Do Equity Markets Care About Income Inequality? Evidence from Pay Ratio Disclosure

- Pan, Pikulina, Siegel, and Wang

- Journal of Finance, 2022

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The academic literature has tackled the topic of increased income inequality in the United States as well as the role of large within-firm pay dispersion in determining it. However, it lacks a debate on how U.S. financial markets and shareholders assess the dispersion in pay between a firm’s top executives and lower rank employees. This paper explores the issue by taking advantage of a new rule (implemented in 2018) that requires U.S. publicly traded companies to report the ratio between CEO pay and median worker pay.

The authors use this new rule as an experiment to address the following question:

- Do markets react negatively to high pay ratios?

What are the Academic Insights?

By collecting information on 2,300 US firms, the authors find:

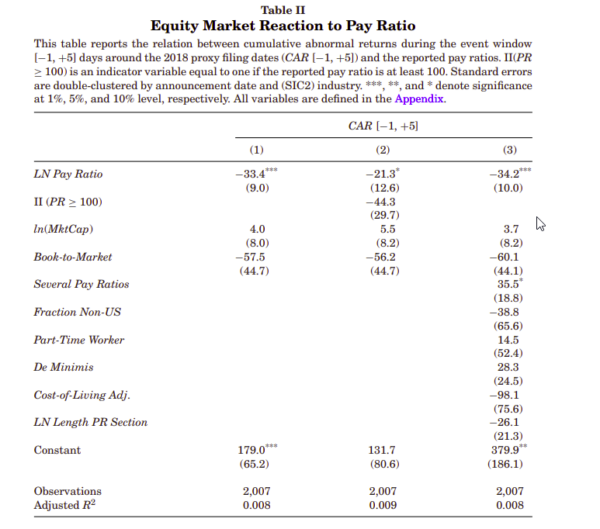

1. YES, a one-standard-deviation increase in pay ratio decreases a firm’s seven-day cumulative abnormal return by about 42 basis points (bps), suggesting that high CEO pay relative to median worker pay leads to a downward revision of firm value. The negative market reaction appears to persist at least several months after the initial pay ratio disclosure and is largely unaffected by the inclusion of firm characteristics as well as proxies for investors’ expectations of pay ratios, suggesting that the market reacts largely to the pay ratio numbers themselves once they become salient

2. Additionally, the significantly negative market reaction to a high pay ratio continues to hold after controlling for contemporaneously disclosed CEO or worker pay, suggesting that financial markets react to within-firm pay disparity independently of pay levels. Therefore, the negative market reaction is not a response to high CEO pay or low worker productivity

3. Firms with more inequality-averse shareholders experience a significantly more negative market response to high pay dispersion. This result holds using both the location- and the holdings-based preferences measures

4. More inequality-averse institutional investors reduce their allocations to stocks with a higher pay

ratio relative to other institutional investors

Why does it matter?

The growing presence of investors concerned about pay disparity and income inequality, through their portfolio decisions and impact on firms’ valuations, could eventually lead to changes in corporate culture and policies that help restrain inequality.

The Most Important Chart from the Paper:

Abstract

Do equity markets care about income inequality? We address this question by examining equity markets’reaction and investors’ portfolio rebalancing in response to the first-time disclosure of the ratio of CEO to median worker pay by U.S. public companies in 2018. We find that firms’ disclosing higher pay ratios experience significantly lower abnormal announcement returns. Additional evidence suggests that equity markets “dislike” high pay dispersion rather than high CEO pay or low worker pay. Firms whose shareholders are more inequality-averse experience a more pronounced negative market response to high pay ratios compared to firms with less inequality-averse shareholders. Finally, we find that during 2018 more inequality-averse investors rebalance their portfolios away from high pay ratio stocks relative to other investors. Overall, our results suggest that equity markets are concerned about high within-firm pay dispersion, and investors’ attitude towards income inequality is a channel through which high pay ratios negatively affect firm value.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.