The question of if investors can save the planet is an interesting one. In this article, we examine the research on the commitment of asset managers to investing in line with the Race to Zero goal of limiting global warming to 1.5 °C with limited or no overshoot.

Can Investors Save the Planet? – NZAMI and Fiduciary Duty

- Gosling and MacNeil

- Capital Markets Law Journal, forthcoming

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

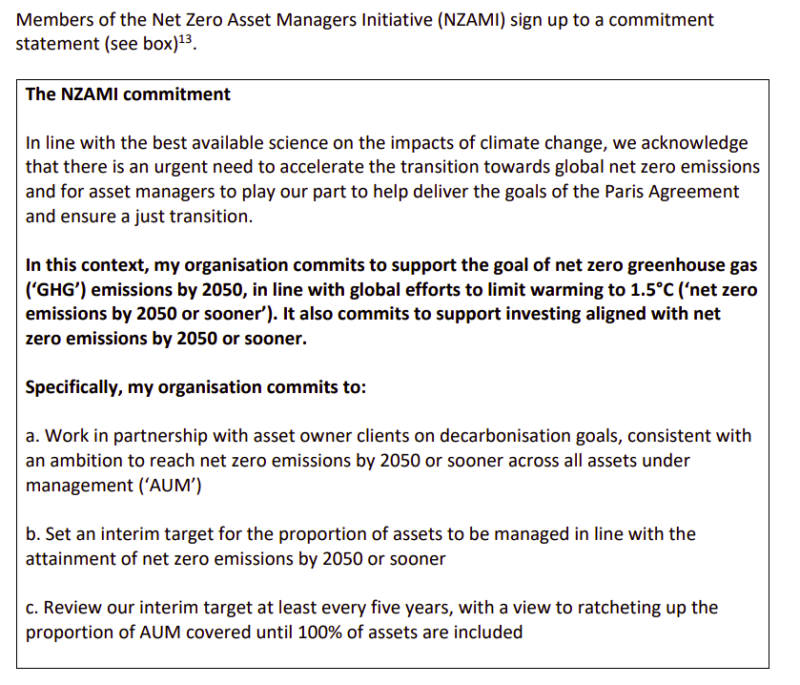

At COP 26, banks, asset owners, asset managers, and insurers representing 450 firms in 45 countries and more than $130 trillion of private capital famously came together to announce the formation of the Glasgow Financial Alliance for Net Zero (GFANZ) with the aim of investing in line with the Race to Zero goal of “limiting warming to 1.5°C with limited or no overshoot.”

Given that a recent report from United Nations Environment Programme says that there is “no credible pathway” in place to 1.5°C, the authors explore the implications for asset managers, as fiduciaries, of investing in line with a climate scenario that might now be considered an unlikely future outcome. In other words, can investors contribute to saving the world?

What are the Academic Insights?

The quick answer is NO. The authors find:

- In practical terms, the risks of being found by a court to be in breach of fiduciary duty for following such strategies is likely to be small. This is because adopting such strategies is, in most practical cases, likely to lead to relatively small differences in investment return compared with investment in the market portfolio. Given the noise in markets and the range of potential investment strategies, it would be difficult to prove that one of these strategies was manifestly unreasonable.

- However, the likelihood of such strategies achieving significant change in carbon emissions – a key objective of the NZAMI project – is low. Moreover, those strategies most likely to achieve such reductions (aggressive tilting, engagement, or impact strategies) are the most likely to deliver significantly impaired returns, especially in a scenario, which is likely, in which governments do not impose the regulation required for global warming to be reduced.

- There appears to be a tension between meeting the stated commitments of NZAMI to “invest in line with 1.5°C” and fiduciary duty considerations. The more likely a strategy is to deliver real-world change in carbon emissions, the more likely it is to give rise to fiduciary concerns. These fiduciary concerns are unlikely in most cases to give rise to enforceable legal liability for the above reasons. However, it is likely that many asset managers, when applying an expected standard of fiduciary duty, will conclude that the strategies that are more impactful in the real world are not consistent with that duty in the absence of an explicit authorizing mandate from clients. As a result, the duties most likely to be adopted by NZAMI signatories are those that meet fiduciary duties to clients but have a low likelihood of making a meaningful contribution to fighting climate change.

Why does it matter?

This study is an important contribution to the debate around whether current impact investing strategies do in fact add value not just in terms of financial returns but, most importantly, in the environmental impact they are supposed to deliver.

The Most Important Chart from the Paper:

Abstract

Asset manager signatories of the Net Zero Asset Manager Initiative, part of the Glasgow Financial Alliance for Net Zero, have committed to investing in line with the Race to Zero goal of limiting global warming to 1.5oC with limited or no overshoot. Given that a recent report from United Nations Environment Programme says that there is “no credible pathway” in place to 1.5oC, we explore the implications for asset managers, as fiduciaries, of investing in line with a climate scenario that might now be considered an unlikely future outcome. We assess common “net zero aligned” investment strategies such as portfolio decarbonization, tilting, active ownership, ESG integration, and impact investing by reference to considerations of fiduciary duty and real-world efficacy at combatting climate change. We find that the more likely a strategy is to deliver real-world change in carbon emissions in line with the 1.5oC goal, the more likely it is to give rise to fiduciary concerns. Although these fiduciary concerns are unlikely in most cases to give rise to enforceable legal liability, it is likely that many asset managers, when applying an expected standard of fiduciary duty, will conclude that such strategies are not consistent with that duty in the absence of an explicit authorizing mandate from clients. As a result, the strategies most likely to be adopted are also the least likely to contribute meaningfully to addressing climate change. We set out ways in which the commitments could be reframed so as to maximize real world impact of the initiative in the fight against climate change, while avoiding conflicts with the fiduciary duties of signatories. Key to this is aligning commitments to a more realistic climate scenario than 1.5oC with limited or no overshoot.

.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.