Podcast: Factor Timing is Next to Near Impossible (Jack)

By Wesley Gray, PhD|July 28th, 2017|Podcasts and Video|

Here is a link to our podcast on the Meb [...]

My “Repackaging” Pet Peeve: Do Other Advisors See This As Well?

By Aaron Brask|July 27th, 2017|Guest Posts|

Like many advisors, I often find myself reviewing accounts and [...]

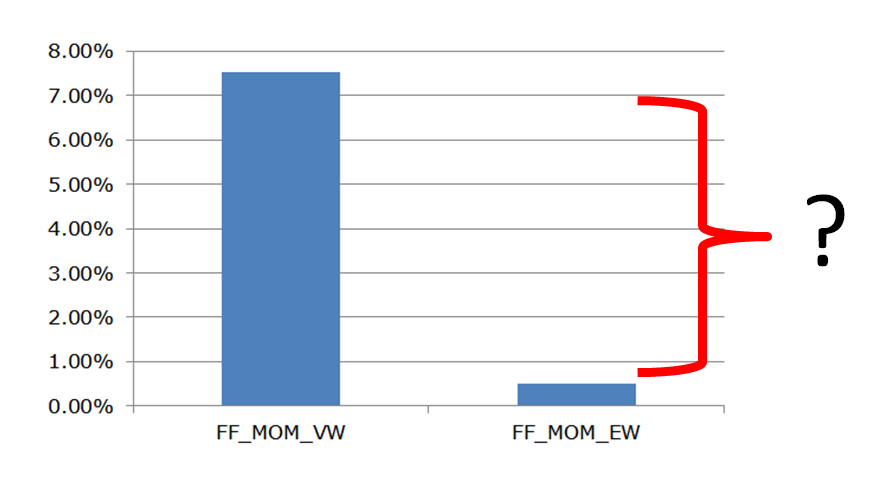

Trick Question: How is the Momentum Factor Performing YTD?

By Wesley Gray, PhD|July 24th, 2017|Research Insights, Momentum Investing Research|

If you ask your typical long-only investor (or financial advisor) [...]

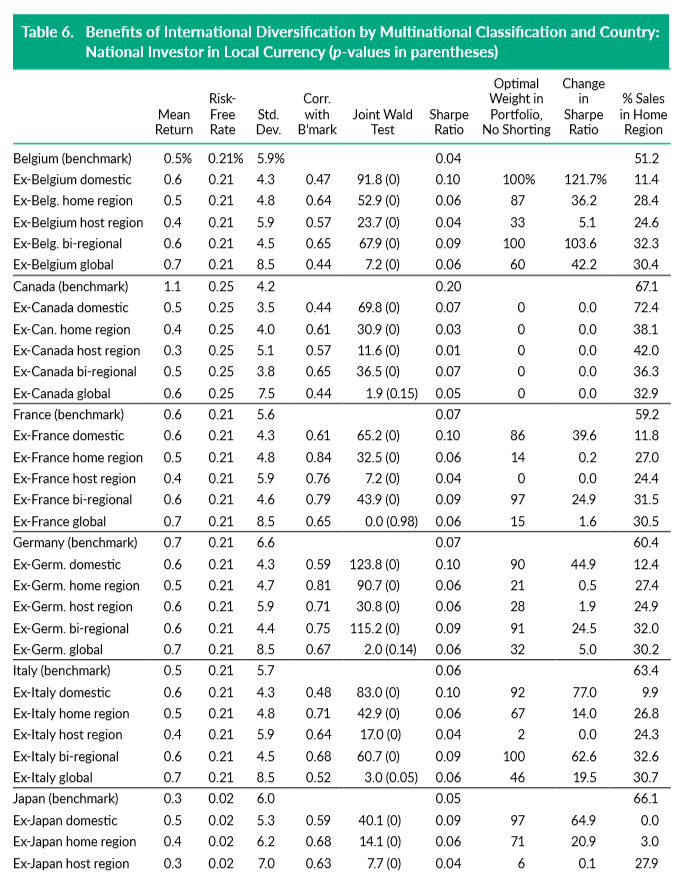

Academic Research Insight: When Does International Investing Make Sense?

By Wesley Gray, PhD|July 24th, 2017|Basilico and Johnsen, Academic Research Insight|

Title: MONONATIONALS: THE DIVERSIFICATION BENEFITS OF INVESTING IN COMPANIES WITH NO [...]

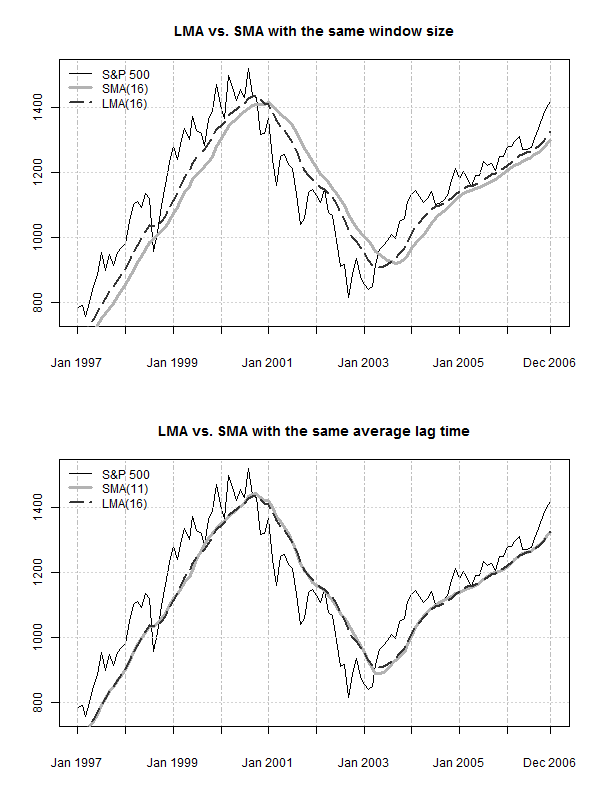

Trend-Following with Valeriy Zakamulin: Types of Moving Averages (Part 2)

By Valeriy Zakamulin|July 21st, 2017|Trend-Following Course, Trend Following, Guest Posts, Introduction Course, Investor Education|

In this post we aim to give an overview of some specific types of moving averages. Specifically, we cover "ordinary" moving averages and mention some examples of exotic moving averages.

