The paper aims to contribute to the literature by providing insights into the current state of financial literacy in Italy, its implications for financial well-being and resilience, and the demographic disparities therein.

Financial Literacy and Financial Resilience: Evidence from Italy

- Bottazzi and Oggero

- Journal of Financial Literacy and Wellbeing, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

By using the Big Three Financial Literacy questions, the authors ask the following questions:

- What is the level of financial literacy among individuals in Italy?

- How do Italy’s financial literacy levels compare with those of other European countries and the OECD average?

- Are there variations in financial literacy across demographic groups, such as education level, gender, and age?

- What is the association between financial literacy and financial well-being, including resilience, during the COVID-19 pandemic?

- Does financial literacy serve as a protective factor against overindebtedness?

What are the Academic Insights?

By studying a new dataset of 5,000 Italian adults collected by BVA Doxa in collaboration with the Italian Financial Education Committee, the authors find:

- The level of financial literacy in Italy appears to be moderate, with notable gaps in understanding certain concepts. Approximately 71% of respondents correctly answered questions related to interest rates. About two-thirds (67%) of respondents answered questions related to inflation correctly. Risk diversification is the concept that Italians seem to know the least about, with only 64% providing correct answers.The percentage of people who answered all three questions correctly is 55%. This indicates that just over half of the sample demonstrated a comprehensive understanding of the basic financial concepts tested in the survey.

- Italy’s financial literacy rate is reported to be the lowest among the G7 countries, including Canada, France, Germany, Japan, the United Kingdom, and the United States. However, this was not true for the whole country, as the difference between the best-performing regions (Friuli Venezia Giulia and Veneto) and the worst-performing one (Calabria) was larger than one proficiency level out of five (OECD, 2014a). Regions would rank very differently than the national average.

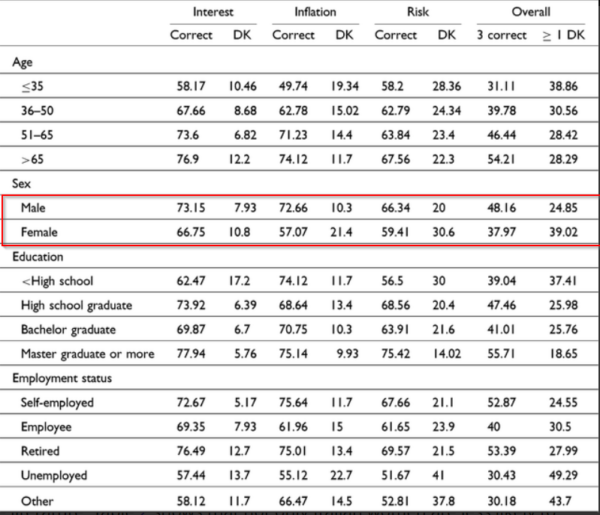

- Financial literacy is lowest among individuals younger than 35 years old and increases progressively with age. There is a notable age gap in the knowledge of inflation, with older individuals demonstrating significantly higher levels of understanding, likely due to their experience with high inflation in the 1970s. This is concerning given the importance of understanding inflation for financial decision-making, especially in the current inflationary environment. There is a persistent gender gap in financial knowledge, with women generally scoring lower on financial literacy assessments compared to men. Women are not only less likely to correctly answer financial literacy questions but are also more inclined to report that they do not know the answers. The gender gap in financial literacy is evident across all age groups and across various financial literacy questions, suggesting a systemic difference in financial knowledge between men and women. Financial literacy tends to increase with higher levels of education. Individuals with higher educational attainment, such as a master’s degree, are more likely to correctly answer financial literacy questions compared to those with lower levels of education. There is a notable difference in financial literacy between individuals without a high school diploma and those with advanced degrees, with the latter group demonstrating higher levels of financial knowledge. Among workers, self-employed individuals tend to have higher financial literacy levels compared to employees, possibly reflecting their greater involvement in financial decision-making and entrepreneurship.

- Financially literate individuals are more likely to make informed financial decisions, such as budgeting effectively, managing debt, and investing wisely. Also, they are more likely to have emergency savings and financial reserves to weather unexpected financial shocks, such as job loss or medical emergencies. Those who correctly answered the Big Three financial literacy questions were found to be 13 percentage points less likely to be financially fragile, even after controlling for various sociodemographic factors. One additional correct answer to financial literacy questions was associated with a 6-percentage-point lower probability of financial fragility. Factors such as higher income, home ownership, and knowledge of interest rates and risk diversification were also associated with lower financial fragility. In contrast, having children and experiencing income shocks increased the likelihood of financial fragility. Respondents who correctly answered the Big Three questions were 10 percentage points less likely to report excessive debt, and each additional correct answer was associated with a 5-percentage-point lower likelihood of perceiving excessive debt. Factors such as experiencing a drop in income, having children, and age were also associated with perceived over-indebtedness. Knowledge of interest rates was highlighted as particularly influential in reducing the likelihood of perceiving excessive debt.

- Financially literate individuals were found to be less likely to report excessive debt, as measured by their ability to answer financial literacy questions correctly.

Why does this study matter?

This article holds several important implications: Policy Relevance: It underscores the importance of financial literacy initiatives as a means to enhance financial well-being and resilience, particularly during times of economic uncertainty; Individual Empowerment: By highlighting the association between financial literacy and various measures of financial well-being, the article empowers individuals to recognize the value of enhancing their financial knowledge; Mitigating Financial Vulnerability: The article emphasizes the role of financial literacy in mitigating financial vulnerability, such as financial fragility and overindebtedness. By promoting financial literacy, individuals can better protect themselves against financial shocks, manage debt responsibly, and maintain financial stability, ultimately reducing their susceptibility to financial hardship.

The Most Important Chart from the Paper:

Abstract

In this paper, we examine financial literacy and financial resilience in Italy. We show that financial literacy is particularly low among the young, women, and the less educated. We also highlight regional differences in financial knowledge, with individuals in Southern Italy performing worse. We find that the lack of financial literacy increases the probability of being unable to face financial shocks and leads to an overaccumulation of debt. Hence, our results support the hypothesis that financial literacy can be considered an enabling factor for financial resilience.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.