The Importance of Climate Risks for Institutional Investors

- Philipp Krueger, Zacharias Sautner, and Laura T. Starks

- Review of Financial Studies

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Private and public companies face direct costs related to three types of climate risks: physical (i.e. extreme weather), regulatory (i.e. policies and regulations implemented to combat climate change), and technological (i.e. electric or fuel-cell-powered vehicles could disrupt traditional car manufacturers). These risks to portfolio companies have the potential to adversely affect the returns achieved by clients, pension beneficiaries, shareholders, and institutional investors. At the same time, climate change provides great investment opportunities for investors. So how do investors think about climate risk in the market today?

In this study, the authors study the following research questions:

- How do investors view and manage climate risks?

- Do institutional investors exhibit systematic cross-sectional variation in their opinions about climate risks and their strategies to manage these risks?

What are the Academic Insights?

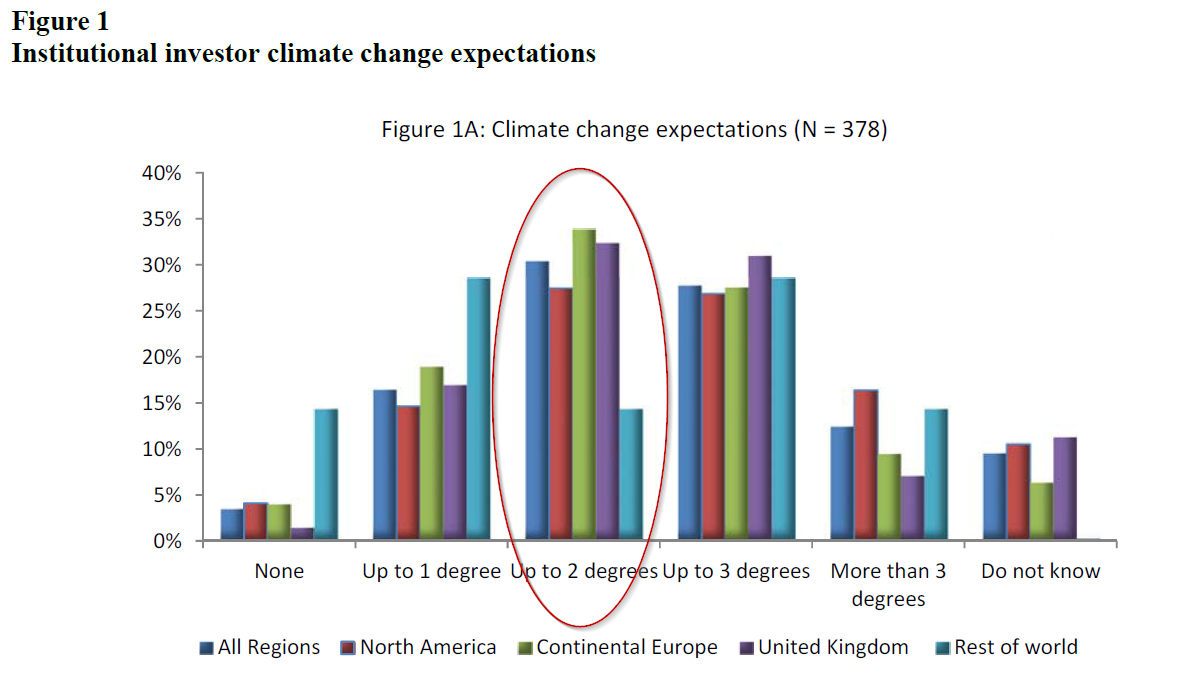

The authors survey 439 global investors, including 48 with AUM>$100 bn between 2017 and 2018. The survey covers four areas: the role of climate risks in investment decisions; climate risk management; shareholder engagement related to climate risks; and the implications of climate risks for asset pricing. They find:

- Institutional Investors still place traditional financial risks be the most important risks they face, followed by operating, governance, and social risks. Climate risks and environmental risks are ranked fifth and sixth, respectively. However, this low relative rank does not imply that climate risks are considered immaterial.

- Investors take a wide variety of approaches to manage climate risks, with only a small percentage (7%) having chosen no approach to manage their climate risks during the 5 years preceding the survey. The two major approaches are to conduct carbon footprint analyses of portfolio firms and stranded asset risk(1) analysis. These approaches are employed by 38% and 35% of the respondents, respectively. Investors also use other forms of climate risk management, such as incorporating climate risks into their valuation models (26%) or hedging against climate risks (25%). From the list of 12 possible approaches, the least frequently used tool is to divest problematic portfolio firms, which is employed by only 20% of the investors.

- There is generally a higher level of engagement by our respondent group as only 16% had taken no engagement actions over the previous 5 years. The respondents typically use multiple channels to engage with climate risks. Having discussions with management is cited as the most frequently used channel (43%). Close to 30% of the investors submitted shareholder proposals on climate risk issues, and a similar fraction voted against management on proposals because of climate risk concerns. In terms of firms’ reaction to shareholders’ engagement, successful engagements are reported by 25% of respondents. Divestment was the least used course of action when investors were dissatisfied with firm responses to their engagement (only 17% exited under such circumstances). This observation, together with the low prevalence of divestment for risk management purposes, is interesting in light of the debate about whether divestment or engagement is more effective in combating climate change.

- Understanding institutional investors’ perceptions of any potential mispricing are particularly relevant as they likely act as marginal investors, thereby affecting equity prices. The respondents of this survey believe that equity valuations do not fully reflect the risks from climate change, although the overvaluations are not perceived as being very large. The oil sector is considered as the most overvalued sector overall, followed by traditional car manufacturers and electric utilities. Overall, the authors find little evidence for a systematic link between investor characteristics and their beliefs about the mispricing of climate risks. An exception is that the authors observe that the investors with a view of more underpricing of climate risks are those with a larger share of their portfolios oriented to ESG standards and those that engage portfolio firms along more dimensions.

Why does it matter?

This study allows us to gain a better understanding of how and why institutional investors consider climate risks in their investment decisions. Overall, the evidence indicates that some investors consider climate risks as an important risk characteristic, but the industry as a whole is still in the early stages of incorporating these risks into their investment processes. For example, nearly 60% of all investors do not consider the basic analysis required to identify and manage carbon and stranded asset risks. In general, the long-term and the larger the investor becomes the better prepared they are for the transition to a low-carbon economy.

Abstract

According to our survey about climate risk perceptions, institutional investors believe climate risks have financial implications for their portfolio firms and that these risks, particularly regulatory risks, already have begun to materialize. Many of the investors, especially the long-term, larger, and ESG-oriented ones, consider risk management and engagement, rather than divestment, to be the better approach for addressing climate risks. Although surveyed investors believe that some equity valuations do not fully reflect climate risks, their perceived overvaluations are not large.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.