When an owner sells their business, the IRS and state taxing authorities will be there to take as much of it as they lawfully can. This one sale can lead to the largest tax payment a business owner will ever make and may represent more than a third of their entire net worth.

In this blog post, I outline strategies we use to help owners avoid taxes when we buy their business. As buyers, we structure our purchases so as to minimize a seller’s tax liabilities and to help fund their future goals – whether that be retirement, estate planning, funding charities or even buying their next business. Some of the strategies outlined herein require a buyer and seller to cooperate and structure the sale while others can be used independently by a seller, regardless of the buyer.

The strategies are as follows:

- Don’t Sell – Install Management

- Opportunity Zones (With an Early Cash-Out)

- Structured Sales

- Post-Sale Consulting with a Defined Benefit Pension Plan

- Pre-Sale Relocation to a Low-Tax State

- Qualified Small Business Stock (QSBS)

- Employee Stock Option Plan (ESOP)

- Charitable Trusts and Gifted Assets

STRATEGY #1: DON’T SELL – INSTALL MANAGEMENT

If you don’t sell your business, you won’t have to pay taxes on a sale. It’s the ultimate tax avoidance strategy. With proper planning and continued ownership, you can remain involved in parts of the business that you enjoy (and stop doing what you don’t enjoy) while potentially earning a larger annual payout than you could from another investment.

So, rather than sell all of your business, consider these options:

- Hire a professional manager: This is what we would do if we bought your business. So, why not do this yourself? If you install great management now, you can sell your business as a turnkey operation later and likely get a higher valuation.

- Buy or merge with another business and have their management team run both companies: Competitors make great candidates for this strategy.

- Train someone to run the business for you: If you don’t have the manpower internally to do this, you’ll have to find someone outside of your firm. Many Ivy League MBAs are seeking to intern, manage, and eventually own small private businesses. Google “Entrepreneurship Through Acquisition” or ETA for more.

- Take out a line of credit from a bank against your business, then use the loan to fund your goals. In this way, you’ll still own the business and have a tax-free lump sum of cash to deploy. If your business can support it, you can get up to 2 or 3 times pretax profits without a personal guarantee from a bank. This is also known as a “Dividend Recap”.

Many of these options involve installing competent management that replaces you. As mentioned, turnkey businesses sell at a much higher multiple (often by 2X to 3X more). So, if you decide to sell your business at a later time, you can capture this value then.

STRATEGY #2: OPPORTUNITY ZONES (With an Early Cash-Out Option)

Opportunity Zones (OZ) investments are potentially the single largest tax break available to business owners. These investments also avoid many of the complexities, costs, and timing restrictions inherent in other tax strategies.

Normally, the sale of your business generates capital gains that are recognized (and taxed) at the time of sale. However, if within six months of recognizing the capital gain, you roll all (or a portion) of your capital gains into an Opportunity Zone Fund (OZF), you obtain a series of tax benefits (listed below).

The OZF will then invest your capital gains into a qualified Opportunity Zone project, which could be real estate or a business. Projects must meet certain criteria to qualify — for example, a real estate project has to be substantially improved, and businesses must have most of their employees and operations within an OZ.

Early Cash-Out Option

Traditional OZ investments involve a 10-year lockup of your investments, but one way to withdraw much of your principal in the first few years, tax-free, is to refinance the project after it’s stabilized. This is much like taking out a home equity line of credit (HELOC) using the equity in your home as collateral.

