DIY Trend-Following Allocations: March 2023

By Ryan Kirlin|March 1st, 2023|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

No exposure to domestic equities. Partial exposure to international equities. No exposure to REITs. No exposure to commodities. No exposure to intermediate-term bonds.

Does International Diversification Work?

By Elisabetta Basilico, PhD, CFA|February 28th, 2023|Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Tactical Asset Allocation Research|

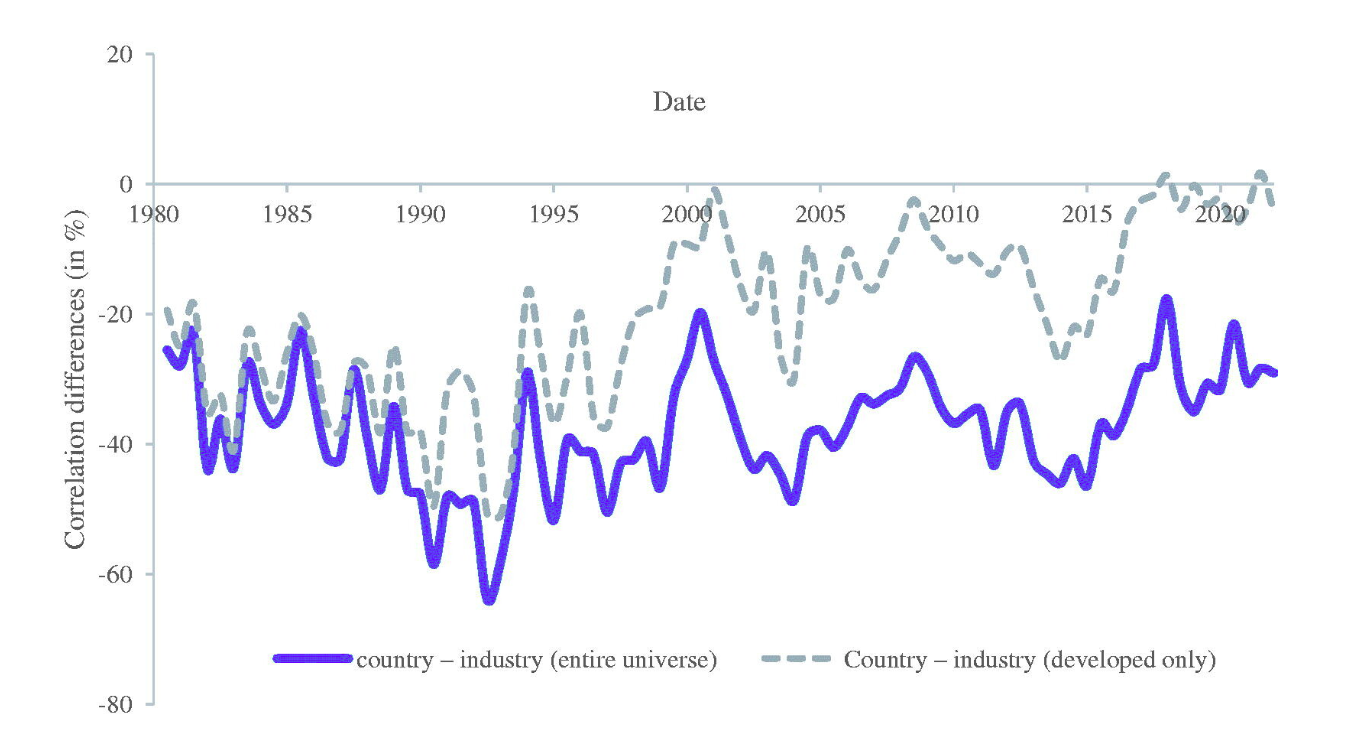

In this article, the authors examine the research on the benefits of international diversification. Some argue that because equity markets generally crash simultaneously, there are no benefits to having equity diversification. The evidence from this paper rejects this hypothesis.

