If you have a large “low-basis stock problem,” or an “embedded capital gain problem,” the Opportunity Zone (OZ) program could possibly be the single largest tax break you’ll ever see. With the right investment, the Opportunity Zone program can create generational wealth, while also transforming economically disadvantaged communities across the United States.

As Wes likes to say, “a huge win-win!”

As an OZ investor, you’re facing a new frontier of investment options. We hope this article will guide you through some of the decisions you’ll face and help you find investment projects worth considering.

We’ll cover, in layman’s terms, the following:

The Opportunity Zone Program Basics:

- Program Overview

- Investment Options

- Tax Benefits

How to Find Opportunity Zone Investments:

- Three (Actually Four) Types of Investments You’ll Encounter

- Two Ways You Can Invest in The Program

- Investor Considerations

- How to Find Opportunity Zone Investments

If you have questions, feel free to contact me directly here.

The Opportunity Zone Program Basics

The Opportunity Zone Program – Overview

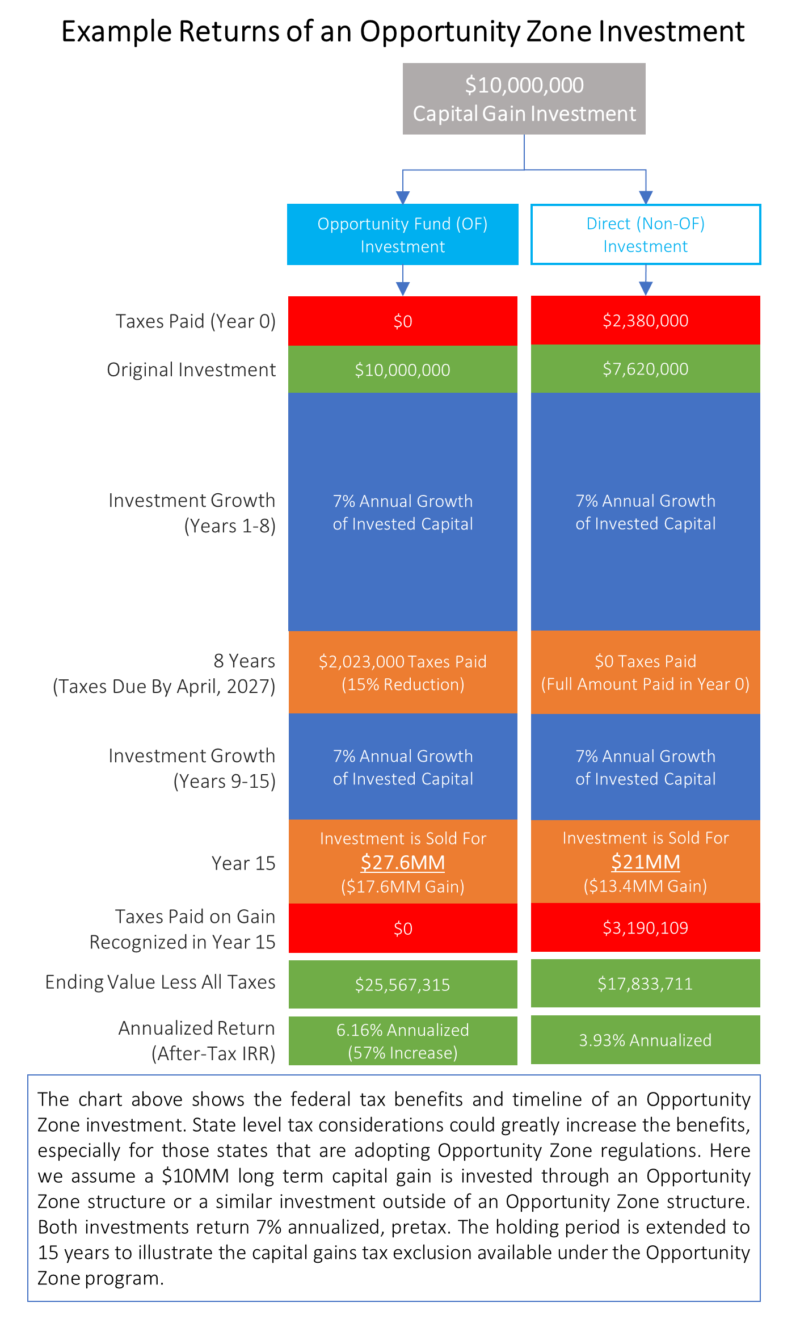

The OZ program was included in the recently passed Tax Cut and Jobs Act of 2017, which allows for investors to take capital gains proceeds from the sale of an asset (which can be stocks, bonds, real estate, a business or just about anything) and defer paying capital gain taxes for up to 10 years. Then, 100% of the capital gain proceeds can be invested into a business or a real estate project operating in an Opportunity Zone. Thereafter, depending on the holding period, OZ investors will get further tax breaks – including never having to pay taxes on future capital gains again (see example chart below).

Opportunity Zones are economically distressed census tracks. Over the summer of 2018, each state’s governor nominated OZ census tracts which were then certified by the U.S. Department of the Treasury (Treasury). A complete list (and a link to a map) of all Opportunity Zones can be found here.

To receive the tax benefits, you can’t invest directly into an OZ, but rather, you must invest in an Opportunity Fund (OF). It is the OF that actually makes the investments into eligible projects located within an Opportunity Zone. OFs can be partnerships or corporations, and they are allowed to self-certify as an OF. They must also hold at least 90% of their assets in an OZ and also manage various compliance, accounting, and reporting requirements each year.

Once an investor generates capital gains, they will have 180 days to invest those funds into an OF. The OF will then have a reasonable period of time to invest that capital into an Opportunity Zone (exact rules on this are pending). From there, the funds must be used within 31 months.

