I recently had a conversation with a client who had a big fat 529 plan and was planning to take a distribution from it to pay for his child’s first college tuition payment. We both knew that this 529 plan would cover all the costs associated with college. His question was surprisingly simple:

As long as this goes toward college expenses, I don’t have to pay taxes on the gains, right?

Unfortunately, my answer was anything but simple.

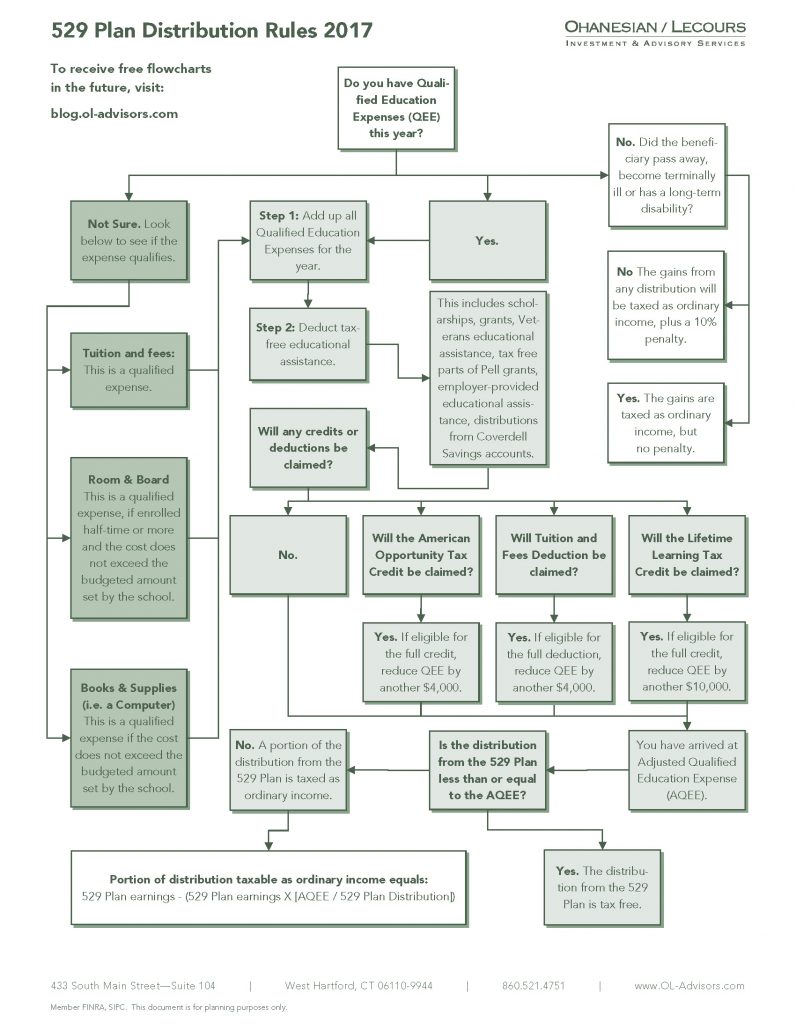

I began by explaining what expenses qualified, and which ones did not. By the time I explained how tax-free educational assistance impacts a 529 plan distribution, my client’s eyes were starting to glaze over. I never even broached the impact that tax credits would have on the distribution. The problem was that I knew his situation well enough to know that he could very easily find himself getting taxed on a small portion of the distributions.

Instead of droning on and on, I stopped and offered to sketch out the concept and have presented it below. This made sense for the client and understood where the tax landmines were located.

I thought other investors and advisors could benefit from this flowchart:

If you want to see more flowcharts about other financial planning topics, check out the recent post on IRA Rules Visualized, or join our mailing list to get them emailed to you.

And finally, I’m always looking for my next flowchart idea. If you have any ideas, please email me.

About the Author: Michael Lecours, CFP®

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.