As the chief research officer of Buckingham Strategic Partners, the issue I am being asked to address most often is about fixed income strategies when yields are at historically low levels and inflation risk is heightened due to the unprecedented increase in money creation (through quantitative easing), the extraordinary expansionary fiscal spending around the globe, and the war in Ukraine driving prices higher (especially for food and energy).

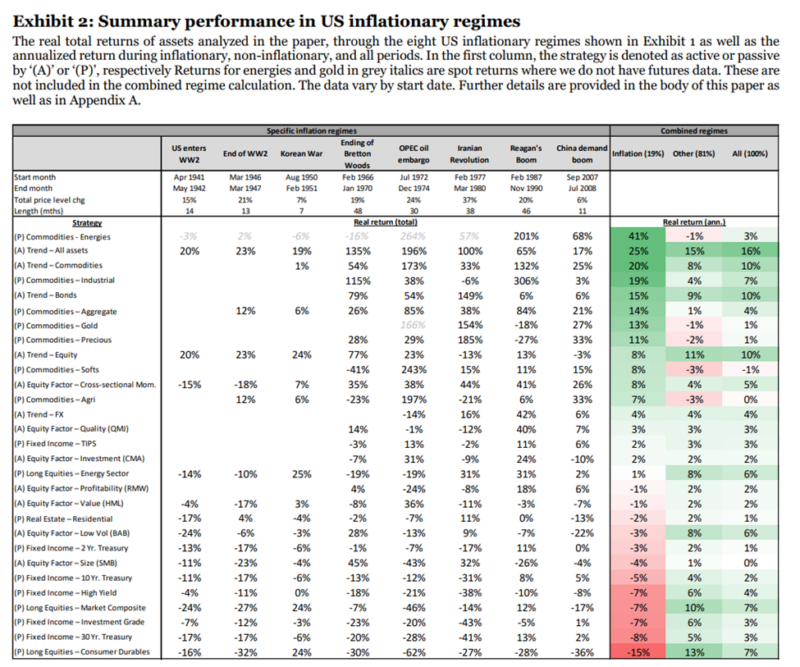

As always, to answer the question we turn first to the academic evidence on which investments in general provide the best hedges against inflation. Studies such as “The Best Strategies for Inflationary Times,” published in the August 2021 issue of The Journal of Portfolio Management (AA Summary), have found that:

- Treasury inflation-protected securities (TIPS) returns provide the best hedge against inflation, with similar positive real returns in inflationary and noninflationary regimes.

- Nominal bonds, both investment grade and high yield perform poorly during high inflationary regimes.

- Despite the conventional wisdom held by many investors that equities provide some protection from inflation (a firm’s debt obligations are inflated away, and product prices may be adjusted), equities tend to suffer from the less stable economic climate (the rate at which future earnings are discounted rises), and costs tend to rise with inflation more than output prices.

- No individual equity sector, including the energy sector, offers significant protection against high and rising inflation.

- Commodities provided the best historical performance, averaging double-digit real returns in high inflationary periods. However, in all other periods, the real return averaged just 1 percent annually.

- Residential real estate underperformed during high inflationary regimes, providing negative real returns.

- Collectibles, such as art (7 percent), wine (5 percent) and stamps (9 percent), provided strong real returns during inflationary periods (although weaker than commodities). In all other periods, the real annualized returns were 2 percent, 6 percent and 3 percent, respectively.

- Among equity factors, cross-sectional stock momentum was the best performer during inflationary regimes, realizing an 8 percent annualized real return versus 4 percent in normal times. However, the difference was not statistically significant for this volatile, high-turnover strategy. The quality and investment factors also performed well during inflationary regimes, returning 3 percent and 2 percent annualized, respectively, in all regimes.

- Equity factors with negative real annualized returns during high inflationary regimes included profitability (-1 percent), value (-1 percent), low volatility (-3 percent), and size (-4 percent). Keep in mind that low beta stocks tend to be more bond-like, and thus their poor performance is not surprising.

- The time-series momentum (trend-following) strategy performed well during inflationary regimes, with the bond and commodity trend performing particularly well, as inflation shocks do not tend to be overnight affairs but rather prolonged episodes that play to the strength of trend strategies.

