This paper seeks to address three pivotal questions that explore the broader economic and social impacts of IPO activity, particularly its role in influencing stock market participation through localized attention and wealth effects.

The Impact of Impact Investing

- Jiang, Lowry and Quian

- Review of Finance, 2025

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The main research questions addressed in this paper can be summarized as follows:

- Does local IPO activity influence stock market participation rates in the surrounding community?

- What is the primary mechanism driving the observed relationship between IPO activity and stock market participation: attention/information effects or wealth effects?

- Are the effects of IPO activity on stock market participation localized, and how do geographical proximity and industry connections affect these outcomes?

What are the Academic Insights?

By studying PSID (based on a survey of households living across the contiguous United States) and Odean data (which contain monthly information on the investments of 78,000 households from January 1991 through December 1996. The data come from a national discount brokerage firm, and they include all accounts opened by each household at this brokerage), the authors find:

- Local IPO activity leads to increased stock market participation in that area. Specifically, the authors find that when IPO activity is high in a particular locale, stock market participation increases by 0.8–1 percentage point in the broader population, with an even more significant increase in stock holdings among households already participating in the market. This suggests that IPO activity has a positive influence on both new and existing participants in the stock market, particularly within the geographic region of the IPO.

- The increase in stock market participation following an IPO is primarily driven by attention and information production rather than wealth effects. The authors find that the timing of the increased participation corresponds closely with the IPO event, particularly in the period immediately before and after the IPO. This short time window supports the notion that attention—spurred by media coverage and social interactions around the IPO—is the key mechanism. Additionally, the increase in stock holdings is focused on companies within the same industry as the IPO firm or those headquartered in the same state, further supporting the role of attention and information dissemination in driving participation.

- YES, the effects of IPO activity on stock market participation are localized. The study finds that the impact of IPOs on stock market participation is significantly stronger in areas geographically closer to the IPO company. This is likely due to increased media coverage, local news coverage, and word-of-mouth effects, which draw more attention to the stock market in these regions. People in these areas are also more likely to have personal connections to the IPO firm, such as knowing someone who works there. Additionally, the study finds that the effects are stronger for companies within the same industry as the IPO firm, as well as for companies located in the same state.

Why does this study matter?

The study sheds light on the broader economic impact of initial public offerings (IPOs) beyond the direct beneficiaries, such as entrepreneurs and early investors. By focusing on stock market participation, the paper explores a channel through which IPOs can promote financial inclusion and wealth-building, particularly for people who are not directly connected to the company.

Understanding how IPOs influence stock market participation is crucial for policy-making, as it helps identify ways to encourage more people, especially those in local or underserved communities, to engage in wealth-building activities. The findings suggest that IPOs can act as a catalyst for increased financial literacy, attention to the stock market, and ultimately broader economic participation, which could lead to long-term positive societal outcomes.

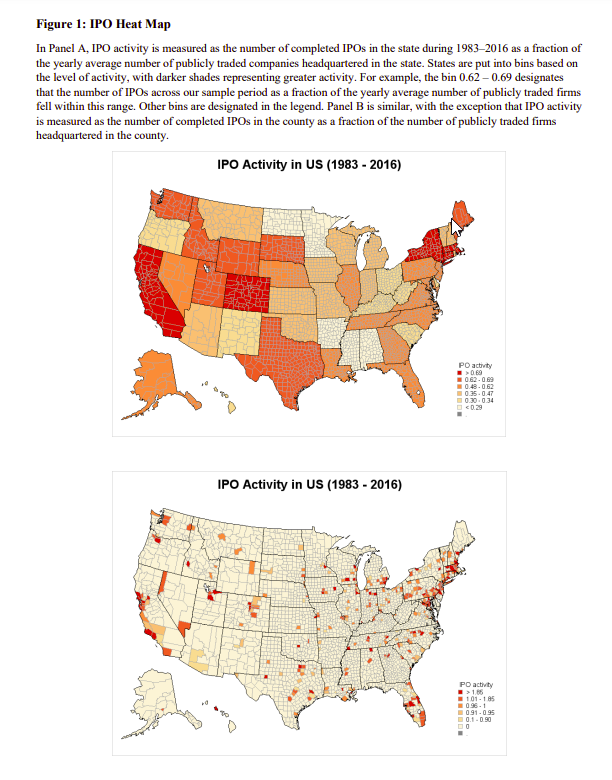

The Most Important Chart from the Paper:

Abstract

The decrease in companies going public has received widespread attention, and the associated costs are widely debated. We document high local IPO activity leads to increases in stock market participation of 5-6%. This is striking given that such participation represents a key factor toward building wealth. Local IPOs increase both households’ propensity to own stock and their percent equity holdings. The attention channel drives effects: local IPOs attract attention to the market, through increased information production and publicity. The wealth channel has little influence, consistent with local IPOs not generating wealth shocks for most households.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.