This paper explores the impact and implementation of financial education policies in U.S. high schools, focusing on how state-level mandates translate into actual course offerings at the local school level.

High school financial education courses in the United States.: What is the importance of setting state policies?

- Allison Oldham Luedtke and Carly Urban

- Journal of Financial Literacy and Wellbeing, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The research questions are as follows:

- What is the extent of access to financial education courses across U.S. high schools from 2019 to 2023?

- Which state policies have the least slippage at the local level, ensuring high levels of implementation in high schools?

- In states without personal finance policies, how do school-level policies develop?

- Are state policies implemented before the first graduating class that is subject to the requirement, ensuring that all students meet the new graduation requirements?

- What inequities exist in access to personal finance education, particularly regarding schools with higher proportions of minority students or schools in different geographic areas (rural vs. urban/suburban)?

What are the Academic Insights?

By studying 10,784 public high schools in the U.S., with 7,446 schools providing data for every academic year from 2018–2019 to 2022–2023., the authors find:

- Holding the set of schools constant over time, the fraction of students with access to a required full semester of personal finance increased from 18% in the 2019–2020 academic year to 24% in the 2022–2023 academic year. An interesting finding is that rural schools are more likely to adopt financial education requirements than schools in urban or suburban areas.

- The state policies that have the least slippage at the local level and ensure high levels of implementation in high schools are those that mandate standalone personal finance courses.States that require every student to complete a standalone semester-long personal finance course before high school graduation exhibit the highest levels of implementation at the local school level.States that require personal finance content to be embedded within another required course (e.g., Economics or Social Studies) show more variability in local implementation.

- In states without personal finance policies, the development of school-level policies for financial education is influenced by several factors such as demographics (schools with higher proportions of minority students tend to have less access to personal finance requirements), economic factors (schools’ economic contexts, such as the median household income and property values in the surrounding area, can also play a role in whether financial education policies are adopted), local control and autonomy (in states with strong local control traditions, individual schools or districts may take the initiative to introduce financial literacy courses based on perceived local needs and priorities).

- There is an effort to implement state policies in advance of the graduation requirements, but the degree of success and adequacy of the timeline can vary. Ensuring a timely implementation is crucial for allowing schools enough time to develop curricula, train teachers, and integrate the courses into students’ schedules.

- Schools with higher proportions of minority students have less access to personal finance education, especially when there are no state-level mandates requiring such education.This disparity suggests that without state-level requirements, minority-serving schools are less likely to independently adopt personal finance courses, leading to inequities in financial education access and potentially in financial literacy outcomes. Schools are more likely to adopt personal finance requirements if their neighboring schools have already done so. This suggests that policy adoption can spread geographically, with one school’s implementation encouraging nearby schools to follow suit.

Why does this study matter?

This study is important because it provides detailed insights into how financial education policies are implemented at the local level. It highlights significant disparities in access to financial education, particularly among schools with higher proportions of minority students and in different geographic areas (rural vs. urban/suburban). Understanding these inequities is crucial for designing policies that promote equal access and address gaps in financial literacy education.

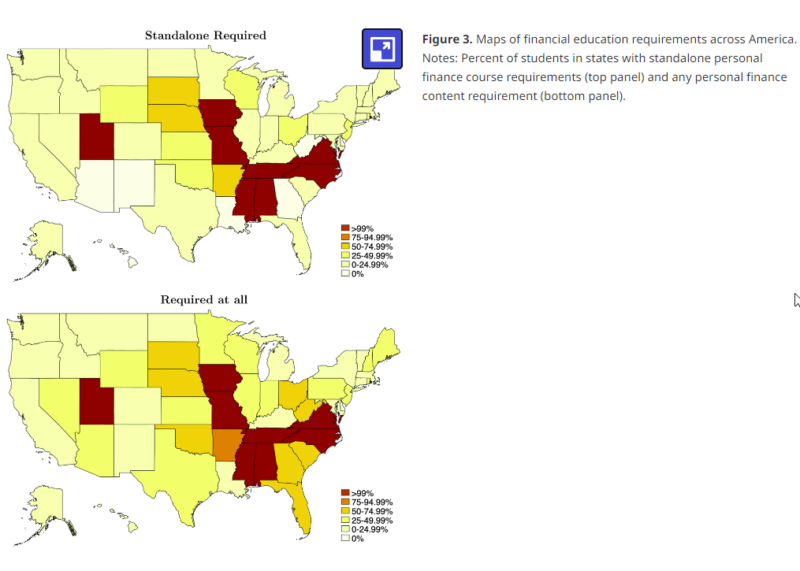

The Most Important Chart from the Paper:

Abstract

Access to financial education courses makes a difference in high school students’ future financial lives. However, little data have been available to assess the access students have to these classes and what types of financial education are offered throughout the United States. We describe a novel dataset of over 19,000 hand-coded high school personal finance courses for over 7,400 high schools across the United States. These data cover the academic years from 2019–2020 to 2022–2023. The most common type of financial education offered is a semester-long course focused entirely on financial education, rather than, for example, a course on another topic that builds in a section on financial education. Schools that are in rural areas, schools with a higher percentage of Black students and schools that are geographically isolated from peers with high financial education requirements are less likely to require financial education courses for graduation.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.