Elisabetta and Tommi Are Helping us Empower Investors Through Education

By Wesley Gray, PhD|July 20th, 2017|Basilico and Johnsen, Guest Posts, Business Updates|

Our mission is to empower investors through education. This mission is our [...]

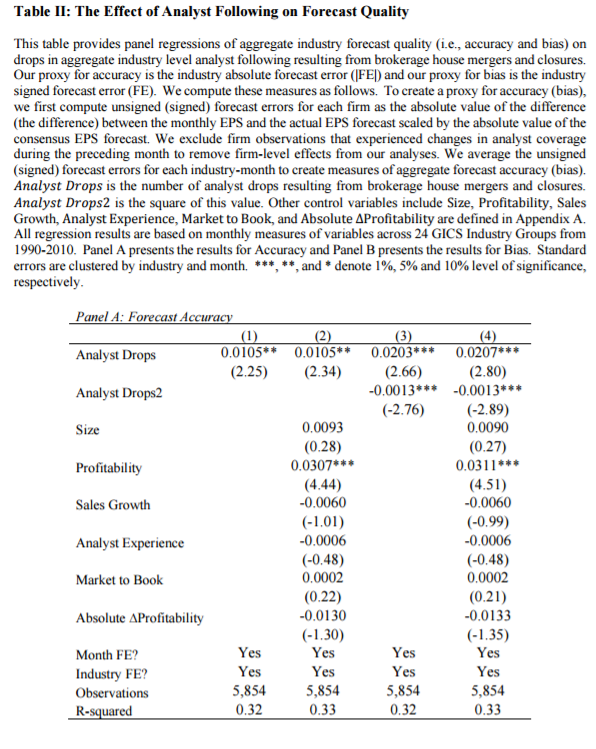

Academic Research Insights: Does the Scope of the Sell-Side Analyst Industry Matter?

By Wesley Gray, PhD|July 17th, 2017|Basilico and Johnsen, Academic Research Insight|

Title: DOES THE SCOPE OF THE SELL-SIDE ANALYST INDUSTRY MATTER? [...]

Trend-Following with Valeriy Zakamulin: Moving Average Basics (Part 1)

By Valeriy Zakamulin|July 14th, 2017|Trend-Following Course, Trend Following, Introduction Course, Guest Posts, Investor Education|

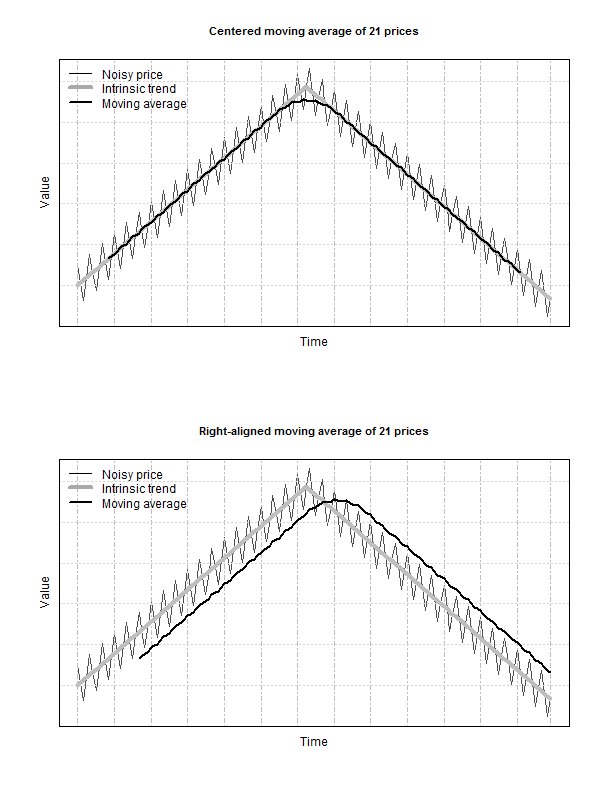

One of the basic principles of technical analysis is that ``prices move in trends". Traders firmly believe that these trends can be identified in a timely manner and used to generate profits and limit losses. Consequently, trend following is the most widespread market timing strategy; it tries to jump on a trend and ride it. Specifically, when stock prices are trending upward (downward), it's time to buy (sell) the stock. Even though trend following is very simple in concept, its practical realization is complicated. One of the major difficulties is that stock prices fluctuate wildly due to imbalances between supply and demand and due to constant arrival of new information about company fundamentals. These up-and-down fluctuations make it hard to identify turning points in a trend. Moving averages are used to ``smooth" the stock price in order to highlight the underlying trend.

Avoiding Overpriced Winners: A Better Way to Capture the Momentum Premium?

By Jack Vogel, PhD|July 12th, 2017|Research Insights, Momentum Investing Research|

Any frequent reader of our blog knows we are fans [...]

Academic Research Insight: Facts about Factors

By Wesley Gray, PhD|July 10th, 2017|Basilico and Johnsen, Academic Research Insight|

Title: FACTS ABOUT FACTORS Authors: PAULA COCOMA, [...]