DIY Trend-Following Allocations: July 2024

By Ryan Kirlin|July 1st, 2024|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Full exposure to domestic equities. Full exposure to international equities. Partial exposure to REITs. Full exposure to commodities. Partial exposure to intermediate-term bonds.

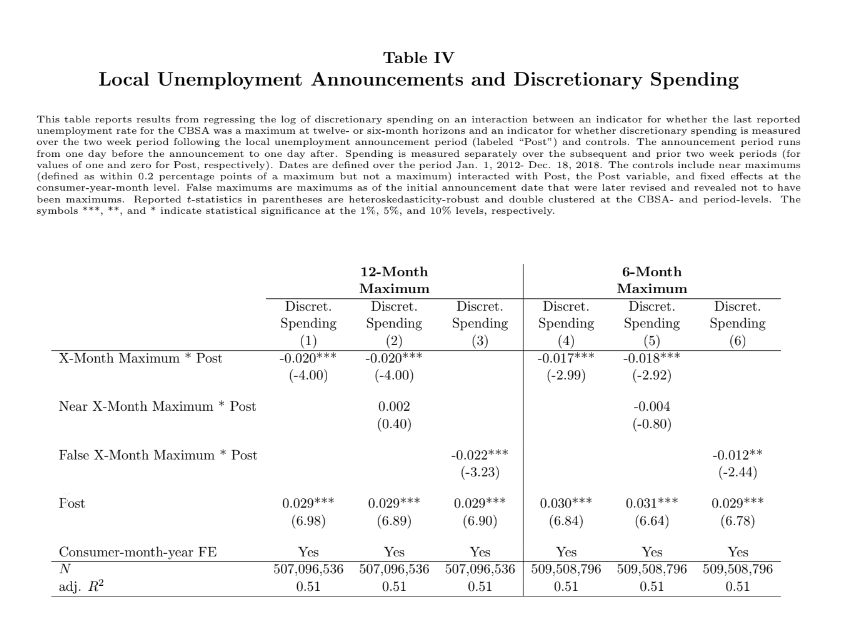

How do macroeconomic announcements impact household spending?

By Elisabetta Basilico, PhD, CFA|July 1st, 2024|Research Insights, Basilico and Johnsen, Academic Research Insight, Other Insights, Behavioral Finance|

What are the primary factors contributing to the steep and persistent decline in U.S. consumption growth during the Great Financial Crisis of 2008-2009?

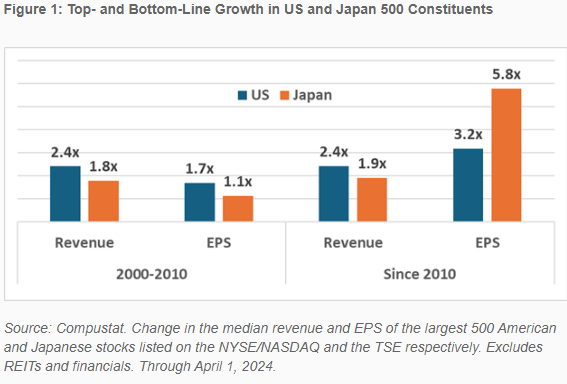

U.S. Companies Have Outperformed Japanese Companies, or Have They?

By Larry Swedroe|June 28th, 2024|Empirical Methods, Research Insights, Larry Swedroe, Guest Posts, Other Insights, Value Investing Research|

While both the S&P 500 and the Nikkei indices have recently hit all-time highs, the valuation and balance sheet data we have reviewed indicate that the downside risks in Japanese stocks appear to be far less than the risks in U.S. stocks. Evidence such as this helps explain why legendary investor Warren Buffett has been buying Japanese stocks.

