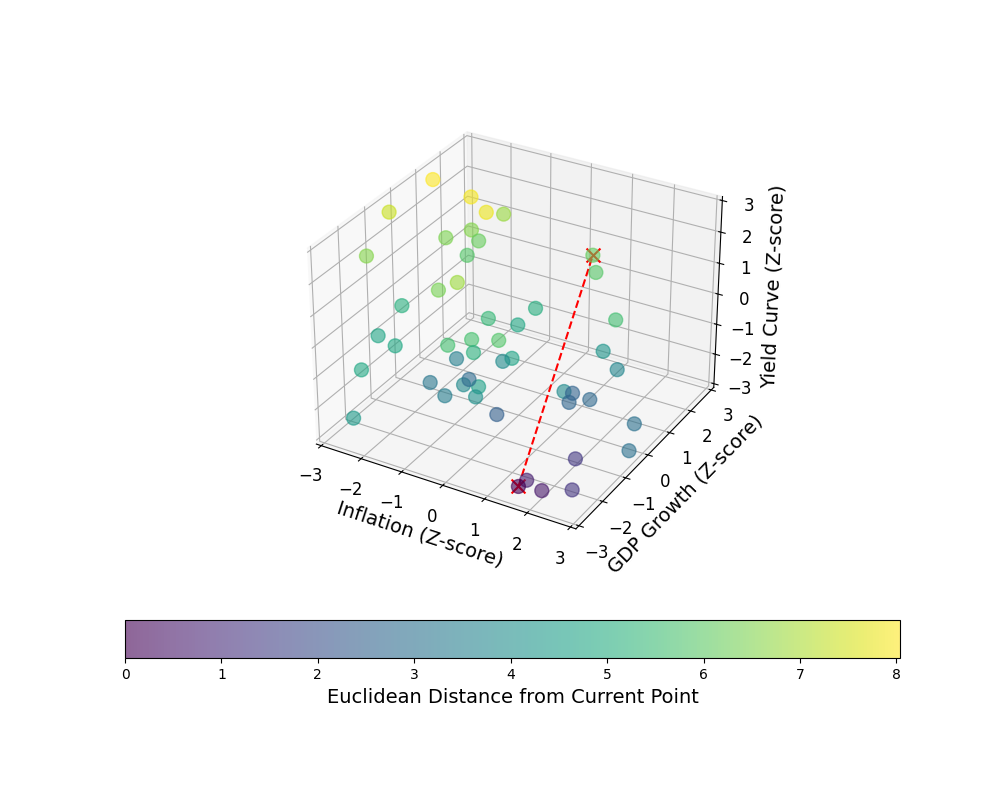

Data-driven Approach to Clustering Similar Macroeconomic Regimes

By Larry Swedroe|September 20th, 2024|Research Insights, Macroeconomics Research|

Knowing what economic regime we might be in won’t provide you with the crystal ball allowing you to foresee what geopolitical events will drive markets, whether “black swans” will appear, or identify whatever unexpected events or government policy actions will drive markets.

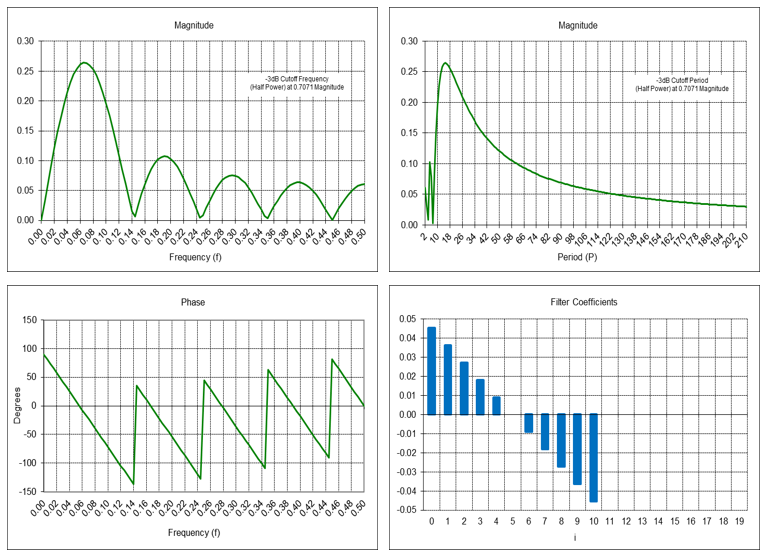

Trend-Following Filters – Part 8

By Henry Stern|September 17th, 2024|Empirical Methods, Research Insights, Trend Following, Guest Posts|

