As the chief research officer for Buckingham Strategic Wealth and The BAM Alliance, I’m often asked, after any asset class or factor experiences a period of poor performance, if the historical outperformance of stocks with that characteristic has disappeared because the premium has become well known and arbitraged away.

The size premium’s relatively poor performance in U.S. stocks over the eight-year period from 2011 through 2018 caused many investors to question its persistence. Using Fama-French three-factor model data, the annual premium was negative in six of the eight years, with returns of -5.0 percent, -0.8 percent, +5.5 percent, -7.0 percent, -4.1 percent, +6.2 percent, -4.1 percent, and -3.1 percent, respectively. The annualized premium over that period was -1.6 percent, with a total return over the period of -12.4 percent. Its performance was similar in international markets—from 2011 through November 2018, the World ex-US Small minus Market factor was an annual average -1.3 percent.

When asked to address this type of question, the first thing I generally point out is that all factors, including market beta, have gone through, and likely will continue to go through, very long periods of negative premiums. (Read Wes Gray’s post, where he suggests that it takes alien powers to take the pain of academic factor portfolios.) That must be the case, or there would be no risk when investing in them, and efficient markets would arbitrage away any premium.

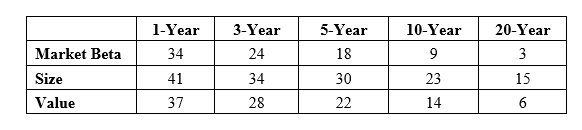

The following table shows the odds of a negative premium, expressed as a percentage, for the three Fama-French factors of market beta, size and value. Data is from the Fama/French Data Library and covers the period 1927 through 2017. Using the historical mean premium, the historical standard deviation of the premium, and Monte Carlo simulations, we can estimate the odds of a premium being negative in future periods. As you can see, even at 20 years, we should expect the equity premium to be negative in 3 percent of periods. (Note that most financial economists believe the equity risk premium, or ERP, will be smaller than the historical average because valuations are now much higher than average. All else being equal, that increases the odds of a negative premium over all time frames.) As you can also see, the most recent eight-year period of poor performance certainly isn’t unusual for the size premium, as it should be expected to be negative in almost one-quarter of even 10-year periods.

The lesson here is that, if you are considering investing in any factor, you should be prepared to endure long periods of negative premiums and understand the importance of staying disciplined. One reason investors fail to earn market returns is that they lose discipline, which is why Warren Buffett stated that temperament is more important than intellect when it comes to

There’s another point worth noting, and it demonstrates the importance of diversification. While the annual average U.S. size premium was -1.6 percent during the eight-year period ending in 2018, the international size premium was +1.5 percent. If the size premium in the United States had disappeared because it was well known, one might think it would also have disappeared in the rest of the developed world.

Why the Size Premium Should Persist

In “Your Complete Guide to Factor-Based Investing,” my co-author, Andrew Berkin, and I provide five criteria a factor must meet before you should consider allocating assets to it. We established the criteria to minimize, if not eliminate, the risk of a finding being the result of data mining. The five criteria are that a factor is persistent across very long periods, pervasive around the globe (and where appropriate, across asset classes), robust (to various definitions), implementable (survives transaction costs) and intuitive. The size premium meets all the criteria. The following briefly summarizes the findings presented in the book, providing intuitive, risk-based explanations for believing the premium should persist (risk cannot be arbitraged away). Relative to large companies, small companies typically are characterized by the following:

- Greater leverage.

- A smaller capital base, reducing their ability to deal with economic adversity.

- Greater vulnerability to variations in credit conditions due to more restrictive access to capital.

- About 50 percent greater price volatility (about 30 percent versus about 20 percent).

- Higher volatility of earnings.

- Lower levels of profitability.

- A premium positively correlated with economic cycles—the risk of small stocks tends to show up in bad times, and assets that perform poorly in bad times require risk premiums.

- Greater uncertainty of cash flow.

- Less liquidity, which therefore makes their stocks more expensive to trade.

Other explanations might include:

- A less proven, or even unproven, track record for the business model.

- Less depth of management.

Roger Grabowski of Duff and Phelps contributes to the literature on the size factor with his November 2018 paper “The Size Effect Continues to be Relevant When Estimating the Cost of Capital.” The paper reviews the size effect and potential reasons why one observes the size

Citing the academic literature, Grabowski offers the following characteristics of smaller firms that cause the rate of return investors expect when investing in stocks of small companies to be greater than the rate of return expected when investing in stocks of large companies. These traits provide a risk-based explanation for why the premium should persist—why it cannot be arbitraged away:

- Potential competitors can more easily enter the “real” market (the market for the goods and/or services offered to customers) of the small firm and take the value that the small firm has built.

- Large companies have more resources to better adjust to competition and avoid distress in economic slowdowns.

- Small firms undertake less research and development and spend less on advertising than large firms do, giving them less control over product demand and potential competition. Small firms have fewer resources to fend off competition and redirect themselves after changes in the market occur.

- Smaller firms often have fewer analysts following them, and less information available about them.

- Smaller firms may have less access to capital.

- Smaller firms have thinner management depth.

- Smaller firms have a greater dependency on a few large customers.

- The stocks of smaller companies are less liquid than the stocks of their larger counterparts.

- Analysts and investors have difficulty evaluating small, little-known companies and estimating traditional quantitative risk measures for them. This ambiguity adds to the risk of investment and increases the return required to attract investors.

