Wallstreetbets has become an increasingly prominent source of investment research, particularly for risk-seeking retail investors. The excitement from the GameStop episode resulted in the forum growing from 500,000 users in July of 2018 to 10.7 million users by June 2021. Do their recommendations have value?

A series of events has led to significantly increased interest in stock and options trading by retail investors:

- The arrival of investing platforms (such as Robinhood) with zero trading commissions and no account minimums.

- The COVID-19 pandemic, causing many workers to remain largely at home for most of 2020, leading to lower consumer spending and more time to pursue alternative ventures.

- The largest ever monetary and fiscal stimulus packages, leading to a significant increase in the amount of cash in retail investors’ hands.

The actions of retail investors gained increased attention when they began to band together on social platforms and executed strategies like short and gamma squeezes. Specifically, the actions of investors on the subreddit thread (user-created areas of interest where participants on the Reddit website discuss stock and options trading) WallStreetBets (WSB) has had a material impact on certain stocks such as GameStop (GME) and AMC Theatres. Their success in executing short squeezes raised the question of whether following WSB strategies is profitable.

To answer that question, Daniel Bradley, Jan Hanousek Jr., Russell Jame and Zicheng Xiao, authors of the April 2023 study “Place Your Bets? The Market Consequences of Investment Research on Reddit’s Wallstreetbets,” examined the consequences of due diligence recommendations on Reddit’s Wallstreetbets forum. They began by noting that postings are anonymous, there is virtually no editorial review, and recommendations tend to focus on speculative strategies that emphasize small probabilities of large gains, possibly at the expense of lower expected returns. They hypothesized that many people were attracted to WSB based on the extraordinary success of the Gamestop short squeeze: “Given investors’ tendency to extrapolate from salient recent events, one concern is that new users will flood the site with research reports on attention-grabbing stocks that emphasize strategies unrelated to firm fundamentals. To the extent that users overestimate the effectiveness of such strategies, WSB research after the GME event may be particularly uninformative.”

Their analysis focused primarily on “single firm ‘Due Diligence’ (DD) reports, which are reports identified by the poster (and verified by moderators) as containing some type of analysis and a clear buy or sell signal. DD reports contain clear investment recommendations and potentially new value-relevant information, which makes them most comparable to other forms of crowdsourced investment research, such as Seeking Alpha (SA) reports. We also separately examine non-research related WSB posts (e.g., meme posts, bragging about recent gains and losses, etc.). Although non-research posts are unlikely to contain useful information, they could still influence prices through attention-based buying.” Their sample included 5,015 DD reports and 13,255 non-research related WSB posts issued between July 2018 and June 2021. Following is a summary of their key findings:

- Both DD reports and non-research posts on WSB tilted toward young, volatile stocks with high skewness and high short interest.

- The overwhelming majority of DD reports (88%) were buy recommendations. In the post-GME era, this increased to 95%.

- WSB preference toward speculative investments increased substantially in the post-GME period, increasing by 150%, while WSB coverage of stocks with heavy short interest increased by nearly 500%.

- While SA coverage also tilted toward volatile firms, SA coverage of speculative stocks did not increase in the post-GME period, suggesting that the GME event had an impact on WSB that did not generalize across all social media platforms.

- In the pre-GME period, DD reports were significant predictors of future returns—an incremental DD buy recommendation was associated with a 5.17% increase in one-month-ahead returns for the full sample and a 2.33% increase after excluding GME and AMC—but the one-month return predictability was fully eliminated.

- In the post-GME period, there was no relationship between DD reports and cash flow news—WSB reports in the post-GME period were negative predictors of forecast revisions.

- WSB recommendations influenced retail investors, particularly smaller retail (less sophisticated) investors.

Their findings led the authors to conclude that the remarkable success of the GME short squeeze attracted new users who placed too much emphasis on coordinated trading strategies, possibly at the expense of analyzing firm fundamentals, and users who had the tendency to trade attention-grabbing stocks, which has been shown to negatively impact retail traders. The fraction of reports focusing on price pressure strategies increased by 165% in the post-GME period, while the fraction of reports issued on attention-grabbing stocks increased by 75%.

Bradley, Hanousek, Jame and Xiao noted that there are several differences between SA and WSB:

- While SA employs an editorial team to review all research reports to try to ensure quality, there is very limited quality control on WSB.