This article describes digital filters derived from time series regression models that can be used as technical analysis tools. The filters are analyzed from a digital signal processing (DSP) frequency domain perspective to illustrate their properties. Example charts of the filters applied to the S&P 500 index are also included.

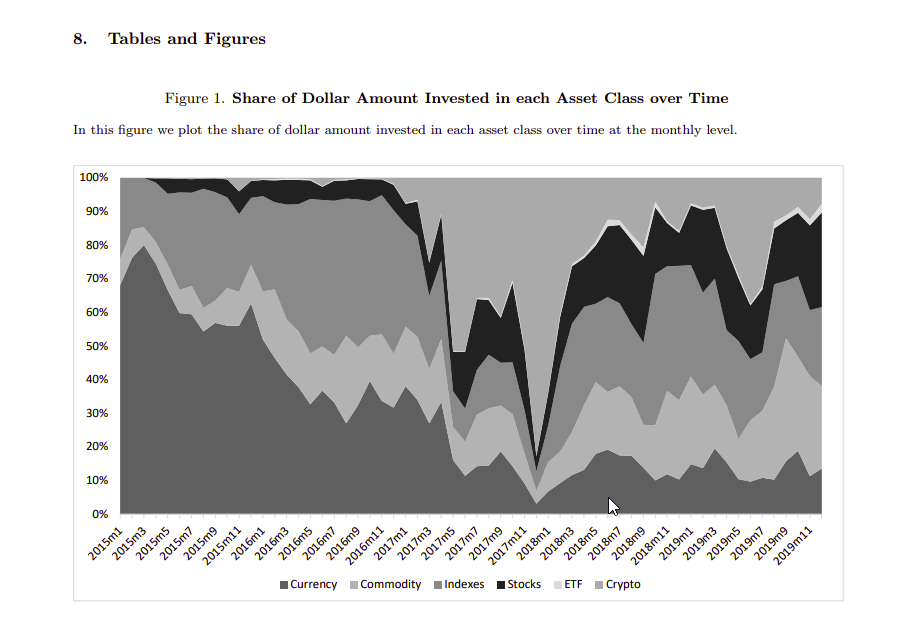

Investors trade Cryptos and Trad-Fi Differently

By Elisabetta Basilico, PhD, CFA|September 9th, 2024|Crypto, Elisabetta Basilico, Research Insights, Academic Research Insight, Other Insights, Behavioral Finance|

Retail traders are contrarian in stocks and gold, yet the same traders follow a momentum-like strategy in cryptocurrencies. The differences are not explained by individual characteristics, investor composition, inattention, differences in fees, or preference for lottery-like assets. We conjecture that retail investors have a model where cryptocurrency price changes affect the likelihood of future widespread adoption, which leads them to further update their price expectations in the same direction.

Global Factor Performance: September 2024

By Wesley Gray, PhD|September 9th, 2024|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index [...]

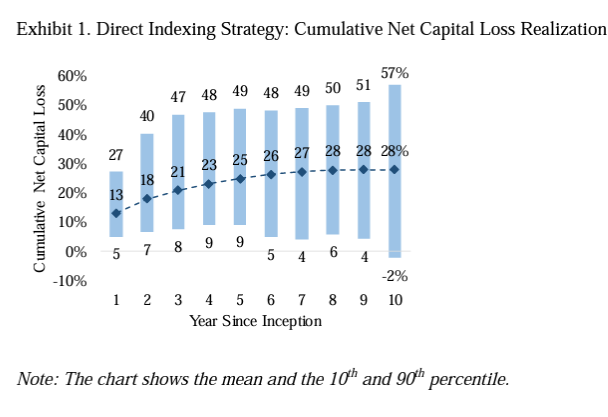

Adding Leveraged, Long-Short Factor Strategies to Improve Tax Alpha

By Larry Swedroe|September 6th, 2024|Research Insights, Larry Swedroe, Other Insights, Tax Efficient Investing|

Joseph Liberman, Stanley Krasner, Nathan Sosner, and Pedro Freitas, authors of the September 2023 study “Beyond Direct Indexing: Dynamic Direct Long-Short Investing,” examined if the utilization of leverage and long-short strategies motivated by the literature on factor-based investing could improve on the tax benefits of direct indexing and tax-loss harvesting.

