How long will it take for the current level of inflation to subside? If history is any guide, it could take quite a while. Across 198 policy interest rate hikes of at least 1%, a decrease of 1% in inflation took 2 to 4 years (Havranke and Rusnak, 2013). The authors of this research article conduct an empirical analysis of the behavior representative of inflation to provide a realistic context for public consideration and interpretation. In April 2021, inflation crossed the 4% mark. Is the current expectation that inflation is, in fact, transitory, or does it foreshadow a much longer recovery period?

How Transitory Is Inflation?

- Rob Arnott and Omid Shakernia

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

One research question: If inflation surges, how long, on average, will it take to subside to a reasonable target rate of 2%?

What are the Academic Insights?

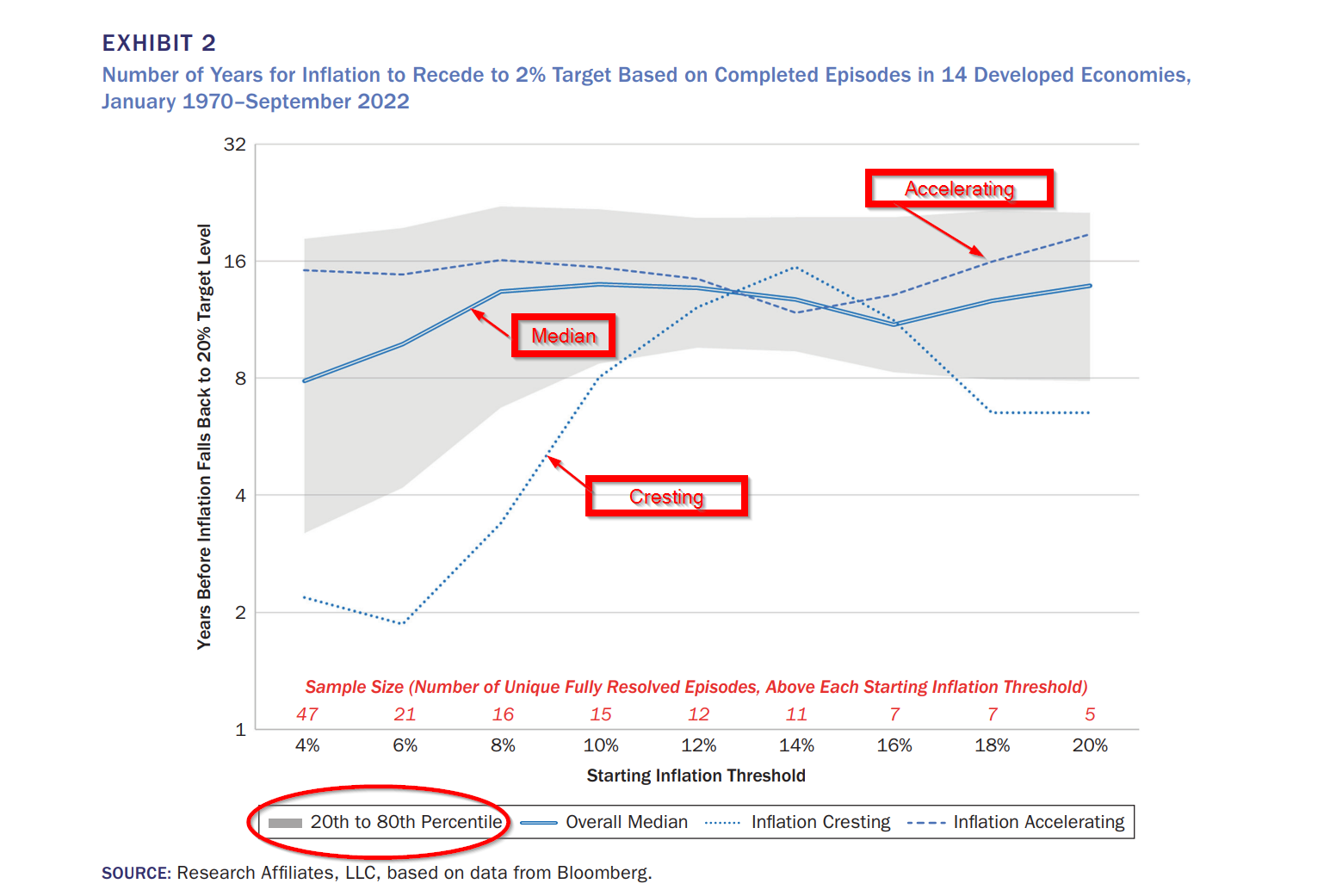

The paper looks at a dataset that included fourteen developed markets (OECD), judged as a relevant comparison to extrapolate from the historical record. The period covered nearly 53 years of data for each country, from January 1970 to September 2022. The aftermath for each country was examined once it exceeded a 4% inflation rate. That criteria was modest and considered helpful for excluding incidents where the economy was recovering from deflation. The results provided a surprisingly useful barometer for evaluating the future path of inflation in the US. Will inflation prove to be transitory at this point in time?

- When inflation reached a 4% level, the lowest quintile of outcomes took less than three years to revert back to 2%. The reversion to 2% took at least 18 years at the highest quintile of outcomes. The median reversion to 2% was eight years. The authors are critical of the period in early 2021, when the FED described inflation as “transitory.” In April 2021, inflation crossed 4%, raising the question of whether or not the term “transitory” should be used to describe a median expectation of 8 years before reverting from 4% to 2%.

- When inflation reaches the 4% threshold but does not exceed 6%, the second threshold, the median reversion, was two years to fall back to 2%. If the second threshold is reached, then a protracted period of high inflation was observed to follow. The reversion back to a 2% target took an average of 15 years. If the level of inflation proceeds to the third threshold of 8% and continues to accelerate, the average reversion to 2% was 16 years. If inflation failed to accelerate (cresting inflation), the reversion dropped to 3.5 years on average.

- For the highest thresholds from 18% to 20%, inflation tended to resolve much faster, possibly due to central bank intervention. However, the number of observations was insufficient to provide much confidence in the result. The worst quintiles observed at every level of inflation exhibited a reversion to 2% between 18 and 22 years.

Why does it matter?

Using the historical record as a guide, labeling the future path of inflation in the US as transitory is possible but bears little resemblance to a central expectation. A quote from the authors:

We are reminded of lyrics by The Who: “I’ll get on my knees and pray we don’t get fooled again.” Of course, for those who take the time to study history, prayer has nothing to do with it. It was a mistake for the Fed to declare inflation transitory when it was rising rapidly; history tells us that, even at a modest 4% rate, it often is not transitory.

Jerome Powell, speaking at the IMF Research Conference on Nov 9, 2023, seems to get it:

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Inflation can take far longer to return to normal levels than most realize. Although transitory inflation is possible, it is hardly a sensible central expectation. Across 14 developed-economy countries over the past half-century, the authors analyze the behavior of inflation once a country’s inflation rate surges past various thresholds and study how long a burst of inflation typically lingers. If history is a guide, inflation can take far longer to return to normal levels than most people realize. Transitory inflation is certainly possible, but it is hardly a sensible central expectation. Messaging and policy response from the US Federal Reserve Bank should reflect the relatively high empirical risk that inflation may persist.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.