Momentum is the tendency for assets that have performed well (poorly) in the recent past to continue to perform well (poorly) in the future, at least for a short period of time.(1) In 1997, Mark Carhart, in his study “On Persistence in Mutual Fund Performance,” was the first to use a momentum factor, together with the three Fama–French factors (market beta, size, and value), to explain mutual fund returns. Initial research on momentum was published by Narasimhan Jegadeesh and Sheridan Titman, authors of the 1993 study “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency.” (summary here)

Momentum is most commonly defined as the last 12 months of returns excluding the most recent month (in other words, months two through 12 of the past year). The most recent month is excluded, as it tends to show a reversal, which some have attributed to microstructure (trading) effects. The momentum factor is the average return of the top 30 percent of stocks minus the average return of the bottom 30 percent as ranked by this measure. The momentum factor is referred to as UMD, or up minus down. Note that UMD is a relative (cross-sectional) measure of momentum, unlike trend-following (time-series) momentum, which is an absolute measure.

Both types of momentum have been found to be persistent across time and economic regimes; pervasive around the globe and across stocks, industries, bonds, commodities and currencies; robust to various definitions; and they have well-documented behavioral explanations for why they have persisted even after publication. And, with the use of patient trading strategies, they survive transaction costs.

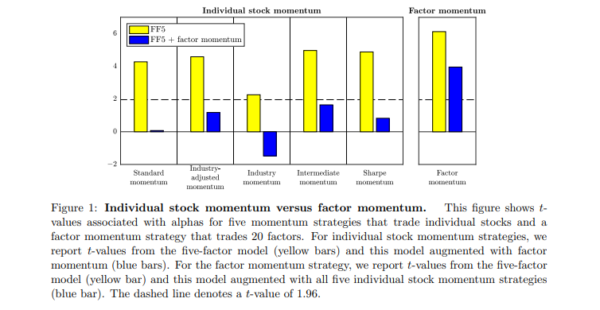

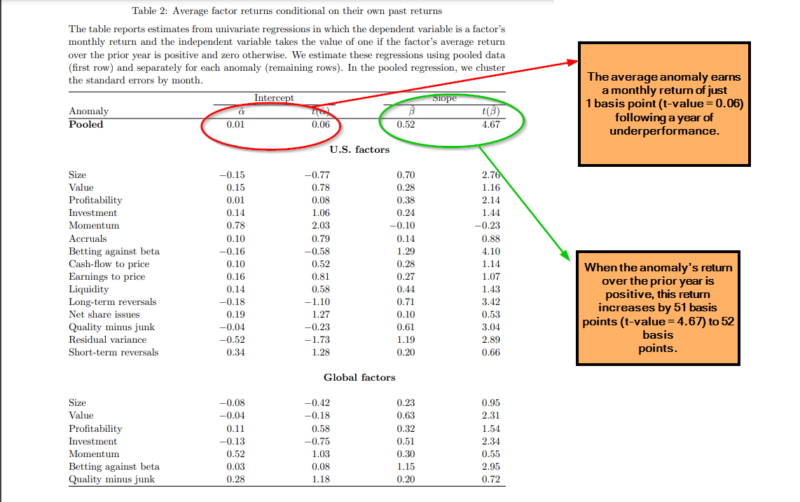

Recent research on momentum has focused on factor momentum. For example, the 2019 study by Sina Ehsani and Juhani Linnainmaa “Factor Momentum and Momentum” covered 15 U.S. factors (accruals, betting against beta, cash-flow to price, investment, earnings to price, book-to-market, liquidity, long-term reversals, net share issues, quality minus junk, profitability, residual variance, market value of equity, short-term reversals, and momentum) and seven global factors (betting against beta, investment, book-to-market, quality minus junk, profitability, market value of equity, and momentum) and found the following:

- Momentum in individual stock returns emanates from momentum in factor returns—a factor’s prior returns are informative about its future returns.

- Momentum in factor returns transmits into the cross section of security returns, and the amount that transmits depends on the dispersion in factor loadings. The more these loadings differ across assets, the more of the factor momentum shows up as cross-sectional momentum in individual security returns.

- Factor momentum explains all forms of individual stock momentum—stock momentum strategies indirectly time factors: they profit when the factors remain autocorrelated, and crash when these autocorrelations break down.