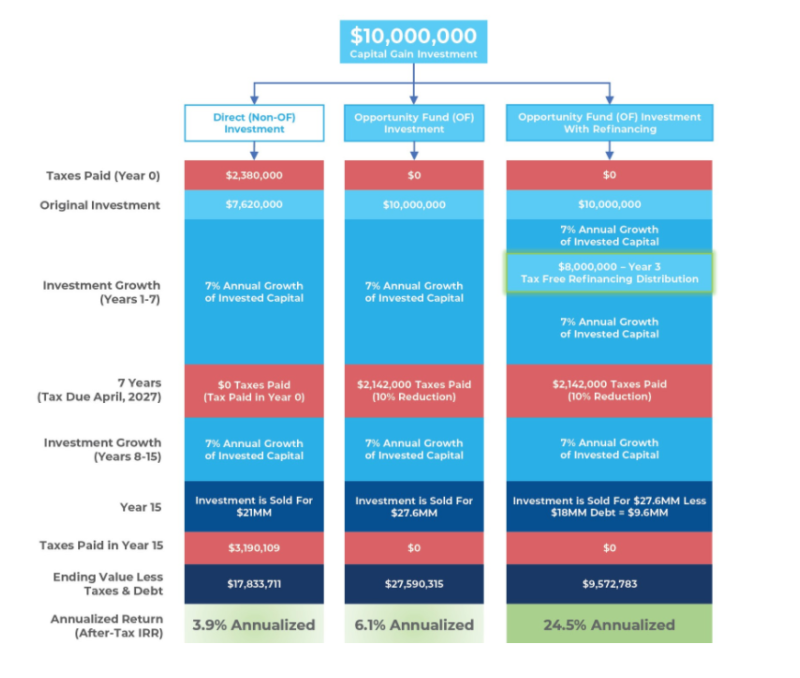

For example, with a typical OZ project, you might invest in an apartment complex using equity. Once the project is complete and approximately 80% of the units are leased out, the project is considered “stabilized” and is eligible for low-cost financing. At this point, you can refinance and get a tax-free distribution, much like with a HELOC. I’ve also written an Investor’s Guide to Opportunity Zones for those who want to take a deeper look into this program. An illustration of the benefits is shown below.

Significant Opportunity Zone benefits:

- You have 180 days from the day you recognize capital gains to invest in an Opportunity Zone Fund.

- Your original capital gains are deferred and are not recognized until the end of 2026.

- Your original capital gains tax will be reduced by 10% if, by the end of 2026, your investment in the OZ was held for at least five years.

- If your investment in the OZ exceeds 10 years, any capital gains from the future sale of those investments are returned to you tax-free.

- You have immediate and full access to the basis, or untaxed amount, of your sale proceeds.

- Opportunity Zones offer a 2% to 3% per year tax benefit, so beware of Opportunity Zone Fund fees (often in the 1% to 2% per year range) which can nearly eliminate any tax benefit of the program.

If you’re looking for direct investment options that avoid onerous fees, feel free to reach out to me. I work with a number of real estate developers and operating businesses with projects in Opportunity Zones.

STRATEGY #3: STRUCTURED SALES

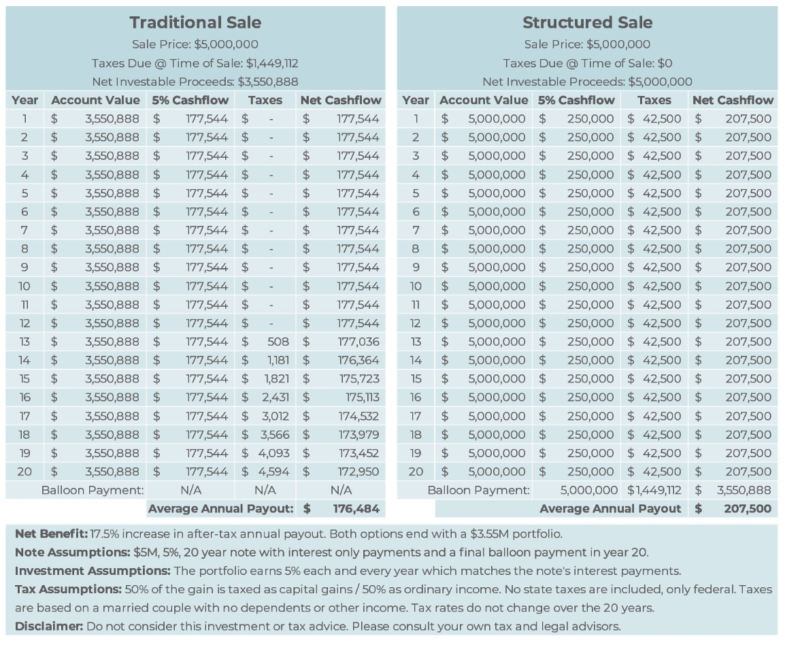

When we buy a business, we can offer to make the purchase under a Structured Sale. With a Structured Sale, instead of receiving a lump sum of cash at closing (and paying taxes immediately), we would instead invest those funds into a stock and bond portfolio (chosen by you) and give you a note or promise to pay you over time. The stock and bond portfolio is then used as collateral and the source of funds to pay you against the note. An example is below:

Depending on what you as a seller are trying to obtain (long term cash flow, tax-deferred portfolio growth etc.), structured sales can be tailored to meet your needs. Note that each owner can defer up to $5M per year of sale proceeds without incurring onerous IRS penalties. By way of example, a married couple who own a business could sell $10M of their business in December and an additional $10M in January using a Structured Sale.

