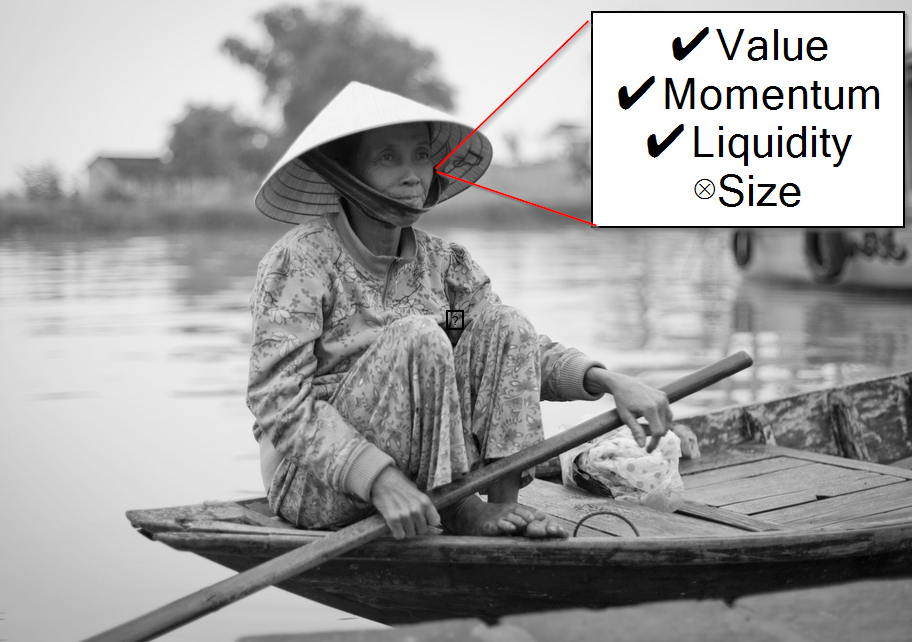

An interesting out of sample test on return drivers in the Vietnamese market from 2006 to 2014. Not surprisingly, value and momentum show some mojo — Liquidity as well…size, not so much. But size only matters if you control your junk, apparently.

This is in line with our own research and the research of many others:

- Value: Never buy expensive stocks.

- Momentum: Ride Winners and Cut Losers.

- Size: Does the size effect exist?

An Analysis of Investment Strategies and Abnormal Returns in the Vietnam Stock Market

The purpose of this paper is to understand the linkages between excess returns and four investment strategies – value, momentum, size, and liquidity – for the Vietnam stock market during the period 2006-2014. The empirical results suggest that a value strategy, such as the E/P and B/P ratios, and momentum and liquidity strategies are the most successful and generate significant excess returns, in contrast to the size strategy, which does not work in the Vietnam stock market. Therefore, investors who want to make a profit when investing in the Vietnam stock market should track published financial information and find winner stocks by referring to value, momentum, and liquidity strategies.

This research is not published in an amazing top-tier journal, but the results serve as another data point supporting the idea that value and momentum are everywhere (Asness et al. 2013). Of course, active investing is simple, but NOT easy.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.