DIY Trend-Following Allocations: January 2023

By Ryan Kirlin|January 3rd, 2023|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

No exposure to domestic equities. No exposure to international equities. No exposure to REITs. Partial exposure to commodities. No exposure to intermediate-term bonds.

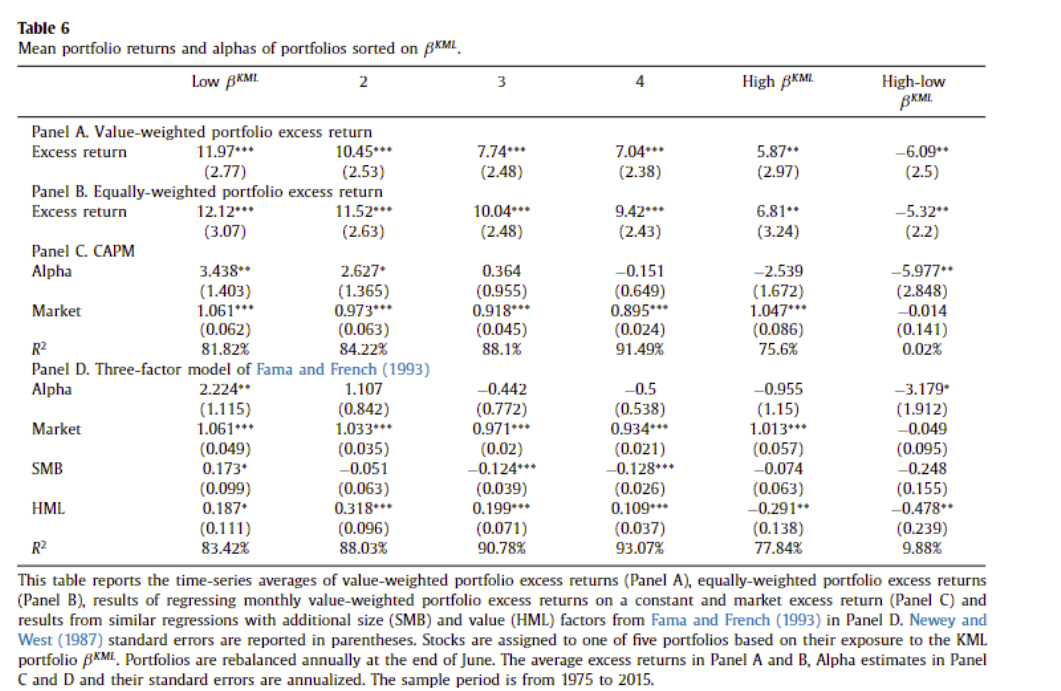

Automation and Asset Pricing Theory

By Elisabetta Basilico, PhD, CFA|January 3rd, 2023|Intangibles, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight|

In this article about asset pricing theory, we examine the research on the impact of technological advances that displace human labor in favor of machine capital to asset pricing.