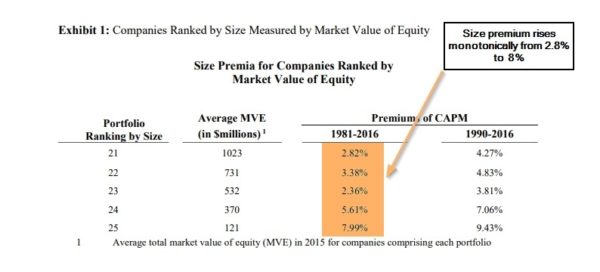

Grabowski also showed that the size premium was robust to various definitions. His database covered the period 1981 through 2016. He chose this period to demonstrate that the premium has not disappeared in the post-Banz period (Rolf Banz’s paper, “The Relationship between Return and Market Value of Common Stocks,” was published in March 1981).

To study the size premium, he created quintile portfolios of the smallest companies. He excluded financial services companies because the regulated nature of banks and insurance companies causes their underlying characteristics to differ from those of nonregulated companies. He also excluded speculative start-ups, distressed (i.e., bankrupt) companies and other high-financial-risk companies. (These groups of stocks are often referred to as “lottery” stocks.) Grabowski wrote: “This methodology was chosen to counter the criticism of the size effect by some that the size premium is a function of the high rates of return for speculative companies and distressed companies in the data set.”

The author found that, when ranking by market cap, the size premium increased monotonically from 2.8 percent in the first quintile to 8.0 percent in the fifth. In addition to market cap, he also examined the results based on ranking by net income. He found the same monotonic increases—the premium increased from 1.7 percent (first quintile) to 6.6 percent (fifth quintile). When ranking by net assets, the premium also increased monotonically, from 2.2 percent (first quintile) to 6.4 percent (fifth quintile). Similar results (though not exactly monotonic increases) were found when ranking by EBITDA (earnings before interest, tax, depreciation and amortization)—the premium increased from 3.4 percent (first quintile) to 6.0 percent (fifth quintile).

When Grabowski examined the subperiod 1990 through 2016, he found very similar results across all size metrics, with premiums tending to increase as size decreased—and in the case of two of the four metrics, the increase in returns was monotonic across quintiles.

Grabowski also examined whether the size premium is a proxy for other risk characteristics. For example, he found that smaller companies tend to have higher leverage and both lower operating margins and much greater volatility of that margin. For example, when breaking the market into 25 portfolios by market cap, the volatility of operating margin for the smallest stocks was about five times that of the largest stocks. These are clear indicators of increased business risk. He also found that business risk as measured by the unlevered asset beta (i.e., greater asset beta indicates greater business risk) generally increases as size decreases. He found these relationships to be robust to the various size metrics he used.

Summarizing, Grabowski noted: “Small companies are believed to typically have greater expected rates of return compared to large companies because small companies are inherently riskier. However, this leaves the question of why small-stock returns have not consistently outperformed large-company stocks for various periods. When talking about expectations, two factors are considered: the probability and the magnitude. Assuming that the small stocks will always outperform large stocks implies that the probability is 100%, which cannot be true. In a recent study, F-F [Eugene Fama and Ken French study ‘Volatility Lessons’] find that the estimated probabilities that small-cap companies can be expected to underperform large-cap companies over a five-year investment horizon is only 29.8%. But they also find that as the investment horizon increases, the likelihood that the returns on small-cap companies will exceed returns of large-cap companies increases: In short, value and small stock premiums over Market are always risky, but for longer return horizons, good outcomes become more likely and more extreme than bad outcomes.”

Summary

One of the more common mistakes investors make is to believe that research publicizing the existence of a premium will eliminate it. The best demonstration of this point is that the ERP—the annual average return to the market beta factor—is certainly well known. Yet, no one believes that it should disappear. The simple explanation is that there are risk-based explanations for it to persist, and risk cannot be arbitraged away. That said, all premiums are subject to potential shrinkage post-publication. They can shrink as more investors become aware of the factor and desire exposure to it, being willing to accept the risks. Alternatively, they can shrink because risks become lower.

For example, it’s logical that the ERP is lower today because economic volatility is much lower than it was 100 years ago. Another rationale for a lower ERP is that implementation costs (fund expenses, commissions, bid-offer spreads) are lower, allowing investors to capture more of the premium. Thus, they should be willing to pay a higher price for exposure to market beta. These same two explanations apply to the size premium (and the value premium). It is for these reasons that, when the Investment Policy Committee at Buckingham Strategic Wealth estimates returns for use in Monte Carlo simulations, we use current valuations to estimate the ERP, while we give historical factor premiums a 25 percent haircut.

To repeat, investors must expect that any risk-based factor will experience long periods of underperformance. One only has to observe the U.S. value factor to see that it’s having a very rough decade. However, that’s not a reason to avoid exposure to a factor, such as size. In fact, investors should find satisfaction in the erratic performance of small stocks. If you believe that small stocks are riskier than large stocks, it should follow that small stocks should not always outperform large stocks in all periods—sometimes the risks show up. This is true even though the expected returns are greater for small-cap stocks over the long term.

The right way to think about the issue of underperformance over long periods is to diversify across factors so your risks are not concentrated in the one (or the few) that happens to go through an extended period of poor performance. Alpha Architect and many others have specifically looked at the benefits of diversifying the value and momentum factors. Diversification becomes especially important as you approach and enter retirement, when the order of returns matters a great deal.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.