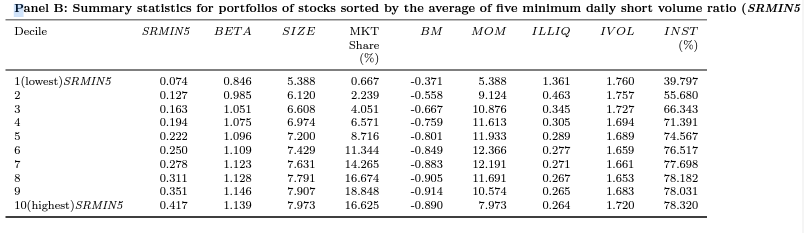

Creating Better Factor Portfolio via AI

By Tommi Johnsen, PhD|June 24th, 2024|Empirical Methods, Transaction Costs, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning|

Trading costs, discontinuous trading, missed trades, and other frictions, along with asset management fees can cause a shortfall between live and paper portfolios. The focus of this paper is to test an effective rebalancing method that prioritizes trades with the strongest signals to capture more of the factor premia while reducing turnover and trading costs.

When Shorts Don’t Short

By Larry Swedroe|June 21st, 2024|Short Selling, Larry Swedroe, Research Insights, Other Insights, Behavioral Finance, Momentum Investing Research|

Low short positions come from positive public news, while negative news can drive average short or extremely high short positions

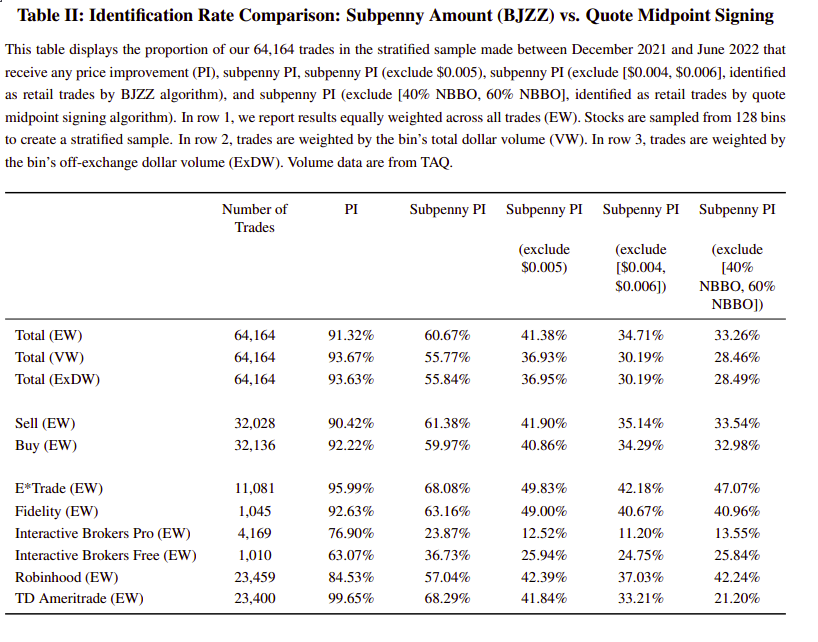

How to Track Retail Investor Activity in TAQ

By Elisabetta Basilico, PhD, CFA|June 17th, 2024|Research Insights, Basilico and Johnsen, Academic Research Insight, Other Insights, Behavioral Finance|

This paper explores the effectiveness of the BJZZ algorithm, developed by Boehmer, Jones, Zhang, and Zhang (2021), in identifying and signing retail trades executed off exchanges with subpenny price improvements.

Private Equity May Not Be the Diversifier We Think (Due to Volatility Laundering), But Private Credit Could Be

By Larry Swedroe|June 14th, 2024|Private Equity, Research Insights, Larry Swedroe, Other Insights|

Volatility laundering causes the risk-adjusted returns and the diversification benefits of private equity to be significantly overstated. However, the problem of volatility laundering is not a problem for all private investments, specifically not for high-quality, floating rate, private credit.

