The article aims to explore the relationship between multitasking and performance for mutual fund managers, investigate the potential mechanisms and factors influencing this relationship, and provide insights for fund companies and investors regarding the implications of multitasking on fund performance.

Managerial Multitasking in the Mutual Fund Industry

- Argawal, Ma and Mullally

- Financial Analyst Journal, 2023

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

- Does multitasking affect the performance of mutual funds?

- What is the mechanism through which multitasking adversely affects fund performance?

- How does the number of funds or investment styles managed by multitasking managers impact performance?

- What is the rationale for fund companies to assign managers to multitask despite the negative impact on performance?

What are the Academic Insights?

By studying data from the survivorship-bias free Morningstar Direct Mutual Fund database and analyzing a final sample of 15,833 portfolio managers from 10,325 mutual funds, covering 995,435 fund-month observations between 1990 and 2018, the authors find:

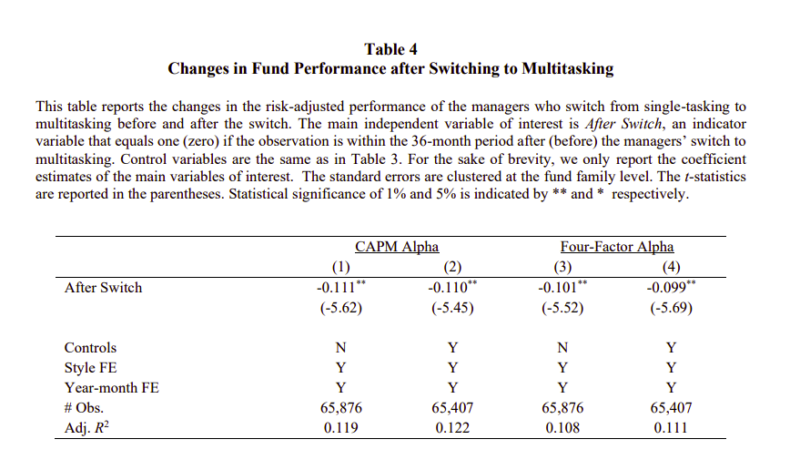

- YES – Multitasking is associated with worse fund performance. Funds run by managers who multitask earn 0.028 – 0.036 percentage points lower monthly risk-adjusted returns than funds led by portfolio managers responsible for just a single fund. Furthermore, when comparing the performance of multitasking managers before and after they are tasked with managing additional funds, their risk-adjusted performance decreases by 0.099 – 0.111 percentage points per month in the 36-month period after taking on additional responsibilities.

- Multitasking reduces the amount of attention and effort that managers can allocate to each individual fund. This reduction in attention can lead to a deterioration in performance.

- The more responsibilities a manager has in terms of handling multiple funds or investment styles, the more their performance suffers due to reduced attention and effort that can be allocated to each individual fund.

- Managers who multitask tend to attract higher levels of investor capital in aggregate. Hence, fund companies may assign multiple funds to their top performing managers as a way of retaining them, especially considering that portfolio manager compensation tends to increase with the assets they manage. Additionally, assigning managers to multitask may help fund companies mitigate the diseconomies of scale that managers face when running large pools of capital in a given style.

Why does this study matter?

This study is important because it contributes to the understanding of fund performance and the factors that influence fund outcomes, explores the impact of multitasking, and provides insights for fund companies and investors to make informed decisions.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Managerial multitasking has become a common practice in the mutual fund industry. Although

multitasking may have certain benefits for fund companies and portfolio managers, these arrangements have significant drawbacks for fund investors. We find that multitasking is associated with worse fund performance. Moreover, we find significant performance deterioration when single-tasking managers begin multitasking. We further provide evidence that multitasking limits the investment options of the fund managers or reduces the attention they allocate to their funds. Our study prescribes caution when assigning a portfolio manager with a greater workload as doing so adversely affects fund performance and, at some point, the ability of the fund family to attract capital.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.