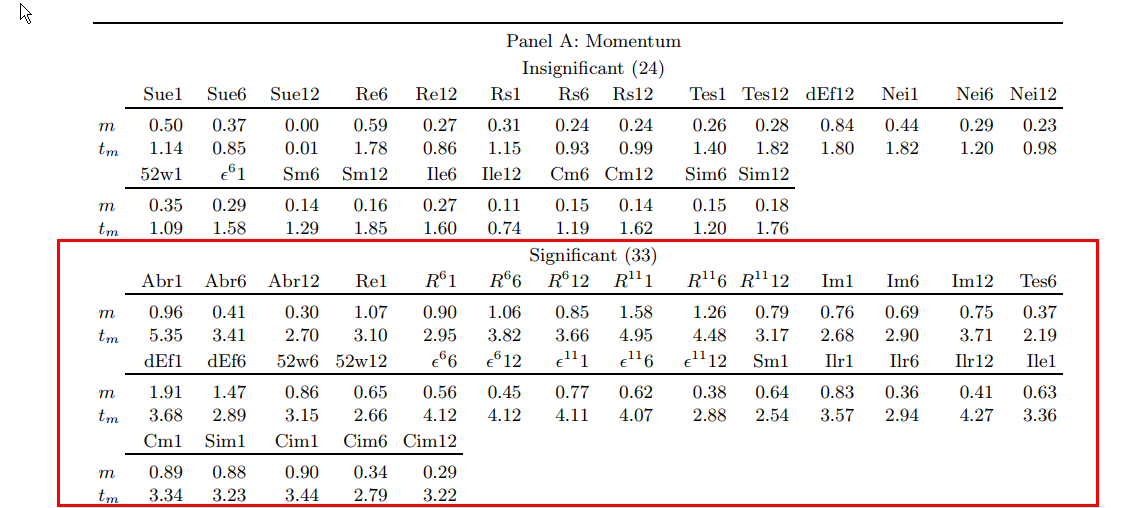

Replicating Anomalies

By Wesley Gray, PhD|October 13th, 2017|Research Insights, Factor Investing, Value Investing Research, Momentum Investing Research|

Academic research is amazing and incredibly useful for helping us [...]

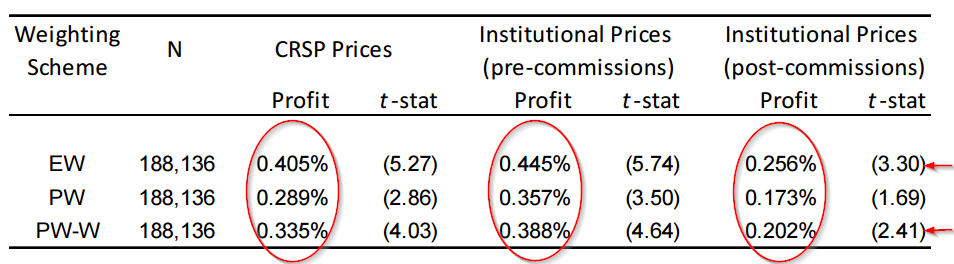

Dividend Capture Strategy: Trade Execution Matters

By David Foulke|October 12th, 2017|Research Insights, Guest Posts|

One area in investing that is often overlooked by investors [...]

