This paper explores how adding women to top management teams (TMT) influences a company’s strategy for refreshing its knowledge base.

What Changes after Women Enter Top Management Teams? A Gender-Based Model of Strategic Renewal

- Corinne Post, Boris Lokshin and Christophe Boone

- Academy of Management, 2022

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The authors ask the following questions:

- How do female appointments to top management teams (TMTs) affect a firm’s approach to knowledge-related strategic renewal?

- Does the presence of existing female incumbents in TMTs or the size of new TMT appointees relative to incumbents moderate the relationship between female appointments and TMT cognition shifts?

What are the Academic Insights?

The authors find:

- When women join top management teams (TMTs), companies often shift their strategy to focus more on internal growth and less on risky approaches. In other words, instead of relying heavily on mergers and acquisitions, these companies work on strengthening their internal skills and capabilities. This shift can lead to more sustainable, long-term growth and innovation.

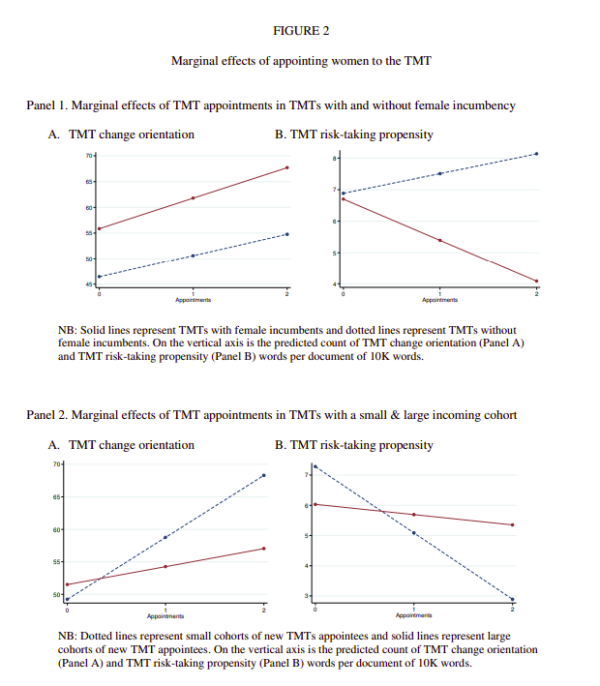

- Yes, the presence of existing female incumbents in top management teams (TMTs) and the size of new TMT appointees relative to incumbents can moderate the relationship between female appointments and shifts in TMT cognitions. Here’s an explanation of how these factors play a moderating role:

- PRESENCE OF EXISTING FEMALE INCUMBENTS: Existing female team members can boost and strengthen changes in the TMT’s mindset, particularly by encouraging a greater focus on change and a reduced inclination towards risky decisions. They also help foster a supportive atmosphere, promoting a more inclusive, collaborative, and balanced approach to strategic decisions. This support can lead to a more united and consistent influence on the team’s shift in thinking.

- SIZE OF NEW TMT Appointees Relative to Incumbents: When new team members join, they usually integrate more easily if there aren’t many of them. However, if there are only a few new people compared to the existing team, their ability to influence the group’s way of thinking might be limited due to existing team dynamics and set norms.On the other hand, if there are more new members compared to the incumbents, they can have a bigger impact on how the team thinks, since their fresh perspectives and values can play a larger role in shaping the group’s approach to strategy.

Why does this study matter?

This study is important because it helps us understand how having more gender diversity in top management teams (TMTs) can influence companies’ strategic decisions and impact overall outcomes. It fills a significant gap in research about gender and leadership by investigating how appointing women to TMTs can change strategic outcomes. It shows that gender diversity might encourage companies to avoid risky strategies like mergers and acquisitions (M&A) and focus more on sustainable approaches like research and development (R&D). This shift can lead to improved company performance, growth, and innovation.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index

Abstract

The question of what changes when women enter upper-echelons teams has long frustrated upper echelons and gender researchers. We build on the dynamic strategic renewal literature, combine it with upper echelons theory insights, and integrate knowledge about female executives’ career strategies to theorize how and when female appointments into top management teams (TMTs) cause firms to change their approach to knowledge-related strategic renewal. In doing so, we reconcile the tension among extant mediating processes invoked to explain how female TMT representation might affect strategic decisions: change orientation and risk-taking propensity. Estimating a dynamic ordinary least squares model on panel data from 163 multinationals, we find that following female (but not male) TMT appointments, TMT cognitions shift, becoming more change oriented and less risk seeking. Subsequently, these TMT cognitive shifts cause a decrease in mergers and acquisitions and an increase in research and development. Our model of female TMT appointments as catalysts that cause shifts in TMT cognitions, which, in turn, redirect knowledge-related strategic renewal from a buying to a building approach, is a novel effort at advancing research on women at upper echelons to examine time-dependent, within-firm mechanisms linking women in upper echelons and firm outcomes.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.