This paper aims to analyze financial literacy in the United States, utilizing the most recent data from the National Financial Capability Study (NFCS) collected in 2021 by the Financial Industry Regulatory Authority (FINRA) Investor Education Foundation. The paper focuses on the importance of financial literacy, particularly in the context of the economic conditions in the US, such as the COVID-19 pandemic, inflation, and changes in the financial system.

Financial literacy and financial well-being: Evidence from the US

- Lusardi and Streeter

- Journal of Financial Literacy and Wellbeing, October 2023

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The authors ask the following questions:

- What is the current level of financial literacy in the United States? (as demonstrated by their ability to answer the “Big Three” financial literacy questions)(1)

- How is financial literacy distributed across different demographic groups in the US?

- To what extent do individuals accurately perceive their own financial literacy, prudent financial planning, such as retirement preparation and managing debt?

- How have recent economic conditions, including the COVID-19 pandemic, inflation, and changes in interest rates, affected financial literacy in the US?

What are the Academic Insights?

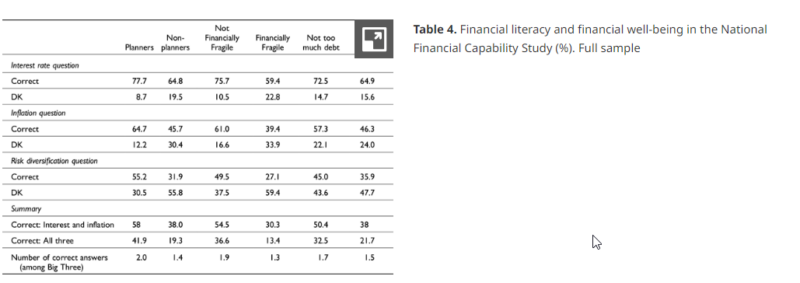

- The paper provides information on the current level of financial literacy in the United States based on data from the National Financial Capability Study (NFCS) conducted by the Financial Industry Regulatory Authority (FINRA) Investor Education Foundation in 2021. Less than 30% of respondents in the NFCS could correctly answer three basic financial literacy questions, known as the “Big Three.” About 69.4% of all respondents could correctly answer the interest rate question, but many struggled with the other questions. A significant proportion of respondents struggled to answer the financial literacy questions. For instance, 15.4% did not know the answer to the interest rate question, 23.1% did not know the response to the inflation question, and more than 45% did not know the answer to the risk diversification question.

- Financial literacy is unevenly distributed across demographic groups. Younger individuals, females, Black Americans, Hispanics, and those with low educational attainment (high school or less) were among the least financially literate. Older individuals generally had higher financial literacy, and those who had lived through prior inflationary periods knew more about inflation than younger generations.

- Respondents tended to overestimate their financial knowledge. People who had less financial literacy were more overconfident about their knowledge. Financial literacy matters as it is associated with financial behaviors and outcomes. More financially literate respondents were more likely to have planned for retirement, prepared for economic emergencies, and kept their debt at a manageable level.

- The COVID-19 pandemic and the inflationary environment exposed individuals and families to unexpected economic shocks. About one in five respondents in the 2021 NFCS reported being laid off or furloughed due to the pandemic during 2020 or 2021. More than one in four respondents experienced a large, unexpected drop in income.

Why does this study matter?

The findings suggest that financial literacy in the United States is below desirable levels, and there are notable disparities across different demographic groups. Efforts to improve financial literacy are highlighted as crucial, given its impact on financial decision-making and well-being, especially in the face of economic uncertainties and changes in the financial landscape.

The Most Important Chart from the Paper:

Abstract

This paper examines financial literacy in the United States, using the 2021 National Financial Capability Study data. A large volume of papers have demonstrated the importance of financial knowledge and documented the low level of financial literacy in America. Using recent data collected during an unusual time when inflation was rising and the country was in the midst of the COVID-19 pandemic, we show that the knowledge of fundamental financial concepts continues to be low in the US, especially among people who are young, less educated, female, or not employed. Our analysis also highlights people’s lack of inflation knowledge and identifies the subgroups that are particularly vulnerable. Finally, we examine how financial literacy affects financial well-being and behaviors. Responses to the Big Three financial literacy questions are linked to important financial behaviors and outcomes, including planning for retirement, financial resilience, and not carrying too much debt.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.