The Opportunity Zone Program – Investment Options

Eligible investments include real estate, operating businesses, or even public-private-partnerships (PPP). However, you cannot provide debt or loans through the program — it must be equity. Furthermore, you can’t invest in “sin” businesses such as liquor stores, massage parlors, golf courses, country clubs, racetracks, casinos or the like.

An Opportunity Fund may invest in the equity of a business, provided that business generates at least 50% of their revenues from the active conduct of their business from within an OZ. Furthermore, at least 70% of the business’ tangible property must be located within an Opportunity Zone.

An OF may also invest in real estate, provided that the property is “substantially improved” within a 30-month period. “Substantially improved” means that the value of the building is doubled from its original value at acquisition.

The Opportunity Zone Program – Tax Benefits

There are three levels of federal tax benefits under the OZ program, depending on how long you hold your investment in the Opportunity Fund. These benefits are as follows:

- Deferral of Capital Gains Tax: You can defer recognizing the original capital gain until the date you sell your investment in an Opportunity Fund or December 31, 2026, whichever is earlier;

- Capital Gains Discount: You get a 10% step up in basis (basically a 10% discount) in capital gains if you hold your investment in the Opportunity Fund for at least 5 years and a 15% step up in basis (15% discount) if you hold your investment in the OF for at least 7 years; and

- 100% Exclusion of Capital Gain Tax: If you hold your investment in the Opportunity Fund for at least 10 years, when you finally do sell your OF investment, you will not owe any capital gains tax on the sale. (Note, you must sell by December 31, 2047).

The tax deferral is great, and the step up in basis is a nice benefit, but it is the permanent exclusion of tax associated with the 10+ year holding period that will generate the most interest.

Below is a graphic comparing the 10+ year option with a standard non-OZ investment:

How to Find Opportunity Zone Investments

The Three (Actually Four) Types of Investments You’ll Encounter with an OZ

As an investor, you’ll likely come across three types of investment opportunities under the OZ program. The first, and most common, are real estate development projects. The second are operating businesses (which has two variants), and the third are Public Private Partnerships (PPP). We’re seeing OFs being set up around each of these investment silos, with real estate projects being the most prevalent.