- WSB allows users greater anonymity than SA. Greater anonymity reduces the incentives to develop a strong reputation and potentially allows users with more nefarious motives (e.g., pump-and-dump schemes) to switch identities without accountability.

- WSB reports tend to be considerably less in-depth than the average SA report.

- The userbase of WSB is likely to have less financial sophistication.

WSB places a larger emphasis on highly speculative trading strategies.

The differences led the authors to caution that the conclusions drawn on WSB should not be extrapolated to other social media sites.

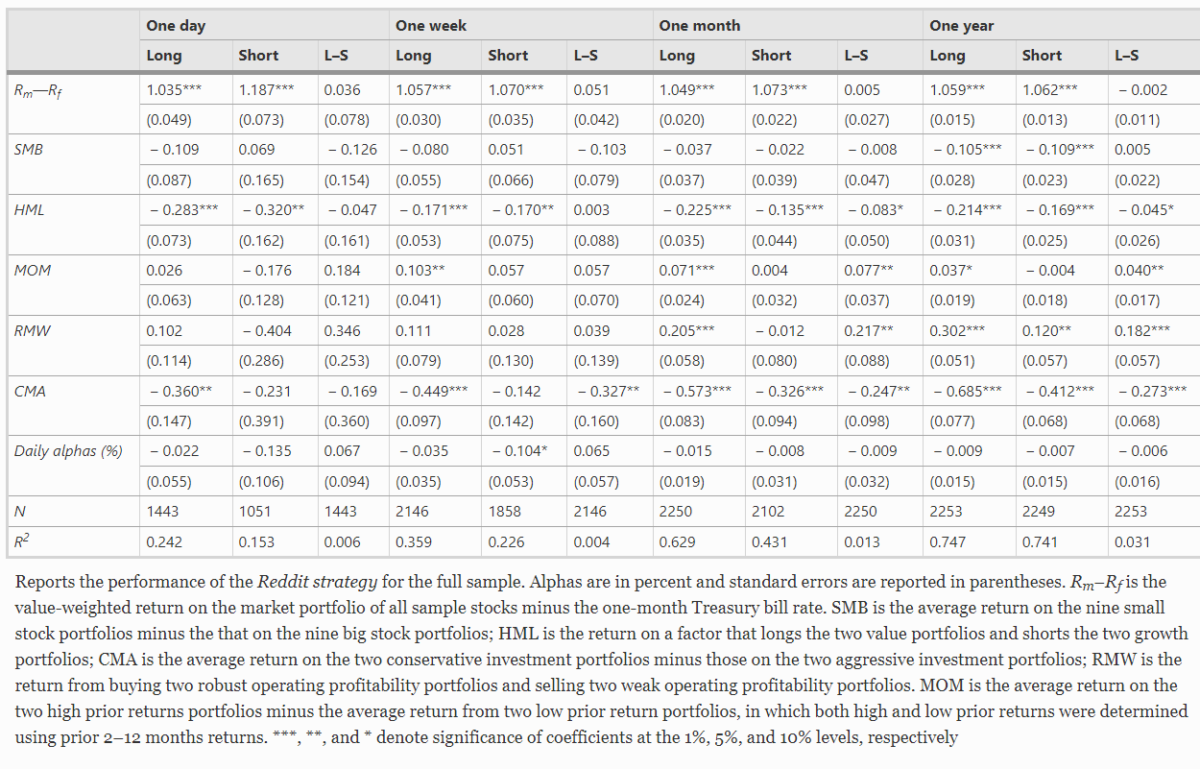

The above findings are consistent with those of Ryan Chacon, Thibaut Morillon and Ruixiang Wang, authors of the study “Will the Reddit Rebellion Take You to the Moon? Evidence from WallStreetBets” published in the March 2023 issue of Financial Markets and Portfolio Management, who investigated whether a trading strategy that follows the WSB subreddit could consistently produce alpha. Their approach was to examine how opinions on a given forum can predict individual stock prices—whether a simple and easily implementable trading strategy following WSB could produce alpha. Using textual analysis from WSB submissions over the period 2012 through the first quarter of 2021 when the GameStop short squeeze occurred, they formed a daily rebalancing long-short portfolio that went long “buy” suggestions and short “sell” suggestions, where the suggested stocks could be held for one day, two days, three days, one week, one month or one year. Their final sample included 221,255 recommendations: 192,550 buy and 28,708 sell recommendations. Here is a summary of their key findings:

- Investors tracked and traded on WSB submission information—they believed the information was valuable.

