One of the great debates in finance is whether the source of the value premium is risk-based or a behavioral anomaly. In our book, “Your Complete Guide to Factor-Based Investing,” my co-author Andrew Berkin and I present the evidence showing that there are good arguments on both sides. Thus, it’s likely the answer isn’t black or white. For example, we show that the academic research demonstrates that value firms not only have poorer earnings and profitability compared to growth firms, but their greater leverage and more irreversible capital increases their risks in times of financial distress.(1) Stocks that do poorly in bad times should command large risk premiums. Thus, investors demand a higher return on value stocks than on growth stocks as compensation for higher vulnerability due to financial distress. With that said, the literature provides us with several behavioral explanations for the value premium.

One such explanation is that investors are systematically too optimistic in their expectations for the performance of growth companies and too pessimistic in their expectations for value companies. Ultimately, prices correct when expectations are not met. An early well-known study of this reasoning is the 1994 paper “Contrarian Investment, Extrapolation, and Risk” by Josef Lakonishok, Andrei Shleifer and Robert W. Vishny.(2)

Another behavioral explanation is that investors confuse familiarity with safety. Because they tend to be more familiar with popular growth stocks, those stocks tend to be overvalued.

Piostroski and So Tackle the Risk Versus Mispricing Debate

Joseph D. Piotroski and Eric C. So, authors of the 2012 study “Identifying Expectation Errors in Value/Glamour Strategies: A Fundamental Analysis Approach,” which covered the period from 1972 through 2010, tested the mispricing hypothesis by identifying potential ex-ante biases and comparing expectations implied by pricing multiples against the strength of firms’ fundamentals. Value strategies would be successful if prices do not accurately reflect the future cash flow implications of historical information in a timely manner, resulting in equity prices that temporarily drift away from their fundamental values.

Piotroski and So classified and allocated observations into value and glamour (growth) portfolios on the basis of each firm’s book-to-market (BtM) ratio. A firm’s BtM ratio reflects the market’s expectations about future performance. Firms with higher expectations will have higher prices and a lower BtM ratio, while, conversely, firms with weak expectations will have lower prices and a higher BtM ratio. Thus, the book-to-market ratio serves as a proxy for the relative strength of the market’s expectations about a firm’s future performance.

The authors classified a firm’s recent financial strength by utilizing the aggregate statistic FSCORE, which is based on nine financial signals designed to measure three different dimensions of a firm’s financial condition: profitability, change in financial leverage/liquidity, and change in operational efficiency. The FSCORE is an early example of a composite quality factor (such as the QMJ, or quality minus junk, developed by researchers at AQR Capital Management).(3)

Firms with the poorest signals have the greatest deterioration in fundamentals and are classified as low FSCORE firms. Firms receiving the highest score have the greatest improvement in fundamentals and are classified as high FSCORE firms. Prior research had demonstrated that the FSCORE is positively correlated with future earnings growth and future profitability levels. Low FSCORE firms experience continued deterioration in future profitability and high FSCORE firms experience overall improvement in profitability.

The following is a summary of Piotroski and So’s findings:

- Among firms where the expectations implied by their current value/glamour classification were consistent with the strength of their fundamentals, the value/glamour effect in realized returns is statistically and economically indistinguishable from zero.

- The returns to traditional value/glamour strategies are concentrated among those firms where the expectations implied by their current value/glamour classification are incongruent ex-ante with the strength of their fundamentals.

- Returns to this “incongruent value/glamour strategy” are robust and significantly larger than the average return generated by a traditional value/glamour strategy.

In the academic literature, the explanation for the mispricing of value stocks relative to growth stocks is that behavioral errors, such as optimism, anchoring and confirmation biases, cause investors to underweight or ignore contrarian information. As Piotroski and So noted:

Investors in glamour stocks are likely to under-react to information that contradict their beliefs about firms’ growth prospects or reflect the effects of mean reversion in performance. Similarly, value stocks, being inherently more distressed than glamour stocks, tend to be neglected by investors; as a result, performance expectations for value firms may be too pessimistic and reflect improvements in fundamentals too slowly.