1: OZ Investment – Real Estate Projects

Many OZ investments will be real estate development projects. To qualify as an OZ investment, the real estate must be substantially improved within a 30-month period. Substantially improved means that the value of the building is doubled from the original value at acquisition. As of the time of this writing, most real estate OFs are investing in real estate projects related to hotels, office buildings, mixed-use retail and multi-family housing units.

- Benefits of Real Estate OZ Projects: We won’t cover all of the benefits of real estate investing in this article, but suffice to say that real estate has been a wealth builder for many investors. There are already inherent tax advantages to real estate, such as the 1031 Exchange and the depreciation of assets that allow for tax-free income and cash-flows. Also, many people consider real estate a hard asset with inherent and stable value. This can be comforting when considering a long-term investment.

- Risks of Real Estate OZ Projects – Location, Location, Location: If real estate is all about “Location, Location, Location” then an OZ real estate investment will have some location risks from the start. By definition, OZs are located in some of the least attractive and most blighted cities and neighborhoods in the country. There are economic and demographic reasons why capital has not historically been invested into OZ census tracts – simply put, they haven’t been profitable places to invest. A tax benefit alone will not change this.

For projects that rely on location and retail foot traffic or even housing and entertainment, Opportunity Zones present some risk. For example, a $20MM hotel investment project in a blighted Opportunity Zone will have an uphill economic battle to attract guests unless there is another reason for them to choose that hotel.

To counter this location risk, many OZ real estate projects are not building just one hotel, but rather they are redeveloping entire sections of a city. Instead of taking on basic location risk, investors are taking on the risk that the developer will be successful in changing the base economics of an area. That’s the goal of the OZ program, so we hope they will be successful.

In my own opinion, the least risky real estate OZ projects will be in areas that are already experiencing an economic turnaround.

2a: OZ Investment – Businesses Equity

An OF may invest in the equity of an operating business. A good OZ investment into a business can generate fantastic returns, but to qualify for OZ investment, a business must generate at least 50% of their revenues from the active conduct of their business from within an OZ. Also, at least 70% of the business’ tangible property must be located within an Opportunity Zone.

- The Benefits of Operating Business Investments: There are three benefits to investing in an operating business.

- First, they can grow and appreciate significantly, thereby maximizing the tax benefits of the OZ program (think venture capital or private equity funds).

- The second benefit is that their economic risk is not tied to their location, at least for many of them. Take, for example, a distribution or manufacturing business. Where they locate their warehouse or manufacturing plant has little do with their economic risk. They can locate just about anywhere and it will be their industry’s economics and their customers that drive the financial returns of their business, not specifically the location of their warehouse or manufacturing plant.

- The third benefit is that operating businesses that locate in OZs can take advantage of other tax incentives by virtue of the fact that they are in a distressed or overlooked community. These include job creation tax credits, property tax abatements, grants, and subsidized loans. These can, in some cases, exceed tens of millions of dollars.

- The Risks of an Operating Business Investment: Most of the businesses that will benefit from the OZ program will be small or middle market companies. They won’t be publicly traded and will have all the risks associated with investing in the asset class. They usually carry higher management risk and are tied to the general economy, like any other business. In a downtrend, they can suffer just like the stock market, likely even more so.

2b: OZ Investment – Operating Businesses Real Estate

This type of investment is a blend between a pure-play real estate investment and an operating businesses investment. Instead of investing in a stand-alone retail-based real estate project or investing in the equity of a family-run middle market business, an OZ investor would invest in the real estate from which a business will operate, under a long-term lease agreement.

For example, an OZ investor may invest in the warehouse/distribution center used by a wholesale business. They might invest in the plant and equipment of a manufacturing company or own the office building used by several companies.

- The Benefits of Operating Business Real Estate: In these examples, the geographic risk of the OZ real estate investment is reduced while also providing the investor with a “hard asset” and all the benefits of a real estate investment. Furthermore, the operating business risk is limited to their ability to make lease payments. And if they can’t make the lease payments or if they go out of business, you can replace them with new business tenants.

