The study emphasizes the importance of integrating machine learning with other tools for investment managers, pension-plan administrators, financial advisors, and independent analysts to help investors select active mutual funds with positive alpha. It also highlights the significance of fund characteristics in predicting alpha, even when portfolio holdings are not disclosed.

Machine learning and fund characteristics help to select mutual funds with positive alpha

- DeMiguel, Victor, Gil-Bazo, Javier, Nogales, Francisco J., and Santos, Andres A.P.

- Journal of Finance 2021

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The authors ask the following questions:

- Can machine-learning methods be used to predict the performance of active mutual funds, specifically in terms of alpha net of all costs?

- Do these machine-learning methods reveal nonlinearities and interactions in the relationship between fund characteristics and future performance, which traditional linear methods might miss?

- Can the identification of active mutual funds with positive alpha through machine learning be attributed to the detection of managers whose skill is not offset by the disadvantages of managing larger funds?

- How does the performance of machine-learning-based portfolios of mutual funds compare to portfolios constructed using traditional linear methods or naive strategies, such as equally weighted and asset-weighted portfolios?

- Does the performance of these machine-learning portfolios vary over time and across different business-cycle and sentiment regimes?

- What is the economic significance of the positive net alphas generated by the machine-learning portfolios, and how do they compare to the average expense ratios of the funds in the sample?

What are the Academic Insights?

- YES – machine-learning methods, particularly those that consider nonlinear relationships and interactions among fund characteristics, can indeed be employed to predict and construct portfolios of mutual funds with positive alpha after all expenses are considered

- YES – machine-learning methods, particularly gradient boosting, and random forests, can uncover complex and nonlinear relationships among various fund characteristics and performance outcomes. These methods are capable of capturing interactions and patterns that linear methods like Ordinary Least Squares (OLS) may not detect

- YES – machine-learning methods, by considering various fund characteristics, can select portfolios of mutual funds that are not only managed by skilled individuals but also managed in a way that avoids the diminishing returns associated with larger fund sizes. This implies that machine learning helps identify both skilled managers and those managers whose skill remains effective even as the fund grows in size

- Machine-learning-based portfolios, particularly those employing gradient boosting and random forests, consistently outperform portfolios constructed using traditional linear methods like Ordinary Least Squares (OLS)

- NO – machine-learning-based approach remains effective in generating positive alpha across different market conditions and economic cycles, providing consistent results over time

- The study reports statistically significant positive net alphas of 2.36% and 2.69% per year for portfolios constructed using the machine-learning methods of gradient boosting and random forests, respectively. These alphas are substantial and suggest that investors can earn economically significant excess returns by investing in these portfolios. Notably, these positive net alphas are more than double the average expense ratio in the sample, which stands at 1.11%.

Why does this study matter?

This paper matters because it challenges prevailing notions about the performance of active mutual funds, showcases the potential for machine learning to enhance investment outcomes, and offers insights that can inform investment strategies, regulatory decisions, and discussions about market efficiency in the mutual-fund industry.

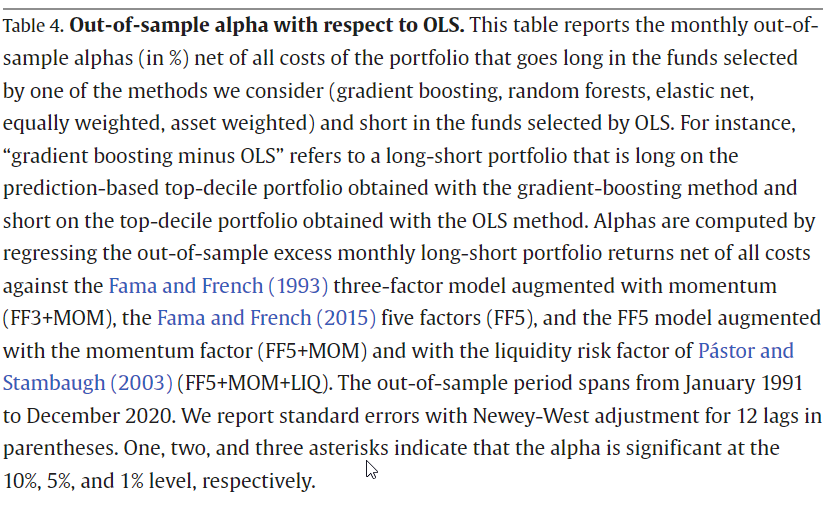

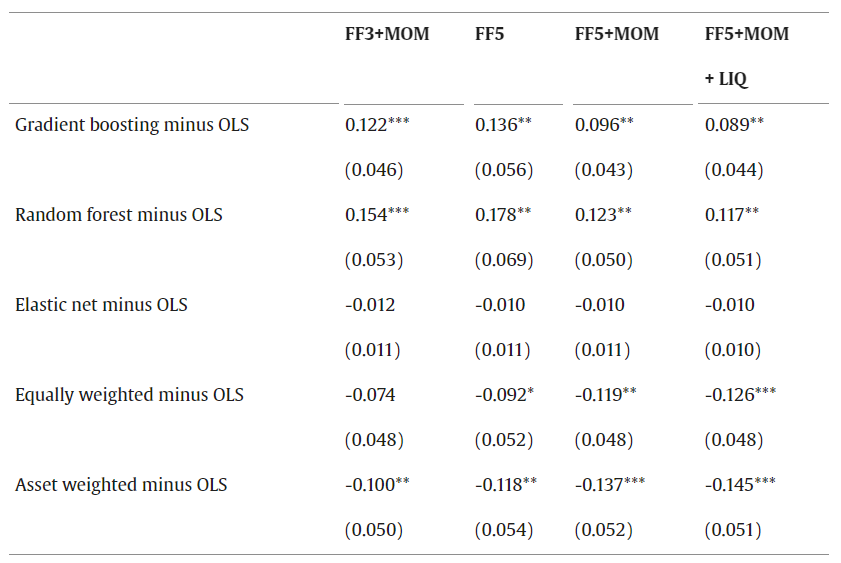

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Machine-learning methods exploit fund characteristics to select tradable long-only portfolios of mutual funds that earn significant out-of-sample annual alphas of 2.4% net of all costs. The methods unveil interactions in the relation between fund characteristics and future performance. For instance, past performance is a particularly strong predictor of future performance for more active funds. Machine learning identifies managers whose skill is not sufficiently offset by diseconomies of scale, consistent with informational frictions preventing investors from identifying the outperforming funds. Our findings demonstrate that investors can benefit from active management, but only if they have access to sophisticated prediction methods.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.