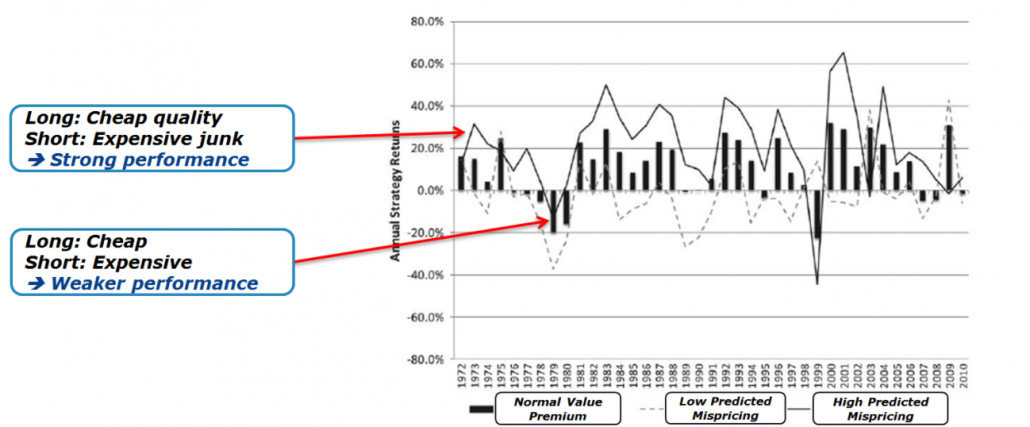

Piotroski and So’s findings were consistent with the mispricing explanations for the value premium. They found that the value/glamour effect was concentrated among the subset of firms for which expectations implied by book-to-market ratios were not aligned with the strength of the firms’ fundamentals (FSCORE). And, more importantly, the value/glamour effect was nonexistent among firms for which expectations in price were aligned with the strength of the firm’s recent fundamentals. They concluded that firms with low book-to-market ratios and low FSCOREs (weak fundamentals) were persistently overvalued, and firms with high book-to-market ratios and high FSCOREs (strong fundamentals) were persistently undervalued. It was in these subsets that the pricing errors were strongest. The authors also noted that while both the traditional value/glamour strategy (relying solely on BtM rankings) and the incongruent value/glamour strategy produce consistently positive annual returns, the frequency of positive returns was higher for the incongruent value/glamour strategy. It generated positive returns in 35 out of 39 years over the sample period (versus 27 out of 39 years for the traditional value/glamour strategy). They also found that annual returns to the incongruent value/glamour strategy were larger than the traditional value/glamour strategy in all but six years, with an average annual portfolio return of 20.8 percent versus 10.5 percent for the traditional value/glamour strategy.

The figure below highlights the key result from Piotroski and So. The incongruent, or high predicted mispricing portfolio, has strong performance, whereas the congruent, or low predicted mispricing portfolio, has weaker performance.