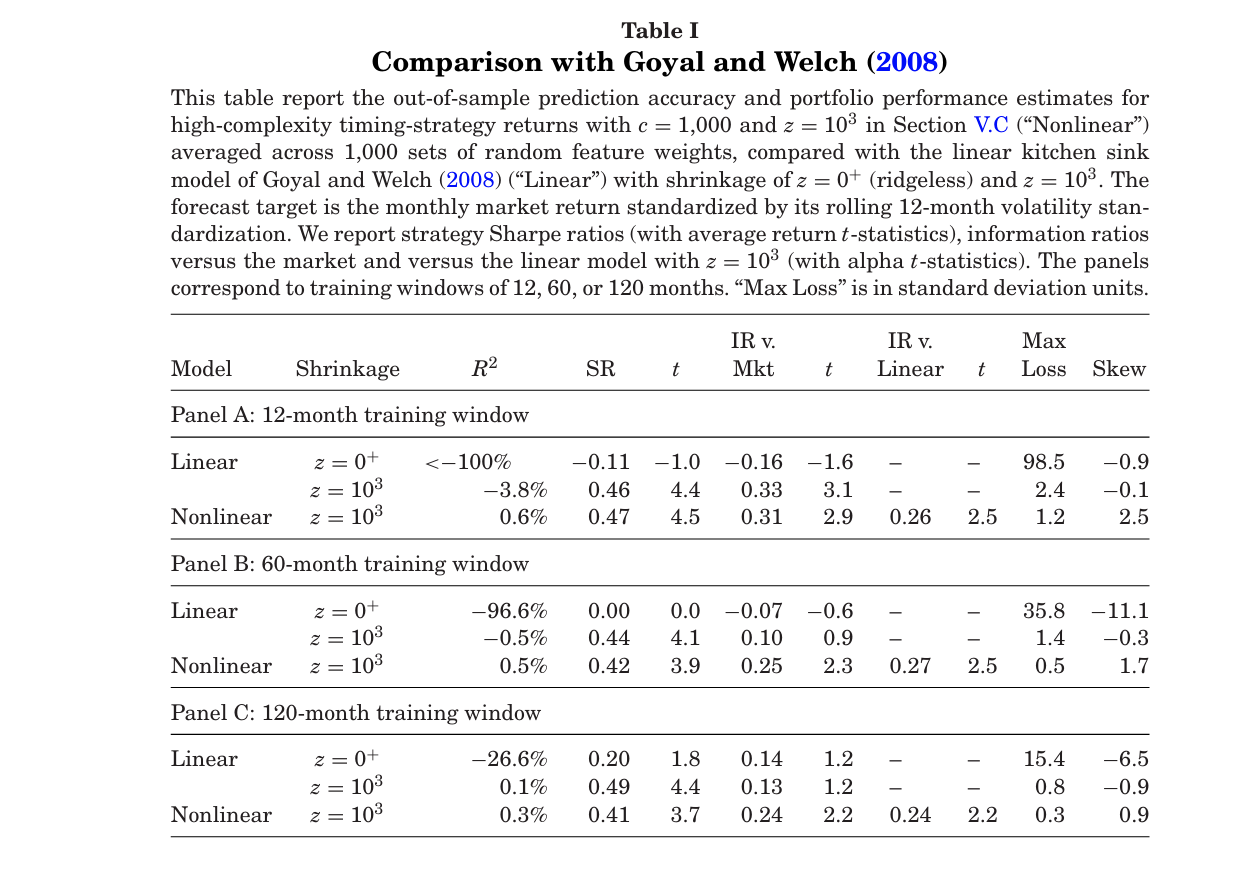

Complexity is a virtue in return prediction

By Tommi Johnsen, PhD|June 11th, 2024|Empirical Methods, Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning|

Simple models severely understate return predictability compared to “complex” models in which the number of parameters exceeds the number of observations.

The Halo Effect Drives Demand for Sustainable and Impact Investments

By Larry Swedroe|June 7th, 2024|ESG, Research Insights, Larry Swedroe, Other Insights|

Both investment motives and investment experience are important determinants for investors’ ability to assess (impact) investment opportunities. While investor preference can justify accepting a lower return as the cost of expressing their values, the halo effect should not play a role in making that assessment—both economic theory and empirical evidence should lead investors to expect lower returns on sustainable investments.

Global Factor Performance: June 2024

By Wesley Gray, PhD|June 6th, 2024|Index Updates, Factor Investing, Research Insights, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index website.