The benefit is that you don’t pay taxes on the sale of your business until you receive the payments in future years. In the meantime, the pre-tax sale proceeds are fully invested and earn a return. Those returns are used to fund the note, so you get tax-deferred growth. Further, by spreading out the payments over several years, you can reduce the portion of the sale proceeds that fall into higher tax brackets.

Compared to other tax strategies, structured sale may require strong legal and tax advisors to make sure that the transaction abides by strict IRS rules so as to avoid ‘constructive receipt’ or recognition of taxable gains.

For additional details on Structured Sales, and an illustration of another way to structure them, see my article (How to Sell a Business Tax Efficiently Using Structured Sales).

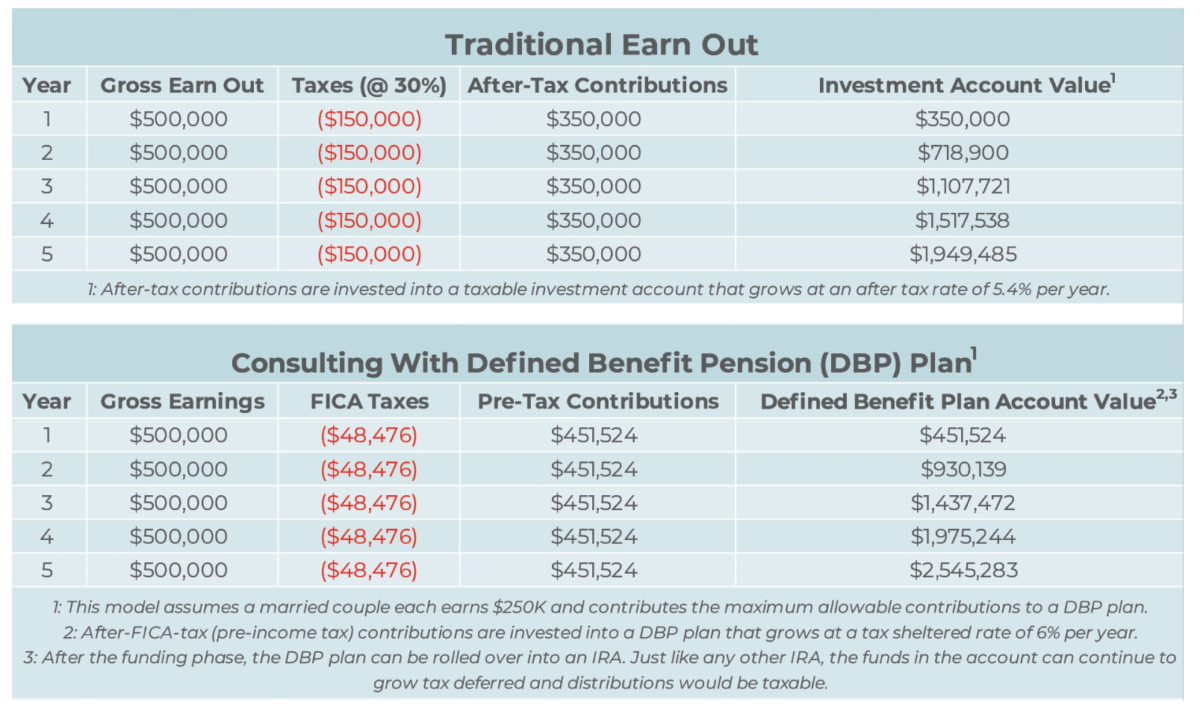

STRATEGY #4: POST-SALE CONSULTING CONTRACT WITH A DEFINED BENEFIT PENSION PLAN

Defined Benefit Pension (DBP) plans are one of the most powerful tax-deferred retirement tools available. These are pension plans set up by a company for the benefit of its employees. Traditional retirement plans such as 401(k)s limit annual pre-tax contributions to $19,500 per year (2020), but employees under DBP plans may be able to contribute over $250K per year on a pre-tax basis. This maximum annual contribution is determined by the plan’s actuary and will depend on your age and earnings.

However, pension plans may need to be offered to a company’s employees. So, if you’re willing and able to contribute $250K per year to a DBP plan for yourself, you may have to also offer pension benefits to employees. If you and your spouse (or maybe even an adult child) are the only employees, this isn’t so much a problem, but a benefit.