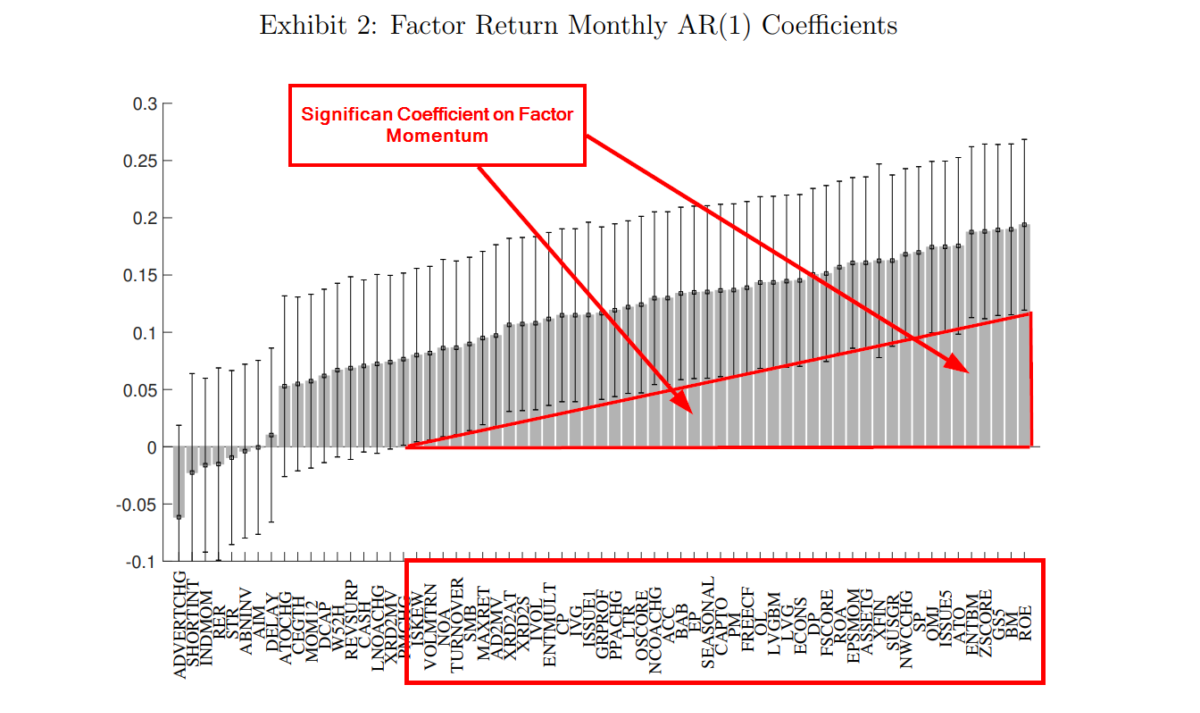

These findings are consistent with those of Tarun Gupta and Bryan T. Kelly in their December 2018 paper “Factor Momentum Everywhere.” (Summary)” They built and analyzed a large collection of 65 characteristic-based factors that are widely studied in the academic literature, including a variety of valuation ratios (e.g., earnings/price, book/market); factor exposures (e.g., betting against beta); size, investment, and profitability metrics (e.g., market equity, sales growth, return on equity); idiosyncratic risk measures (e.g., stock volatility and skewness); and liquidity measures (e.g., Amihud illiquidity, share volume, and bid-ask spread). They found:

- Individual factors exhibit robust time-series momentum, being positive for 59 of the 65 factors, and significantly positive in 49 cases.

- Robust momentum behavior among the common factors is responsible for a large fraction of the covariation among stocks.

- A portfolio strategy that buys the recent top-performing factors and sells poor-performing factors achieves significant investment performance above and beyond traditional stock momentum.

- On a standalone basis, factor momentum outperforms stock momentum, industry momentum, value, and other commonly studied investment factors in terms of the Sharpe ratio.

- While factor momentum and stock momentum are correlated, they are also complementary—factor momentum earns an economically large and statistically significant alpha after controlling for stock momentum and expenses.

- Demonstrating pervasiveness, factor momentum is a global phenomenon—it manifests equally strongly outside the U.S.—in a large global (ex. U.S.) sample and Europe and Pacific region subsamples.

Gupta and Kelly concluded:

“Our findings of momentum among equity factors support the conclusion that factor momentum is a pervasive phenomenon in financial markets.”

