Regression is a tool that can turn you into a fool

By Wesley Gray, PhD|July 27th, 2023|Empirical Methods, Research Insights, Factor Investing, Value Investing Research|

Running regressions on past returns is a great tool for academic researchers who understand this approach's nuance, assumptions, pitfalls, and limitations. However, when factor regressions become part of a sales effort and/or are put in the hands of investors/advisors/DIYers, "the tool can quickly turn you into a fool."

Female execs bring more accuracy to analysts’ earnings forecasts

By Tommi Johnsen, PhD|July 24th, 2023|ESG, Research Insights, Women in Finance Know Stuff, Basilico and Johnsen, Academic Research Insight, Behavioral Finance|

The results of this research extend the literature in a number of areas including: the analyst forecast literature; the literature on behavioral accounting and finance with respect to corporate decision-making all in the context of gender; and the dominant role of the CEO on information transparency.

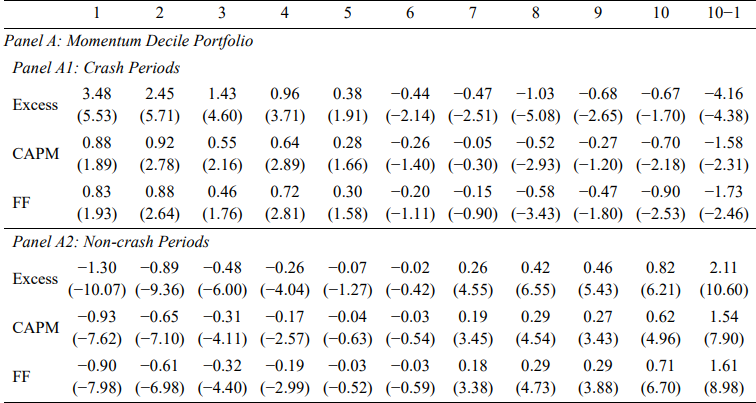

Reducing the Risk of Momentum Crashes

By Larry Swedroe|July 21st, 2023|Larry Swedroe, Factor Investing, Research Insights, Momentum Investing Research|

The empirical research demonstrates that, on average, investing in previous winners and short selling previous losers offers highly significant returns that other common risk factors cannot explain. However, momentum also displays huge tail risk, as there are short but persistent periods of highly negative returns. Crashes occur particularly in reversals from bear markets when the momentum portfolio displays a negative market beta and momentum volatility is high.

March for the Fallen 2023: Detailed Logistics Outline and What to Expect

By Wesley Gray, PhD|July 18th, 2023|Training Section, MFTF Training Series|

This is going to be an incredible experience and I’m looking forward to hearing a ton of stories over our 28 miles. Sometime during the weekend please find me and introduce yourself. I’m looking forward to meeting everyone.