Here’s how it works:

You sell your business to a buyer in a transaction that involves an earn-out, where the buyer pays you over time for some or all of your business. The earn-out requires you to stay on with the business for a period of time to help with a smooth transition. However, instead of being hired by the buyer, you form an LLC and provide services you sold through the LLC. The earn-out is paid to the LLC for services rendered rather than to you directly. In this way, you generate business income and can provide yourself as an employee of your LLC generous pension benefits. Further, you can benefit from legitimate business expenses and deductions such as the Qualified Business Income (QBI) deduction, health insurance premiums, home office, and travel expenses, among others.

As shown in the tables above, this strategy can reduce the taxes paid on an earn-out by 66% or more. As an added benefit, you can rollover the assets from the Defined Benefit Pension plan to a traditional IRA after the initial funding period.

A few caveats: The funds in the DBP plan are just like an IRA in that they aren’t taxed until you take disbursements, at which time they are taxed at ordinary tax rates. This works well if you plan to live off of the income from the plan, but if you need immediate access to all of the funds, you’ll pay a significant tax at that time. Further, the chart above is illustrative and assumes contributions needed to exactly zero out business income. The actual maximum contributions will vary. An actuary would be needed to confirm the actual contribution limits.

STRATEGY #5: RELOCATE TO A LOWER-TAX STATE

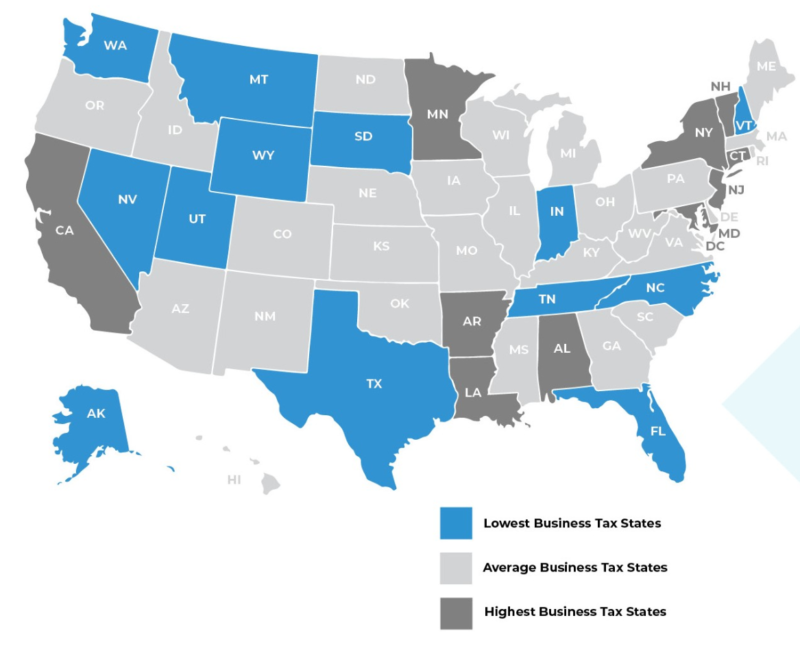

This strategy has two variations: The first is a legal ownership relocation using trusts. The second is a physical relocation. In either case, the idea is to move all or a portion of the business to a lower-tax state. Once relocation is complete, you execute the sale and pay lower taxes on the proceeds.

For example, you could physically move a portion of your business (the sales division, headquarters, or warehouse operations) to a lower-tax state. When the business is sold later, you can attribute a portion of the taxable gain to the lower-tax state. In this way, a smaller portion of the sale is taxable in the higher-tax state.

Another option is to transfer ownership interest into a trust, often domiciled in Nevada, before selling the business. Because Nevada doesn’t levy an income tax and has favorable trust laws, the sale is subject to federal taxes only. However, each state treats these trusts a little differently, so consult your legal and tax advisors to learn how your state of residence would tax the transaction, if at all.

The graphic below shows the relative tax burden of each state. If you’re in one of the higher tax states, it may make sense to move into a lower tax jurisdiction before you sell. For more on this, here’s an article that can be useful when relocating your business for tax purposes: “How to Negotiate Your Taxes”.

Highest and Lowest Business Tax States

STRATEGY #6: QUALIFIED SMALL BUSINESS STOCK (QSBS)

Section 1202 of the Internal Revenue Code allows you to avoid federal taxes on capital gains when you sell stock of a C-corporation (C-corp). The exclusion is capped at the greater of $10 million, or 10 times the amount paid for the stock. Further benefits include elimination of the Alternative Minimum Tax and the Net Investment Income Tax against the sale proceeds.