Inside the Minds of Expected Stock Returns

By Larry Swedroe|February 24th, 2023|Research Insights, Factor Investing, Larry Swedroe, Behavioral Finance|

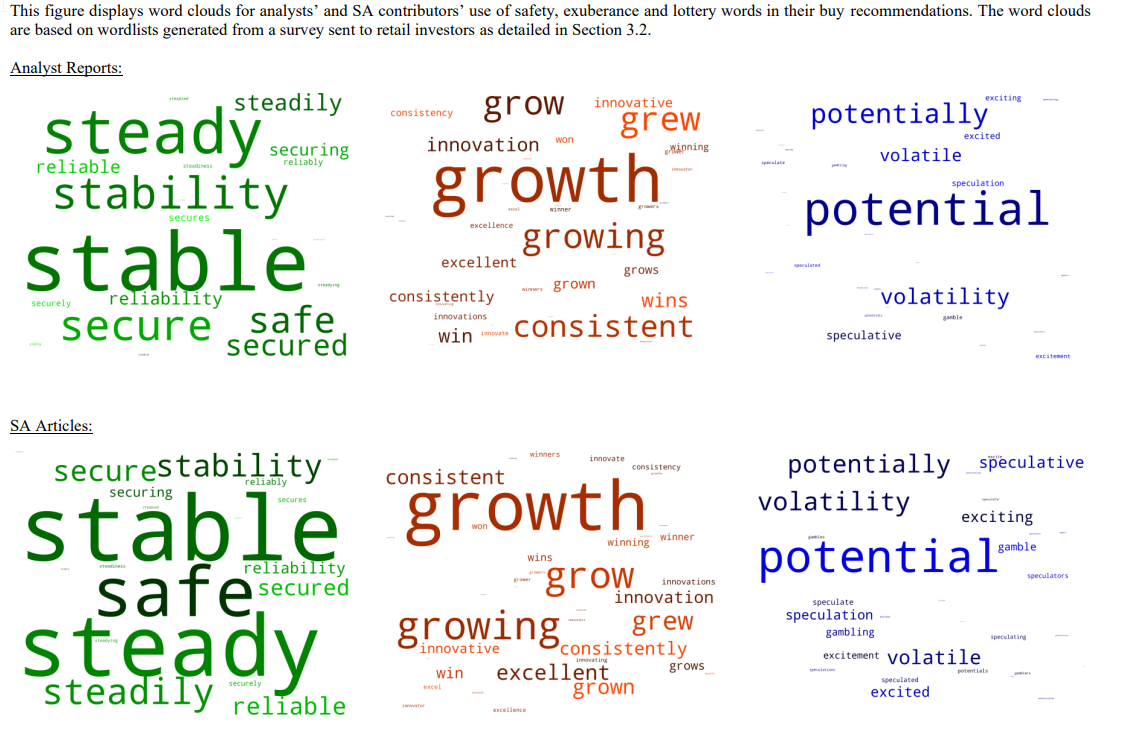

Non-traditional investor preferences play an important role in explaining the cross-section of expected stock returns.

How Pervasive is Corporate Fraud?

By Elisabetta Basilico, PhD, CFA|February 21st, 2023|ESG, Insider and Smart Money, Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Corporate Governance|

In this article, we examine the research on the pervasiveness of corporate fraud (misconduct or alleged fraud), which is one of the (less emphasized) costs of public ownership.

