Academic Research Insight: Facts about Factors

By Wesley Gray, PhD|July 10th, 2017|Basilico and Johnsen, Academic Research Insight|

Title: FACTS ABOUT FACTORS Authors: PAULA COCOMA, [...]

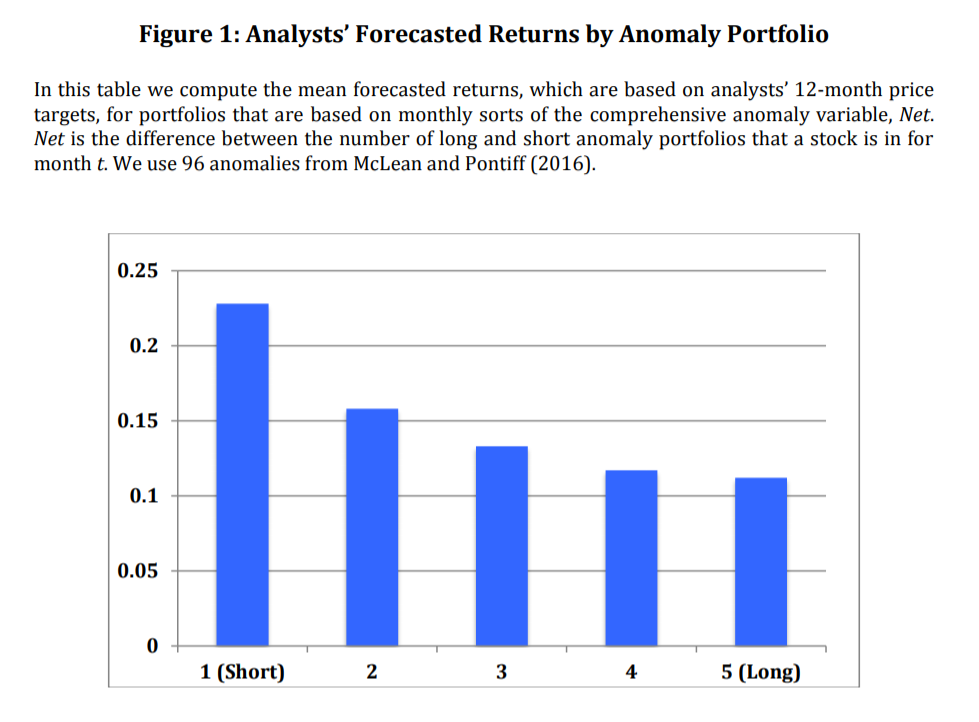

Do Security Analyst Recommendations Bet on or Against Academic Findings?

By Larry Swedroe|July 6th, 2017|Larry Swedroe, Research Insights, Behavioral Finance|

As my co-author Andrew Berkin, the director of research for [...]

A few highlights from The Evidence-Based Investing Conference (West)

By Jack Vogel, PhD|June 30th, 2017|Business Updates|

Earlier this week, I attended the Evidence-Based Investing Conference (West) and [...]

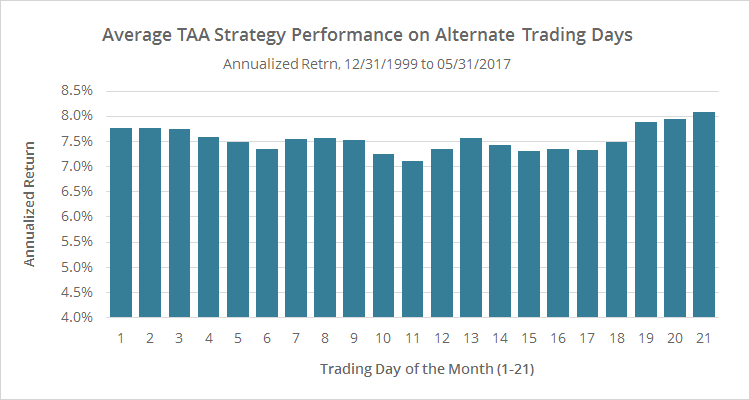

Tactical Asset Allocation: Does the Day of the Month Matter?

By Walter Jones|June 29th, 2017|Guest Posts, Tactical Asset Allocation Research|

Most long-term approaches to investing, like tactical asset allocation or [...]

Podcast: Value Investing with Charlie Tian (Wes)

By Wesley Gray, PhD|June 28th, 2017|Podcasts and Video|

Here is a link to our podcast on Behind the [...]

Academic Research Insight: The Value of Crowsourced Earnings Forecasts

By Tommi Johnsen, PhD|June 26th, 2017|Basilico and Johnsen, Academic Research Insight, Guest Posts|

Title: THE VALUE OF CROWDSOURCED EARNINGS FORECASTS Authors: RUSSELL JAME, RICK [...]