Both the business and the investor/owner must qualify. In addition, there are graduated benefits depending on when the stock was acquired (full benefits apply to stock purchased after September 2010).

For the business to qualify, it must be a C-corp with less than $50 million in gross assets at the time (or immediately after) the original stock was issued. The business must also not be involved in any trade or business where the principal asset is the reputation or skill of one or more of its employees (i.e. many solo service business). Other excluded businesses include restaurants, banks, hotels, and farming.

For the owner to qualify, they must have obtained the stock when it was originally issued and they must not be a corporation. They must also have owned the stock for five years. If the owner held the stock for less than five years, they may roll the proceeds over into another QSBS within 60 days to avoid paying capital gains tax.

Forming a QSBS doesn’t work as well if you expect the business to generate significant cash flows to owners and you anticipate not selling the business for a long time. In such cases, the double taxation of profits involved with a C-corp can offset the projected capital gains benefit. In those cases, a pass-through entity such as an LLC or a subchapter S-corp may be better.

Further, a QSBS will not work if you anticipate an asset sale of your business rather than a stock sale. I didn’t cover this topic here, but most private businesses are sold via asset sales because they benefit the buyer’s future tax and legal liabilities. If both you and your business qualify for QSBS treatment, it’s a reason to mandate a stock sale.

Tax Tip: In some cases, you can convert a partnership to a C-corp prior to sale so as to take advantage of a QSBS benefits. Please consult with your tax advisor to see if this is appropriate for your situation.

STRATEGY #7: EMPLOYEE STOCK OPTION PLANS (ESOP)

An Employee Stock Option Plan (ESOP) is a way for owners to sell their business to employees. A trust is set up (ESOP trust) that purchases the business from the owner. Usually, a bank loan is used to fund the purchase. The ESOP trust then allocates shares of the business to employees’ retirement accounts.

If the business is a C-corporation and the owner sells 30% or more of their business to the ESOP trust, the sale proceeds can be rolled over into Qualified Replacement Property (QRP), which allows the taxes on the sale to be deferred indefinitely.

The QRP or roll-over investments that qualify for tax deferment are typically stocks and bonds. However, they are often offered at high fees. For a fantastic discussion on how to implement QRP solutions at a low cost while simultaneously achieving market returns, I recommend checking out Alpha Architect’s QRP Solutions.