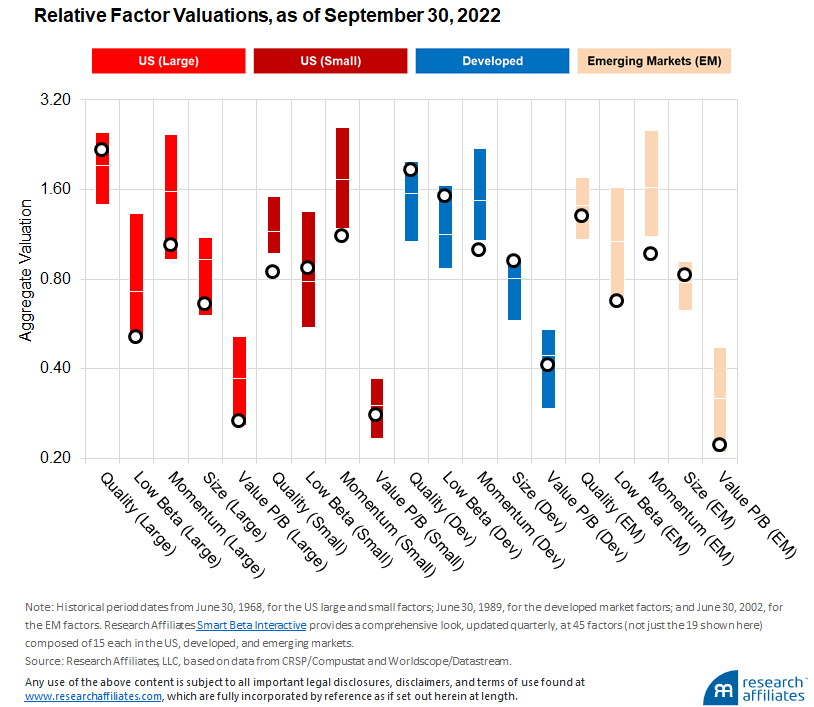

It’s Always Darkest Just Before Dawn

By Larry Swedroe|February 17th, 2023|Research Insights, Larry Swedroe, Value Investing Research|

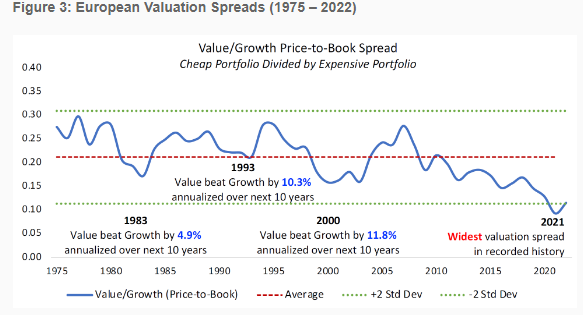

Wide divergences between the valuations of cheap stocks relative to expensive stocks have preceded significant outperformance for value over the subsequent decade, as shown in this figure.