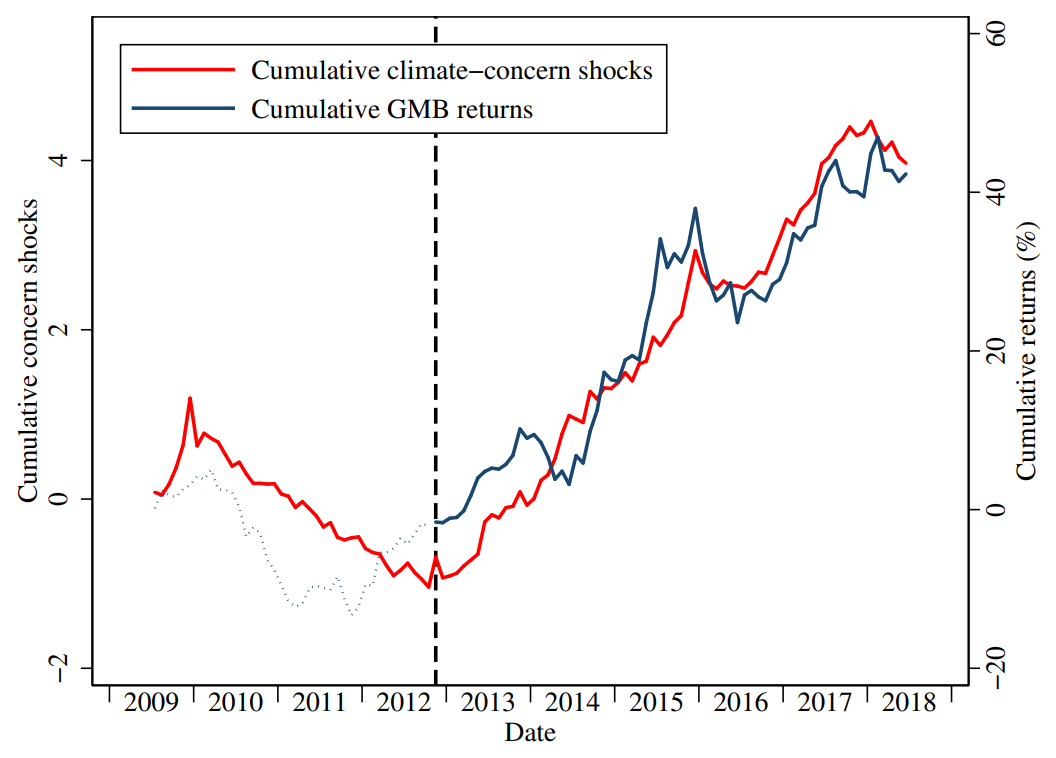

Expected Returns to Green Stocks

By Larry Swedroe|December 30th, 2022|ESG, Research Insights, Larry Swedroe|

The past decade has seen a dramatic growth in sustainable investing—applying environmental, social and governance (ESG) criteria to investment strategies. Investments considered environmentally friendly are often referred to as “green,” while “brown” denotes the opposite. Important questions for investors are: What are the expected returns to green stocks? What does their past performance tell us about their future expected returns? We begin by looking at what economic theory tells us our expectations should be.

Measuring Geopolitical Risk

By Tommi Johnsen, PhD|December 28th, 2022|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight, Macroeconomics Research|

Although geopolitical risk has traditionally been approached from a qualitative aspect, what makes it a novel risk is the application of innovative techniques to measure it.

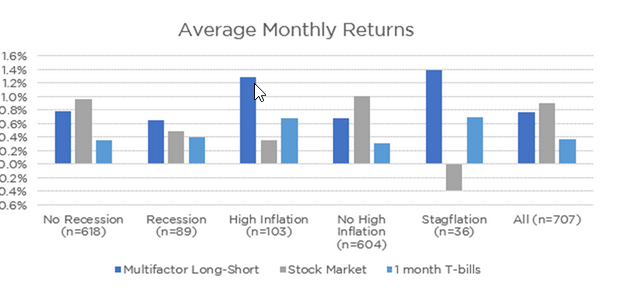

The Performance of Multi-Factor Long-Short Portfolios in Various Economic Regimes

By Larry Swedroe|December 23rd, 2022|Research Insights, Factor Investing, Larry Swedroe|

To determine if a multi-factor approach has provided diversification benefits in terms of exposure to economic cycle risks, the research team at Counterpoint evaluated returns to multifactor long-short strategies, stocks, and 1-month T-bills in a variety of economic conditions (recession or no recession, high or no high inflation, and stagflation) over the period July 1963-August 2022.

Book Review: The Bogle Effect by Eric Balchunas

By Wesley Gray, PhD|December 20th, 2022|Research Insights, Academic Research Insight, Other Insights, Book Reviews|

This is a review of Eric Balchunas's book "The Bogle Effect: How John Bogle and Vanguard Turned Wall Street Inside Out and Saved Investors Trillions."

Bigger is Not Always Better in Asset Management

By Elisabetta Basilico, PhD, CFA|December 19th, 2022|Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Active and Passive Investing|