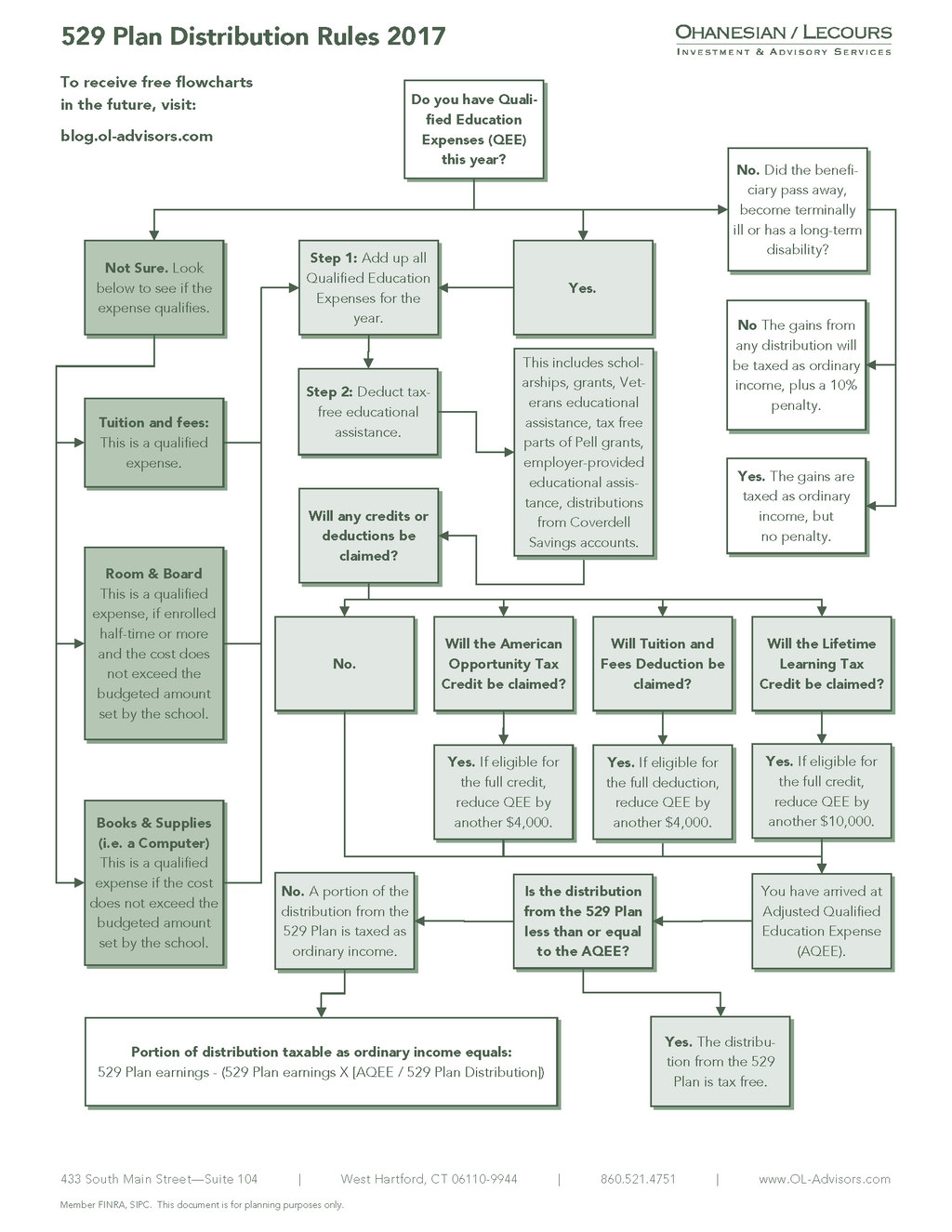

529 Plan Distribution Flowchart

By Michael Lecours, CFP®|October 10th, 2017|Research Insights, Tax Efficient Investing|

I recently had a conversation with a client who had [...]

Academic Research Insight: Does Social Capital payoff during times of crisis in the markets?

By Wesley Gray, PhD|October 9th, 2017|Research Insights, Basilico and Johnsen|

Title: Social Capital, Trust, and Firm Performance: The Value of [...]

