Recent research, including the 2020 studies “Explaining the Recent Failure of Value Investing” and “Intangible Capital and the Value Factor: Has Your Value Definition Just Expired?,” have investigated the impact on U.S. value strategies of the increase in the relative importance of intangible assets compared to physical assets.(1) Because global accounting standards require companies to expense rather than capitalize the amount spent on activities that create intangible capital, there is a systematic and persistent understatement of the book value of equity. Researchers generally adjust book-to-price ratios to account for the biases caused by unrecorded intangible capital.(2) Their empirical findings suggest an improvement for value strategies using such adjustments as including unrecorded intangibles in the book value, which increases the value premium and aligns with risk-based explanations. However, they also concluded that the decline in the effectiveness of valuation-based investment strategies in the U.S. could not be attributed to the structural economic changes generated by intangibles or the failure of accounting standards to adapt to those changes.

Amitabh Dugar and Jacob Pozharny contribute to the literature on intangibles and the value factor with their December 2020 study, “Equity Investing in the Age of Intangibles,” published in the Second Quarter 2021 issue of the Financial Analysts Journal. They extended the U.S. research on this topic to the world’s 14 largest international economies, including eight developed markets and six emerging markets. They proposed:

“a composite measure of intangible intensity that captures the inter-industry variation in the financial statement impact of three types of intangible capital: intangible assets reported on the balance sheet (excluding goodwill), innovation capital, and organization capital.”

Their composite measure of intangible intensity was constructed from three components: (1) total intangibles assets excluding goodwill relative to total assets (2) research and development expenses relative to total revenues, and (3) sales, general and administrative expenses relative to total revenues. Using this composite to classify industries (except banks, insurance, and diversified financials) into high and low intangible intensity groups, they analyzed the contemporaneous relationship between (a) stock prices and (b) book values and earnings within each intangible intensity group for both U.S. and international companies. Their data sample covered the fiscal years 1994-2018.

Following is a summary of their findings:

- Over the sample period, for international firms the proportion of capitalized intangible assets (excluding goodwill) relative to total assets increased from 0.2 percent to 2.2 percent, while for U.S. firms it rose from 2.75 percent to 6.12 percent—presumably with a corresponding impact on intangible amortization expense.

- For each of three types of intangible capital, and for the intangible intensity composite, relative industry ranks have remained very stable over time (and are consistent between domestic and international universes) at statistical levels of confidence exceeding 99 percent—providing confidence that investment strategies based on the choice or weighting of factors that drive investment returns according to intangible intensity are likely to be stable and replicable.

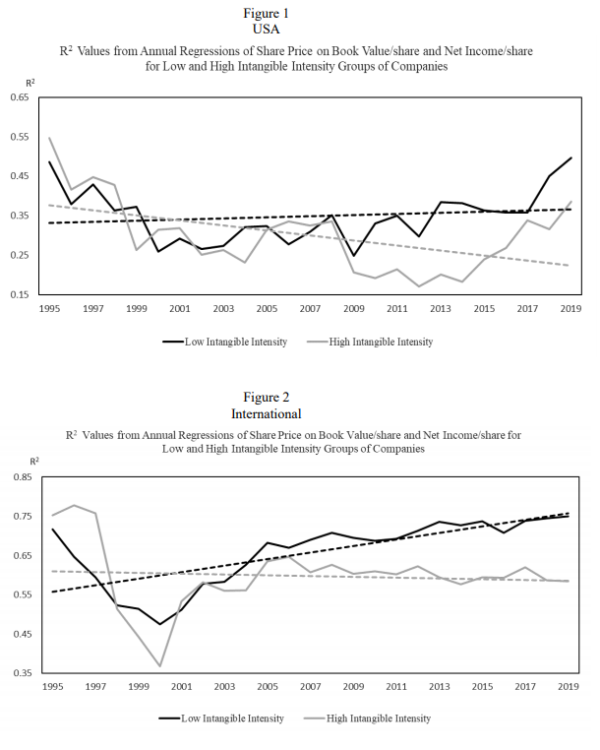

- Within the high intangible intensity group, the combined value relevance of book value and earnings has declined for both U.S. and international companies. In contrast, the value relevance of these variables for the low intangible intensity group has remained stable in the U.S. and increased internationally over the same period. This held across all 21 industries.

- The relationship between financial variables and contemporaneous stock prices has weakened so much for high intangible intensity companies in both the U.S. and abroad that investors can no longer afford to ignore the changes in the economic environment created by intangibles.

- The value-relevance of book value and earnings for companies in the low intangible intensity group has increased from 2009 onwards (and noticable from 2003 onward for the international universe)

Their findings led Dugar and Pozharny to conclude:

“Our results are especially important for international equity investors seeking to build investment strategies that account for the impact of intangible intensity on valuation ratios and other financial metrics used to assess the profitability, quality, growth, and risk characteristics of firms.”

Addressing the Intangibles Problem

One way that academics and fund managers have tried to address the issues related to intangibles not being on the balance sheet is to use alternative value metrics such as price-to-earnings (P/E), price-to-cash flow (P/CF), and enterprise value-to-earnings before interest, taxes, depreciation, and amortization (EV/EBITDA). Many fund families (such as Alpha Architect, AQR, BlackRock, Bridgeway, and Research Affiliates) assess multiple metrics. Another alternative is to add other factors into the definition of the eligible universe. For example, since 2013 Dimensional has included profitability as a screen in their value funds. A third alternative is to add back to book value an estimate of the value of intangibles, such as R&D expenses. A fourth way to address the issue is to apply what some call contextual stock selection, using different metrics or different weightings of those metrics, depending on the intangible intensity. For example, if book value is not well specified for industries with high intangibles, it may be less effective in those industries than in industries with low intangibles.

The bottom line is that the increasing importance of intangibles, at least for high intangible industries, is playing an important role in the cross-section of returns and should be addressed in portfolio construction. For example, not accounting for intangibles affects not just value metrics but other measures, such as profitability, which often scale by book value or total assets, both of which are affected by intangibles. Dugar and Pozharny suggest a framework in which to evaluate this by grouping industries.

Editor’s Note: Kai Wu’s has an interesting and take on this subject here.

Important Disclosures

The information presented here is for educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured author are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. LSR-21-91

References[+]

| ↑1 | An interesting take on the rise of intangibles is Kai Wu’s post utilizing analyzing text instead of financials to create factor investing portfolios. |

|---|---|

| ↑2 | Kai takes a different approach |

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.