The research literature on diversity in asset management, while promising, is limited with respect to the breadth of the evidence produced to date. We don’t really understand the broad-based benefits of diversity nor how diversity delivers value in asset management. How does it really work? Is it the university, the college major, gender, race, the work experience? That is where this study comes into play. The authors propose a unifying concept called homophily to analyze the impact of diversity in asset management using hedge funds as their laboratory. Sociology describes homophily as groups of people that share common characteristics such as beliefs, values, education, and so on. In a team setting those characteristics make communication and relationship formation easier. Further, a large body of research in sociology documents explicitly the presence of homophily with respect to education, occupation, gender, and race. Luckily, management teams within hedge funds can be characterized by just those dimensions. It makes sense that “…hedge funds are uniquely positioned to harness the value of diversity given the complex and unconstrained strategies that they employ. Yet, they are often managed by teams with homogeneous educational backgrounds, academic specializations, work experiences, genders, and races.“

Diverse Hedge Funds

- Yan Lu, Narayan Y. Naik and Melvyn Teo

- The Review of Financial Studies

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

- Does diversity of management teams operating in hedge funds affect performance?

What are the Academic Insights?

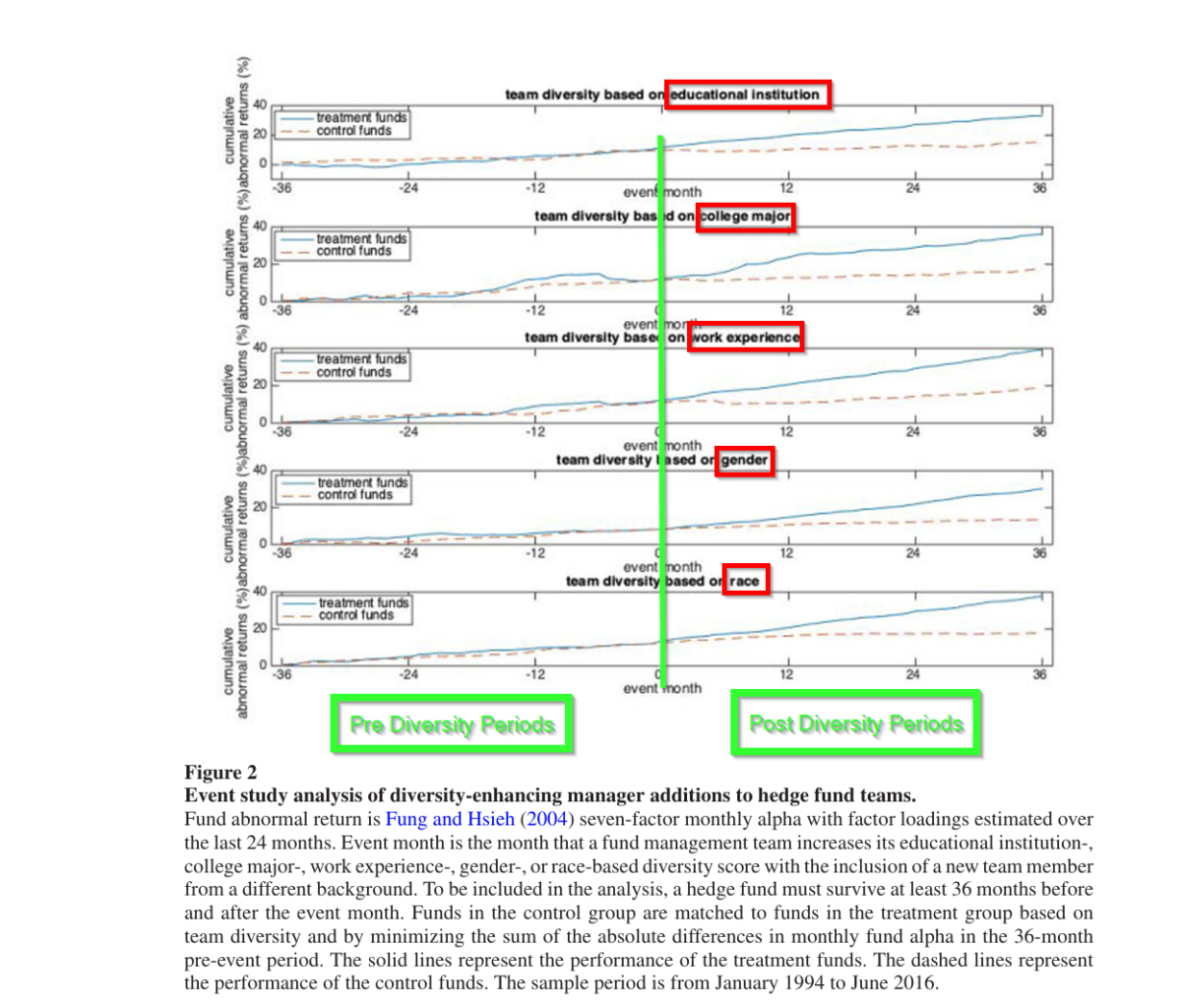

- YES. Regression analysis of the residuals from risk-adjusted portfolio returns find that diverse teams outperform homogeneous teams by 4.44% to 6.00% annually. These results were robust with respect to the impact of common factors including value, momentum, liquidity, profitability, investment and emerging markets and other marco variables, as well as fund and team characteristics. As an example, see the results in Figure 2. The vertical green line denotes the point in time when hedge funds moved into a distinctively diverse set of managers. Note the outperformance that occurs during the post-diversity period (36 months) for each of the five diversity attributes. The results are compared to non-diverse funds and are controlled for any biases in the data, characteristics of the fund, size, demographics, and omitted variables. The authors attribute the outperformance to the adoption of strategy enhancements including arbitraging the strongest stock anomalies, avoiding behavioral biases like overconfidence or disposition effects, prudent risk management by reducing tail risk exposures, operational risk, and errors in reporting returns.

Why does it matter?

The theory of whether diversity should create value in asset management is unclear. From a purely sociological view, the description of heterogeneous teams provides a measure of insight. As the data indicates and as the authors argue, the mechanics of diversity override the advantages of homogeneity in hedge fund teams. Hedge funds are uniquely situated to assess the impact of diversity on performance. This industry engages in complex and unconstrained strategies, using small teams. and does not appoint directors for management purposes. This is important because it allows the industry to fully exploit the variety of skills present in a diverse team without the complicating impact of a diverse Board of Directors. Diversity beats homogeneity in terms of outperformance, resilience to tail risk events, and lower exposure to capacity constraints for investors. The argumentfor diverse teams is attractive when viewed from the perspective of fund management firms looking to enhance the diversity of their leadership and analyst ranks. From the investor’s viewpoint, the capacity constraints that limit allocation of capital (to skilled managers) can be alleviated by increasing the pool of skilled managers.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Hedge fund teams with heterogeneous educational backgrounds, academic specializations, work experiences, genders, and races, outperform homogeneous teams after adjusting for risk and fund characteristics. An event study of manager team transitions, instrumental variable regressions, and an analysis of managers who simultaneously operate solo- and team-managed funds address endogeneity concerns. Diverse teams deliver superior returns by arbitraging more stock anomalies, avoiding behavioral biases, and minimizing downside risks. Moreover, diversity allows hedge funds to circumvent capacity constraints and generate persistent performance. Our results suggest that diversity adds value in asset management.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.