The paper examines key factors that influence the performance and success of private equity investments. Specifically, it focuses on the importance of manager selection, the role of LP sophistication and skill, the relationship between fund size and performance, the potential misalignment of incentives between GPs and LPs, and the benefits and risks associated with co-investment opportunities.

The Economics of Private Equity: A Critical Review

- Alexander Ljungqvist

- Centre for Economic Policy Research (CEPR) working paper, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

By reviewing more than 80 academic studies of private equity, the author aims at synthesizing the main insights to the following research questions:

- How does private equity perform as an asset class?

- What is the track record of private equity in creating value for companies?

- How are the interests of private equity fund managers aligned with those of their investors?

- What are the key factors that influence the success of investments in private equity funds?

- What insights can be drawn from academic research on private equity that are most relevant to investors?

What are the Academic Insights?

Private equity has evolved into a substantial asset class, managing USD 3.3 trillion in assets globally as of 2022. A significant portion of institutional investors, including most foundations and university endowments (88% according to a recent survey), have invested in private equity. Yale University, known for its leadership in alternative investments, currently allocates 17.5% of its endowment to private equity, while the Virginia Retirement System has an even higher allocation at 33%. With this premise the main insights of this review are:

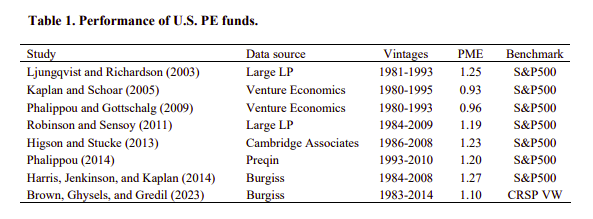

- The author premises that this is not an easy question to answer because of the opacity in data availability, the illiquidity of the asset class and its long term horizon plus the fact that a perfect and precise measure of calcultating performance does not exist. Despite these challenges, academic research indicates that private equity has historically outperformed public equity markets (like the S&P 500) after fees. However, whether these returns reflect true alpha (i.e., risk-adjusted outperformance) is debated. Some studies suggest the higher returns compensate for risks such as illiquidity and leverage.

- Private equity has a solid track record of creating value for companies, primarily through operational improvements, financial leverage, and strategic exits at favorable valuations. However, the true impact of PE on value creation is difficult to measure due to the opacity of private equity and the reliance on private, illiquid assets. Since PE funds do not have to publicly disclose detailed performance data, and valuations are hard to estimate before exits, it is challenging to assess how much value is created purely from operational improvements versus financial engineering.Some scholars argue that much of the “value” created by PE could simply be compensation for the risks taken, such as liquidity risk and leverage, rather than pure operational gains.

- The interests of private equity (PE) fund managers (General Partners, or GPs) and their investors (Limited Partners, or LPs) are primarily aligned through compensation structures and performance incentives, though these mechanisms also create potential conflicts. These structures are :

- Carried Interest: GPs earn a share of profits, aligning them with LPs. However, this can lead to excessive risk-taking, as GPs benefit more from gains but don’t bear losses.

- Management Fees: Fixed fees incentivize GPs to raise larger funds, which can reduce performance quality, misaligning interests.

- Gaming Valuations: GPs may manipulate portfolio valuations and exits to boost interim performance, benefiting themselves at LPs’ expense.

- Follow-on Fundraising: GPs may inflate fund performance to attract future investments, creating pressure to prioritize fundraising over LP returns.

- Co-investments: Co-investment opportunities reduce fees for LPs, but require sophisticated LPs with resources for independent due diligence.

- The key factors are manager skill, fund size, incentive alignment, performance transparency, and LP sophistication. Specifically:

- Manager Selection: Success hinges on choosing skilled GPs through thorough due diligence rather than relying on past performance.

- Fund Size: Larger funds can underperform due to diseconomies of scale, as GPs may struggle to manage more deals effectively.

- Incentive Alignment: GP compensation structures can lead to misaligned incentives, encouraging excessive risk-taking or prioritizing fund size over returns.

- Fundraising and Valuation: GPs may inflate interim valuations to attract follow-on funds, which can obscure true performance.

- LP Sophistication: Experienced LPs tend to perform better through deeper due diligence and co-investments, which lower fees and align interests.

Why does this study matter?

This study matters because it nicely summarizes academic literature on Private Equity from more than 80 papers. This body of literature shows that manager selection is critical, as performance varies widely between top- and bottom-quartile funds, and past performance alone is not always a reliable indicator of future success. Thorough due diligence on a GP’s strategy, deal flow, and team quality is essential for identifying skilled managers. LP skill also plays a significant role in returns, with larger, more experienced LPs typically earning better returns due to their ability to allocate more resources to manager selection, due diligence, and liquidity management. Superior LPs consistently invest in top-performing funds. Fund size and performance are inversely related; as funds grow, GPs often face difficulties maintaining returns due to the challenges of managing a high volume of deals. Incentive misalignment between GPs and LPs, particularly around carried interest and fee structures, can lead to excessive risk-taking or manipulated valuations for short-term gains, highlighting the importance of scrutinizing compensation terms. Finally, co-investment opportunities, where LPs invest alongside the main fund without fees or carried interest, offer potential cost savings and higher returns, but require careful assessment of the deals, as performance results are mixed.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Over the past half century, private equity has grown into a $3 trillion asset class. In this review, I critically synthesize the main insights of the academic literature on private equity, with a special focus on the performance of private equity as an asset class and its track record of value creation. I also review key aspects of investing in private equity that are of relevance and concern to investors when forming and managing a portfolio of private equity funds.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.