The Dark Side of ETFs?

Sounds interesting, and in my humble opinion, an image of Darth Vader on page 1 would be a great addition to the paper.

The paper, “Is there a dark side to exchange traded funds? An information perspective,” written by Doron Israeli, Charles M. C. Lee, and Suhas A. Sridharan, digs into the details on some implications of higher ETF ownership on individual stocks.

The main premise of the paper is as follows–more people are investing using ETFs, so what are the implications of higher ETF ownership for individual stocks?

Wes recently wrote a summary of a theory paper on this exact topic for etf.com. An interesting fact from the theory paper is the following (quoted from the paper):

We find that after introducing composite securities with endogenous designs, asset prices reflect more systematic information and less asset-specific information, because market makers, understanding that the factor speculator now fully exploits his informational advantage, set prices more sensitive to the composite security orders.

The theory paper suggests that systematic information becomes important (as ETF ownership grows) and firm-specific information becomes less important. Very interesting!

So while the theory says that ETFs are causing firm-specific information to have less of an impact, what does the data say? That is the point of this paper we will discuss below.

Paper Hypotheses

The paper begins by proposing that there are two ways that increased ETF ownership can affect individual stocks.

We propose and test two hypotheses. First, we posit that as ETFs become larger holders of a firm’s shares, trading costs for the underlying securities will increase. This increase in trading costs is associated with a decrease in available liquidity for the component securities owned by ETFs. Second, we posit that the increased trading costs will lead to a general deterioration in the pricing efficiency of the underlying securities. Specifically, we posit that the increased trading costs will deter traders who would otherwise expend resources on information acquisition about that stock. In other words, for firms that are widely held by ETFs, the incentive for agents to seek out, acquire, and trade on firm-specific information will decrease. Over time, this will result in a general deterioration in the firm’s information environment and a reduction in the extent to which its stock price can quickly reflect firm-specific information

So the papers is proposing two hypotheses:

- As ETF ownership increases, the trading costs of the underlying securities will increase.

- As ETF ownership increases, firm-specific information will be reflected less in prices (while market/industry information will be more important).

What could be the cause of this? In the authors words:

Even more importantly, ETFs offer an attractive alternative investment vehicle for uninformed (or “noise”) traders, who would otherwise trade the underlying component securities. As ETF ownership increases, some uninformed traders in the underlying securities migrate toward the ETF market. Over time, this migration creates a steady siphoning of firm-level liquidity, which in turn generates a disincentive for informed traders to expend resources to obtain firm-specific information.

The authors suggest noise traders have simply moved from stocks to ETFs.(1) Doing so causes liquidity to move from the underlying stocks, and for information to move to the market/industry level as opposed to the firm-specific level.

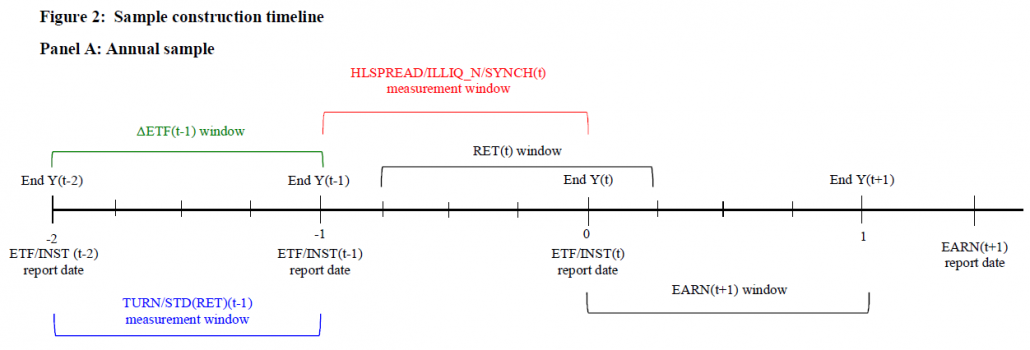

The authors examine the results by looking at the changes in ETF ownership (not the level) and it affect on the variables above. Figure 2 in the paper (shown below) provides a nice visual of the variable construction in the paper.

Below we examine how the authors test these ideas.