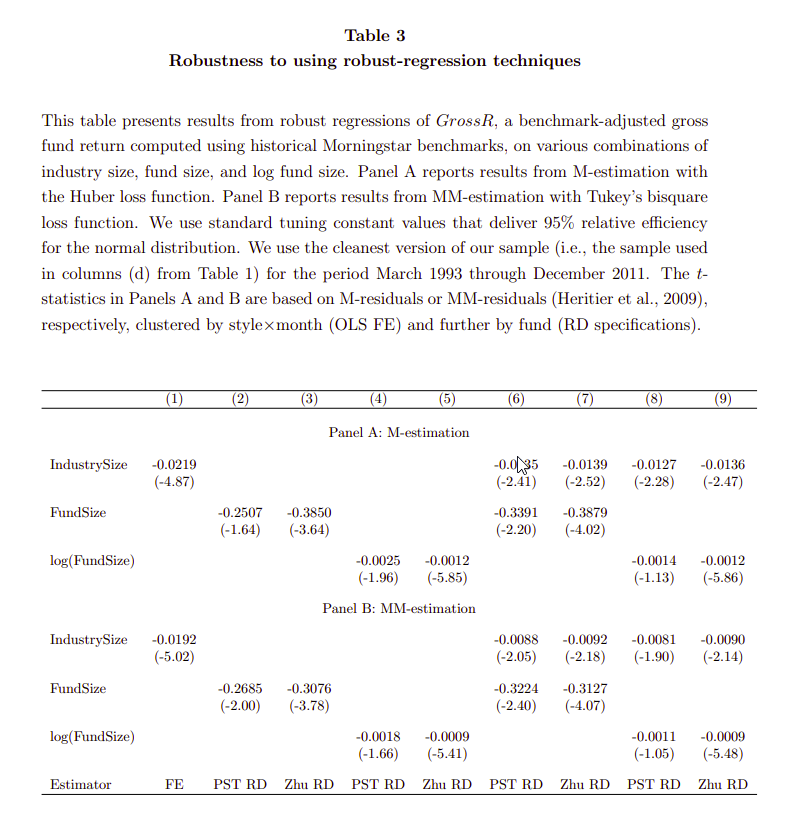

Pastor, Stambaugh, and Taylor (2015) and Zhu (2018) provide significant evidence of decreasing returns to scale (DRS) at both the fund and industry levels. The authors examine the robustness of their inferences after Adams, Hayunga, and Mansi (2021) critique the above two studies.

Mutual Fund to ETF Conversions: To Proxy or Not to Proxy, that is the question

By Pat Cleary|December 16th, 2022|ETF Operations, Tax Efficient Investing, ETF Investing|

ETF conversions are accelerating and we are seeing more and more mutual funds converting into ETFs. The reasons for mutual fund to ETF conversions are obvious: tax efficiency, transparency, and lower operating costs. But how does this work? What are the pro/cons? This post provides a glimpse behind the curtain and a practical guide for any asset manager considering a mutual fund conversion. Below we outline the laws behind a mutual fund conversion, options for mutual fund conversions, and the nitty-gritty behind how to optimize a mutual fund conversion.

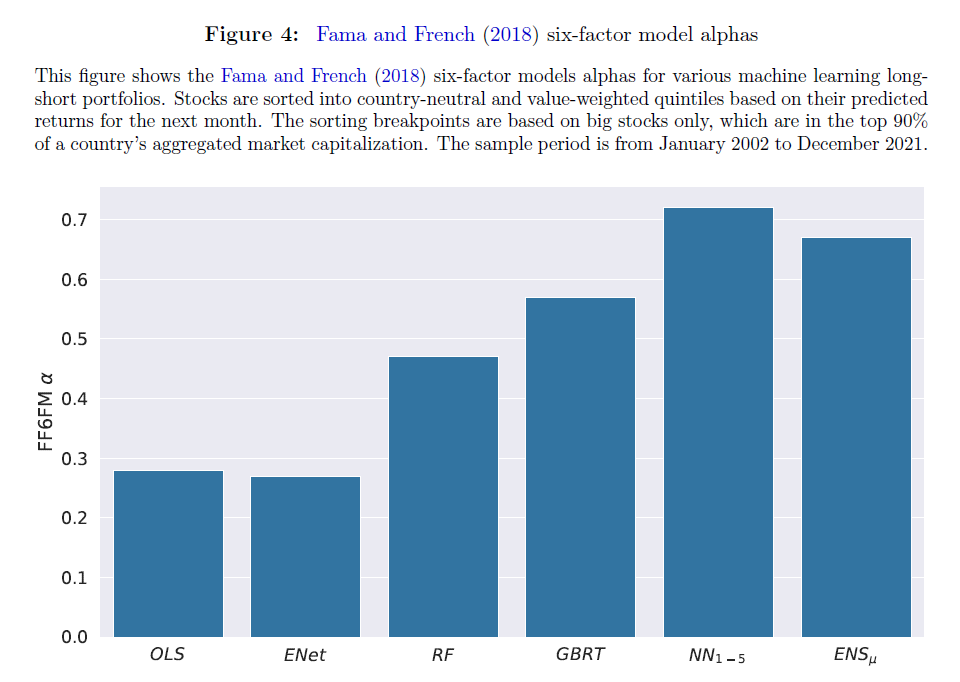

Machine Learning and The Cross-Section of Emerging Market Stock Returns

By Matthias Hanauer|December 15th, 2022|Research Insights, Guest Posts, AI and Machine Learning|

The paper documents that return forecasts from machine learning methods lead to superior out-of-sample returns in emerging markets.

Global Factor Performance: December 2022

By Wesley Gray, PhD|December 12th, 2022|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Downloads