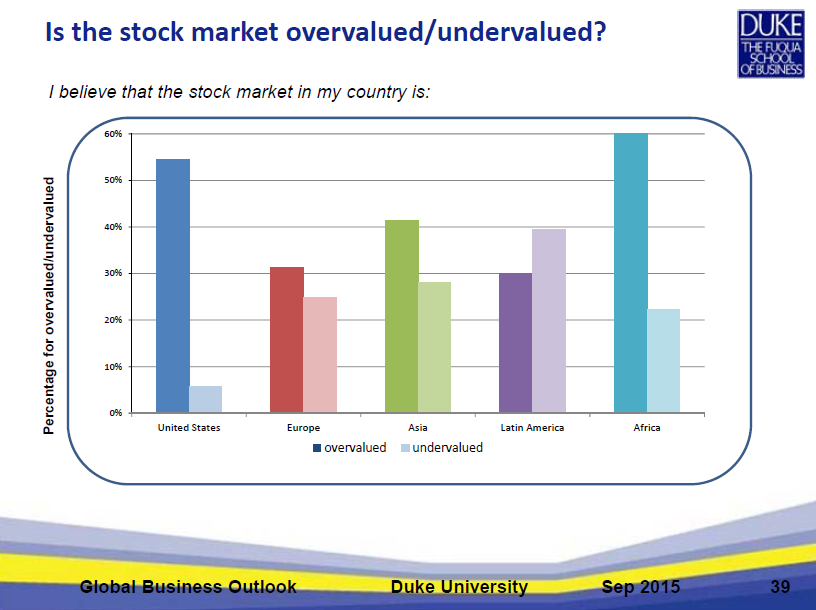

According to the latest Global Business Outlook survey jointly conducted by Duke University and CFO magazine, 55% of U.S. companies say they think the stock market is overvalued, while only 6% of them think the stock market is undervalued.

More than 1,200 CFOs, including 510 from the U.S., participated in this recent quarterly survey. The survey questions cover five main parts: Business Optimism, CFO top concerns, Employment and wages, stock market valuation, and risk management concerns. (Click to download: CFOsurveyOverview_2015Q3 Final)

CFOs are very bearish on the U.S. market,” said Fuqua professor Campbell R. Harvey, a founding director of the survey. “Our survey took place during a volatile time where there was a 10 percent market correction. Even after this drawdown, 55 percent of CFOs thought the market was overvalued. source.

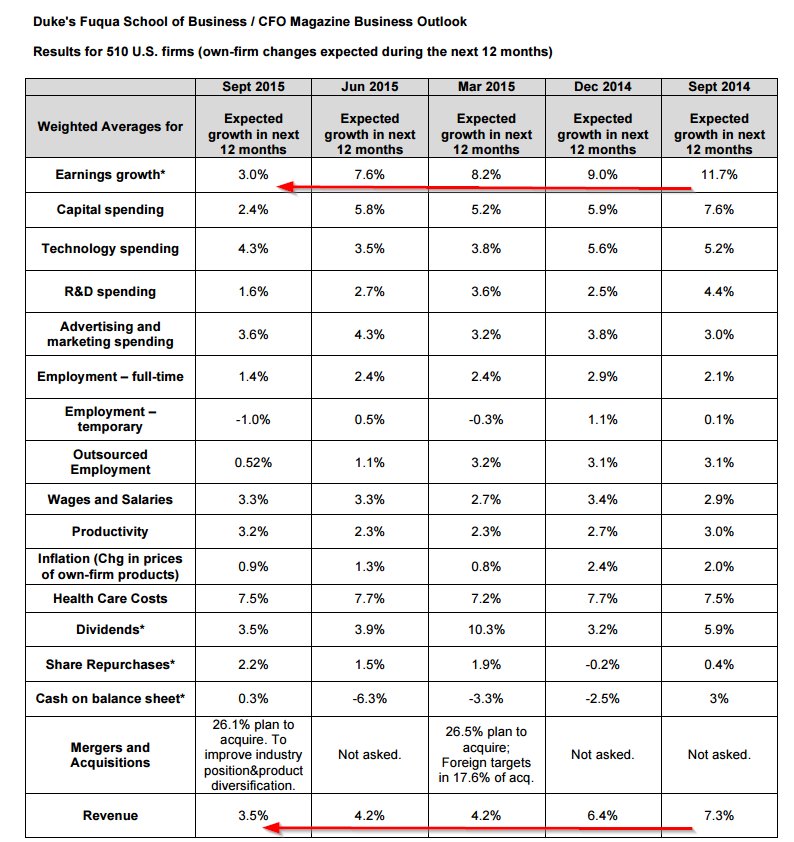

Here are some stats on various metrics from 510 U.S. firms.

- CFOs’ expected earnings growth in next 12 months is 3.0%, down from 11.7% last year.

- CFOs’ expected revenue growth in the next 12 months is 3.5%, down from 7.3% last year.

**The survey has been conducted every quarter since July 1996. An archive of past surveys is available under the “Past Results” tab athttp://www.cfosurvey.org.

Not a lot of bulls in CFO land…

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.