The Data and Results

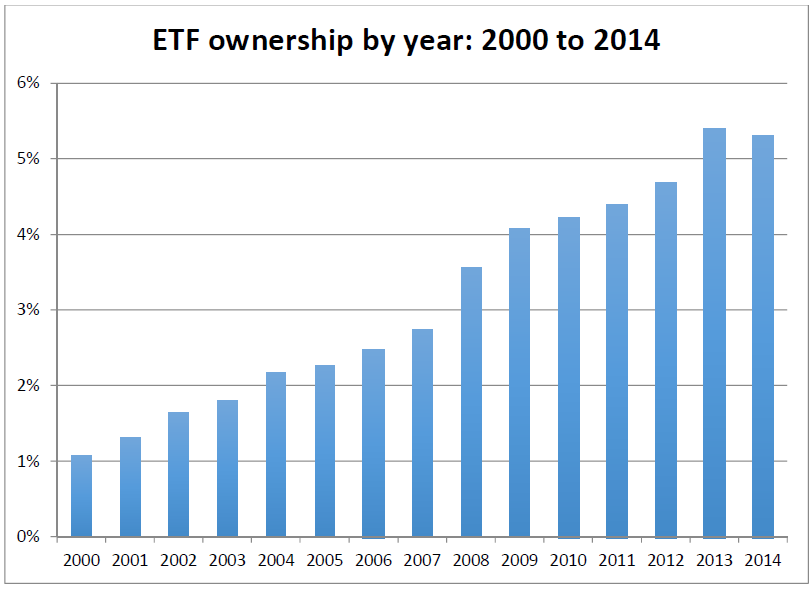

The paper examines U.S. stocks from 2000-2014 to study the effect of ETF ownership on (1) Trading costs and (2) proxies for firm-level pricing efficiency. Figure 1 (shown below) highlights that ETF ownership has greatly increased over this time period. Figure 1 graphs the average percentage of shares outstanding held by ETFs for firms in the sample. While starting close to 1% in 2000, the average percentage of shared held by ETFs is now above 5%!

This figure graphs the average percentage of shares outstanding held by ETFs for firms in the sample.

So what are the effects of this increased ownership?

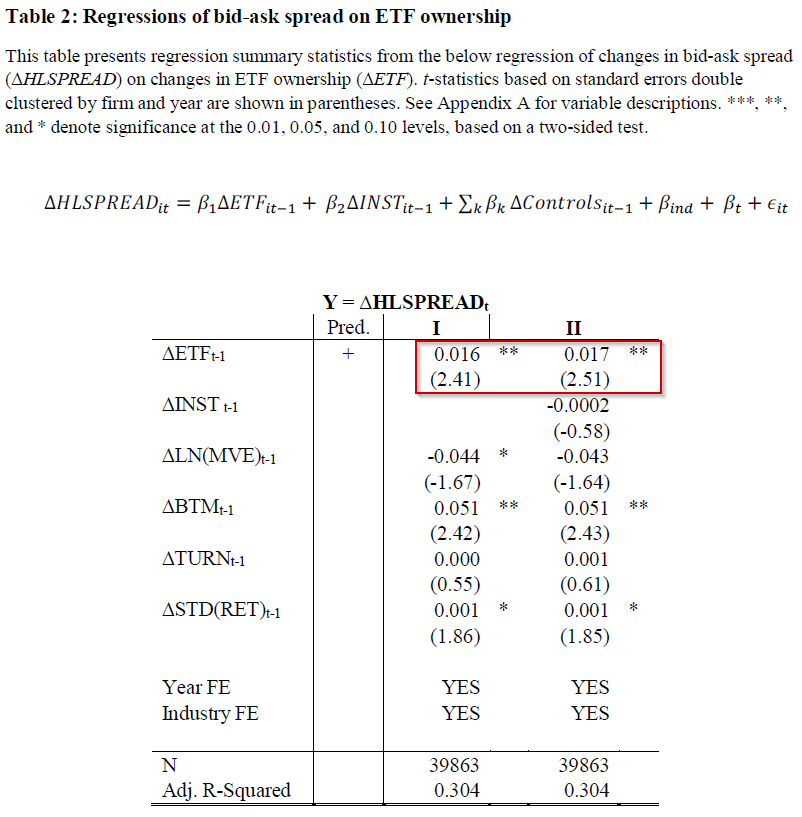

The paper first tests the impact that increased ETF ownership has on trading costs for the underlying stocks. To test this idea, the authors regress the change in ETF ownership for each stock against two measures of trading costs: (1) average bid/ask spread and (2) an adjusted measure of the price impact of trades. Table 2 (below) shows the results to the regression on the average bid/ask spread. As can be seen on the first line, the paper finds that as ETF ownership increases, the average bid ask spread increases, and the result is significant. The paper finds a similar result in Table 3, whereby increasing ETF ownership causes the price impact of trades to increase.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The results in Tables 2 and 3 of the paper indicate that increased ETF ownership appears to be increasing the cost of trading the underlying securities!(2)

Next, the authors examine how increases in ETF ownership affects firm prices. They examine this through two measurement variables:

- Stock return synchronicity (SYNCH) — the extent to which variation in firm-level stock returns is attributable to movements in market and related-industry returns.

