Independent Women: Investing in British Railways, 1870-1922

- Graeme G. Acheson; Gareth Campbell; Áine Gallagher and John D. Turner

- Economic History Review, 2020

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions

When we think of the investing community of the late 19th Century and early 20th Century, our minds might immediately think of characters such as Rich Uncle Pennybags(1). It turns out that Uncle Pennybags should be joined, if not replaced, by “Rich Aunt Stuffed-Pockets”. Scholars have documented the rise of women investing during the nineteenth century but this paper focuses on answering two important questions about the development of female investors:

- How did this phenomenon progress into the twentieth-century?

- Whether women shareholders over a century ago behaved differently from their male counterparts?

What are the Academic Insights?

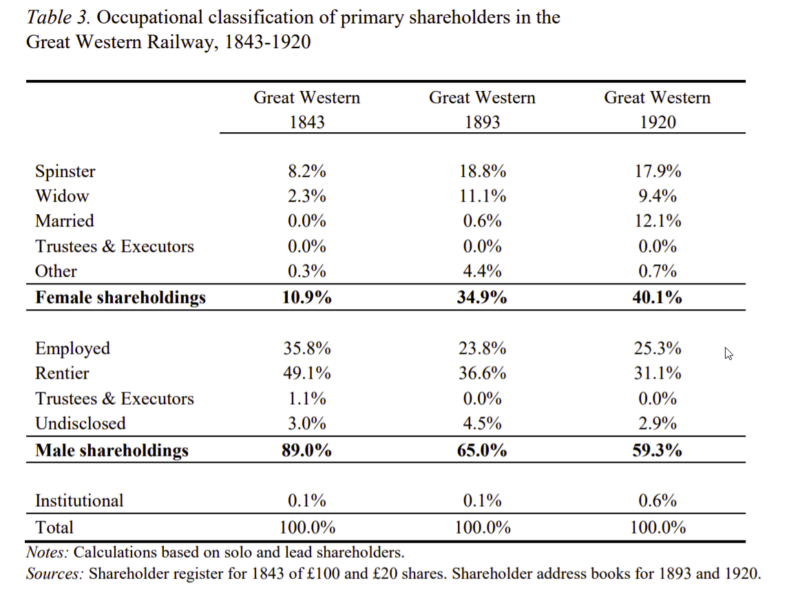

By analyzing the shareholder constituencies of railways(2), which were the largest public companies at the time and a popular investment among the middle class, the authors find:

Why does it matter?

These findings provide evidence that women shareholders were acting independently by choosing to take on the sole risks and rewards of share ownership when making their investments as a single shareholder as opposed to sharing the risks and rewards via a joint shareholding. The conclusions of this paper paints a more nuanced picture of how we should think about female investors in the past.

The Most Important Chart from the Paper:

Abstract

The early twentieth century saw the British capital market reach a state of maturity before any of its global counterparts. This coincided with more women participating directly in the stock market. In this paper, we analyze whether these female shareholders chose to invest independently of men. Using a novel dataset of almost 500,000 shareholders in some of the largest British railways, we find that women were much more likely to be solo shareholders than men. There is also evidence that they prioritized their independence above other considerations such as where they invested or how diversified they could be.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.