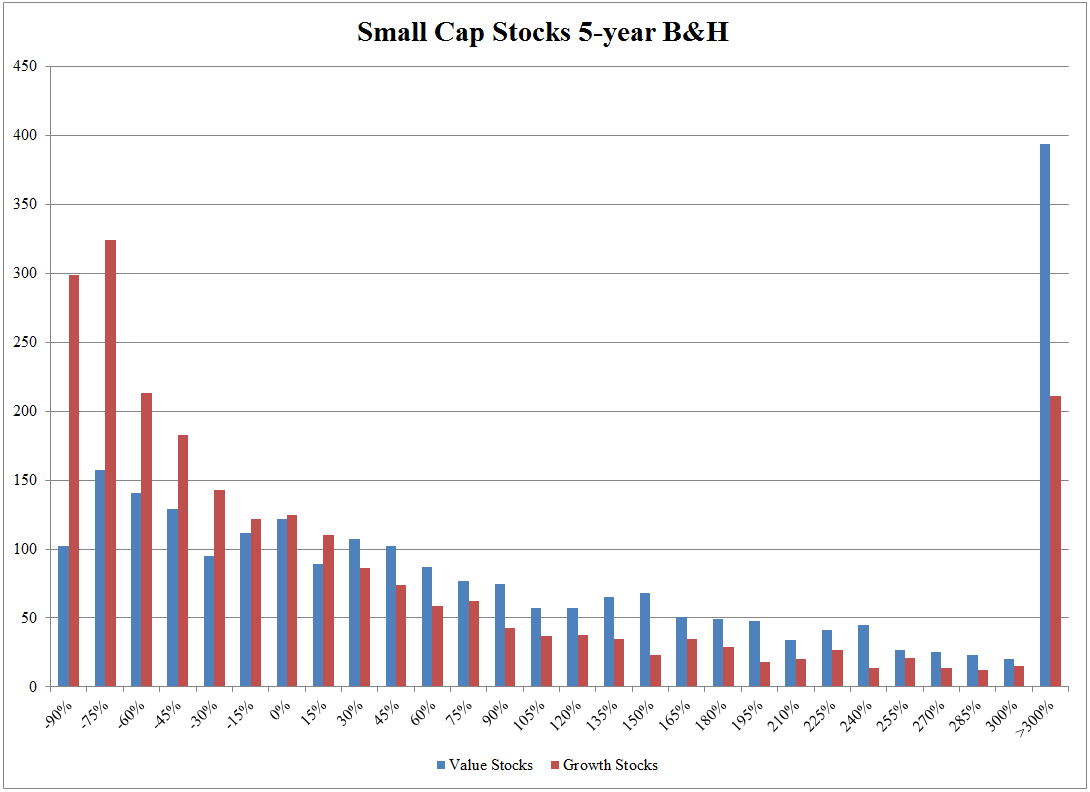

Reconciling Individual Stock Returns and Factor Portfolio Returns

By Jack Vogel, PhD|October 6th, 2017|Research Insights, Key Research, Value Investing Research|

Those in the financial media have recently been writing multiple [...]