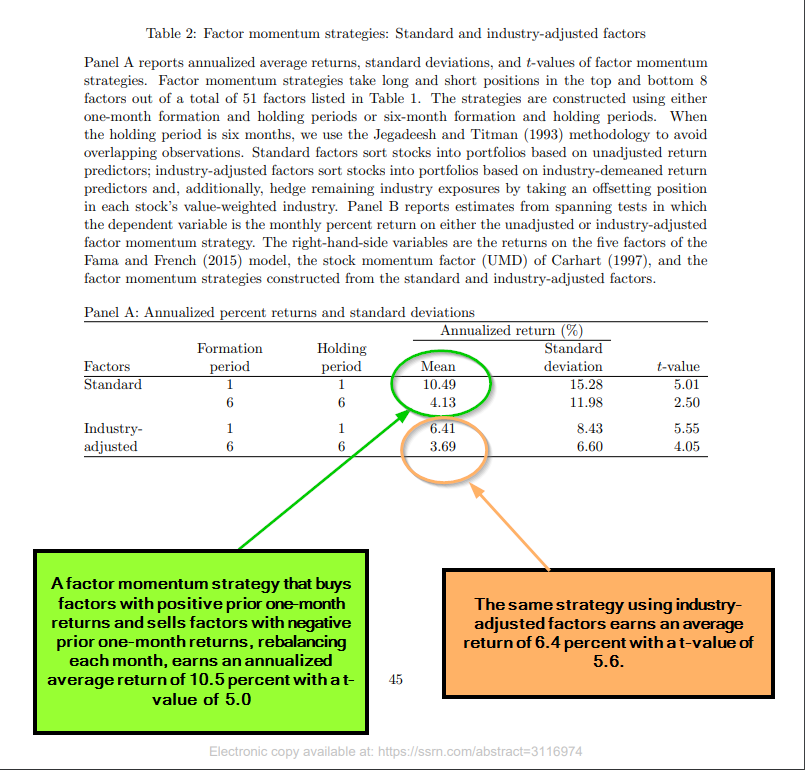

Robert D. Arnott, Mark Clements, Vitali Kalesnik, and Juhani Linnainmaa contribute to the momentum literature with their 2019 study, “Factor Momentum.” Their sample covers the periods 1963 through 2016, focusing on cross-sectional (relative) momentum for 51 factors, 38 of which are accounting-based. Their strategy is long the top eight and short the bottom eight industries. Following is a summary of their findings:

- Past industry returns predict the cross section of industry returns.

- Industry momentum stems from factor momentum.

- Factor momentum is transmitted into the cross section of industry returns via variation in industries’ factor loadings.

- Factor momentum strategies generate statistically significant profits when measured by average returns and five-factor model alphas.

- Momentum in industry-neutral factors spans industry momentum; industry momentum is therefore a by-product of factor momentum, not vice versa. An industry momentum strategy that uses one-month formation and holding periods earns an annualized return of 8.7 percent (t-value = 4.1). However, controlling for factor momentum, alpha falls close to zero. Industry momentum, by contrast, does not subsume factor momentum.

- The strategy that stands out in both economic and statistical significance buys and sells factors based on their prior one-month returns and holds them for a month. Controlling for industry momentum, individual stock momentum, and the five factors of the Fama-French model, this strategy’s annualized alpha is 3.9 percent with a t-value of 3.8.

- Factor momentum is a pervasive property of all factors.

- Factor momentum can be captured by trading almost any set of factors.

- A factor momentum strategy that buys factors with positive prior one-month returns and sells factors with negative prior one-month returns, rebalancing each month, earns an annualized average return of 10.5 percent with a t-value of 5.0. The same strategy using industry-adjusted factors earns an average return of 6.4 percent with a t-value of 5.6.

- Factor momentum’s abnormal returns are not specific to any one part of the 1963–2016 sample period.

- Whereas industry momentum “stops working” around year 2000, post-2000 factor momentum is indistinguishable from pre-2000 momentum. Moreover, whereas stock momentum suffers crashes, factor momentum experiences positive spikes.

- Some factors contribute significantly more towards factor momentum profits than others, but no factor significantly lowers these profits. The factors that relate to distress, illiquidity, idiosyncratic risk, volatility and market beta are among those that contribute the most toward factor momentum profits.

Their findings led Arnott, Clements, Kalesnik, and Linnainmaa to conclude:

“Our results can yield new insights about the sources of momentum profits in well-diversified portfolios. The finding that industry momentum stems from factor momentum, for example, rules out some explanations for industry momentum. Industry momentum cannot, for example, be due to underreaction to industry-specific news; after all, our industry-adjusted factors do not make industry bets. If factor momentum is due to underreaction to information, this information must thus reside at the factor level. If factors relate to macroeconomic risks, then the market must be underreacting to macroeconomic news.”

They added that on the other hand:

“factors may relate to mispricing; under this view, return comovement emerges from common shocks to mispricing rather than correlated news about fundamental values.”

If mispricings build up over time and then begin to vanish when arbitrageurs enter, factor returns are serially correlated. Factor momentum may thus arise from cross-sectional persistence inflows that induce, and those that later correct, mispricing.

References[+]

| ↑1 | review more in the AA white paper on momentum |

|---|

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.