- Future earnings response coefficient (FERC) — the association between current firm-specific returns and future firm earnings.

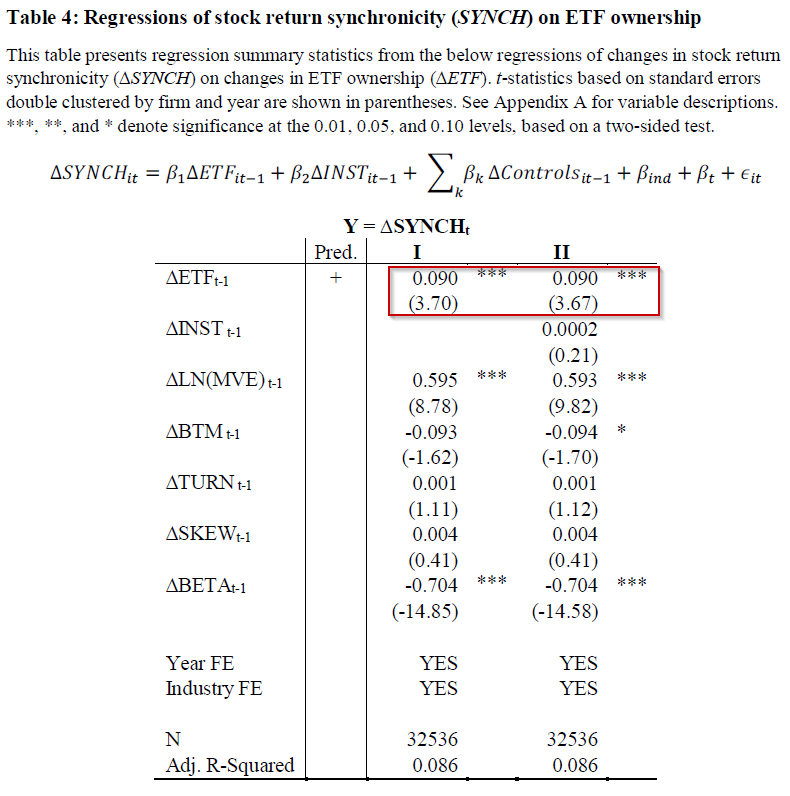

The authors find very similar results to a separate theory paper, which is that asset prices reflect (1) more systematic information and (2) less asset-specific information. The test for asset prices reflecting more systematic information is found in Table 4 (shown below), where the authors regress the SYNCH variable against the changes in ETF ownership. As suggested by the authors and the theory, as ETF ownership increases, more of the stock return movement is explained by movements in the market and related-industry returns. This is shown as the coefficient on the SYNCH variable is positive and statistically significant. The paper finds that a one percentage point increase in ETF ownership is associated with approximately a 9 percentage point increase in the average annual change in return synchronicity.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

