A large body of research demonstrates that “familiarity breeds investment.” For example, a study by Gur Huberman found that shortly after AT&T was broken up and shareholders were given shares in each of what were called the Baby Bells, the residents of each region held a disproportionate number of shares of their regional Bell. Each group of regional investors was confident their regional Baby Bell would outperform the others. How else can you explain each investor having most of their eggs in one baby basket? This is not Lake Wobegon where all Baby Bells can outperform the average of the group.

Other examples of familiarity breeding investment are Georgia residents who own a disproportionate share of Coca-Cola stock, and people in Rochester, New York, who tended to own disproportionate shares in local companies such as Kodak, Xerox and Bausch & Lomb. This story is a good analogy for the way domestic investors view nondomestic assets.

Research documents that familiarity breeding investment (leading to a home country bias) is a global phenomenon, as most investors hold the vast majority of their wealth in the form of domestic assets. In a 2017 study, Vanguard found that in each case they examined, investors exhibited a strong home-country bias.

| U.S. | U.K. | Japan | Canada | Australia | |

| Percent of Global Market Capitalization | 50 | 7 | 7 | 3 | 2 |

| Percent Allocated to Domestic Equities | 79 | 26 | 55 | 59 | 67 |

Note that the countries with a smaller market share tend to have larger gaps between the share of assets allocated to domestic markets and their share of global market capitalization. For example, the home country bias in the U.S., with at the time a 50 percent share of global market capitalization, results in U.S. investors overweighting domestic assets by 29 percentage points. The gap for Japan, with just a 7 percent share of global market capitalization, is 48 percentage points. For the even smaller Canadian and Australian markets, the gaps are 56 percentage points and 65 percentage points, respectively. U.K. investors appear to be relatively less subject to this bias, with a gap of just 19 percentage points.

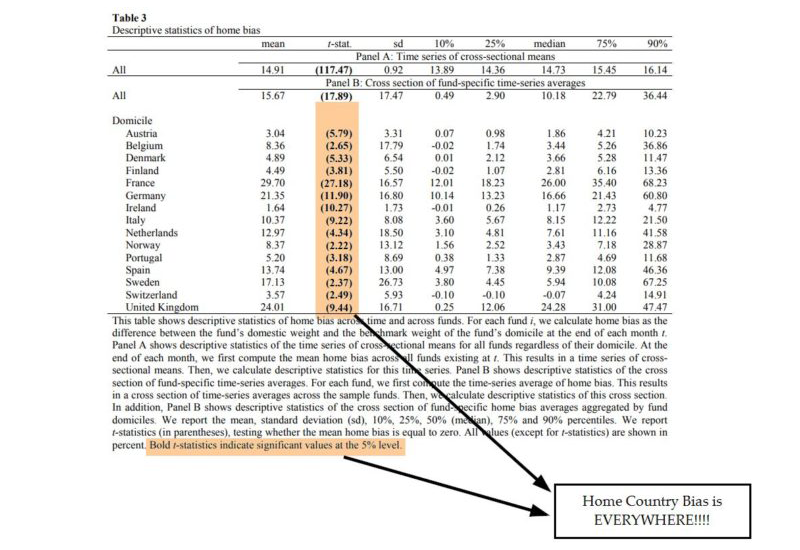

Even supposedly sophisticated professional money managers are subject to home country bias. Moritz Maier and Hendrik Scholz, authors of the January 2019 study “Determinants of Home Bias: Evidence from European Equity Funds,” examined the holdings of 699 actively managed equity funds, domiciled in 15 European countries, that broadly invested in European stocks over the period January 2003 to December 2016. Following is a summary of their findings:

- More than 90 percent of funds show, on average, a home bias.

- The home bias was present in all 15 markets. France had the highest overweighting (30 percentage points), followed by the U.K. (24 percentage points) and Germany (21 percentage points).

- On average, funds overweight their domestic stocks by about 16 percentage points. At the 90th percentile, the overweight was about 36 percentage points.

- The home bias across funds is quite stable over time.