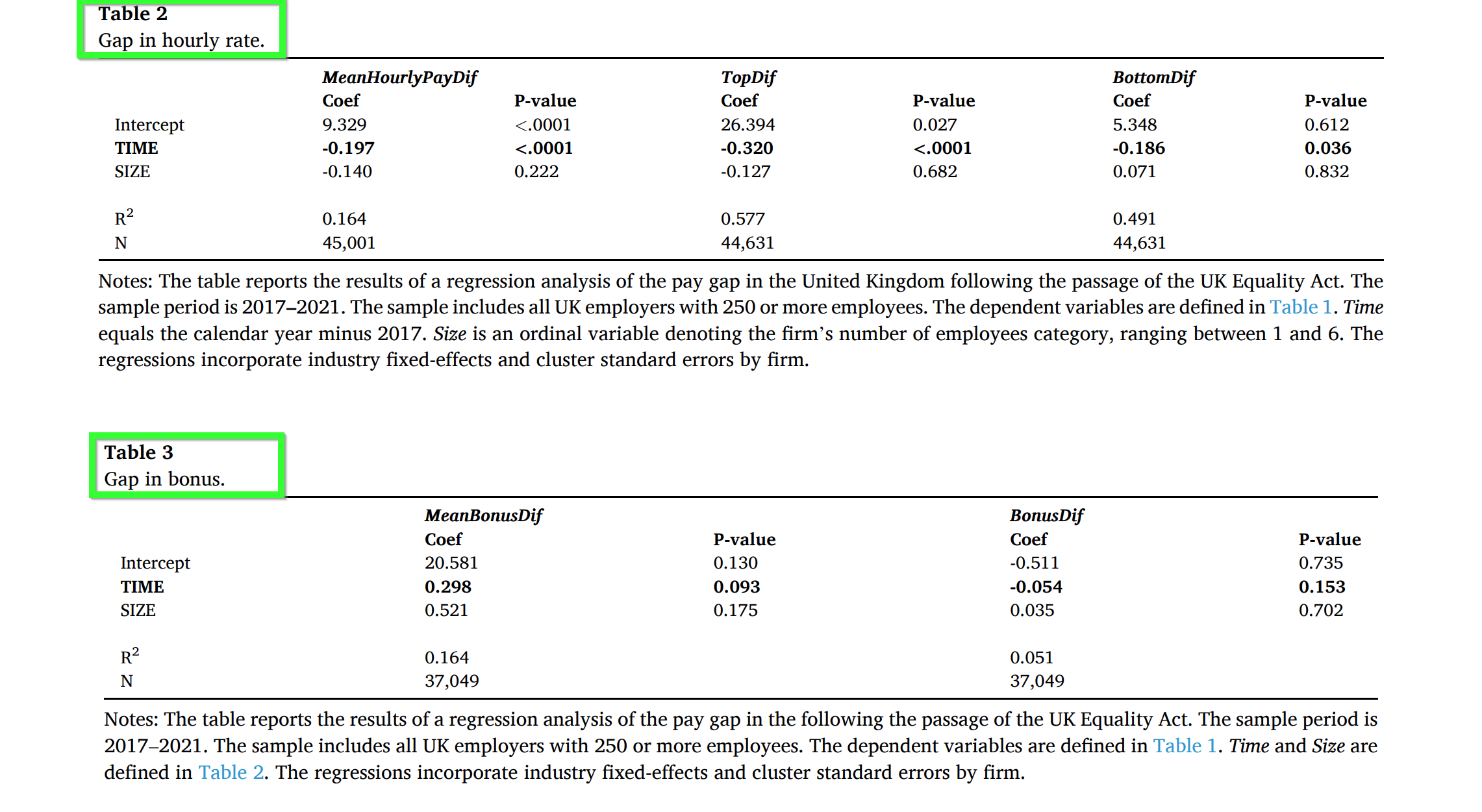

Do Gender Pay-Gap Disclosures Make a Difference?

By Tommi Johnsen, PhD|February 13th, 2023|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight|

The verdict is still out on the impact of legislation regarding firm disclosure rules on the gender pay gap (GPG). Results from recently published research are mixed.

Global Factor Performance: February 2023

By Wesley Gray, PhD|February 10th, 2023|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Downloads

Factor Returns and the Information in Valuation Spreads

By Larry Swedroe|February 10th, 2023|Factor Investing, Larry Swedroe, Research Insights, Value Investing Research|

Given that valuations provide information on equity returns, it should not be surprising to learn that valuation spreads provide information on future factor premiums.

Do Investors Pay Less Attention to Women (Fund Managers)? YES

By Elisabetta Basilico, PhD, CFA|February 7th, 2023|Insider and Smart Money, ESG, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight|