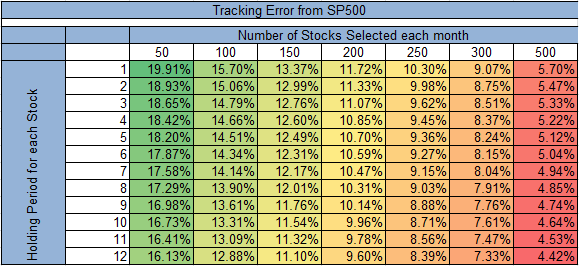

Factor Investing: Evidence Based Insights

By Jack Vogel, PhD|June 22nd, 2017|Factor Investing, Research Insights, Key Research|

I will be talking on the Factor Investing panel at [...]

1042 Exchange: Navigating Between a Rock and a Hard Place

By Doug Pugliese|June 20th, 2017|1042 QRP Solutions, Strategy Background, Tax Efficient Investing|

This particular Greek dilemma is what came to mind when I first encountered an ESOP. I observed that business owners who sold shares to an ESOP seemed, like Odysseus, to find themselves between a rock and a hard place. They could elect to pursue a 1042 exchange and bypass the Scylla of capital gains taxes, but in doing so they had to roll their sale proceeds into qualified replacement property. That path would likely lead to the Charybdis of Floating Rate Notes. These special ESOP bonds are the predominant 1042 exchange asset in the marketplace, a fact that belies their relative shortcomings as an investment asset. Just how unattractive floating rate notes are, and why they became the default 1042 rollover strategy among financial advisors, is the subject of this article. However, unlike Odysseus, business owners seeking to implement 1042 exchanges have more affordable and transparent paths to navigate between a rock and a hard place.

Academic Research Insight: The Strategic Timing of Earnings News

By Tommi Johnsen, PhD|June 19th, 2017|Basilico and Johnsen, Academic Research Insight|

Title: FURTHER EVIDENCE ON THE STRATEGIC TIMING OF EARNINGS NEWS: JOINT [...]

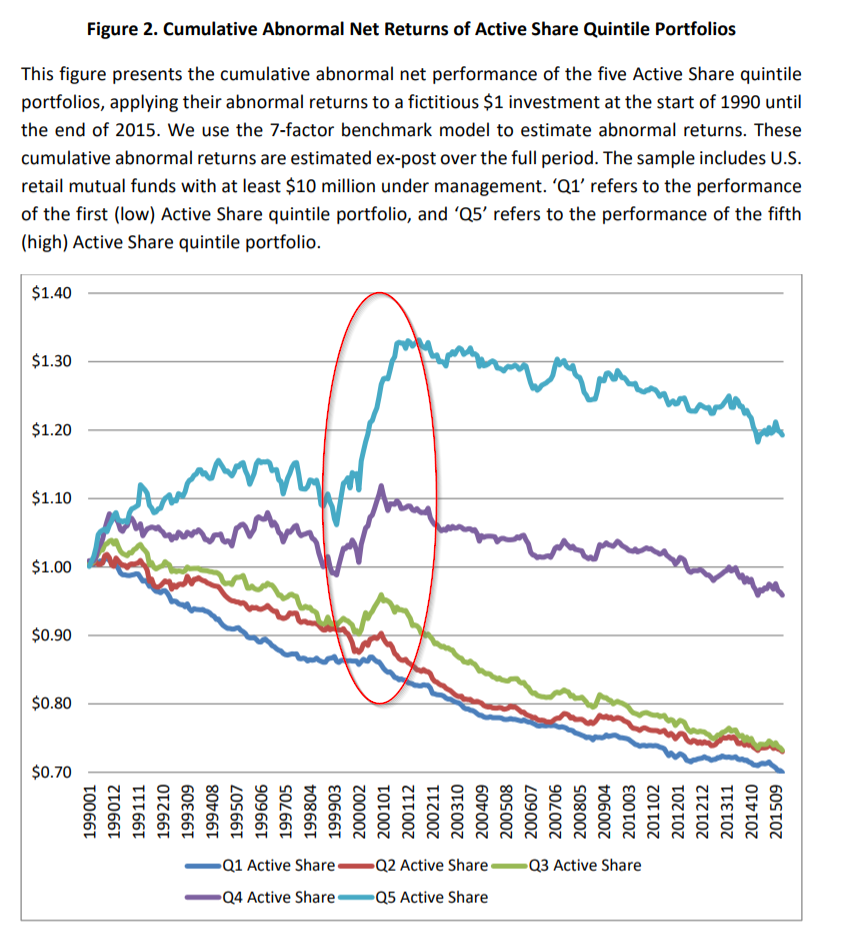

Active Share: Does it Predict Fund Performance?

By Larry Swedroe|June 15th, 2017|Factor Investing, Larry Swedroe, Active and Passive Investing|

The Holy Grail for mutual fund investors is the ability [...]