- The Risks of Operating Business Real Estate: There is geographic and location risk to owning an industrial or commercial building in an Opportunity Zone. The census tracks that make up Opportunity Zones are not traditionally where businesses have chosen to locate, and this has depressed values in the past. This is true for commercial buildings that lease office space and it is also true of industrial businesses. An OZ investor is taking risk that the lease rates and resale value of their real estate will not greatly appreciate by virtue of the location.

3: OZ Investment – Public Private Partnerships (PPP)

Many cities and towns and counties have public projects that require funding, which may come from the Opportunity Zone program. These include wastewater treatment plants, schools and libraries, roads, bridges, parking garages, etc. Normally, the local government would issue bonds to pay for these projects. The government would then operate the facilities and charge fees or taxes to service the debt and pay for employee salaries.

Public-Private-Partnerships (PPP) take a different course. They allow outside private investors to buy those assets, improve them and either lease them back to the local government or operate them independently. They would generate income by charging tolls, issuing service charges, or billing the government directly, which would use tax revenue to service those fees.

PPPs are a viable option for OZ financing. If you’re interested in owning a water treatment facility, a bridge or a building that is leased to a municipality, this type of investment could work for you.

The pros and cons of this type of investment are varied, depending on the specific investment, and too numerous to list here, but they could provide solid risk-adjusted returns under the right scenarios.

Two Ways to Invest in Opportunity Zones

To receive tax benefits, an investor cannot invest directly into an Opportunity Zone business or real estate. Instead, they must invest in an Opportunity Fund (OF) that redeploys their cash into qualified investments. To date, we see two types of Opportunity Funds. These are Third-Party Opportunity Funds and Self-

Directed Opportunity Funds.

- Third-Party Opportunity Funds: Under this model, a private equity, venture capital, or another investment firm, would set up an Opportunity Fund. This fund will seek to pool or match investor funds with projects that need capital. For investors that do not want to spend their time looking for projects, or who do not want to manage project-level investments, this is how they will likely make their OZ investments. I would expect the fee structure of these funds to mirror other existing fund fees, which can be expensive, if not more so, due to the tax savings of the program. So, pay attention to the fee structure.

- Self-Directed Opportunity Funds: There is nothing to stop an investor from registering their own Opportunity Fund with Treasury and investing directly into qualified opportunity zone projects. For investors who are comfortable with sourcing their own deals and performing due diligence, and have the time, this can be a great way to make use of the program and limit fees.

At the same time, companies and developers with projects in Opportunity Zones can also set up Self-Directed Opportunity Funds to receive private capital directly from investors. If you’re able to find investors for your projects, specifically those with capital gains to invest, this can be a great option.

As for costs, a Self-Directed Opportunity Fund can save on management fees, but you’ll be responsible for all legal costs, annual compliance, and tax reporting that will need to be made on behalf of the Opportunity Fund. Don’t underestimate these costs, or rather underestimate their importance, as a mistake in this area could result in a significant tax bill.

Investor Considerations

To help guide your decisions, I’d like to raise a few points and considerations.

Do You Owe Capital Gains Tax? If you’re facing a capital gains tax liability, then this program could be a great fit for you. However, it’s not a good reason to start selling assets just to generate a capital gain so you can invest in an Opportunity Fund – unless you find a great OZ investment. If you’re already invested in great assets with no need to sell, take your time considering this program.

OZ Program vs. a 1031 Exchange: 1031 exchanges allow investors to sell real estate and to roll the proceeds over into a new property tax-free. If this is your intention, then the 1031 exchange might be the better path for you, especially since the OZ program requires that the new property be improved by 100% over its basis within 30 months (think of new construction or major renovations). However, the OZ program can eliminate future capital gains whereas 1031 exchanges only defer taxes. And if you are selling another asset class (business, stocks etc.) or wish to switch asset classes out of real estate, then the OZ program could be an option for you.