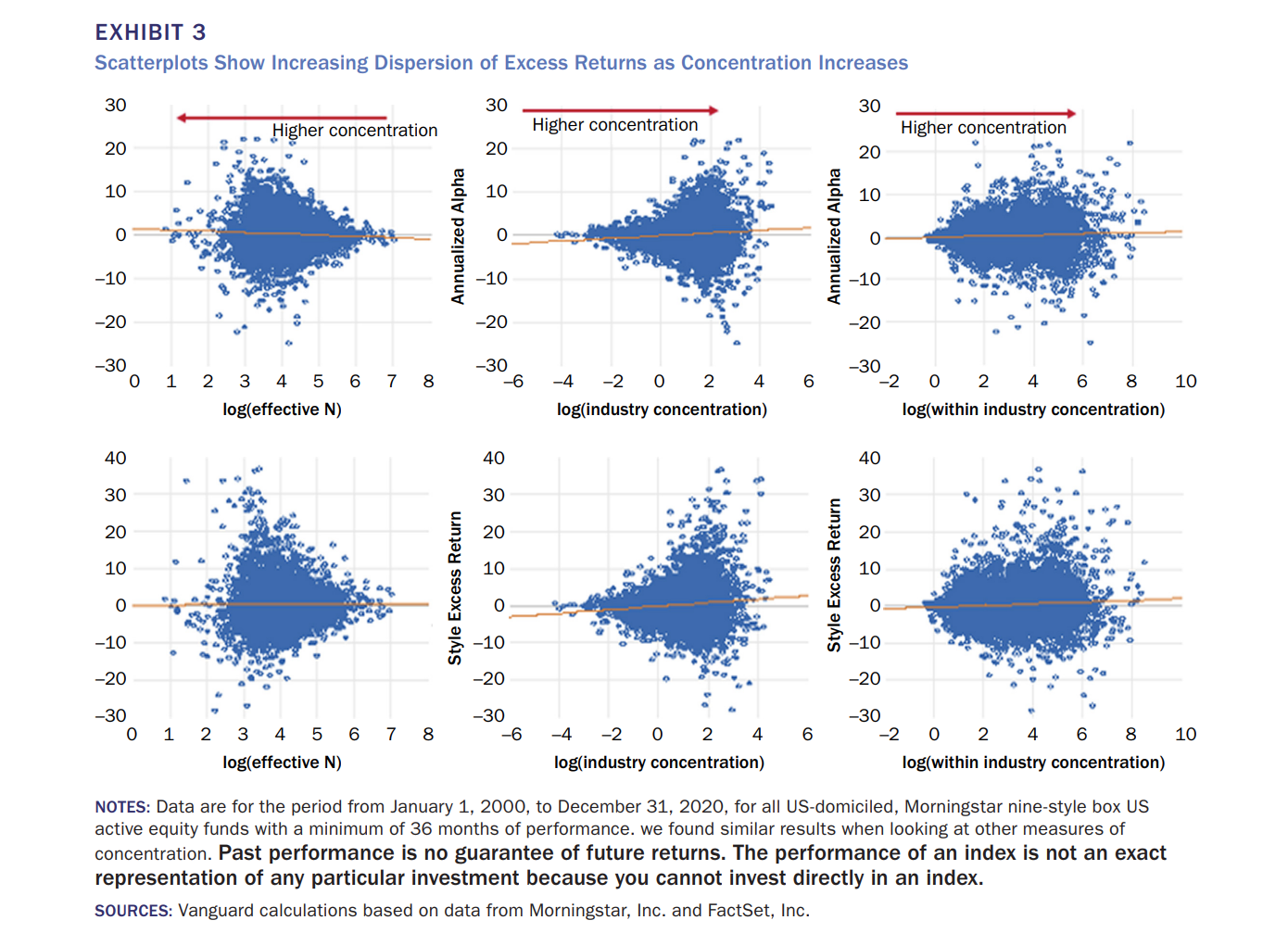

Does investing in a more concentrated fund result in better performance?

By Tommi Johnsen, PhD|July 17th, 2023|Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Active and Passive Investing|

This study explores the degree to which fund concentration (high tracking error) affects the magnitude of excess returns and whether or not the likelihood of outperformance or underperformance are distributed similarly.

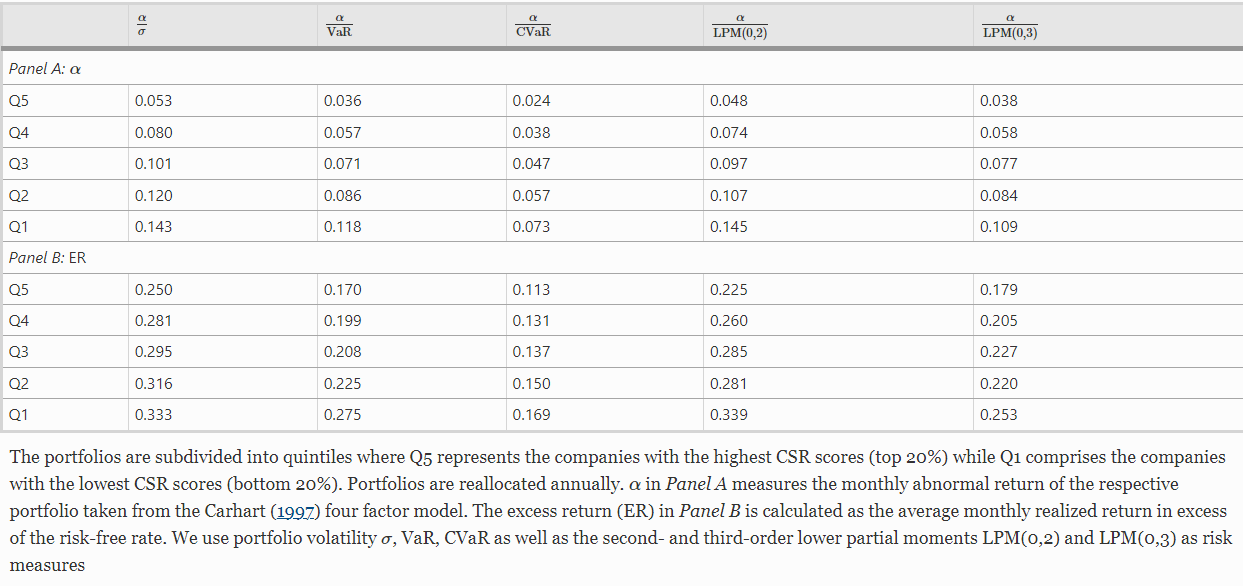

Are Sustainable Investors Compensated Adequately?

