The article introduces a concept called “impact elasticity,” which measures how a firm’s environmental impact changes in response to shifts in its cost of capital (the “E” in “ESG”). It finds that the dominant sustainable investing strategy, which favors green firms and punishes brown firms by altering their cost of capital, can be counterproductive.

Counterproductive Sustainable Investing: The Impact Elasticity of Brown and Green Firms

- Hartzmark and Shue

- Working paper

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

- How does sustainable investing, which focuses on channeling capital towards environmentally friendly “green” firms and away from environmentally harmful “brown” firms, impact firms’ financing conditions?

- What is the concept of “impact elasticity,” and how can it be used to measure a firm’s change in environmental impact in response to changes in its cost of capital?

- Does the dominant sustainable investing strategy effectively motivate firms to become more environmentally friendly, or does it inadvertently make brown firms worse while failing to significantly improve green firms?

- To what extent have sustainable investors succeeded in raising the cost of capital for brown firms relative to green firms, and what are the potential implications for the broader economy and the environment?

- How does the sustainable investing strategy align with the goal of a green economic transition, and what are the implications for different types of investors and their objectives, such as those pursuing a “transition” objective versus a “degrowth” objective?

- Do sustainable investors tend to reward firms for small percentage reductions in emissions, and how does this impact the effectiveness of their strategy in promoting environmental improvements?

What are the Academic Insights?

By studying data from 2002 to 2020, the authors find:

- It has the potential to influence firms’ financing conditions by altering their cost of capital (green firms may benefit from a lower cost of capital as sustainable investors favor them, while brown firms may face a higher cost of capital as they are shunned), access to capital (green firms may find it easier to access capital and attract investment due to their positive environmental profile), risk-return profiles (green firms may be perceived as lower-risk investments, given their positive environmental impact and potential for sustainable growth. In contrast, brown firms may be viewed as riskier investments due to their negative environmental impact, potentially leading to lower valuations and higher expected returns), and behavior (green firms may be motivated to maintain or enhance their positive environmental impact to continue benefiting from lower financing costs. In contrast, brown firms may face pressure to reduce their negative environmental impact to attract capital or avoid further increases in their cost of capital).

- It is a concept used to quantitatively measure and compare a firm’s responsiveness to changes in its cost of capital with respect to its environmental impact. It provides valuable insights for assessing how firms’ financing conditions influence their environmental behavior and can inform strategies related to sustainable investing and corporate sustainability efforts.

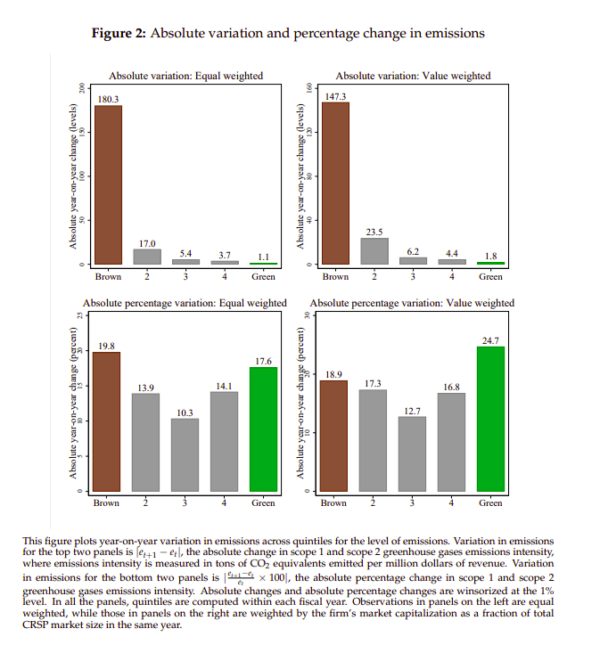

- NO – In fact the paper suggests that it may have unintended consequences. Specifically, it points out that this strategy may not be as effective as intended in motivating firms to become more environmentally friendly, and it may even inadvertently make brown firms worse without significantly improving green firms. The argument is based on the concept of “impact elasticity,” which measures how sensitive firms are to changes in their cost of capital concerning their environmental impact. The paper finds that brown firms (those with negative environmental impacts) tend to have a larger negative impact elasticity. This means that they become substantially less environmentally friendly in response to easier access to capital and become even more environmentally harmful when pushed toward financial distress. Additionally, the current strategy of sustainable investing tends to focus on percentage changes in emissions, which can lead to a mistaken emphasis on green firms for economically trivial reductions in their already low emissions. Green firms have little scope for further improvement in their environmental impact, making it less effective to reward them for small percentage reductions.

- The paper does not take a strong stand on the specific magnitude of this influence.

- The dominant sustainable investing strategy may not effectively align with the goal of a green economic transition, particularly for investors with a “transition” objective. It suggests that the strategy’s focus on percentage reductions in emissions and sectoral underweighting may hinder the desired transition. However, it may align more closely with the “degrowth” objective, as it can lead to the elimination of brown firms. This distinction emphasizes the importance of clarifying investor objectives and considering the broader economic and sectoral implications of sustainable investing strategies.

- YES – sustainable investors, in the dominant strategy described in the paper, tend to reward firms for small percentage reductions in emissions, and this can impact the effectiveness of their strategy in promoting environmental improvements. This approach may lead to the misallocation of incentives and may not be the most efficient way to encourage meaningful environmental improvements. The authors suggest that sustainable investing strategies should consider the absolute level of emissions reductions and explore more effective ways to drive environmental progress, especially for brown firms.

Why does this study matter?

This research addresses critical issues related to sustainable investing, environmental impact, and aligning finance with sustainability goals. It provides insights to inform investment decisions, policy development, and academic research.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We develop a new measure of impact elasticity, defined as a firm’s change in environmental impact due to a change in its cost of capital. We show empirically that a reduction in financing costs for firms that are already green leads to small improvements in impact at best. In contrast, increasing financing costs for brown firms leads to large negative changes in firm impact. Thus, sustainable investing that directs capital away from brown firms and toward green firms may be counterproductive, in that it makes brown firms more brown without making green firms more green. We further show that brown firms face very weak incentives to become more green. Due to a mistaken focus on percentage reductions in emissions, the sustainable investing movement primarily rewards green firms for economically trivial reductions in their already low levels of emissions.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.