The variance risk premium (VRP) refers to the fact that, over time, the option-implied volatility has tended to exceed the realized volatility of the same underlying asset. This has created a profit opportunity for volatility sellers—those willing to write volatility insurance options, collect the premiums and bear the risk that realized volatility will increase by more than implied volatility. Because the equity VRP risk (specifically, when the sale of options performs poorly) tends to show up in bad times (when risky assets perform poorly), we should expect a significant premium, one that cannot be arbitraged away. On the other hand, price shocks happen at different times for different assets. For example, volatility in natural gas prices may be driven by weather, which is not correlated with equity risks. And volatility in agricultural prices may be driven by Midwestern floods like we experienced in May 2019.

The fact that volatility shocks can happen at different times for different asset classes is an argument for a diversified by asset class VRP strategy. William Fallon, James Park and Danny Yu, authors of the study “Asset Allocation Implications of the Global Volatility Premium,” published in the September/October 2015 issue of the Financial Analysts Journal, examined the performance of volatility premiums over the 20-year period beginning in 1995. They began by defining and calculating standardized returns to volatility exposure for a variety of global asset markets. They scaled each of the 34 volatility return series to target an annualized volatility of 1 percent each month at trade inception. They found that shorting volatility offers a very high and statistically significant Sharpe ratio: 0.6 equities, 0.5 fixed income, 0.5 currency, 1.5 commodities, and 1.0 for a global VRP composite strategy (which is dramatically higher than the 0.4 Sharpe ratio for the market beta premium). They also noted:

Selling volatility is profitable in virtually all markets nearly all the time, including the five-year period surrounding September 2008.

However, they also cautioned that shorting volatility strategies is not a free lunch in that they come with occasional, but substantial tail risks. The tail risk in the diversified portfolio was similar to the average tail risk of the individual strategies, indicating that correlations tend to rise in bad times. However, they added that the diversified strategy, when added to a multi-asset class portfolio, did not increase the tail risk and greatly improved (by 31 percent) the Sharpe ratio.

A large body of evidence demonstrates that the VRP is persistent and pervasive as well as robust to various maturities across asset classes (stocks, bonds, commodities, and currencies) and around the globe. My ETF.com article of August 2, 2017, presented the evidence from several academic studies on the subject.

Further Evidence

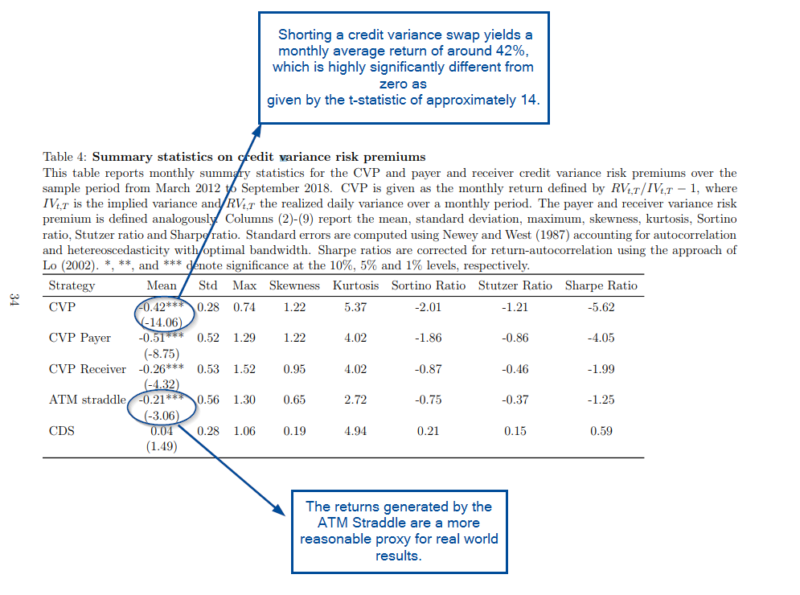

Thanks to Manuel Ammann and Mathis Moerke, authors of the June 2019 study “Credit Variance Risk Premiums” we have further evidence documenting the pervasiveness of the VRP. Their contribution was to extend the research to credit markets. For their data set, they drew upon options written on the CDX North America Investment Grade 5 Year Index and covers the period from March 2012 to September 2018. They synthetically constructed the variance swap rate from out-of-the-money payer and receiver swaptions. They found that the CVP was significantly profitable after transactions costs, with very high T-stats, and that it was not subsumed by the Fama-French six-factor model (i.e., it’s likely a unique source of risk and return).