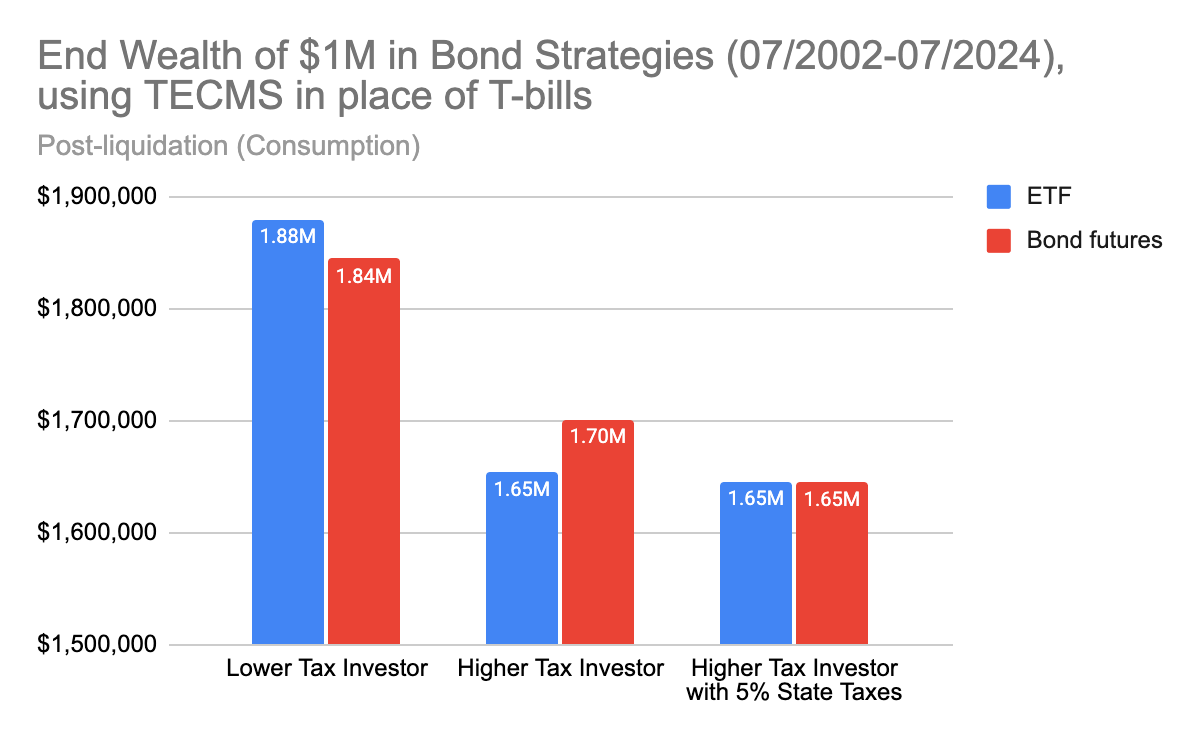

Exploring Bond Tax Efficiency: Futures or Bond ETFs?

By Stephanie Lo|September 5th, 2024|Research Insights|

Bond futures are often assumed to be more tax-efficient than bond ETFs. My analysis indicates that this assumption is frequently incorrect. Although investors might view the 60/40 tax treatment of futures as advantageous, a futures strategy faces several challenges compared to a bond ETF, including frequent taxable events, potential tax drag from cash collateral, and additional state taxation. My analysis suggests that, between July 2002 and July 2024, the bond ETF wins under a variety of realistic assumptions. However, bond futures may be compelling for high-tax investors, especially if they can find a tax-efficient cash solution. There is no universally “tax-efficient” instrument between bond futures and bond ETFs; rather, tax efficiency is defined by the investor’s particular circumstances.