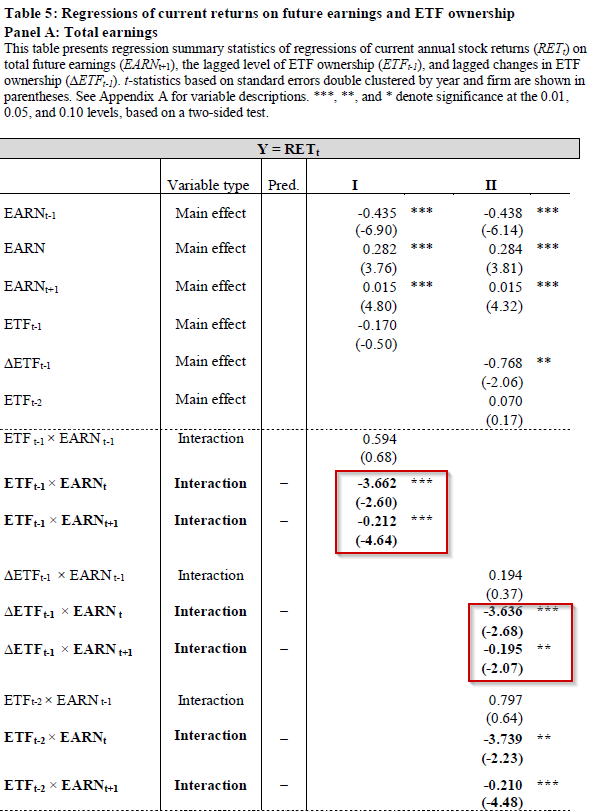

Next, the authors examine how firm-specific information gets embedded in prices as a result of increases in ETF ownership. To do this, they regress current stock returns on future earnings, to examine the extent to which current firm-level returns reflect future firm (or macro) based earnings. The results to the regression are shown in Table 5, Panel A (shown below). Examining the interaction term of (1) the changes of ETF ownership and (2) future earnings for a firm, one finds a statistically significant negative relationship.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

But what do those regression results mean? Here is a direct quote from the paper:

This suggests that firms experiencing a one percentage point increase in ETF ownership also experience a 14% reduction in the average magnitude of their future earnings response coefficients.

That is a large and interesting finding. As ETF ownership increases, the effect of firm-specific information embedded in prices decreases.

The authors do note that there is another working paper that finds the the exact opposite result! Here is the link to the other working paper by Glosten, Nallareddy and Zou (2017). However, after examining the competing paper, the “Dark side” paper finds that the difference in results has to do with the construction of the variables, namely the lagging of ETF ownership.(3)

Conclusion

How ETFs affect the market landscape is on the top of every investor’s mind. This paper helps shed some preliminary light on the subject. But what are we to make of these results?

The authors discuss this in their conclusion:

It is useful to remind ourselves of an important caveat imposed by our research design. While we have demonstrated an association between lagged changes in ETF ownership and changes in firms’ trading costs and pricing efficiency, this association alone does not imply causality. Both the changes in ETF ownership and the subsequent changes in other firm characteristics may be due to another, yet unidentified, latent variable. We cannot think of a good candidate, but our inability to do so does not preclude its existence. At a minimum, we have documented a set of empirical findings that are broadly consistent with an information-based explanation, which future researchers seeking an alternative explanation should address.

The finding that stock prices move more with the market/industry and less to firm-specific information as ETF ownership increases is interesting, as we are proponents of Value and Momentum investing. This implies that information which may be relevant (such as earnings increasing / decreasing in this paper) is not being properly embedded in prices, and may actually cause factor premiums to be larger in the future! However, this would only occur if the information eventually gets embedded in the stock prices (this was not tested in the paper). Additionally, while firm-specific information is not being embedded in prices (a pro for factor investors), the cost of trading individual stocks is also increasing (a con for factor investors).

It is difficult to understand how the pros and cons line up from a factor-investor’s point of view (more analysis is needed). This paper may be more relevant to CEOs/CFOs of companies — if firm specific information is not “properly” being embedded in prices, an agile CEO/CFO may be able to take advantage of this via the funding channel — buy shares if “good” information is not embedded (buy low), and sell equity/debt if “bad” news is not being embedded (sell high).

Overall, this is a very interesting and thought-provoking paper, please let us know what you think below!

**Hat tip (not trick) to Art Johnson for suggesting we review this paper!

Is There a Dark Side to Exchange Traded Funds (ETFs)? An Information Perspective

- Doron Israeli, Charles M.C. Lee, and Suhas A. Sridharan

- A version of the paper can be found here.

Abstract:

We examine whether an increase in ETF ownership is accompanied by a decline in pricing efficiency for the underlying component securities. Our tests show an increase in ETF ownership is associated with: (1) higher trading costs (bid-ask spreads and market liquidity); (2) an increase in “stock return synchronicity”; (3) a decline in “future earnings response coefficients”; and (4) a decline in the number of analysts covering the firm. Collectively, our findings support the view that increased ETF ownership can lead to higher trading costs and lower benefits from information acquisition. This combination results in less informative security prices for the underlying firms.

References[+]

| ↑1 | Note this is a low blow to the ETF strategist community, to link them in with the “noise” traders |

|---|---|

| ↑2 | Some other interesting facts from the regression above are that (1) as firms become “value” stocks, by increasing B/M ratio, the cost of trading increases and (2) if firms have increased stock return volatility (standard deviation of returns), the cost of trading increases. |

| ↑3 | Here is the quote from the paper:

|

About the Author: Jack Vogel, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.