The article aims to provide insights into the gender gaps in executive employment and compensation, explore the role of corporate culture and temporal flexibility in these gaps, and understand the factors influencing gender differences in entry, exit, and pay among top business executives.

The Gender Gap Among Top Business Executives

- Keller, Molina and Olney

- Journal of Economic Behavior and Organization, 2023

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

- What are the gender gaps in executive representation and compensation in the corporate business world?

- How do corporate culture and preferences for temporal flexibility contribute to gender gaps in executive entry, exit, and compensation?

- Does the gender pay gap vary with different types of compensation, such as salary and bonuses?

- How do female-friendly firms impact gender employment and pay gaps?

What are the Academic Insights?

By studying data on executive-level information (ExecuComp) of publicly traded U.S. firms (Compustat) with the addition of firm-level information on temporal flexibility and corporate culture (KLD Research and Analytics) over 25 years (1992-2017), the authors find:

- In terms of representation, women were only 6% of top business executives at the beginning of the sample, and by the end of the sample period, the representation increased to 10%, indicating slow progress. In terms of compensation, the article reports that unconditionally, women earn 26% less than men among top business executives. After accounting for individual characteristics, industry and firm fixed effects, and job title, the gender pay gap decreases to about 8%. This suggests that even after controlling for relevant factors, female executives with similar experience and education, working at similar firms and doing similar jobs, still earn less than their male colleagues.

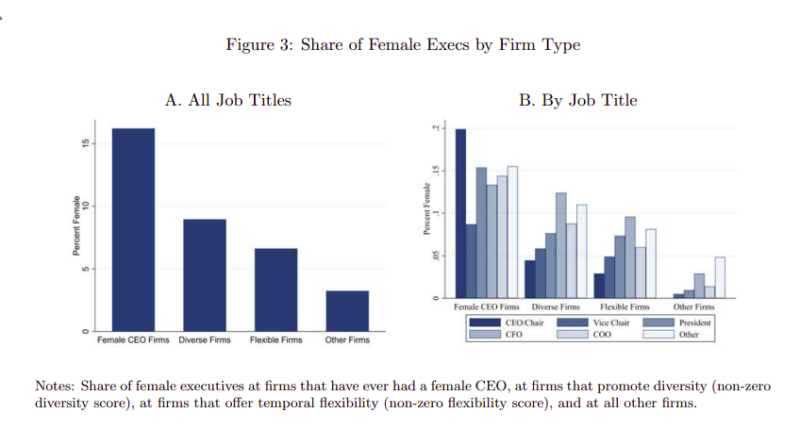

- While temporal flexibility and corporate culture play a role in gender gaps in executive entry, exit, and compensation, the influence of corporate culture appears to be more significant. Female-friendly firms that prioritize diversity and have a female CEO exhibit smaller gender gaps in both employment and compensation. In fact, female executives are disproportionately found in firms that offer temporal flexibility and have a female-friendly corporate culture. Female entry rates are higher at flexible firms, suggesting that women are more likely to join organizations that provide work schedule flexibility. Additionally, female exit rates are lower at female-friendly firms, indicating that women are more likely to stay in environments that prioritize gender and racial diversity.

- Women earn 26% less than men. YES – The article finds that the gender pay gap is larger for non-salary forms of compensation, such as bonuses. Discretionary pay, which is influenced by factors like negotiation, personal connections, and insider relationships, tends to disproportionately favor men.

- Female-friendly firms mitigate the effects of a male-dominated corporate culture on gender employment and pay gaps. The presence of a female CEO and a commitment to diversity and inclusion positively impact gender equality in compensation within firms.

Why does this study matter?

By addressing an important social issue, offering novel insights, and providing actionable recommendations, this study contributes to the ongoing efforts to achieve gender equality in the corporate world and promote more inclusive workplaces.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

This paper examines gender differences among top business executives using a large executive-employer matched data set spanning the last quarter century. Female executives make up 6.2% of the sample and we find they exhibit more labor market churning – both higher entry and higher exit rates. Unconditionally, women earn 26% less than men, which decreases to 7.9% once executive characteristics, firm characteristics, and in particular job title are accounted for. The paper explores the extent to which firm-level temporal flexibility and corporate culture can explain these gender differences. Although we find that women tend to select into firms with temporal flexibility and a female-friendly corporate culture, there is no evidence that this sorting drives the gender pay gap. However, we do find evidence that corporate culture affects pay gaps within firms: the within-firm gender pay gap disappears entirely at female-friendly firms. Overall, while both corporate culture and flexibility affect the female share of employment, only corporate culture influences the gender pay gap.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.