Obfuscation in Mutual Funds

- deHaan, Son, Xie and Zhu

- Journal of Accounting and Economics, 2021

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

According to the Investment Company Institute, mutual funds traded on US Exchanges comprise 58% of investors’ retirement savings. However, despite their popularity, there is ample evidence that they underperform their market benchmarks(1), and are usually tax-inefficient compared to ETF’s. The underperformance, at least in part, is due to overly complex disclosures and fee structures that make it difficult to understand and compare funds. Carlin (2009) suggests that complexity persists because it is part of a strategy to obfuscate unfavorable information and extract rents from retail investors. The authors of this paper ask the following questions:

- Do mutual funds create unnecessarily complex disclosures and fee structures to obfuscate weak net performance?

What are the Academic Insights?

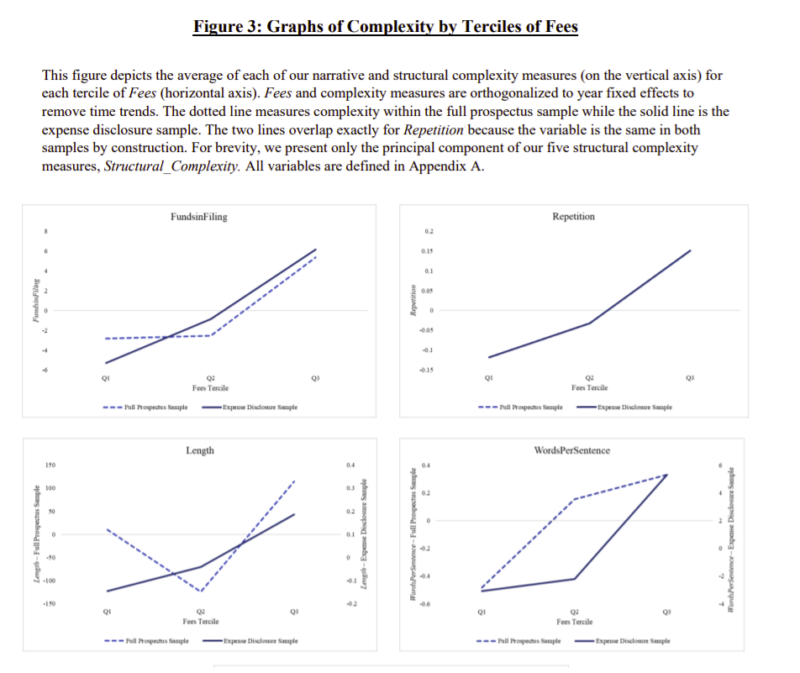

The authors study the narrative complexity of 38 S&P 500 index mutual funds prospectuses from 1994 to 2017 by developing four measures of readability ( number of funds included in the prospectus, the repetition between the summary section and the rest of the prospectus, the length of the document as number of words, and finally the writing clarity) as well as the structural complexity(2). The authors find:

- Yes, there is strong and positive associations between fees and multiple measures of both narrative complexity and structural complexity. The authors find evidence that high fee funds have more complex disclosures and fee-structures than low fee funds.

The authors conduct a number of robustness checks to exclude that narrative complexity is a non-discretionary byproduct of an omitted variable or irrelevant to investors.

The authors comment that their findings do not necessarily mean that managers consciously create complexity to obfuscate high fees. However, even if managers do not understand the effects of complexity, the findings indicate that high-fee funds have not embraced the SEC’s efforts to reduce complexity in fund disclosures.

Why does it matter?

This paper is important because it contributes to the literature investigating why retail investors make poor mutual fund choices.

The Most Important Chart from the Paper:

Abstract

Mutual funds hold 32% of the U.S. equity market and comprise 58% of retirement savings, yet retail investors consistently make poor choices when selecting funds. Theory suggests that poor choices are partially due to mutual fund managers creating unnecessarily complex disclosures and fee structures to keep investors uninformed and obfuscate poor performance. An empirical challenge in investigating this “strategic obfuscation” theory is isolating manipulated complexity from complexity arising from inherent differences across funds. We examine obfuscation among S&P 500 index funds, which have largely the same regulations, risks, and gross returns but can charge widely different fees. Using bespoke measures of complexity designed for mutual funds, we find evidence consistent with funds attempting to obfuscate high fees. Our study improves our understanding of why investors make poor mutual fund choices, and of how price dispersion persists among homogeneous index funds. We also discuss insights for mutual fund regulation and the academic literature on corporate disclosures.

References[+]

| ↑1 | see for example French 2008, Frazzini and Lamont 2008, and Choi et al. 2010 |

|---|---|

| ↑2 | the fund’s number of share classes and types and tiers of fees |

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.