This paper examines the time-varying roles of subjective expectations in driving stock price and return variations. Specifically, it focuses on how subjective cash flow expectations (CF) and discount rate expectations (DR) contribute to stock price fluctuations across different economic conditions, with a special emphasis on periods of financial uncertainty and economic crises.

Time-Varying Drivers of Stock Prices

- Dat Mai

- Financial Analyst Journal, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The main research questions addressed in this paper can be summarized as follows:

- What drives stock price variations?

- How do subjective expectations contribute to time-varying comovements with stock prices and returns?

- How do inflation expectations affect stock price variations?

- How do subjective CF expectations influence variations in future returns across Fama-French factors?

What are the Academic Insights?

By analyzing data from IBES, CRSP prices and outstanding shares and Compustat quarterly data, the authors find:

- Stock price variations are primarily driven by two factors: subjective cash flow (CF) expectations and subjective discount rate (DR) expectations. CF expectations, which reflect market participants’ projections of future earnings or cash flows, play a dominant role during recessionary periods and times of heightened financial uncertainty. For instance, during the Great Recession, CF expectations explained up to 76% of price variations, and they were similarly significant during the Covid-19 pandemic, particularly in industries like Healthcare. Conversely, DR expectations, which represent the required returns or the rate at which future cash flows are discounted, tend to dominate during normal economic conditions and periods of low financial uncertainty. Outside of major economic crises, DR expectations are the primary driver of stock price movements, as observed in the post-2000 period excluding recessionary regimes.

- Subjective expectations of cash flows (CF) and discount rates (DR) contribute to time-varying comovements with stock prices and returns by influencing how market participants evaluate future earnings and risks in different economic conditions. These expectations determine whether stock price changes are driven by revisions in future cash flow projections or adjustments in discount rates. The paper highlights that the relative importance of CF and DR expectations shifts over time and across economic regimes.

- Inflation expectations influence stock price variations primarily in periods of high inflation. The paper finds that during such periods, inflation expectations significantly impact price-earnings ratios and stock prices, reflecting investors’ concerns about how inflation affects future cash flows and discount rates. For instance, in high-inflation environments like the 1970s, 1980s, and early 2020s, inflation expectations explained a substantial proportion of price-earnings variations. However, during periods of stable or low inflation, the role of inflation expectations diminishes significantly. From 1998 to 2020, inflation expectations accounted for at most 6% of price variations across industries, indicating that they were not a major driver of stock prices in more recent periods of relatively stable inflation.

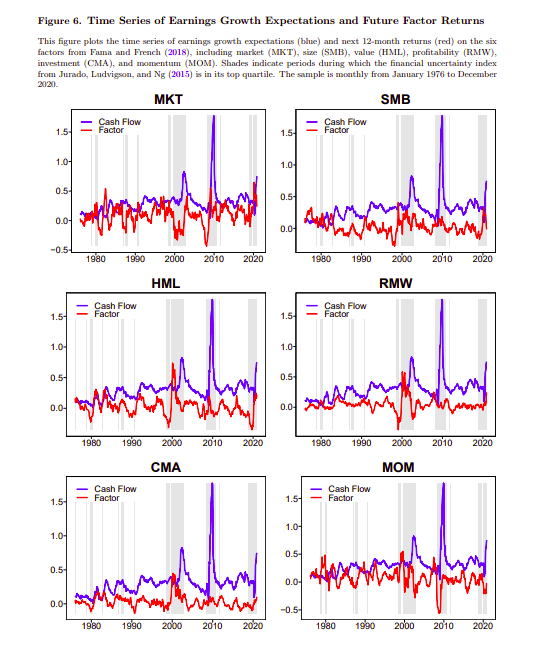

- Subjective cash flow (CF) expectations influence variations in future returns across Fama-French factors differently under high and low financial uncertainty. During periods of high uncertainty, CF expectations explain about 30% of market return variations, positively comoving with size, value, and investment factors, but negatively with profitability and momentum factors. In contrast, under low uncertainty, CF expectations have minimal influence on overall returns, negatively comoving with size, value, and investment factors while losing explanatory power for profitability and momentum. Additionally, CF expectations impact converging factors (e.g., size and value) positively in high uncertainty but negatively in low uncertainty, while diverging factors (e.g., profitability and momentum) show the opposite pattern. This highlights how economic conditions shape the relationship between CF expectations and factor returns.

Why does this study matter?

Understanding the time-varying drivers of stock valuations has several practical implications for different market participants: Equity Analysts can refine valuation models by identifying when to focus more on cash flow expectations versus discount rate changes, particularly during periods of financial uncertainty; Financial Advisors can better communicate with clients about the factors influencing stock prices and guide them through volatile markets; Individual investors can use this understanding to build more resilient investment strategies, tailoring their approaches to withstand economic turbulence and take advantage of shifts in valuation drivers during different market regimes.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

This paper provides novel evidence of the time-varying roles of subjective expectations in explaining stock price variations. Cash flow expectations matter more during times of financial uncertainty and recessions, especially among the hardest-hit industries such as Telecommunications during the Dot-com Bubble, Financials during the Great Recession, and Healthcare during the Covid-19 pandemic. Conversely, discount rates explain more price variations during expansionary periods. Inflation expectations, while accounting for more than half of price fluctuations in high inflationary environments, play a negligible role otherwise. Finally, factor returns tend to move against earnings growth expectations under low financial uncertainty but move in sync with earnings growth expectations when financial uncertainty is high.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.