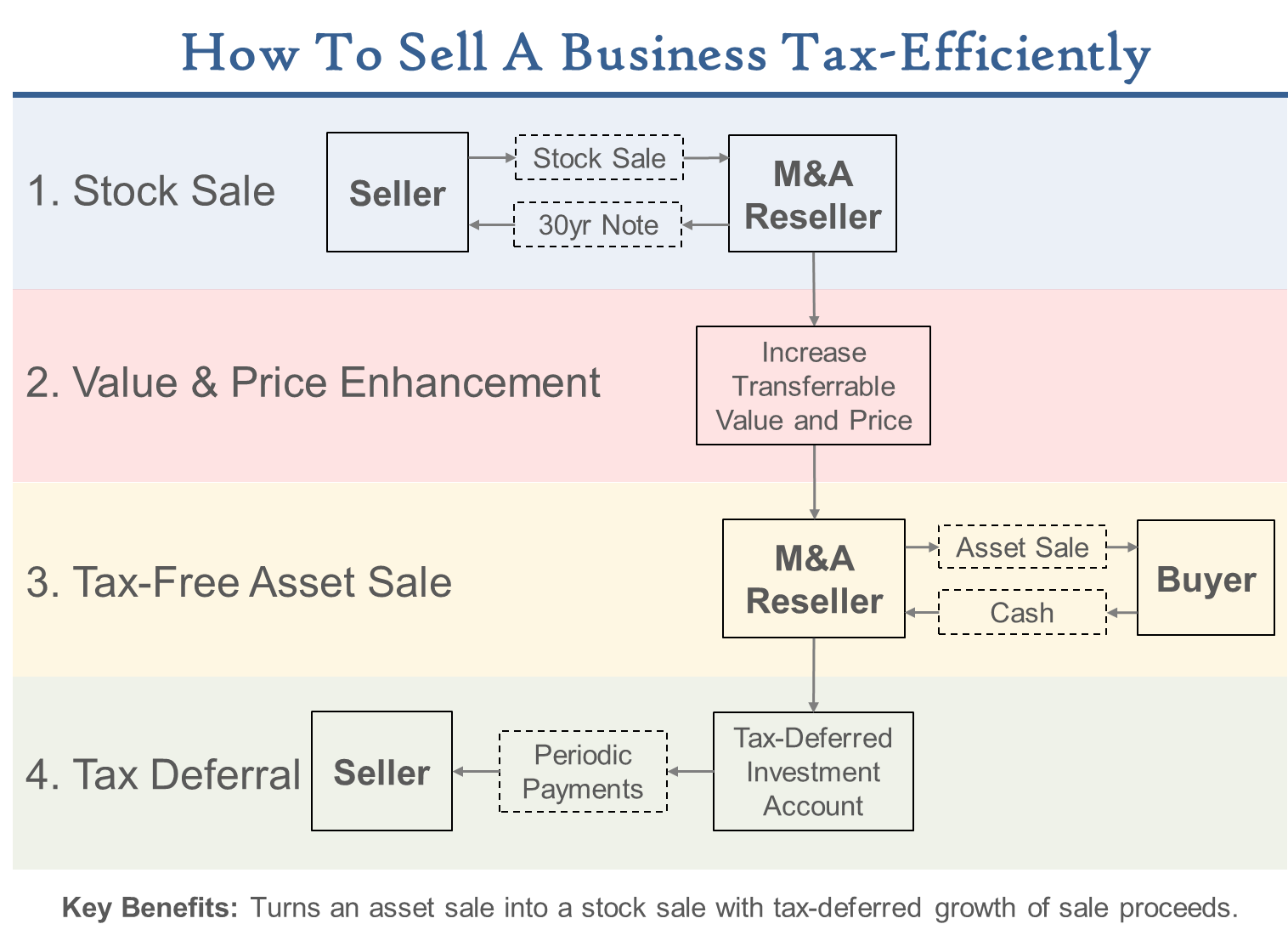

How To Sell A Business Tax Efficiently via Structured Installment Sales

By Adam Tkaczuk|October 5th, 2017|Tax Efficient Investing|

When an owner sells their business, the IRS and state taxing authorities will be there to take as much of it as they lawfully can. This one tax bill can be the single largest tax payment an owner will ever make and may represent over a third of their entire net worth. Furthermore, it comes after years of paying income/payroll taxes, working harder, and generally taking more risks than non-business owners. And when an owner wants to retire, the process is significantly more complicated than an employee who simply has to give a few weeks’ notice and maybe rollover a 401K. That’s because a business owner’s life’s savings is locked up in the value of their business. In fact, selling their business IS their retirement plan. So, accessing that wealth at the best possible price, in a way that is tax and cost efficient, is critical to their retirement. In this article, we introduce a unique service offering that can significantly reduce the impact of taxes and increase the price when selling a business. We’ve designed it to be used by business owners and their financial advisors (Wealth Managers, CFP’s, M&A Advisors, CPAs, etc.). If you are a business owner, or operate on behalf of business owners, read on.

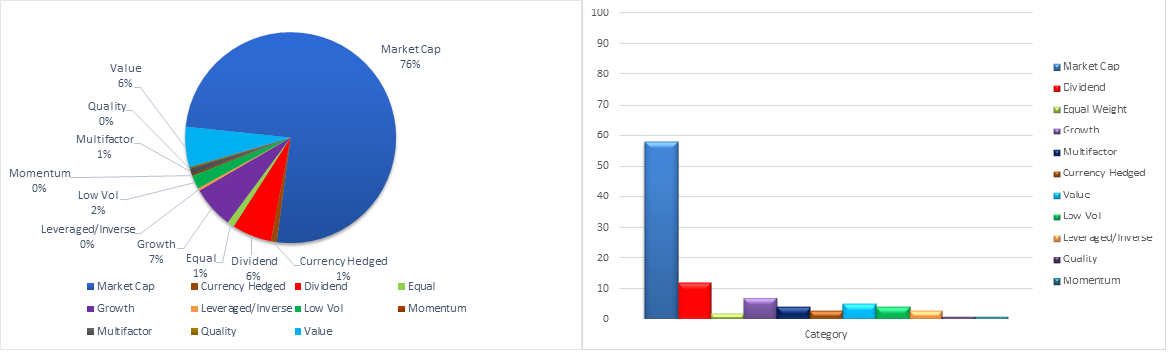

ETF Product Development: Past, Present, and Future

By Ryan Kirlin|October 4th, 2017|Factor Investing, Active and Passive Investing, ETF Investing|

On October 1st, 1908 Henry Ford introduced the Model T [...]

Hiking Mountains, Gladly, To Honor The Fallen

By Wesley Gray, PhD|October 3rd, 2017|MFTF Training Series, Business Updates|

Landon Thomas Jr. recently wrote an article in the New [...]

Academic Research Insight: VOLATILITY WISDOM OF SOCIAL MEDIA CROWDS

By Tommi Johnsen, PhD|October 2nd, 2017|Research Insights, Basilico and Johnsen|

Title: VOLATILITY WISDOM OF SOCIAL MEDIA CROWDS Authors: Ahmet [...]

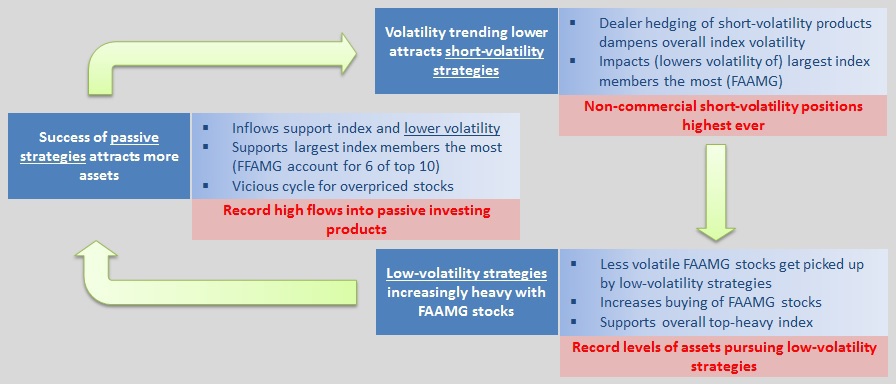

Assessing the Potential Market Impact of Passive, Short-volatility, and Low-volatility Strategies

By Aaron Brask|September 29th, 2017|Research Insights, Guest Posts, Active and Passive Investing, ETF Investing|

The market has recently experienced record low levels of realized [...]