By Larry Swedroe|July 14th, 2023|ESG, Larry Swedroe, Factor Investing, Research Insights|

Academic research has demonstrated that the higher risk associated with less sustainable firms should be compensated by higher returns. It also has shown that more sustainable firms have less investment risk.

Global Factor Performance: July 2023

By Wesley Gray, PhD|July 11th, 2023|Index Updates, Factor Investing, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Downloads

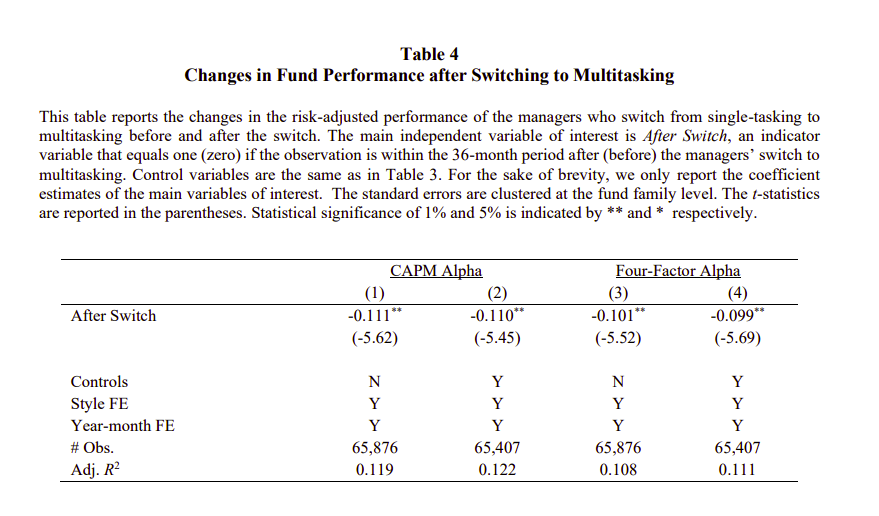

Managerial Multitasking in the Mutual Fund Industry

By Elisabetta Basilico, PhD, CFA|July 10th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, Corporate Governance|

The article aims to explore the relationship between multitasking and performance for mutual fund managers, investigate the potential mechanisms and factors influencing this relationship, and provide insights for fund companies and investors regarding the implications of multitasking on fund performance.

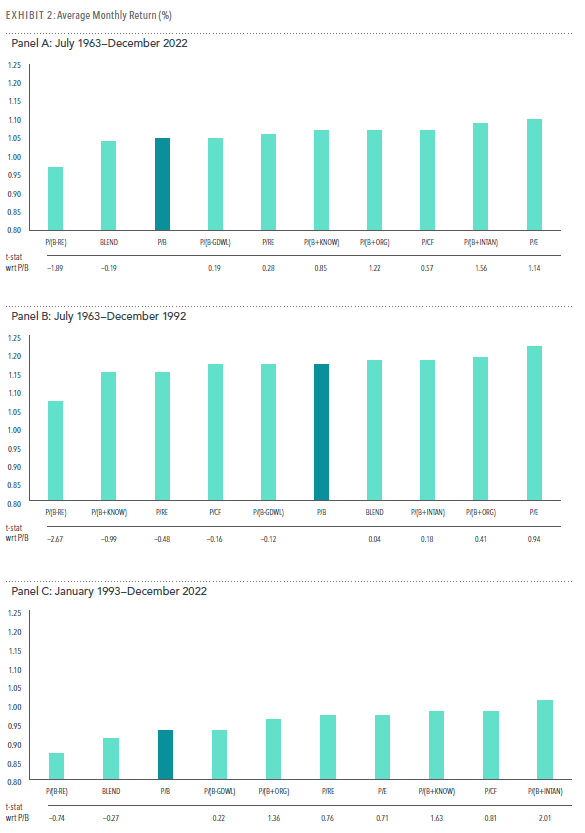

And the Winner Is: Examining Alternative Value Metrics

By Larry Swedroe|July 7th, 2023|Factor Investing, Research Insights, Larry Swedroe, Value Investing Research|

Although the most efficient way to implement a value strategy may need to be clarified, it is clear that value has withstood the test of time and that some implementations are superior to others. The evidence suggests that P/B is not an efficient metric as a standalone criteria. Instead, value strategies that use P/B should include at least a measure of profitability while managing sector - and security-level diversification.

DIY Trend-Following Allocations: July 2023

By Ryan Kirlin|July 3rd, 2023|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Full exposure to domestic equities. Full exposure to international equities. No exposure to REITs. No exposure to commodities. No exposure to intermediate-term bonds.