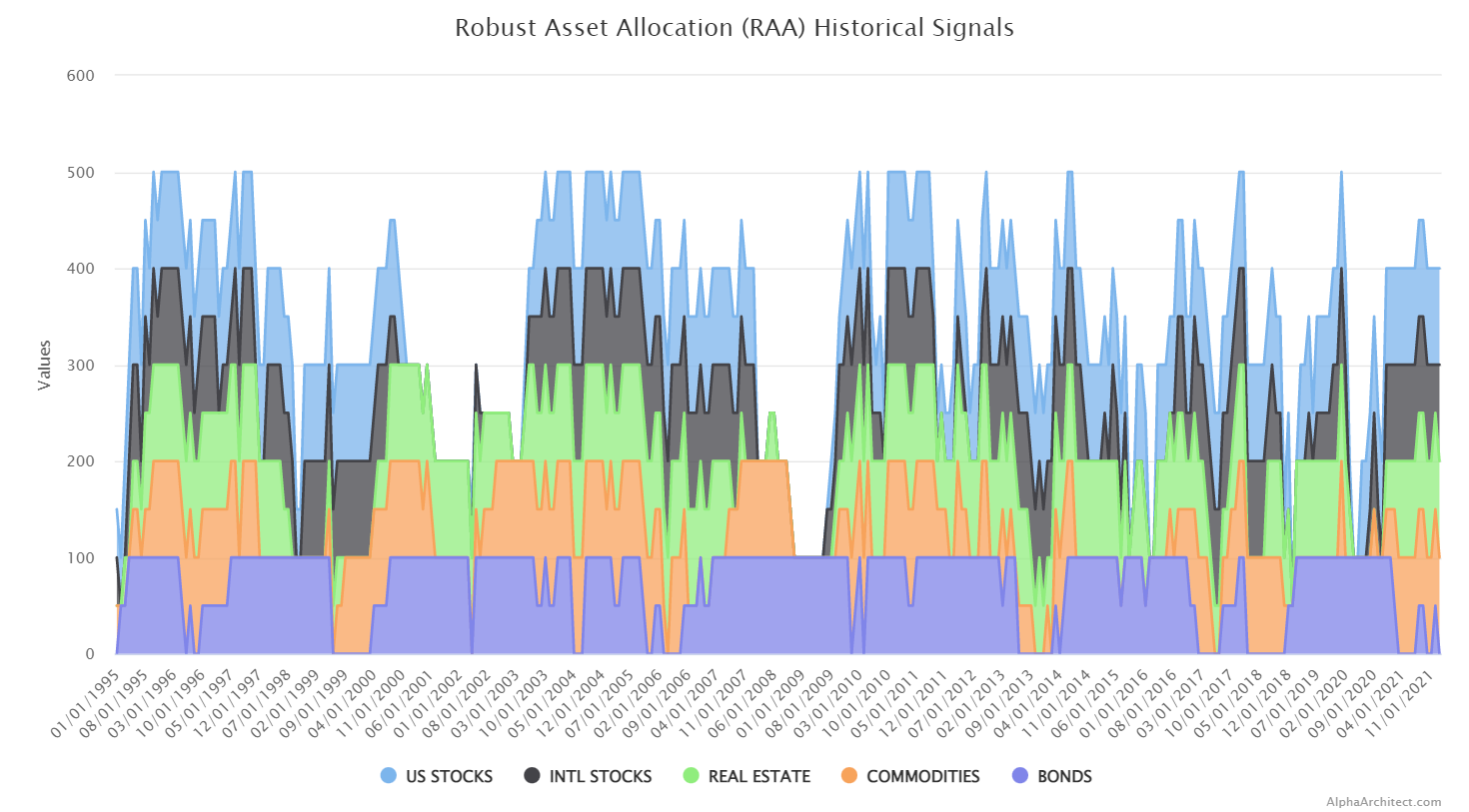

DIY Trend-Following Allocations: September 2024

By Ryan Kirlin|September 3rd, 2024|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Do-It-Yourself trend-following asset allocation weights for the Robust Asset Allocation [...]