For those who read the paper, some words of caution are warranted. While there has been a credit VRP, it’s not some magic asset, no asset is. And the very high return found by the authors could not be realized in the real world for several reasons. First, the analysis used a variance swap, which does not trade. Returns to a straddle are a more reasonable proxy. Second, as another cautionary note, the data sample ends just before a particularly difficult time for credit risk (from the fourth quarter of 2018 through the start of 2019). Third, transaction costs are likely understated. Transactions costs can be high unless you are a patient trader who sells liquidity to the market, not takes it from the market. Thus, the premium they found may overstate the realizable premium. The reason is that the high returns they found are not what an investor would experience. This is an artifact of the return convention used, which is akin to a return on premium rather than return on assets. A fund implementing the strategy would have much higher assets than the premium collected (in order to manage risk and control the level of volatility). With that said, there is still a significant premium for those who have the infrastructure to patiently trade.

Before summing up, it’s worth noting that the findings of a significant CVP should not be a surprise as the VRP has been found to be pervasive around the globe and across asset classes. Naturally, selling volatility insurance means accepting considerable tail risk for which sellers must be compensated. It’s also important to note that there are natural buyers of credit insurance—banks and financial institutions. The great financial crisis changed the way they must look at credit risk. The 2010 Dodd-Frank Act required banks to submit what is called a Comprehensive Capital Analysis and Review (the stress test). One way to meet their capital requirements (reducing their need for expensive capital) and pass the stress test is to buy credit insurance.

Summary

We have strong evidence of persistence (across time) and pervasiveness (across the globe and asset classes) of the VRP. The VRP also has a simple intuitive risk-based explanation for why it should persist post-publication of the research: It results from the desire of investors to protect themselves against economically unfavorable states of the world—they are willing to pay an insurance premium.

Diversification has been called the only free lunch in investing. And diversification is investors’ only relief from systemic and unforecastable market risks. Effective diversification requires uncorrelated investments, as well as a look beyond traditional stock and bond indexes to other areas of risk and return, such as reinsurance, alternative lending, carry, and the VRP. Thus, the key to successful investing is pursuing a combination of strategies across low-correlating assets to produce a broadly diversified portfolio.

While the VRP is best known in U.S. equities (so most volatility products focus on them), diversification across many asset classes has the potential to improve VRP returns through reducing portfolio volatility. This is both intuitive and empirically observable in historical data, which shows low correlation of the VRP across asset classes, including commodities, currencies and credit.

Before investing in the VRP, or any strategy that exhibits negative skewness, you should be aware that, while such strategies can consistently accrue small and consistent gains over many years, rare, large losses disproportionately occur in bad times. It’s this poor timing of losses that helps explain the large required risk premiums. For example, a simple strategy that involves capturing the S&P 500 volatility premium lost more than 48 percent in October 2008. However, volatility premium strategies tend to recover quickly, more so than other asset classes, because it is precisely in the immediate aftermath of a crisis event when the implied volatility is highest (caution: a high implied volatility doesn’t guarantee a high return as realized volatility can continue to increase). This is similar to how insurance companies, which raise premiums after incurring large losses from catastrophic events, operate.(1)

References[+]

| ↑1 |

Note that the fund my firm uses to access the VRP is Stone Ridge Asset Management’s All Asset Variance Risk Premium Fund (AVRPX). The fund, which has a 10 percent volatility goal over the long term (note that volatility can be higher in the short term), systematically selling thousands of listed and over-the-counter options across equities, interest rates, foreign exchange, volatility (the volatility of volatility) and commodities (such as livestock, agricultural products, energy and metals) markets around the globe. It also has exposure the credit VRP which is obtained from selling options in the CDX Indices as the evidence demonstrates that it is a diversifying source of risk that has historically been profitable on average and over time. |

|---|

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.