Gold, the Golden Constant, COVID-19, “massive Passives,” and Déjà Vu

- Claude Erb, Campbell R. Harvey, Tadas Viskanta

- A version of this paper can be found here.

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

The world has unquestionably be sent on a wild ride in 2020. We entered the year full of optimism and hope. Markets were at or near all-time highs, unemployment was low, living on easy street was good. Then the impact of COVID-19 ripped through the market and the economy with enough force to make the winds of even a double hurricane green with envy. This massive and rapid readjustment of the economy sent the Federal Reserve and the Federal Government into a frenzy of money printing that has reached altitudes that even the team at Alpha Architect wouldn’t want to hike at. Market observers and armchair macro-economists minds start firing with thoughts of the Weimaraner republic, and wheelbarrows of Deutch Marks needed for even small routine purchases. To quell these fears the first place people turn is to gold(1). With gold approaching all-time highs, even on inflation-adjusted terms, we must ask if it’s a good inflation hedge. The authors of this paper pull on the string of gold as an inflation hedge by utilizing gold futures prices, CPI data, and other metrics to answer this question.

What are the research questions?

- How well has gold been as an inflation hedge in the past?

- If gold is not an inflation hedge, can it still go higher?

What are the Academic Insights?

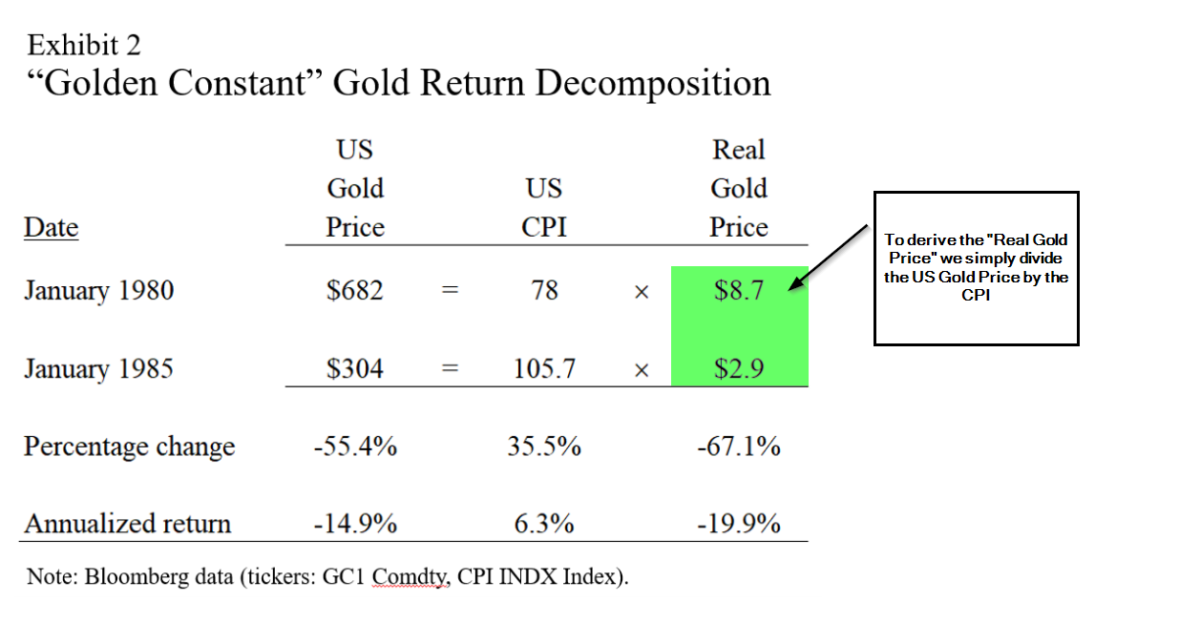

- Since 1975, when gold futures started trading, gold has not performed well as an inflation hedge. Historically gold prices rise in as the anticipation of inflation rises, but when that inflation does arrive (or doesn’t as in 2011) the real returns of gold have been abysmal. January of 1985 marked a peak in gold prices of $682 an ounce, while the CPI was at 78. Over the following 5 years, gold fell to $304 per ounce (a -55.4% return), while the CPI rose to 105.7(a 35.5% increase). The real gold price from 1980 to 1985, a period marked by relatively high 6.3% annualized inflation, saw gold prices fall 67.1% (-19.9% annualized). 2011 was a slightly different story as the expected high inflation never materialized. From gold’s peak in August 2011 to August 2016 the nominal price of gold fell 28% and the real price of gold fell 33%.

- Yes, the authors point towards the expanded use of ETF’s to bring investors aka “massive passives” into the gold market. They argue that the widespread utilization of gold ETF’s could potentially create Keynesian demand-pull inflation, where too much money is chasing too little gold. These massives passives investors are fed on higher prices and in the author’s opinion higher gold prices beget higher prices in a virtuous cycle that can take gold prices to levels never seen before.

Why does it matter?

Gold is again at a peak valuation and inflation expectations are high. So, it’s a critical time to look at the past and consider that as Buffett succinctly puts it:

“Price is what you pay, value is what you get.”-Warren Buffett

-Warren Buffett

The authors argue that if the high prices of gold, due to high levels of concern for inflation, did not reward high inflation fears in 1980 and 2011, why should it do so now? The data they provide is compelling and gives a good balance to the inflation fear-mongering that is fairly easy to rationalize when such extreme initiatives are being taken by the federal government. One concern I have with the paper is that the sample size of two price spikes and utilizing such limited data sets to draw conclusions leaves a bit more uncertainty. Maybe we can entice Jamie Catherwood to take a deeper dive into the history of gold and it’s performance over a much longer time period in history. That said the paper presents a wide breadth of ways to analyze and think about gold as an investment and is a great read for educational benefit alone.

There is little doubt that “massive passive” investors in markets can derive some very extreme price swings, note oil trading at -$35 a barrel. In any event, it is prudent to be aware that price volatility and valuation increases well beyond even “high prices” is possible, even with the conclusion that gold has not been a wonderful inflation hedge over the last 40 years.

The most important chart from the paper

Abstract

Currently, the real, inflation-adjusted, price of gold is almost as high as it was in January 1980 and August 2011. Since 1975, periods of high real gold prices have occurred during periods of elevated concern about high future price inflation. Five years after the real price peaks in January 1980 and August 2011 the nominal (real) prices of gold fell 55% (67%) and 28% (33%), respectively. Today’s high real price of gold suggests that gold is an expensive inflation-hedge with a low prospective real return. However, “massive passive” ETF financialization of gold ownership may introduce a period of “irrational exuberance”.

About the Author: Rich Shaner, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.