The bottom line is that the best inflation hedge based on the data, the investment with the highest correlation to inflation, has historically been TIPS, with commodities also tending to do well. However, because commodities tend to provide poor returns in all other periods and can experience very long periods of poor performance, they should only be considered by investors with the discipline to stick with the strategy of including commodities over the long term. Unfortunately, neither stocks nor nominal return bonds (which make up the vast majority of most investor portfolios) nor residential real estate has provided a good hedge against inflation. In fact, in their 2022 Asset Allocation Report, Cliffwater LLC showed that the inflation beta of the S&P 500 Index was slightly negative over a period of one month (-0.07) to even five years (-0.11). On the other hand, commodities (using the S&P GSCI Index) had positive inflation betas, increasing from 0.21 at the monthly horizon to 0.47 at five years.

Since many investors consider gold to be a good inflation hedge (over the very long term it has been, though providing no real return over centuries), we will take a quick look at its inflation-hedging properties.

Gold as Inflation Hedge

First, Cliffwater found that gold’s inflation betas were similar to that of the S&P GSCI Index. Second, Goldman Sachs’ 2013 “Outlook” warned that during the post-World War II era, in 60 percent of episodes when inflation surprised to the upside, gold underperformed inflation. And finally, emphasizing that gold can underperform inflation over even very long horizons, consider the following: On January 21, 1980, the price of gold reached a then-record high of $850. On March 19, 2002, gold was trading at $293, well below where it was 20 years earlier. The inflation rate for the period 1980 through 2001 was 3.9 percent. Thus, gold’s loss in real purchasing power was about 85 percent. How can gold be an inflation hedge when over the course of 22 years it lost 85 percent in real terms?

Alternative Fixed Income Strategies

For investors who are either greatly concerned about the increased risk of inflation or whose financial plans would be more damaged by higher-than-expected inflation, there is an alternative to traditional safe bonds (like Treasuries, CDs, and high-quality municipals) that may be worth considering.

While there are no free lunches in investing, for investors who do not need liquidity for at least some of their portfolio (which is likely true for almost all investors), a potential way to reduce the risk of inflation while also aiming to increase expected returns is to shift some of their allocation from a more standard bond portfolio to one that includes certain interval funds consisting of private debt. An example would be the Cliffwater’s Corporate Lending Fund (CCLFX)(1), which invests in the senior secured floating rate private debt of middle-market companies, the vast majority of which are backed by private equity firms.

Middle market loans are generally not rated, are considered non-investment grade, and are not publicly traded. However, that doesn’t necessarily make them riskier from a credit perspective. For example, the average recovery rate for U.S. middle-market senior loans between 1989 and 2018 was 75 percent—far higher than the 56 percent for senior secured bonds. As another example, while private debt default rates never rose above 2 percent in 2020 (during the COVID crisis), leveraged loan and high-yield bond default rates were around 4 percent and 10 percent, respectively.

Because direct private loans are not liquid investments, they do carry an illiquidity premium, resulting in yields that are generally higher than similarly risky (from a credit perspective) traditional broadly syndicated bank loans and publicly traded high-yield bonds. For example, consider the Cliffwater Direct Lending Index (CDLI), which seeks to measure the unlevered, gross of fee performance of U.S. middle-market corporate loans as represented by the asset-weighted performance of the underlying assets of business development companies (BDCs), including both exchange-traded and unlisted BDCs, subject to certain eligibility requirements. As of the end of the first quarter 2022, the CDLI was yielding about 8.1 percent, 2.1 percentage points higher than the 6.0 percent yield of the Bloomberg High Yield Bond Index.

The high yields along with the relatively low default losses(2) combined with the elimination of term (duration) risk—all loans are based on floating rates—have attracted investors.

The attraction for investors concerned about inflation risk is that by shifting some portion of their allocation to safe bonds (for example, five-year Treasuries with a current yield of about 2.7 percent) to an interval fund(3) that has a current net of fee yield of about 7.3 percent, they would significantly reduce their risk of inflation (by reducing the maturity risk) while also earning a significant risk premium. The trade-off is accepting some economic cycle risk and giving up the daily liquidity offered by Treasuries.