STRATEGY #8: CHARITABLE TRUSTS AND GIFTED ASSETS

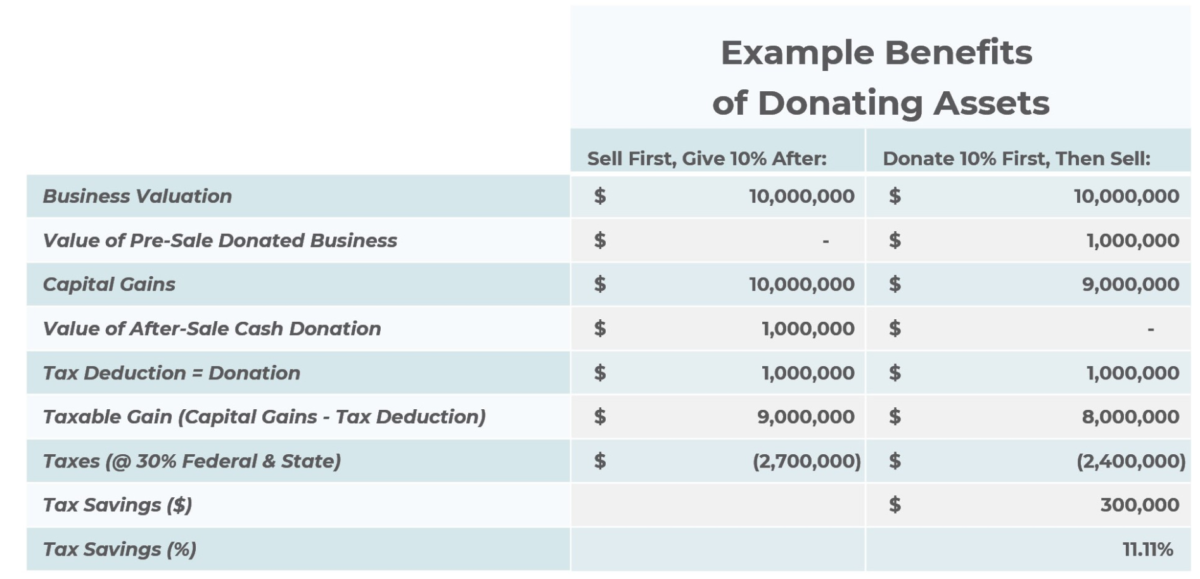

If you want to fund charitable causes or organizations with the after-sale proceeds of your business, there’s a tax-effective way to do this. Instead of selling your business first then donating cash, you can donate a portion of your business to the charity first, then sell it. In this way, you get the same tax deduction, but you avoid recognizing the capital gain on the donated assets.

Here’s how this strategy would work, using a 10% donation as an example:

Tax Tip: If you need funds from the donated portion of your business to provide you with an annual income, you can donate the “corpus” or principal into a charitable trust, obtain the tax deduction and have the trust pay you an income for life.

PUTTING IT ALL TOGETHER

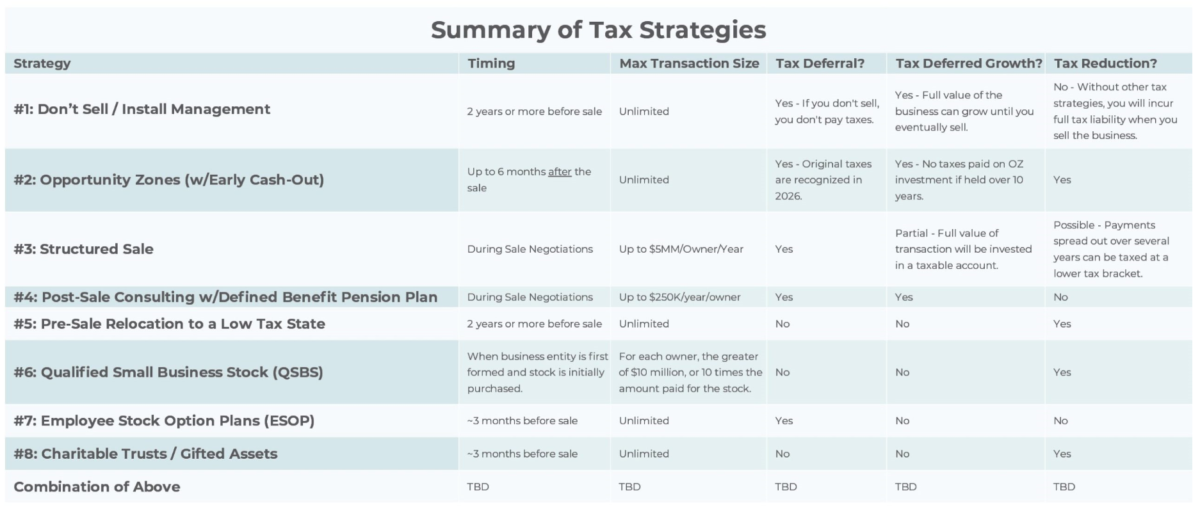

The strategies outlined can be stand-alone options or can be combined with two or more to increase the value of your business and to significantly knock down your tax liability. This chart summarizes the strategies to help you identify the most useful options:

ABOUT ME: HOW I CAN HELP

I help business owners and their advisors in a few ways:

First, I’m a partner at the investment firm Ventoux Industrial Holdings where we seek to buy businesses with revenues between $10M and $100M. If you’re thinking about selling your business, give me a call. If it’s a fit, we may be an interested buyer. Further, it can be incredibly helpful to have a buyer who will work with you to reduce taxes. We want to be that buyer and will help you implement the tax strategies listed in this article.

Second, I’m the principal at Sterling Point Capital. This is my tax consulting practice where I help businesses and nonprofits reduce their tax liability (e.g. in a sale), raise capital, and assist with relocation and expansion

projects. If you’re interested in these tax avoidance strategies, I will help you determine which ones are right for you and then help you implement them — even if I’m not the buyer of your business.

When not working, I enjoy fly fishing, mountain biking, coffee roasting and creating memories with my family.

Adam Tkaczuk

Partner: Ventoux Industrial Holdings

Principal: Sterling Point Capital

Email: [email protected] / [email protected]

For a pdf version of this article, click here: “8 Ways to Minimize Taxes When Selling a Business“

About the Author: Adam Tkaczuk

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.