Can smart rebalancing improve factor portfolios?

By Tommi Johnsen, PhD|September 3rd, 2024|Tommi Johnsen, Transaction Costs, Factor Investing, Research Insights, Academic Research Insight, Value Investing Research, Momentum Investing Research|

This paper provides new evidence on the efficacy of prioritizing transactions so as to focus portfolio turnover on the trades that offer the strongest signals and hence the highest potential performance impact.

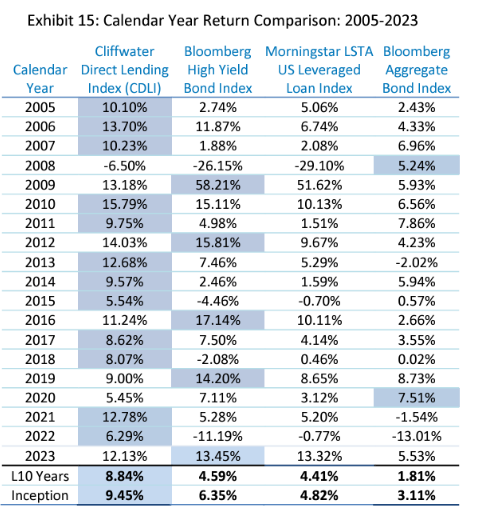

The After-Fee Performance of Private Debt

By Larry Swedroe|August 30th, 2024|Larry Swedroe, Research Insights, Other Insights, Fixed Income|

Private debt funds are a rapidly growing segment of the [...]

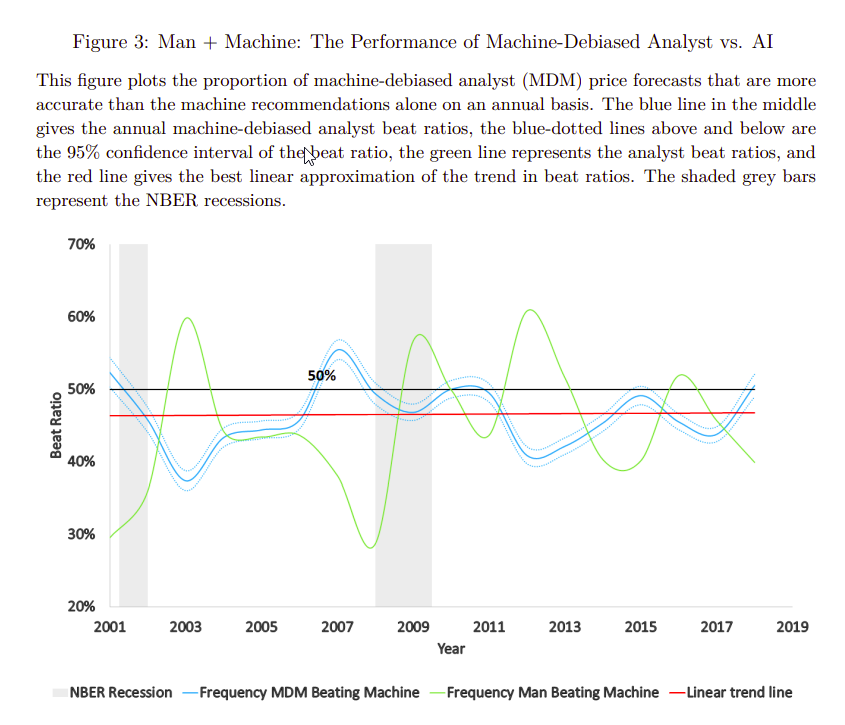

From Man vs. Machine to Man + Machine: The Art and AI of Stock Analyses

By Elisabetta Basilico, PhD, CFA|August 26th, 2024|Elisabetta Basilico, Research Insights, Academic Research Insight, AI and Machine Learning, Other Insights|

An AI analyst trained to digest corporate disclosures, industry trends, and macroeconomic indicators surpasses most analysts in stock return predictions. AI wins when information is transparent but voluminous. Humans provide significant incremental value in “Man + Machine,” which also substantially reduces extreme errors.