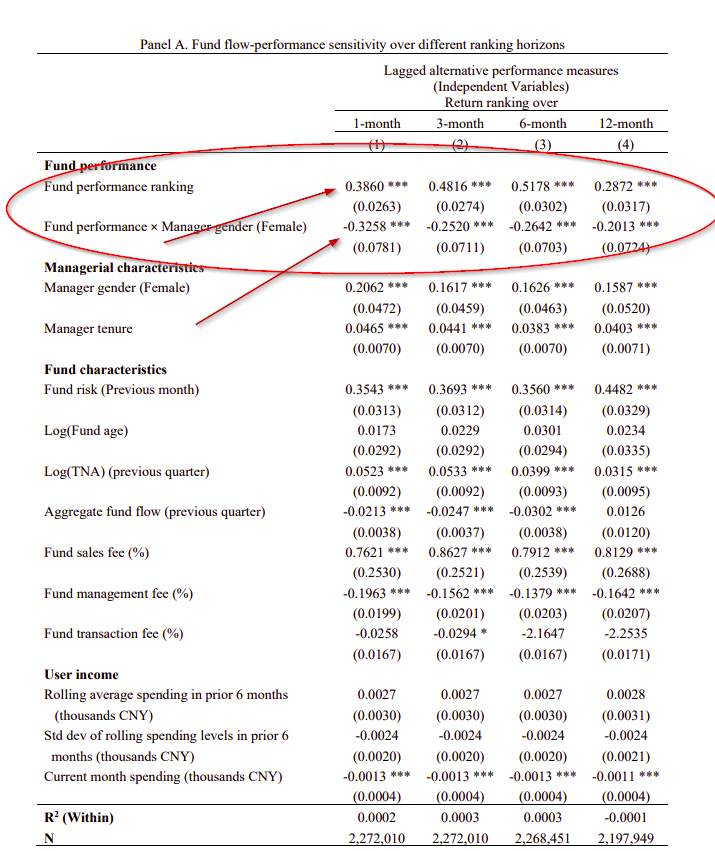

This article examines the research on gender bias and fund management. Specifically, we will focus on the gender-based attention bias.

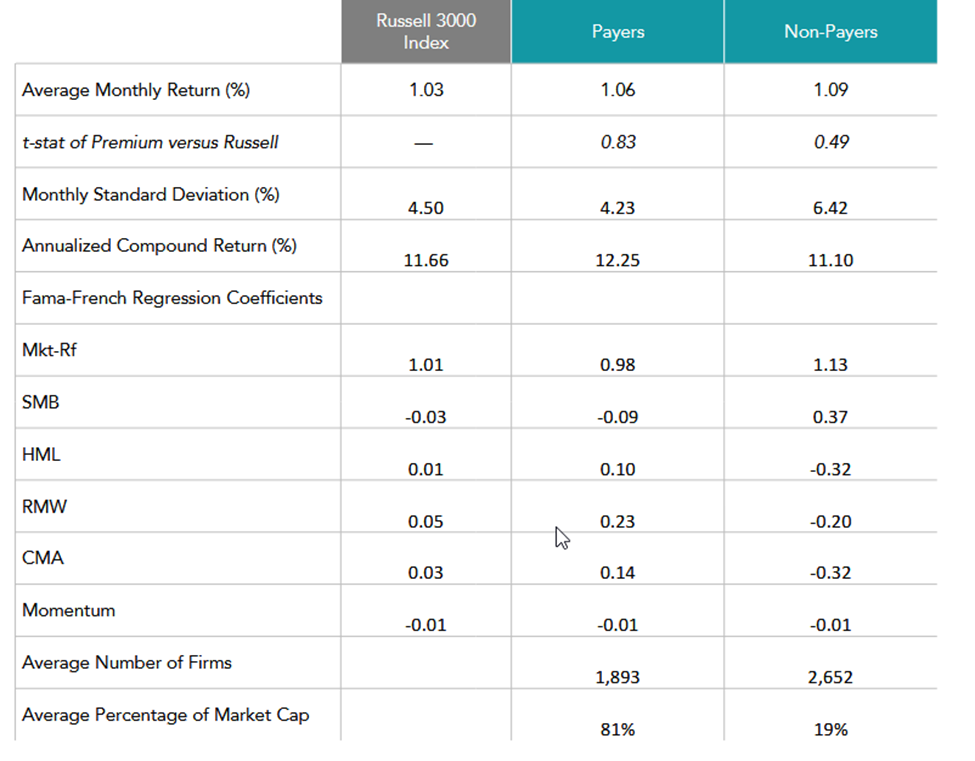

Should investors be indifferent to dividend impact on stock returns?

By Larry Swedroe|February 3rd, 2023|Dividends and Buybacks, Larry Swedroe, Research Insights|

In their 1961 paper, “Dividend Policy, Growth, and the Valuation of Shares,” Merton Miller and Franco Modigliani famously established that dividend policy should be irrelevant to stock returns. As they explained it, at least before frictions like trading costs and taxes, investors should be indifferent to $1 in the form of a dividend (causing the stock price to drop by $1) and $1 received by selling shares. This must be true, unless you believe that $1 isn’t worth $1. This theorem has not been challenged since, at least in the academic community.