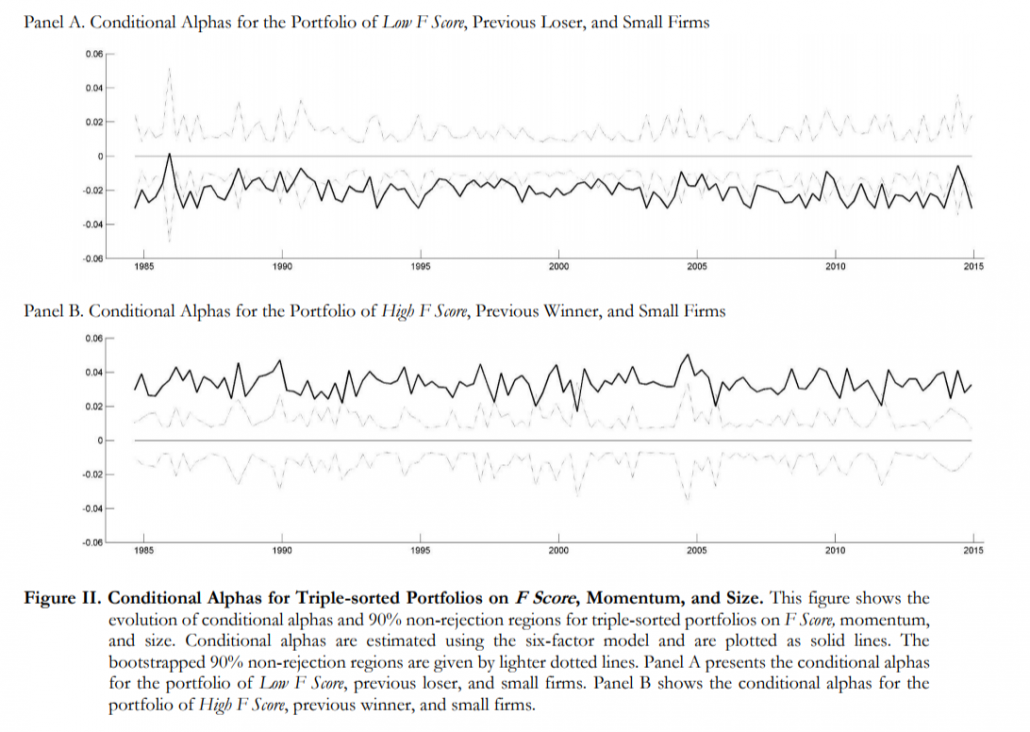

Piotroski and So’s findings are supported by those of H.J. Turtle and Kainan Wang, authors of the study “The Value in Fundamental Accounting Information,” which appears in the Spring 2017 issue of the Journal of Financial Research. Using Piotroski’s FSCORE, they examined the role of fundamental accounting information in shaping portfolio performance. Their data set covers the period from 1972 through 2012. Providing support for the behavioral-based explanations as a source of the value premium, they showed that portfolios of firms with strong fundamental underpinnings generated significant positive performance after controlling for the factors of market beta, size (SMB, small minus big), value (HML, high minus low), momentum (MOM), investment (CMA, conservative minus aggressive), and profitability (RMW, robust minus weak). They noted that their results “suggest that the abnormal gains from a strategy based on underreaction to fundamental value changes under information uncertainty are not subsumed by common risk factors documented in the literature.” The figure below, taken from the source paper, makes their point clear.

Turtle and Wang explain that one potential source of the outperformance is an underreaction to public information when information uncertainty (proxied by size, illiquidity and idiosyncratic volatility) is high. They note:

Underreaction to information is likely to be most prevalent in opaque firms with greater degrees of information uncertainty. Examples include small firms, illiquid firms, and firms with few analysts.

Their findings confirmed this hypothesis. For example, they found that,

the average conditional alpha in the smallest size portfolio shows a Low F Score conditional alpha of -3.92%, and a corresponding High F Score conditional alpha of 10.60%.

They also found that performance benefits seem prevalent in periods of high investor sentiment (when mispricing is most likely). They concluded:

Our annual results find strong post-portfolio formation returns and suggest evidence of marginal performance that is not solely compensation for increased risk. Observed conditional alphas are often highly significant for portfolios with strong fundamentals, lending support to the F Score anomaly explanation.

They concluded:

The majority of the performance due to momentum and F Score is found in firms with high information uncertainty consistent with the gradual resolution of information.

As mentioned earlier, there are other behavioral explanations for the value premium.

Other Behavioral Explanations

Another behavioral explanation for the value premium is loss aversion. Nicholas Barberis and Ming Huang, authors of the 2001 study “Mental Accounting, Loss Aversion, and Individual Stock Returns,” explain that the size of investor loss aversion depends on whether the individual has recently experienced gains or losses. They write: “A loss that comes after prior gains is less painful than usual because it is cushioned by those earlier gains.” In other words, risk aversion decreases because the investor is now playing with the house’s money. The authors continue: “On the other hand, a loss that comes after other losses is more painful than usual: After being burned by the first loss, people become more sensitive to additional setbacks.”

Growth stocks are generally companies that have performed well recently, as evidenced by their current high price. Investors, therefore, become less concerned about future losses, being cushioned by the gains from recent performance. They thus apply a lower risk premium (as they are now willing to accept more risk) to growth stocks. This might also help explain the momentum effect because the now low required risk premium drives prices up even further and, of course, future expected returns lower. On the other hand, value stocks are generally associated with companies that have performed poorly in the recent past, as evidenced by their current low prices. The pain of the recent loss causes investors to perceive these stocks as even riskier. They therefore raise the required risk premium, driving prices even lower and expected future returns even higher.

We’ll touch on one more behavioral explanation for the value premium. Many investors have a preference for “lottery ticket” investments that provide the small chance of a huge payoff. Investors find this small possibility attractive. The result is that positively skewed securities (small-cap growth stocks) tend to be “overpriced,” meaning that they earn negative average excess returns. The poor returns to these stocks are reflected in the value premium.

To summarize, the behavior patterns we have discussed help explain why the value premium has been so large, larger indeed than most financial economists believe is justified based solely on risk characteristics. Sentiment has been shown to impact prices, and limits to arbitrage (such as short sale constraints) prevents sophisticated investors from fully correcting mispricings. Thus, we have an explanation for why patterns are likely to continue, even after the publication of research demonstrating the existence of anomalies. That is, they are likely to persist unless, of course, investors stop acting like human beings. Moreover, even if the value investing premium is partially attributable to systematic mispricing, attempting to exploit the anomaly involves a high degree of arbitrage risk and can often suffer long bouts of underperformance. As Wes points out in his piece, Sustainable Active Investing, value investing is simple, but not easy.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.