Distracted Institutional Investors

- Daniel Schmidt

- Journal of Financial and Quantitative Analysis, forthcoming

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

- How severe are attention constraints* among professional investors?

- Through exactly which channel do they operate?

- How does inattention affect trade performance?

*The primary distraction proxy is the (weighted) fraction of stocks on the investor’s watchlist that exhibit an earnings announcement in a given period

What are the Academic Insights?

By exploiting detailed transaction-level data* for a large sample of U.S. institutional investors, the authors find the following:

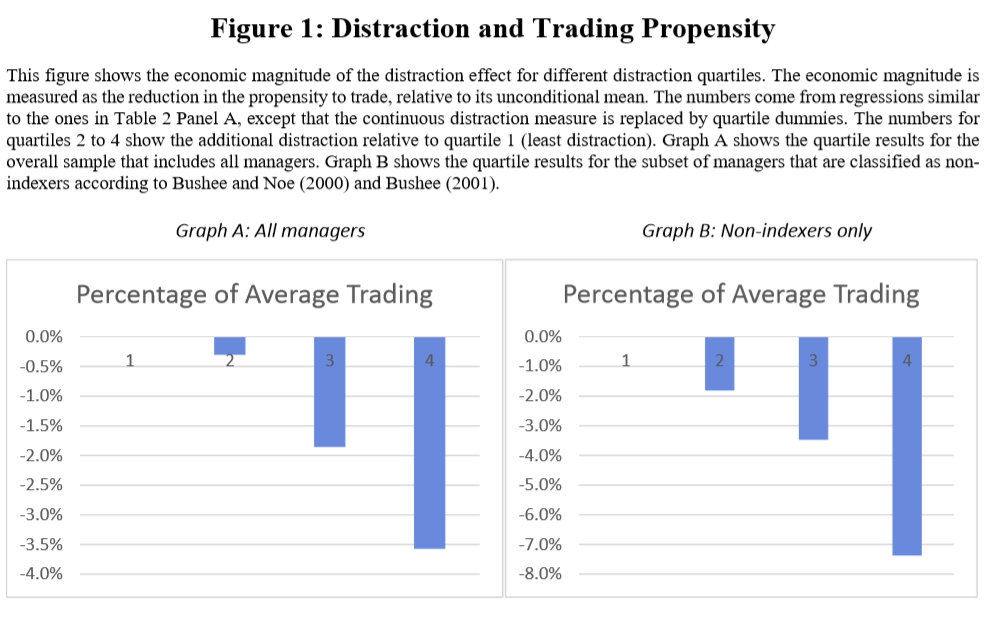

- Institutional investors are significantly less likely to trade in a given stock when there are many earnings announcements for other stocks on their watchlist. An increase from the bottom to the top quartile of distraction reduces the propensity to trade in a given stock by 3.5%. For the subset of managers that follow active investment strategies; the effect doubles to more than 7%.

- The authors find two channels: a) distraction leads managers to make poorer trading decisions (the distraction effect on trade and in particular sell decisions is pronounced for stocks that trade at a loss; b) distracted managers incur higher transaction costs on their trades. The authors find that in addition to rational considerations, attention allocation decisions are influenced by subconscious

and/or psychological factors such as a stock’s salience and emotions toward gains and losses. - The authors find a statistically significant distraction effect on trade profitability: a one‐standard deviation increase in distraction decreases the average post‐trade profitability over the subsequent four weeks from roughly 0.1% to ‐0.1%. Thus, while the institutional managers in the sample on average earn money with their trades, they begin losing money when they are distracted. Additionally, this distraction effect is pronounced for the group of non-indexers with a magnitude that is twice as large as the one for the baseline sample.

The authors perform a number of robustness checks.

*data comes from Ancerno Ltd, a consulting firm that helps institutional investors to monitor their trading costs. Prior research finds that Ancerno trades represent approximately 10% of all institutional trading volume in the U.S. and that they are not significantly different from trades made by the average U.S. institutional investor.

Why does it matter?

Investors (professional asset managers) employ significant resources to overcome attention constraints: they hire research staff, acquire access to real‐time news feeds and invest in computer capacities for algorithmic trading or smart order‐routing. Despite these efforts, attention constraints occasionally appear to be binding. Specifically, managers with a large fraction of watchlist stocks exhibiting an earnings announcement are significantly less likely to trade in other stocks. Additionally, distracted managers trade less profitably and incur higher transaction costs.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We investigate how distraction affects the trading behavior of professional asset managers. Exploring detailed transaction-level data, we show that managers with a large fraction of portfolio stocks exhibiting an earnings announcement are significantly less likely to trade in other stocks, suggesting that these announcements absorb attention which is missing for the choice of which stocks to trade. Hence, attention constraints can be binding even among this elite group of traders. Finally, we identify two channels through which distraction hurts managers’ performance: distracted managers fail to close losing positions, partly explained by these managers displaying a stronger disposition effect, and incur slightly higher transaction costs.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.