The following is another example of why investors might consider a high yield interval fund. At the end of March 2022, CCLFX was yielding 7.3 percent. Compare that to the 3.9 percent yield of the Vanguard High-Yield Corporate Fund (VWEHX) with similar credit risk. This gives the interval fund a 3.4 percentage points higher yield while it also minimized term risk because its loans are all floating, whereas VWEHX has an effective maturity of about 4.5 years. As of this writing(4), in the Treasury market that difference in maturity (one month versus 4.5 years) would require an incremental yield of about 2.3 percent. Despite investors demanding a term premium, CCLFX yielded 3.4 percentage points more. The trade-off of that higher yield and minimization of term risk is that investors sacrifice the daily liquidity available in VWEHX.

For investors who don’t need liquidity for at least some portion of their portfolio, this may be a worthwhile trade—while not exactly a free lunch, it is at least a free stop at the dessert tray. For example, consider the retiree who is taking no more than their required minimum distribution (RMD) from their IRA account. Even at age 90, the RMD is not even 10 percent, while some interval funds are required to meet liquidity demands of at least 5 percent every quarter. For such an investor, the illiquidity premium is definitely worth considering.

There is one final example of why investors should at least consider a private debt interval fund. Investors who seek to reduce inflation risk while accepting increased economic cycle risk (credit risk) could choose to invest in a daily liquid fund holding securities with similar credit risk, such as the SPDR Blackstone Senior Loan ETF (SRLN), with assets under management of $10.7 billion. The fund has a current yield (April 8, 2022) of about 3.9 percent, or 3.4 percentage points less than that of CCLFX. If you don’t need the liquidity, why sacrifice the yield differential? In addition, SRLN also has an effective maturity of 4.9 years, taking significantly more inflation risk than CCLFX. Note that Stone Ridge’s Alternative Lending Risk Premium Fund (LENDX), which makes loans to consumers, small businesses, and students, offers similar benefits (yield similar to CCLFX and short maturity, with a duration of just over one year.) Both CCLFX and LENDX provide investors with a way of making the most while markets are offering little.

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third-party data which may become outdated or otherwise superseded without notice. Third-party data is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio nor do indices represent results of actual trading. Information from sources is deemed reliable, but its accuracy cannot be guaranteed. Performance is historical and does not guarantee future results. Total return includes reinvestment of dividends and capital gains. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them.

The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. LSR-22-275

References[+]

| ↑1 | Interval funds are non-diversified, closed-end management investment companies and involve substantial risk, including lack of liquidity and restrictions on withdrawals. Individuals should carefully consider the fund’s risks and investment objectives, as an investment in the fund may not be appropriate for all investors and is not designed to be a complete investment program. An investment in the fund involves varying degrees of risk and an investor should refer to the applicable prospectus for complete information on risk factors and risk of loss. Shares are an illiquid investment and investors will not have access to the money invested for an indefinite period of time. Investment should be avoided if you have a short-term investing horizon and/or cannot bear the loss of some or all of the investment. An investment in the funds is not suitable for an investor if the investor has a foreseeable need to access the money invested. Because an investor will be unable to sell fund shares or have them repurchased immediately, investors will find it difficult to reduce the exposure on a timely basis during a market downturn. The funds are non-diversified management investment companies and may be more susceptible to any single economic or regulatory occurrence than a diversified investment company. Investors should not consider these funds as a supplement to an overall investment program and should invest only if they are willing to undertake the risks involved. Investors could lose some or all of their investment. There can be no assurance that the fund investment objective will be achieved or that the investment program will be successful. |

|---|---|

| ↑2 | in their 2021 Q4 Report on U.S. Direct Lending, Cliffwater reported that realized losses since inception in 2004 were just 1.1 percent per annum |

| ↑3 | As an interval fund, CCLFX is required to provide a minimum of 5 percent liquidity per quarter but typically not more than 25 percent, and repurchase offers may be suspended or postponed in accordance with regulatory requirements (however, depending on demand for redemptions, it is possible an investor could redeem all their assets |

| ↑4 | April 4, 2022 |

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.