New Accounting Standards and the Performance of Quantitative Investors

- Travis Dyer, Nicholas Guest, Jia Yin (Elisha) Yu

- SSRN-Working paper

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

How well do quantitative investors navigate around the changes to the accounting standards that are endemic to the financial data used in quantitative strategies? The numbers reported on financial statements are wholly governed by regulation and by each firm’s interpretation of those accounting standards. So do quants stick to their empirical evidence on old data methods or do they react in terms of the strategy when the change in standards is material?

The evolution of the situation could go something like this: first, regulators revise an accounting procedure, say, one that now includes transactions that were previously excluded from reporting requirements. This action imparts variability in accounting values over time that are not due to the economic or valuation characteristics of the firm. Meanwhile, stodgy quant investors may not incorporate the change, particularly if they are unable to differentiate the economic issues from the accounting issues. For example, It could be a skill deficit(1). In any case, it is an interesting question that likely has a material impact on performance numbers one way or the other.

The authors define the issue as a simple empirical question:

- Do material accounting changes impair or improve quantitative performance?

Given that a significant proportion of strategies, both quantitative and fundamental investors utilize accounting-based values and ratios, the authors analyzed a universe that included three standards that affected the balance sheet in a straightforward manner.

Two of the standards required firms to recognize pension and leasing entries on the balance sheet and removed them from the footnotes. The third required noncontrolling interests to be recognized as equity and removed from the liability section.

Specifically:

- SFAS 158 Pension–Recognized the funding status of defined benefit pension plans in the financial statements;

- ASC 842 Leases–Required the recognition of the asset and liabilities of operating leases on the balance sheet;

- SFAS 160/141R Noncontrolling interest–NCI required to be presented in the equity section of the balance sheet and removed from the liabilities section; Consolidated Net Income should be presented before deduction of income attributed to NCI. NCI required to be recognized at fair value at the purchase.

- Is the performance of quant funds affected by material changes in accounting standards described in the previous paragraph?

- What is the mechanism driving the deterioration in performance for quant funds?

- Do quant managers change or mitigate their use of accounting- based signals?

What are the Academic Insights?

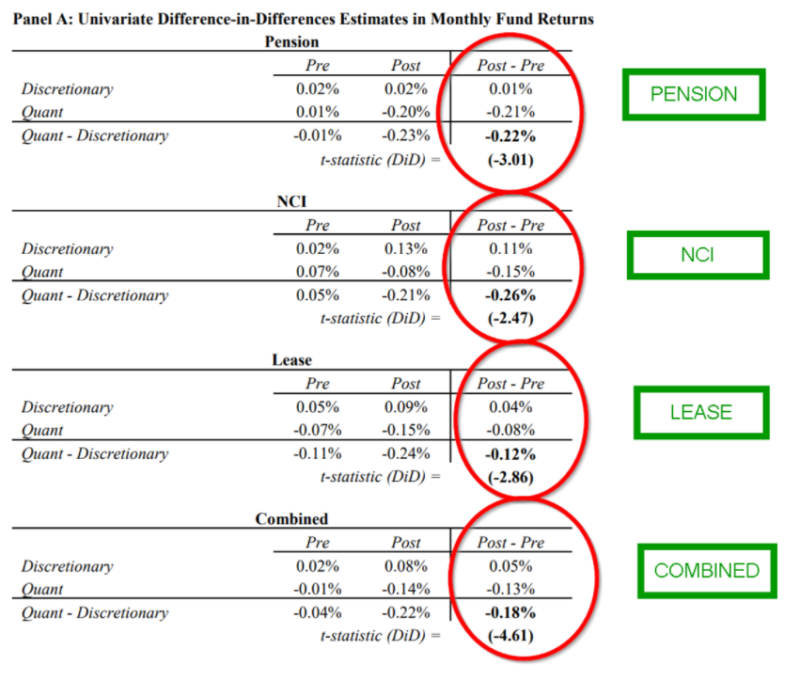

- YES. But not in a good way. The evidence is presented in Table 3. For each of the 3 accounting standards, the authors report that quantitative fund returns decline by almost -.18% in the month surrounding the announcement of the change, an equally weighted average of the 3 standards. This translated to approximately 3% in the year following the change. The largest monthly decline was -.21% for the pension event, followed by -.15% for the NCI event and -.08% for leases. All pre/post differences when compared to a “discretionary” or traditionally fundamental fund were significant. The impact on the fundamental funds were uniformly positive with a range of .01% to .11%. The quants come up short on this issue. It seems that the performance of fundamental strategies are not impacted by changes in the 3 accounting standards analyzed here. To further add fuel to the fire, the authors tested 3 specific factor funds under the same empirical design. Not surprisingly, quant funds identified as “value” with large exposures to balance sheet ratios like high book-to-market, produced an even larger level of underperformance when returns were measured around the changes in standards. Two other quant factors were tested, momentum and size, and exhibited no significant differences pre and post and when compared to fundamental strategies. Again, not surprising since size and momentum have minimal exposure to the accounting changes scrutinized in this paper.

- TRADING COSTS. The authors hypothesize and confirm an increased level of trading, turnover and transactions costs following changes in the accounting standards. Relative to fundamental funds, turnover costs for quants increased after the NCI, lease change, and combination of the three changes in standards. The results were statistically and economically significant. Coincidentally, much of the underperformance is associated with funds holding larger numbers of portfolio positions. Overall, the funds did recover after one year following the standard change. In year two, the underperformance was nonexistent.

- NO. There was no statistical evidence that quant investors shifted or tilted their strategies toward or away from any of the three factors following the change in standards.

Why Does it Matter?

It matters if quant investors are not sufficiently acquainted with the complexities of accounting and its regulatory regime changes. If quant investors make trading errors as a result of inadequate knowledge of accounting ratios and how they are constructed, then the fund’s performance will suffer. A sampling of the most common critiques from the accounting literature in this regard includes disregarding off-balance sheet operating leases or ignoring the timing of inventory purchases as well as ignoring changes in accounting regimes/standards while building investment strategies. As an academic and a teacher, the results of this study are consistent with my perceptions of the quality and quantity of the accounting content in finance degree programs. As financial analysts, we generally accept the financial statements, especially the bottom-line numbers, as given by the accountants and then subject them to financial analysis. Perhaps it makes sense to augment the finance curriculum not only with quantitative methods but with a comprehensive study on the impact of accounting rules and the changes that are wrought by the regulators of financial statements. Education matters and the accountants have something of value to contribute to quant strategies.

The Most Important Chart from the Paper

Abstract

Quantitative investing relies on historical data and limited day-to-day human involvement, which could create short-term inflexibility in the face of changing economic conditions. In this study, we examine quantitative investors’ ability to navigate a common and occasionally material change to the financial data generating process: new accounting standards. We find that returns of quantitative mutual funds temporarily decrease following the implementation of standards that change the definition of key accounting variables. The lower performance we document is relative to more traditional “discretionary” funds that rely heavily on human discretion to make investment decisions. Our result is stronger for value funds, which rely heavily on accounting data, and absent among funds slanted towards price-based strategies, including momentum and size. When we further investigate funds’ operations, we observe excess portfolio turnover following the implementation of accounting standards. Relatedly, quantitative underperformance is concentrated among funds holding more stocks. Overall, our results highlight a significant adjustment cost associated with accounting regulation that could become even more significant as more investors turn to quantitative strategies.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.