- The home bias of individual funds is, on average, positively related to the relative size of the stock market, the cumulative 12-month lagged domestic stock market return in excess of the European stock market return, real GNP growth and the country’s credit rating.

- Informational advantages do not seem to be a reason for the observed home bias.

- The differences between future returns of the stocks bought and sold by funds are essentially zero.

Does Home Country Bias Impact Stock Prices?

An interesting question: If investors all around the globe exhibit a home country bias, does it affect stock prices? In other words, if everyone equally overweights their domestic market, does it all essentially wash out, with the overweights canceling out the underweights? Victor Haghani and James White of Elm Partners sought to answer this intriguing question.

They developed the following thought experiment. They began by assuming a simple world with no home bias, and eleven national markets with a total value of $100: the big U.S. market, weighing in at 50 percent of the total, and ten small markets (Japan, United Kingdom, China, Canada, France, Switzerland, Germany, Australia, South Korea and Taiwan), representing 5 percent each. In line with the findings from the aforementioned Vanguard study, Haghani and White then assumed that U.S (the big market) investors now want to be 80 percent invested in their domestic market, 30 percentage points above the market cap weight of 50. The 10 small markets exhibit even stronger home bias, wanting to be 50 percent invested in their home market, 45 percentage points above their 5 percent weight.

They found that by flipping the home bias switch, they created a supply-and-demand problem: the U.S. market isn’t currently big enough to take on the extra demand created by the home bias of domestic investors plus the demand from global investors—the demand is greater than the supply in terms of market capitalization. On the other hand, the smaller markets have a shortfall, as demand is less than the market capitalization.

Haghani and White note:

“Ultimately, this conundrum must be resolved by market values changing: specifically, the big market going up in value relative to the small markets. All else equal it would have to go up quite a lot: 60%, from $50 to $80 if we hold the small markets constant. The increase in big market value could be accomplished either through rising prices or through new issuance. If prices rise, this would mean a reduction in the long-term expected return of the big relative to the small market of around 1.5% , a very sizable impact assuming both markets had expected returns around 4% without the home bias distortion. If instead there’s new issuance, such issuance would represent less attractive investment opportunities at the margin than previously outstanding equity, resulting again in lower expected returns for big market equities.” Haghani and White, ” Home Biased: A Case for More Indexing,” 2019

Their findings lead to an interesting conclusion. While active investors have been claiming that passive investing is leading to distortions in market prices, Haghani and White demonstrate that, at least in terms of relative valuations between U.S. and international markets, it seems the reverse is more likely the case. The active decisions of investors (influenced by a home country bias) leads them to overweight, not market-cap weight, their home country. And because of the large size of the U.S. market relative to all other markets, that bias can lead to distortions in markets.

“If there were less home bias and more passive investing in line with global market-value proportions, US equity investors would likely enjoy lower relative valuations and higher expected returns.” Haghani and White, ” Home Biased: A Case for More Indexing,” 2019

Keep this in mind as you consider your global equity allocation. Are you market-cap weighting? Or, perhaps influenced by another well-documented bias, recency, are you overweighting U.S. equities? As you consider these questions, remember that behavioral biases have a tendency to destroy investment returns. As legendary investor Pogo stated, “We have met the enemy and he is us!”

Finally, I add this note of caution, one that might help you avoid home country bias. If a belief in relatively high market efficiency has led you to conclude that you should be a passive investor—accepting market prices as the best estimate of the right prices—you should also accept the idea that all risky assets have similar risk-adjusted returns. If that were not the case, capital would flow from assets with lower expected risk-adjusted returns to the assets with higher expected risk-adjusted returns until equilibrium was reached. If all risky assets have similar risk-adjusted returns, there is no reason to have a home country bias—other than perhaps a small bias to take into account that investing in U.S. stocks is a bit cheaper than investing in international stocks. On the other hand, if you are still employed, it is likely your labor capital is more exposed to the economic cycle risks of the U.S. than to foreign market risks. If that is the case, once you include your labor capital as part of your portfolio, you should consider overweighting foreign markets to offset your labor capital risk.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.