Good Investment or a Good Tax Break? Just because the OZ program offers a great tax break does not imply that every OZ deal will be a good investment. Look closely at both sides of this coin – the tax incentives and the investment itself to make your decision.

Fees, Diversification and Due Diligence: As with all investments, buyer beware. Pay attention to all the things you would normally consider when making a private investment. These include looking at fees, performing due diligence and background checks on those you invest with, and remembering to diversify both within the program’s parameters, but also across your entire portfolio.

Government Incentives: The Opportunity Zone is only one of many government tax and financing incentives available to companies and developments. In fact, many OZs are also eligible for New Market Tax Credits (a form of grant funding), USDA Loan Guarantees and other federal, state and local funding sources (see a $30MM example here). It would be wise to consider adding these low-cost financing sources to your overall capital stack.

Total Portfolio Management: No one investment should be made in a silo, but rather the investment should be made in consideration of your entire portfolio. We’ve thought a lot about how to manage personal wealth and investments and the data supports investing across as many asset classes as possible.

How to Find Opportunity Zone Investments

The Opportunity Zone program is fairly unregulated, and there is no central exchange, website or organization that connects all investors with all potential projects. Investors will have to be creative with how they find projects to invest in. To help, I’ve listed where to find these projects below. Some are relatively simple while others require more time and effort for the investor.

Private Equity and Venture Capital Firms: A simple Google search will reveal that many PE and VC firms are starting Opportunity Funds and are raising capital. These firms are setting up OFs right alongside their existing funds and will presumably operate under similar fee structures. They do all the work identifying projects and vetting out the management, and will therefore serve as a direct link between capital gain investors and investment opportunities. This is the easiest path forward.

Real Estate Developers: Private RE developers, especially those operating in traditionally overlooked communities, have projects that could use capital. I would start looking for developers in your geographic areas of interest that have great track records.

Banks: Just about every company, developer or project that is seeking funding has already been in touch with their local or regional bank to ask for funding. The banks’ regional relationship managers know which projects need funding and can play matchmaker between you, as the investor, and these projects.

Government Economic Development Agencies: Each state and county, and many cities, have economic development agencies or other similar organizations (such as chambers of commerce) that know the businesses in their OZs. Investors can contact them directly and ask for introductions to companies and projects that need funding. Here, the investors must perform their own due diligence on all projects, follow up with each lead and weed out the projects. For those willing and able to devote this time, they may avoid some of the fees associated with traditional private equity sponsored funds.

Community Development Entities: CDEs, as they are called, are government-supported financial institutions that provide financing to projects in low-income communities. Many of these communities are in Opportunity Zones, and CDEs would know which projects in these OZs require capital financing. Some CDEs are setting up their own OFs to invest in projects they like, so they can be a great resource for investors.

CPA Firms, Law Firms and Commercial Real Estate Brokers: There are a few CPA and law firms that are involved with the program and know about viable OZ projects. These firms often connect projects with investors and other service providers. Commercial real estate brokers are also a good source for many projects.

Contact Me: Finally, feel free to contact me. Many of my clients (operating businesses and real estate developers) are in Opportunity Zones and are seeking investors. I’m also in contact with many Opportunity Funds, economic development agencies, banks, CDEs, CPA firms and law practices involved in the program – pretty much everyone I listed above. I’d be happy to connect you with the right people and to make introductions.

About Me:

Adam Tkaczuk is the Managing Principal at Sterling Point Capital (www.sterlingpointcapital.com). He provides tax and financial consulting services to businesses and real estate developers, many of which have projects in Opportunity Zones. He specializes in reducing his client’s tax exposure and raising capital for projects that can benefit from government subsidies. Adam also assists Alpha Architect with their structured business sale practice and manages a Registered Investment Advisory business. He earned his MBA in Finance from Rensselaer, has a BS in Physics from the University of Massachusetts, and studied Portfolio Theory at the National University of Singapore.

About the Author: Adam Tkaczuk

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.