The paper examines several key questions related to how retail investors’ trading behaviors in cryptocurrencies differ from their behaviors in traditional asset classes like stocks and commodities.

Are cryptos different? Evidence from retail trading

- Shimon Kogan, Igor Makarov, Marina Niessner, Antoinette Schoar

- Journal of Financial Economics, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The research questions are as follows:

- How do retail investors’ trading behaviors in cryptocurrencies differ from their behaviors in traditional asset classes like stocks and commodities?

- What factors contribute to the observed dichotomy in trading strategies, such as contrarian behavior in stocks and momentum-like behavior in cryptocurrencies?

- Does the difference in trading behavior between cryptocurrencies and traditional assets arise from the composition of investors or other demographic factors?

- Is the observed trading behavior in cryptocurrencies and traditional assets influenced by factors such as inattention, preference for lottery-like assets, lack of cash flow information, or trading fees?

- How do investors’ trading behaviors in cryptocurrencies change following significant price movements, such as major crashes, and does this impact their momentum-like strategy?

What are the Academic Insights?

By studying firm-level, industry-level, and macroeconomic variables, as well as textual information from

firms’ disclosures, news, and social media (updated to right before the time of an analyst forecast), the authors find:

- In the cryptocurrency market, investors tend to follow a momentum-like strategy. They are inclined to increase their portfolio share in assets that have recently risen in price and hold onto them during declines. This behavior persists even during periods of high volatility, with investors showing little inclination to rebalance their holdings in response to price swings. In contrast, when trading stocks and commodities, retail investors generally adopt a contrarian approach. They are more likely to reduce their holdings in assets that have experienced recent price increases and increase their investments in those that have declined. This strategy is more pronounced, and investors actively adjust their portfolios based on price movements, especially around events like earnings announcements.

- Stocks, being well-established, benefit from regular financial disclosures and historical valuation models, leading investors to adopt contrarian strategies based on these data and market reactions. In contrast, cryptocurrencies, which lack such periodic updates and established valuation frameworks, prompt investors to use price movements as indicators of future adoption, thus favoring momentum-like strategies. Additionally, the novelty of cryptocurrencies and the high volatility of their markets encourage speculative trading, reinforcing momentum behavior.

- No, the difference in trading behavior between cryptocurrencies and traditional assets does not primarily arise from the composition of investors or demographic factors. Research shows that even when the same investors trade in both cryptocurrencies and traditional assets like stocks, their trading strategies remain distinct. Retail investors exhibit momentum-like behavior in cryptocurrencies and contrarian behavior in stocks regardless of their personal characteristics, such as age or financial savvy. This suggests that the observed trading behavior is more related to the nature of the assets themselves and how investors perceive and value them, rather than being driven by demographic or investor composition factors.

- The observed trading behavior in cryptocurrencies versus traditional assets is not primarily influenced by inattention, preference for lottery-like assets, lack of cash flow information, or trading fees. Inattention is ruled out because the dichotomy remains evident even among active investors. Preference for lottery-like assets does not fully explain the differences, as similar trading behavior is observed in gold, which also lacks periodic cash flow updates. Additionally, trading fees for cryptocurrencies do not have a substantial impact, as evidenced by unchanged trading patterns for stocks following fee changes. Instead, the differences in trading strategies are more likely attributed to how investors perceive and model these assets.

- Investors’ trading behaviors in cryptocurrencies do not significantly change following major price movements, such as major crashes. Despite experiencing substantial price drops, like the one in early 2018, investors continue to exhibit a momentum-like strategy, where they maintain or increase their holdings in response to price increases rather than adjusting their portfolios based on past price movements. This persistent momentum-like behavior suggests that significant price changes do not alter their underlying trading strategies, indicating a strong tendency to follow trends rather than reassess their strategies post-crash.

Why does this study matter?

This study matters because it sheds light on how retail investors interact with emerging financial markets like cryptocurrencies compared to traditional assets. By revealing that investors display contrasting trading behaviors—contrarian strategies in stocks and momentum-like strategies in cryptocurrencies—it highlights how investor psychology and market dynamics differ across asset classes. Understanding these differences is crucial for improving market predictions, developing tailored investment strategies, and addressing the unique challenges posed by new financial instruments. Additionally, insights from this study can inform policy makers and financial institutions about investor behavior in rapidly evolving markets, helping to enhance market stability and investor protection.

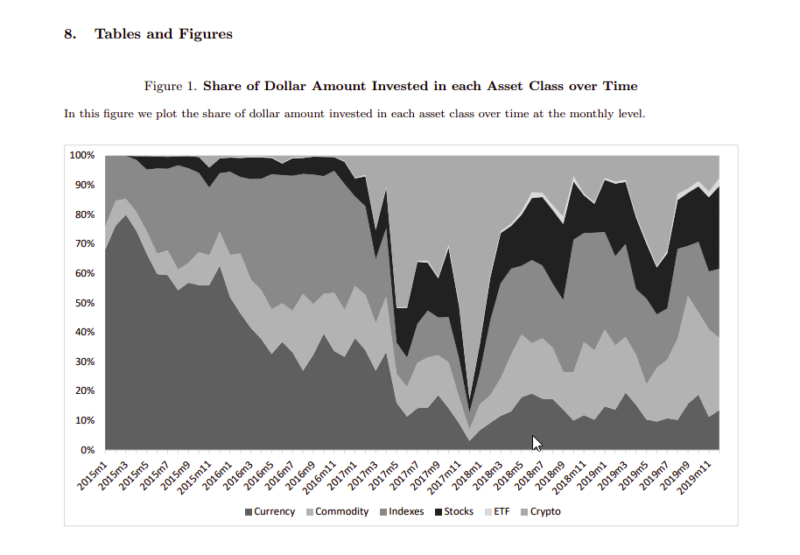

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Trading in cryptocurrencies grew rapidly over the last decade, dominated by retail investors. Using data from eToro, we show that retail traders are contrarian in stocks and gold, yet the same traders follow a momentum-like strategy in cryptocurrencies. The differences are not explained by individual characteristics, investor composition, inattention, differences in fees, or preference for lottery-like assets. We conjecture that retail investors have a model where cryptocurrency price changes affect the likelihood of future widespread adoption, which leads them to further update their price expectations in the same direction.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.