- Consistent with the group seeking out short-squeeze opportunities, the typical short interest as a percentage of float for buy recommendations was 9% compared to just 3% for the S&P 500.

- The WSB community focused on small growth firms (the average market-to-book ratio was 24.1 for buy recommendations, 2.7 for sell recommendations, and 3.9 for the S&P 500) with high short interest for buys, and somewhat larger value firms with high short interest for sells—“Redditors” sought high-risk, high-reward opportunities.

- Redditors also tended to target firms that invested heavily (they loaded negatively on the investment [CMA] factor), and momentum tended to be positive and significant in the long portfolios as well.

- Across all holding periods, the long-minus-short portfolio failed to produce alpha that was distinguishable from zero. In addition, the long portfolio across every holding period was negative, inconsistent with achieving good performance.

- Their findings were robust to various tests, including whether the strategy was bullish (when investor sentiment, as measured by the put-call ratio, was high) or bearish (when investor sentiment was low), and weighting the buys and sells by the number of recommendations.

- The pre-2021 results were very similar to those of the full sample regarding alphas and many of the factor loadings, alleviating the concern that the results were driven only by the recent GameStop and other meme stock trading activities.

Reddit Strategy Performance

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Recognizing that there was likely heterogeneity of skill across posters, they identified the top 40 (1.6% of the posters) by submission volume and examined their individual performance. Using a two-day trading window following the buy or sell submission, and benchmarking returns against the Fama-French five-factor model (market, size, value, investment, and profitability) plus momentum, they found a wide range of performance across the top 40, ranging from an average of 14.86% long-short cumulative abnormal returns (CAR) to a -14.73% long-short CAR. The average long-short CAR for the top 40 posters was 0.25%, and the median was -0.38% (more top posters had negative alphas than positive ones), both very close to 0—the most frequent posters were no more likely to generate alpha on average.

Their findings led Chacon, Morillon and Wang to conclude that while WSB recommendations induced trading activity, there was no evidence that WSB recommendations produced alpha: “In no cases were the buy recommendations as a group fruitful and in very few cases were the sell recommendations useful. As the viewership and contribution to this public thread have grown, alpha is equally elusive.”

Their findings are consistent with the results of the VanEck Vectors Social Sentiment ETF (BUZZ), which tracks the 75 large-cap U.S. stocks with the most bullish perception from social media and other alternative data sets. Using the backtest tool at Portfolio Visualizer, over the period April 2021-March 2024, BUZZ returned -3.58%, underperforming the 11.58% return of Vanguard’s 500 ETF (VOO) by 15.16 percentage points.

Their findings are also consistent with those of the authors of the 2014 study “The Cross-Section of Speculator Skill: Evidence from Day Trading,” the 2020 study “Attention Induced Trading and Returns: Evidence from Robinhood Users,” and the 2022 study “Retail Trader Sophistication and Stock Market Quality: Evidence from Brokerage Outages,” who found that younger investors following social media are less financially literate, more subject to attention biases, more likely to chase stocks with extreme performance and volume than other retail investors, and exhibit herding behavior that leads to abnormal negative returns.

Investor Takeaways

Bradley, Hanousek, Jame and Xiao’s findings contribute to a large body of literature demonstrating that retail investors are naive on average, subject to many biases that result in negative outcomes, while the platforms they trade on prosper. The findings hopefully serve as helpful information to the droves of retail investors searching the internet for trading advice. The historical evidence on efforts of individual investors to generate alpha clearly shows that while it’s not impossible to generate alpha consistently, the odds of doing so are so poor it’s not prudent to try. If you look in the mirror and see Warren Buffett, go ahead and try to pick stocks that will outperform (although even he has not been able to outperform for the past 16 years; Berkshire Hathaway Inc. Class A underperformed the S&P 500 from 2008 to 2023, 8.76% versus 9.80%). But unless you live in Lake Wobegon, where everyone has Buffett-like abilities, you will not likely see the Oracle of Omaha in the mirror. For those who don’t, the winning strategy is to build a globally diversified portfolio that reflects your unique ability, willingness and need to take risk, and stay the course, rebalancing and tax managing as events dictate.

Larry Swedroe is the author or co-author of 18 books on investing, including his latest, Enrich Your Future: The Keys to Successful Investing.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.