Jack and I will be attending the Evidence-Based Investing Conference tomorrow in NYC. We’re excited to participate and be part of the crowd. Be sure to give us a holler — love to discuss whatever is on your mind!

Historically, the conversations at EBI can end up covering fun topics.

For example, Over the summer, Jack spoke at the West Coast version and recapped his experience via this post. Key highlights?

- Investor Behavior Matters

- Embrace Transparency

- Being an Evidence-Based Investor is difficult!

I spoke at the EBI conference last year in NYC (will be doing so again this year). The chatter at that conference was related to the low volatility anomaly. A recap is here. The main point I made during this discussion, in not so eloquent terms?

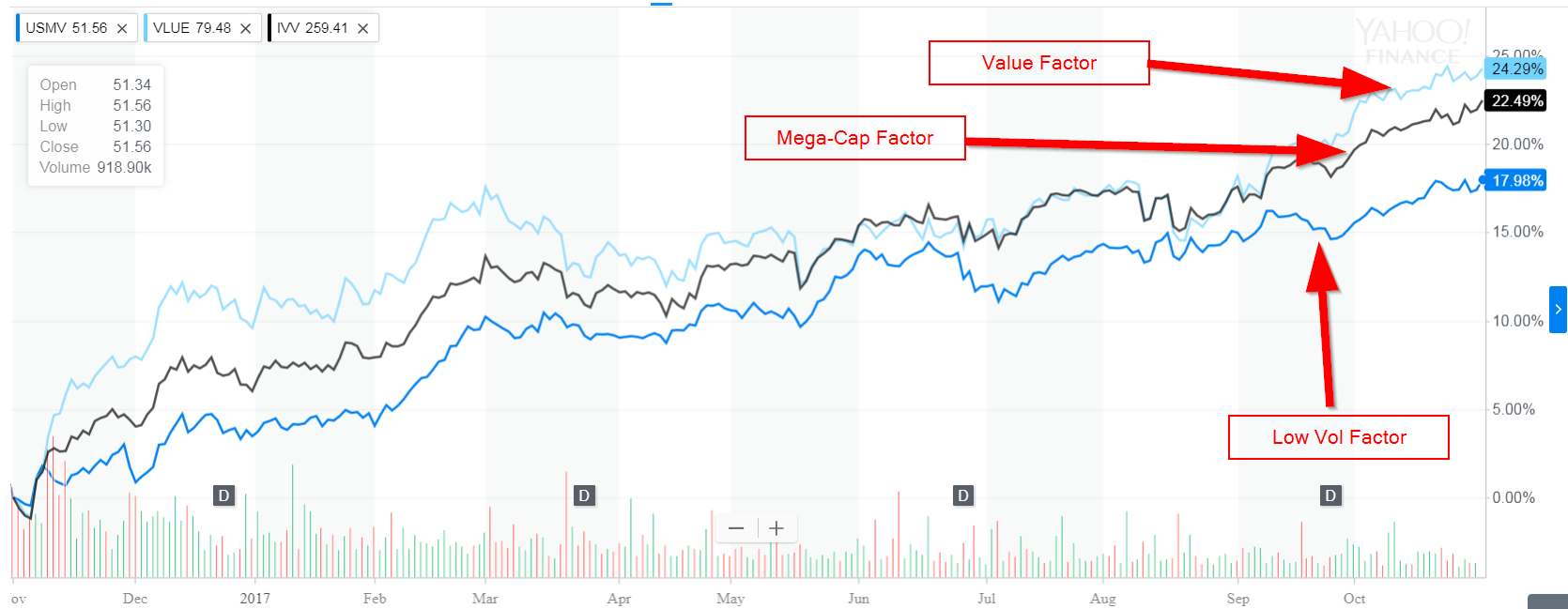

Right now, low-vol is expensive crap. You should be buying cheap crap.

Turns out that was the correct sentiment for the past year:

Where will be go this year? I’m guessing passive versus active, machine learning, and maybe some Amazon chatter. But who knows. Hopefully, we’ll geek out on factor research with Cliff Asness at the helm. Or maybe Tim Buckley can explain how they plan on addressing a basic question: how big is too big? Jason Zweig should be good for an update or two on how our “monkey” brains work and/or don’t work.

With Josh Brown and Barry Ritholz on the mic, you know this will be an exciting event.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.